Picture this: a promising entrepreneur with an innovative idea walks into a room filled with investors. These meetings, once rare, have become a cornerstone of today’s economic landscape. The venture capital (VC) industry has seen seismic shifts over the past decade. As startups continue driving innovation, the numbers paint a fascinating story of resilience and evolution.

Editor’s Choice

- Global VC funding reached $126.3 billion in Q1 2025, marking a ten-quarter high.

- The US accounted for over two-thirds of total global VC funding in Q1 2025.

- Median deal size across all stages stood at $12.0 million in Q2 2025.

- Global VC funding in Q2 2025 totaled approximately $101.05 billion, reflecting continued investor momentum despite a decline from Q1.

- Average deal size across all stages rose to $19.2 million in Q2 2025.

- VC investment in generative AI reached $49.2 billion in H1 2025, already surpassing the 2024 total.

- Female-founded startups secured 2.3% of total global VC capital in 2024, showing a slight improvement.

Global Venture Capital Investment Trends

- North America captured around 70% of global VC funding in Q2 2025 as other regions lagged.

- Asia-Pacific VC investment reached $12.8 billion across 2,022 deals in Q2 2025.

- Europe attracted $14.6 billion in VC funding during Q2 2025, led by fintech and green tech.

- Global VC funding totaled $101.05 billion in Q2 2025 amid a drop in megadeals.

- Clean energy VC flows slowed in 2025 as investor focus shifted to AI and software.

- Cross-border deals remained stable, but growth decelerated in H1 2025.

- Late-stage VC activity declined while early and growth-stage deals held firm in 2025.

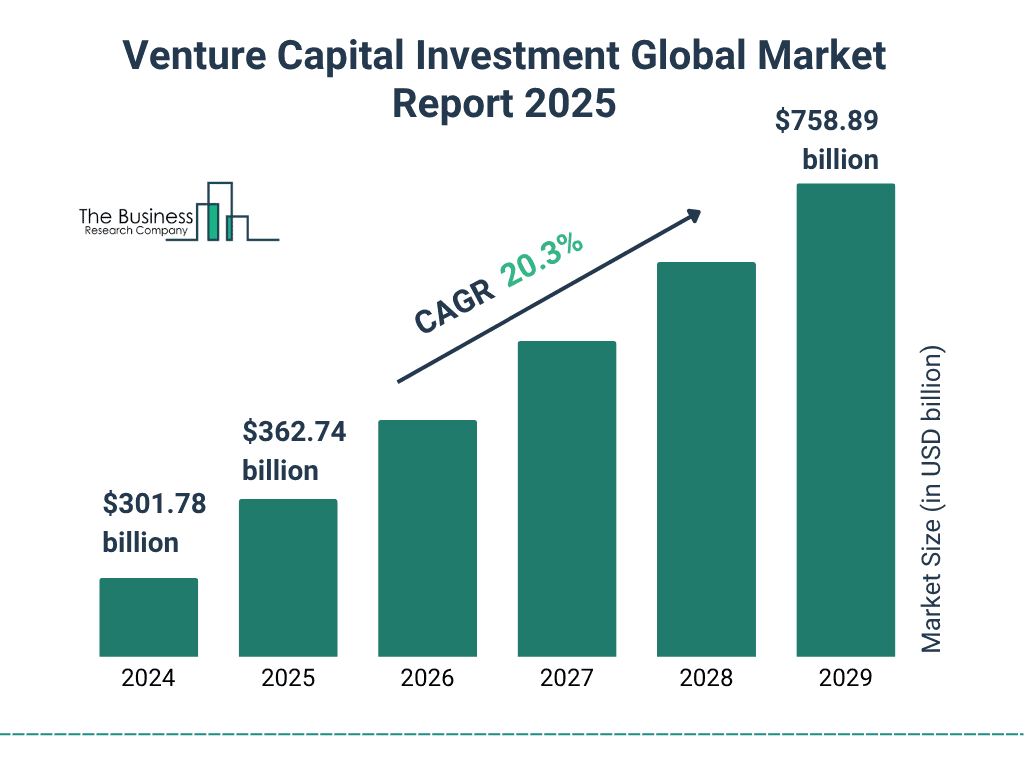

Global Venture Capital Market Growth Insights

- The venture capital investment market is projected to grow to $758.89 billion by 2029.

