VanEck is gearing up to launch its Avalanche ETF, revealing critical updates on management fees, staking mechanics, and custodial partnerships as it awaits regulatory approval.

Key Takeaways

- VanEck has finalized its proposed Avalanche ETF details, setting a management fee of 0.30% with no fee waiver.

- Coinbase Crypto Services will serve as the staking provider, retaining 4% of staking rewards under a service agreement.

- The ETF will use liquid staking protocols from Benqi Finance, Hypha, and Yield Yak, allowing flexible staking while maintaining AVAX exposure.

- If approved, the ETF will list on Nasdaq under the ticker VAVX, with Anchorage Digital and Coinbase Custody handling asset security.

What Happened?

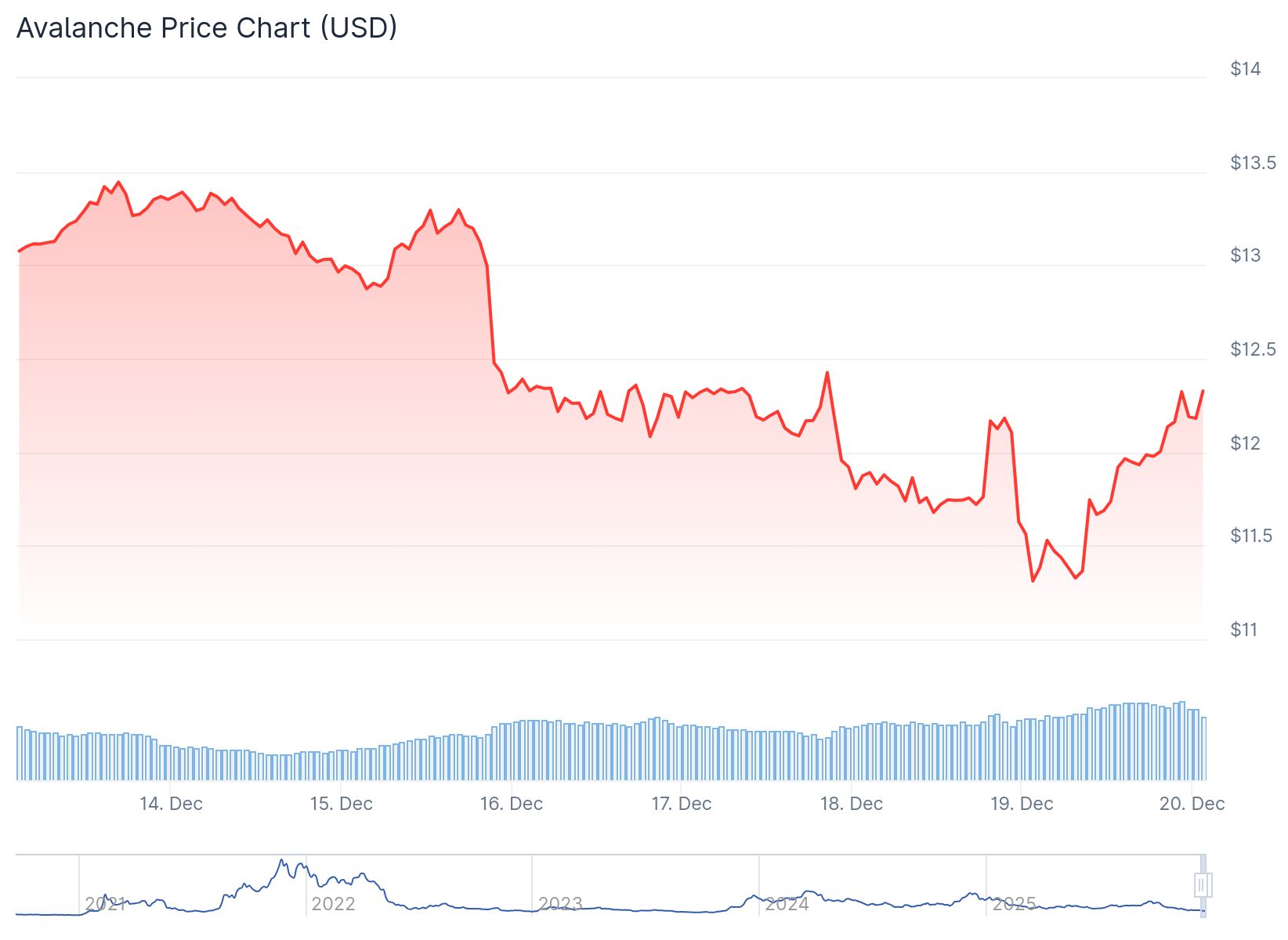

VanEck has filed a third amendment to its S-1 registration form with the U.S. Securities and Exchange Commission for its proposed Avalanche (AVAX) ETF. The updated filing outlines final details including a fixed management fee, staking structure, and operational partners, putting the fund on track for regulatory review. Market interest in AVAX surged after the news, with prices climbing more than 6% and daily trading volume topping $517 million.

JUST IN: Looks like VanEck’s $AVAX ETF is back with a twist.

— The Degen Times (@DegenTimes69) December 19, 2025

The 3rd amendment allows up to 70% of $AVAX to be staked via Coinbase, transforming it from a simple spot ETF into a yield-generating powerhouse.

Source: Edgar @SECGov pic.twitter.com/FAfUvYMJSd

VanEck Locks in 0.30% Fee Without Waiver

The updated prospectus confirms that the Avalanche ETF will carry an annual management fee of 0.30%. This positions VanEck competitively against Bitwise, which proposed a slightly higher 0.34% fee but with a temporary waiver. VanEck’s decision not to offer a promotional fee period suggests confidence in its structure and long-term appeal to institutional investors.

Coinbase to Handle Staking with 4% Reward Deduction

A central feature of the ETF is staking, which allows the fund to earn additional yield by helping validate the Avalanche network. VanEck appointed Coinbase Crypto Services as the staking provider, under an agreement where Coinbase will deduct 4% from staking rewards. The custodian’s staking facilitation fee remains at zero.