- This reflects a compound annual growth rate (CAGR) of 20.3%, signaling robust long-term momentum.

- In 2025, the market is expected to reach $362.74 billion, up from the previous year.

- The forecast suggests that the market will more than double within five years, adding over $457 billion in new capital.

- This rapid expansion highlights an increasing global appetite for startup funding, innovation, and early-stage investments.

Regional Analysis

- The United States retained dominance with ~64% of global VC funding in Q2 2025 as its ecosystem stayed strong.

- India raised approximately $26.4 billion in PE/VC funding in the first half of 2025, holding its position among the top global recipients.

- China’s deal‑value share in Asia‑Pacific dropped in 2024 with modest growth into 2025 amid regulatory headwinds.

- Africa’s startups secured $1.35 billion in funding in H1 2025, marking a 78% increase from H1 2024.

- Latin American startups raised just over $800 million in Q1 2025 across the seed to growth stage, showing year‑on‑year growth but a drop from the prior quarter.

- Global VC funding in Latin America grew 26% in 2024 from 2023, with expectations of a further rise in 2025.

Sector‑Specific Investments

- Fintech attracted $44.7 billion globally in H1 2025, showing a resurgence driven by payments infrastructure, insurance tech, and large growth rounds.

- Biotech funding fell to around $4.8 billion in Q2 2025 amid a broader pullback in early‑stage deals.

- Clean energy sectors lagged behind fintech and AI in 2025, with interest steady but investment growth muted.

- EdTech saw renewed attention but remains modest compared to other sectors in 2025.

- Agritech is gradually rising, though specific funding figures for 2025 remain below peer sectors.

- Gaming continues benefiting from AR/VR trends, but has not returned to peak funding levels as of mid‑2025.

- E‑commerce remains strong in Southeast Asia and Europe, with deal activity steady, though overall funding growth has slowed.

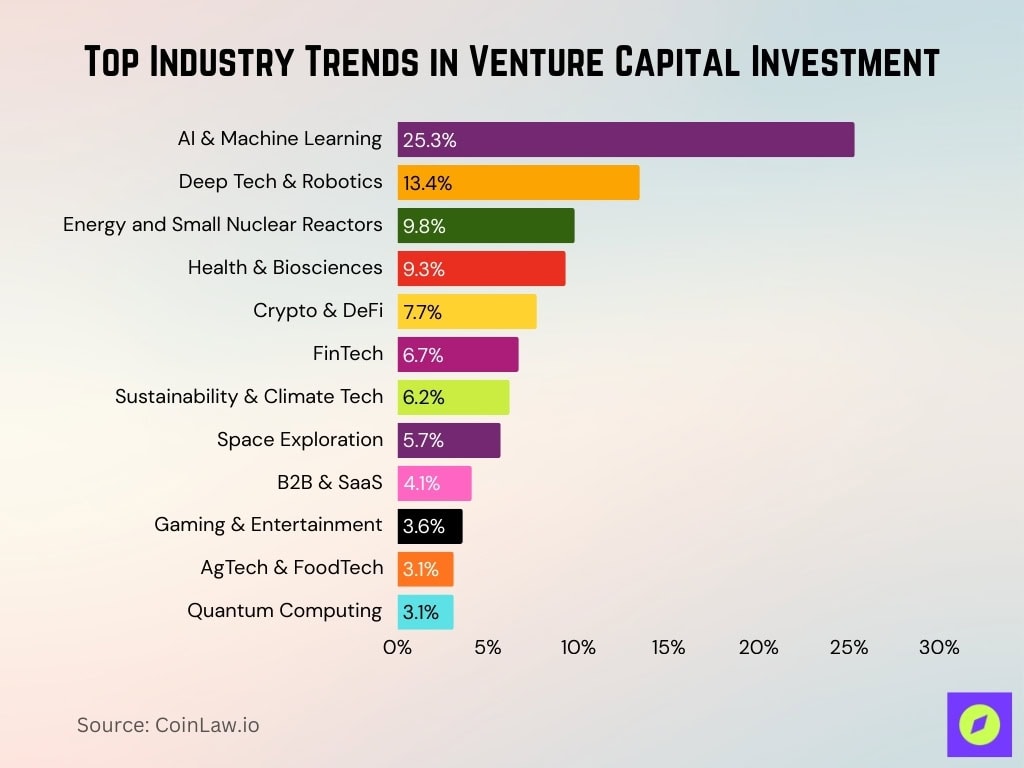

Top Industry Trends in Venture Capital Investment

- AI & Machine Learning attracted the highest VC interest, accounting for 25.3% of total industry funding focus.

- Deep Tech & Robotics followed with 13.4%, reflecting investor confidence in automation and frontier technologies.

- Energy and Small Nuclear Reactors secured 9.8%, highlighting growing VC bets on next-gen clean power solutions.

- Health & Biosciences captured 9.3%, showing sustained momentum in biotech and life sciences innovation.

- Crypto & DeFi received 7.7%, despite market volatility, indicating long-term faith in decentralized finance.

- FinTech remained strong at 6.7%, driven by demand for digital banking, payments, and embedded finance tools.

- Sustainability & Climate Tech pulled in 6.2%, reflecting a shift toward green, impact-driven investing.

- Space Exploration drew 5.7%, as commercial launches and satellite tech expand investor interest.

- B2B & SaaS held a 4.1% share, supported by the need for scalable, enterprise-first software solutions.

- Gaming & Entertainment claimed 3.6%, boosted by Web3 gaming and immersive content platforms.

- AgTech & FoodTech gained 3.1%, targeting sustainability in food production and agri-supply chains.

- Quantum Computing also earned 3.1%, as early-stage capital flows into high-potential quantum breakthroughs.

Funding Stages and Deal Sizes

- Seed-stage deals in Q2 2025 saw median deal sizes rise to $5.5 million after a strong rebound.

- Series A rounds raised $4.7 billion in Q2 2025, with median valuations reaching $47.9 million.

- Average deal size across all stages climbed to $19.2 million in Q2 2025 despite fewer deals.

- Late-stage funding cooled with Series D+ rounds down 8.9% and valuations falling 48%.

- SAFEs dominated early-stage deal structures, accounting for over 90% of pre-seed rounds.

- Deal count across all stages fell about 13% year over year by Q2 2025.

- Time between funding rounds increased, reaching a median of 696 days in Q2 2025.