To enhance operational flexibility, the ETF will use liquid staking solutions provided by Benqi Finance (sAVAX), Hypha (STAVAX), and Yield Yak (yyAVAX). These services enable the ETF to stake assets while maintaining liquidity and exposure to AVAX.

Key Players in ETF Operations

VanEck’s amended filing lists a suite of institutional partners to manage fund operations:

- Anchorage Digital Bank will act as the primary custodian.

- Coinbase Custody Trust Company will serve as the secondary custodian.

- State Street Bank and Trust Co. is named as the cash custodian, administrator, and transfer agent.

- VanEck Securities Corporation will manage distribution.

The ETF will track the MarketVector Avalanche Benchmark Rate, which reflects the price and staking performance of AVAX.

Nasdaq Listing Pending SEC Approval

The ETF is expected to trade under the ticker VAVX on the Nasdaq stock exchange, pending approval under the SEC’s Generic listing guidelines. With the fund structure finalized, VanEck’s proposal is technically ready and now awaits the regulatory green light.

AVAX Price Rallies on ETF Momentum

Following VanEck’s updated filing, AVAX surged to $12.34, marking a 6.74% gain in 24 hours, with total market capitalization approaching $5.3 billion. Trading volume also spiked by over 32%, crossing the $517 million mark. This rebound comes after a week of losses, and reflects renewed institutional interest tied to ETF developments.

CoinLaw’s Takeaway

In my experience watching ETF launches, this move by VanEck shows how crypto ETFs are maturing beyond basic price tracking. Integrating staking, liquidity protocols, and top-tier custodians sets a new bar for institutional-grade crypto exposure. The 0.30% fee without gimmicks also signals confidence. If the SEC gives the green light, this could become a benchmark product for Avalanche in the U.S. market. I found the timing interesting too, right when AVAX was regaining momentum. It’s clear that regulated staking is becoming a key battleground for ETF innovation.