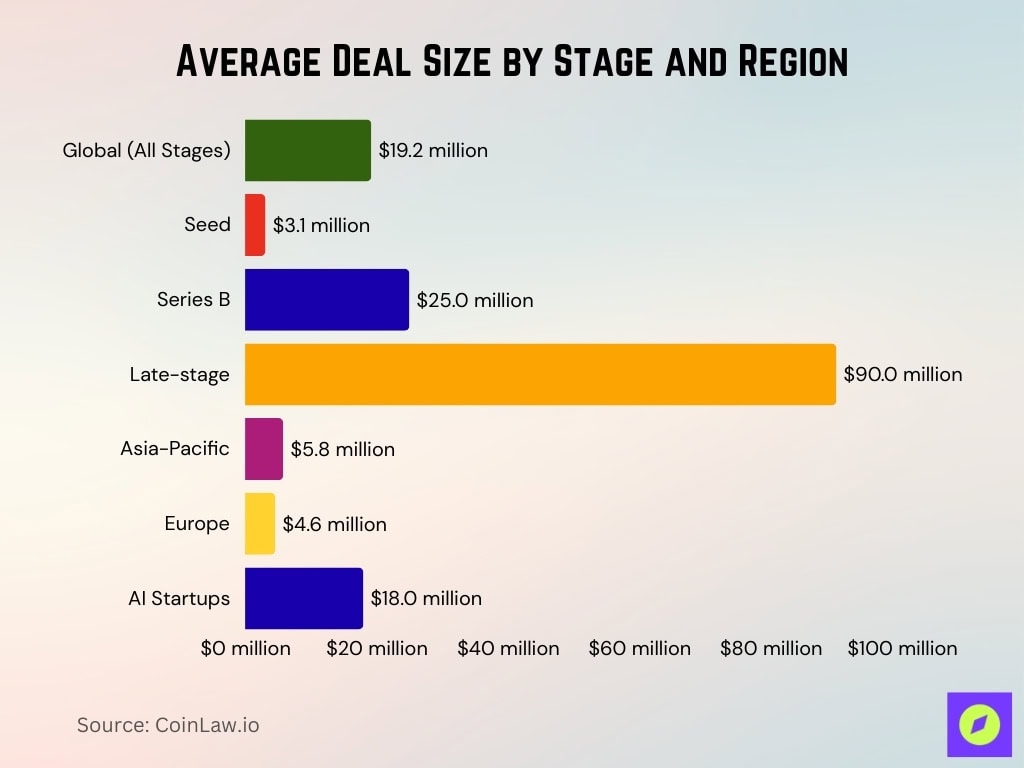

Average Deal Size

- Global average deal size across all stages rose to $19.2 million in Q2 2025 amid fewer but larger rounds.

- Seed rounds averaged about $3.1 million for YC‑style startups in early 2025 as startup valuations recovered.

- Series B deals saw averages around $25 million in Q1‑Q2 2025 as growth‑stage funding regained some momentum.

- Late‑stage average deal size hovered near $90 million in large rounds despite investor caution.

- Asia‑Pacific early‑stage deal size averaged roughly $5.8 million in 2025, while Europe’s was closer to $4.6 million.

- AI startup investments had some of the highest average deal sizes globally in H1 2025, often exceeding $18 million.

Number of Deals

- Global VC deals in Q2 2025 totaled 7,356 deals, showing a decline despite funding resilience.

- The United States led with around 3,073 deals, maintaining its dominant position.

- Asia-Pacific and Europe contributed much of the remaining global deal flow in Q2 2025.

- Early-stage deal activity remained strong, driven by seed and pre-seed momentum.

- Cross-border deals made up a smaller portion of activity in Q2 2025 amid regional investor focus.

Key Market Indicators

- Unicorn births rose to 719 new unicorns globally as of mid‑2025, reflecting continued high‑value startup formation.

- Down‑rounds accounted for about 15.9% of all venture‑backed deals in 2025 so far, marking a decade high.

- Active VC firms globally number over 2,400, with the United States maintaining the highest concentration.

- Average time‑to‑exit for funded startups stretched to about 6.5 years in 2025 as market conditions drive longer growth periods.

- Private equity buyouts make up roughly 20–25% of startup exits in 2025 as acquisition paths gain preference.

- Secondary market transactions rose by around 14% YoY in early 2025, with more stakeholders seeking liquidity.

- IPO valuations have lifted slightly to an average of around $2.8 billion in 2025 as public market optimism returns.

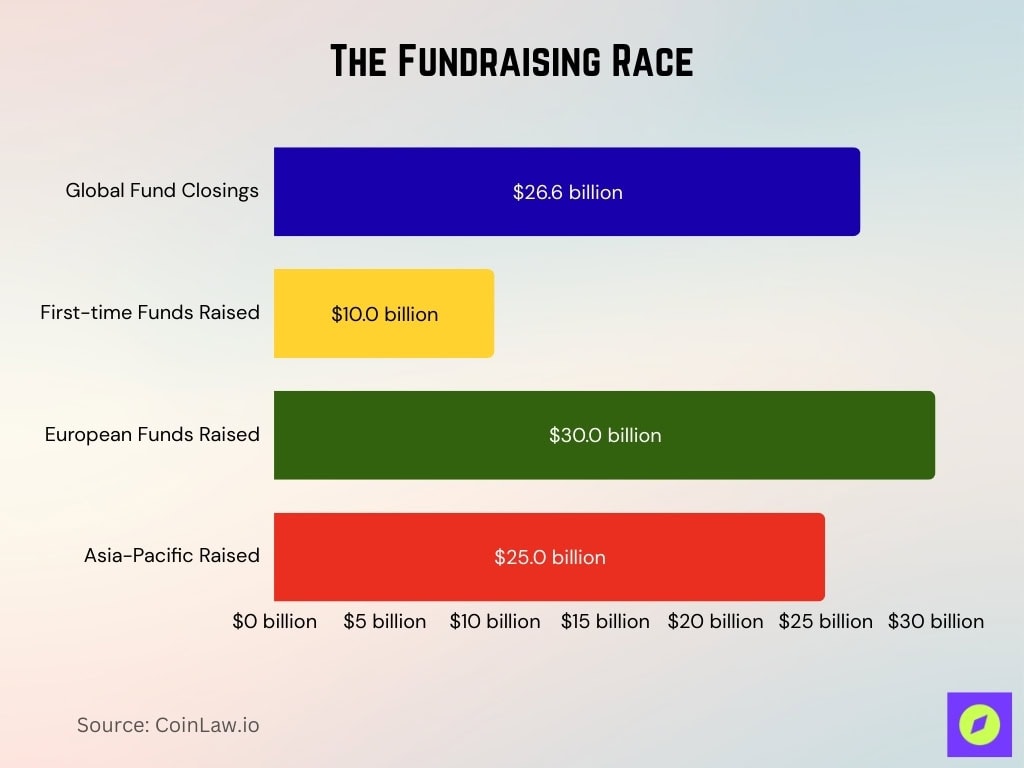

The Fundraising Race

- Global venture fund closings in H1 2025 totaled roughly $26.6 billion, reflecting a steep drop from prior years as investor caution rises.

- First‑time funds raised about $10 billion in 2025, continuing to struggle amid tighter LP scrutiny.

- European funds secured roughly $30 billion in capital through early 2025, led by fintech and AI‑focused funds.

- Asia‑Pacific fundraising rebounded modestly with about $25 billion raised so far in 2025, buoyed by sovereign wealth and government‑backed vehicles.

- Impact investment funds drew in less capital than in prior years, though interest remains, with only a few billion dollars committed in early 2025.

- Average time to close a venture fund increased to about 15.3 months in early 2025 as diligence periods lengthened and LP negotiations stretched.

Exit Strategies and Returns

- M&A activity surged to $100+ billion in H1 2025, marking a 155% increase over the same period in 2024.

- IPOs of venture‑backed companies in H1 2025 reached about $169 billion in market cap across 11 listings.

- Direct listings remain rare in 2025, making up a small share of public exits as IPOs dominate among late‑stage companies.

- Acquihires accounted for roughly 5‑8% of exits in 2025, especially in artificial intelligence and fintech sectors.

- Venture‑backed IPOs represented nearly half of the public exit value in tech‑heavy industries during early 2025.

- Secondary and tender offers saw strong growth with 60+ liquidity events logged by mid‑2025 across various exit types.

- Top‑tier VC funds reported an average ROI of 20‑25% in 2025, led by big exits, while mid‑tier funds trended slightly lower, around 12‑18%.

Sustainable Start‑Ups Gaining Momentum

- Climate tech startups raised about $13.2 billion in H1 2025, showing a decline from 2024 but still capturing a growing share of total VC funding.

- EV and mobility ventures secured $15 billion in 2025 as electrification remains a priority in many markets.

- Agri‑tech funding fell compared to prior years, though total figures stayed in the low billions as food security innovation continues.

- Circular economy startups saw modest investment growth in 2025, though not yet breaking into the top-funded sectors.

- B‑Corp and social impact‑certified early‑stage companies made up a rising portion of the funding structure, but still under 10% of total VC deployment.

- Carbon capture and removal technologies attracted renewed investor interest in 2025 with major deals pushing totals upward.

- Sustainable packaging and green materials startups saw increasing demand, though investment remains modest relative to AI, fintech, and clean energy sectors.

Resurgence in IPO Activity

- The global IPO market recorded 539 listings in H1 2025, raising $61.4 billion, showing a 17% increase in proceeds year over year.

- US IPOs in Q2 2025 rose by 16% compared to Q2 2024, with 50 listings generating about $8.1 billion.

- VC-backed IPOs delivered strong post-IPO returns averaging around 450%, outperforming other exit types.

- IPO proceeds in Asia-Pacific surged in H1 2025, with tech and logistics firms fueling growth.

- Europe’s IPO activity remained sluggish in H1 2025 as many firms postponed or cancelled offerings.

‘Dry Powder’ Surplus

- Global dry powder among private equity and venture capital funds reached roughly $2.5 trillion in mid‑2025, continuing to hover near record levels.

- Private equity firms held about $1.2 trillion of that dry powder as pressure mounted to deploy capital.

- Early‑stage/venture‑focused funds account for a smaller share of dry powder in 2025, as much of it is concentrated in buyout and growth funds.

- Tech‑oriented funds represent nearly 40% of total dry powder, showing sustained interest in innovation sectors.

- Europe’s portion of global dry powder sits at over $400 billion mid‑2025 as many firms adopt cautious investment stances.

- Mega‑funds (funds sized $1B or more) held a large slice of dry powder in 2025, positioning them to lead large deals when markets allow.

- Dry powder rose by about 10‑12% since 2022 as investors delayed deployment amid valuation and rate uncertainty.

Impact of Macroeconomic Factors

- Rising interest rates in Q2 2025 contributed to about a 25% drop in late-stage deal value.

- Global inflation led to early-stage deals being priced 10–15% lower than in pre-2024 rounds.

- Cross-border investment volume declined by approximately 5% amid ongoing geopolitical tensions.

- A strong US dollar led to a 7% decline in foreign-led investments in US-based startups.

- Recession fears shifted investor focus toward cash-flow positive and profitability-focused startups.

- Government incentives boosted investments in sustainable and AI-focused startups by around 25% year over year.

- China’s regulatory easing triggered a 10–12% recovery in VC funding led by AI and enterprise tech sectors.

Recent Developments

- AI startups attracted about $89.4 billion in 2025, representing over one-third of global VC funding.

- A single $40 billion AI deal in Q1 2025 lifted total VC activity above $80 billion that quarter.

- Generative AI investment rose by approximately 19% year over year, driven by larger foundational model demand.

- Venture fundraising remained concentrated among established firms, while first-time funds continued to face hurdles.

- Leading AI startups like Mistral AI reached valuations of around $14 billion in 2025.

- AI-driven investment platforms gained traction as VC firms increasingly used machine learning for deal analysis.

Frequently Asked Questions (FAQs)

Global VC funding in Q2 2025 was $101.05 billion, down from $128.4 billion in Q1 2025.

There were 7,356 deals in Q2 2025, and the average deal size across all stages was about $19.2 million.

The global VC investment market, valued at $364.19 billion in 2025, is projected to reach $764.78 billion by 2029, implying a 20.4% CAGR.

In Q2 2025, the United States accounted for 64% of global VC funding.

Conclusion

The venture capital industry today is poised for continued evolution, balancing cautious optimism with bold investments. From the rise of AI and green tech to the increasing globalization of venture deals, the trends signal an exciting future. Whether you’re an entrepreneur, investor, or industry observer, the numbers tell a compelling story of transformation and opportunity.