USDT staking has become a growing avenue for earning passive income in stablecoin markets. Users can stake USDT in DeFi protocols, centralized exchanges, and yield-optimized platforms. Two real‑world scenarios show its impact: retail investors in the U.S. using USDT staking on platforms like Kraken to earn approximately. 5.5% APY rather than letting USDT sit idle, and institutions leveraging stablecoin staking (or dual-investment structures) in DeFi to enhance returns while managing risk.

This article explores the latest statistics, including rates, volumes, platform data, regulatory shifts, risks, and environmental implications, to help you understand USDT staking today.

Editor’s Choice

- Tether (USDT) remains the largest stablecoin by market cap globally, leading with $169 billion vs. USDC’s ~$72 billion as of mid‑2025.

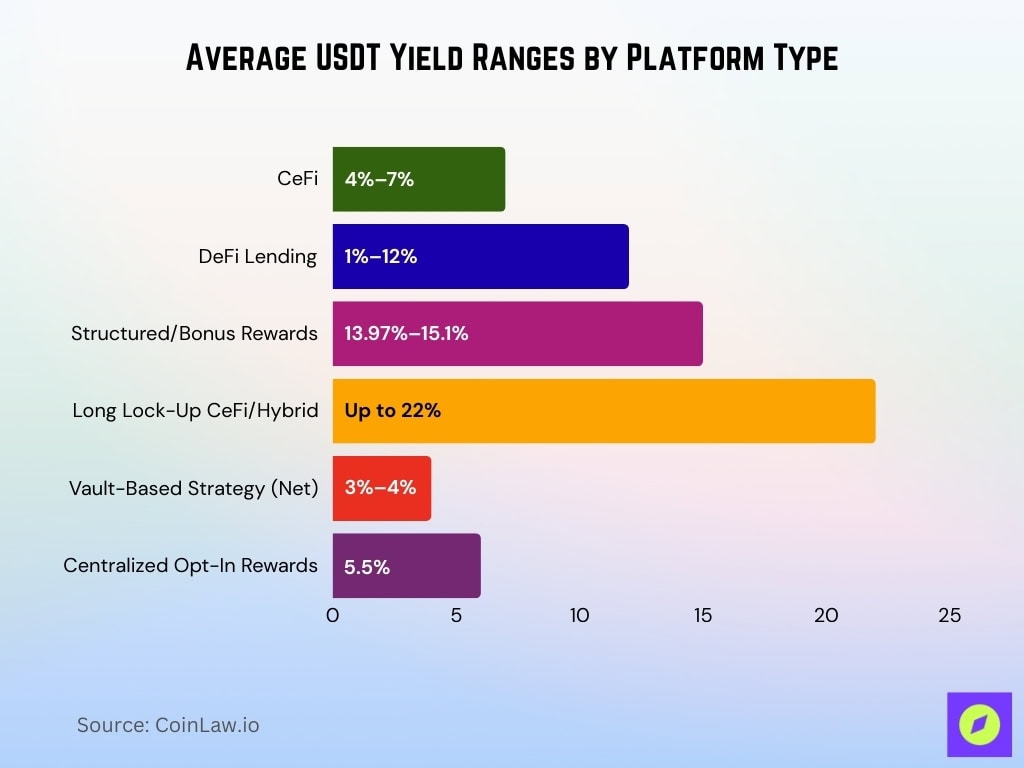

- USDT staking yields typically range from 1%–8.8% on most platforms. However, yields as high as 22% may appear on niche or promotional products that involve longer lock periods, additional risk, or incentive programs.

- On Gate.com, USDT staking (flexible) is advertised with estimated APRs of ~13.97% to 15.1% for certain “staking / reward” products.

- Kraken offers “opt‑in rewards” on USDT holdings, with up to 5.5% APY for users who hold USDT in its system.

- Platforms such as SLEX offer USDT staking options with lock‑up periods (e.g., 4, 8, 10, 12 months) and returns up to about 22% in some cases.

- Regulatory clarity has improved. On May 29, 2025, the U.S. SEC issued a Statement on Certain Protocol Staking Activities clarifying how federal securities laws apply.

- On August 5, 2025, the SEC stated that certain liquid staking activities do not require treatment as securities under U.S. law, provided they meet defined criteria.

Recent Developments

- The SEC’s staff clarified that liquid staking activities that issue “receipt tokens” for staked assets are not securities under U.S. securities law, provided they fulfill certain conditions.

- U.S. stablecoin regulation is in motion. The GENIUS Act, passed in mid‑2025, aims to establish a licensing framework for stablecoin issuers, reserve backing, and audit requirements.

- Tether has announced plans to launch a new U.S.‑specific stablecoin by late 2025 to better comply with regulatory requirements under the GENIUS Act.

- The stablecoin market size globally is creeping toward $300 billion, with USDT and USDC holding ~80% of that combined share.

- On the yield front, USDT staking or reward programs are diversifying, DeFi platforms offering 1%‑12% APY depending on liquidity, and centralized ones between 4%‑7%.

- Some platforms (e.g. Gate.com) are advertising USDT staking products with higher APRs (~14‑15%) for flexible/short-term staking.

- Emerging platforms like SLEX are pushing higher locking returns (up to ~22%) for longer lock periods.

- Yield optimization tools are more widespread, dual‑investment or structured products combining USDT staking/lending to increase returns.

USDT Staking Rates and Yields

- CeFi exchanges typically offer 4%‑7% APY for staking USDT in flexible or locked‑savings type programs.

- DeFi lending platforms may offer 1%‑12% APY, dependent on liquidity demand, utilization of pools, collateral, and platform.

- Structured or bonus reward programs can push yields higher, e.g., Gate.com showing 13.97% to 15.1% for certain USDT staking‑reward products.

- Lock‑up duration matters; longer lock times often give higher yields. Platforms like SLEX offer up to 22% for multi‑month lock periods.

- Some vault‑ or strategy‑based DeFi tools offer more modest returns (3%‑4%) after fees and gas costs.

- Kraken’s opt‑in rewards for USDT provide 5.5% APY on holdings.

Top Platforms for USDT Staking

- Kraken, up to 5.5% APY on USDT via opt‑in rewards. Minimums are low, flexibility is high.

- Gate.com offers USDT staking products with estimated APRs in the ~14‑15% range for specific short‑term or reward‑based programs.

- SLEX Exchange, locking USDT for 4‑12 months, can yield up to ~22% according to their current offerings.

- MEXC is known to offer USDT staking yields up to about 8.8% for stablecoins with flexible terms.

- Other platforms in comparative lists include exchanges and DeFi protocols that combine rewards, lending income, or platform incentives.

- Risk management features vary; some platforms have proof‑of‑reserve or insurance, and some require lock‑ups.

Annual Earnings from USDT Staking

- DeFi platforms offering the highest yields (around 8% APY) on USDT can translate $10,000 staked into $800 in annual earnings.

- Centralized exchanges (4%–7% APY) generate $400–$700 per $10,000 staked annually.

- If USDT supply increased by 9.2% in H1 2025 (to 96.7 billion tokens), the total supply rise implies increased potential reward distributions.

- The global stablecoin market cap reached approximately $250 billion by mid‑2025, suggesting more capital could shift into staking.

- Combined trading volume of USDT and USDC hit $23 trillion in 2024, indicating high liquidity that supports staking ecosystem growth.

- Monthly stablecoin trading volumes averaged $1.48 trillion in early 2025, up 27% YoY, increasing opportunities for yield-generating integrations.

- Institutions likely contributed to increased staking activity, although precise figures remain proprietary.

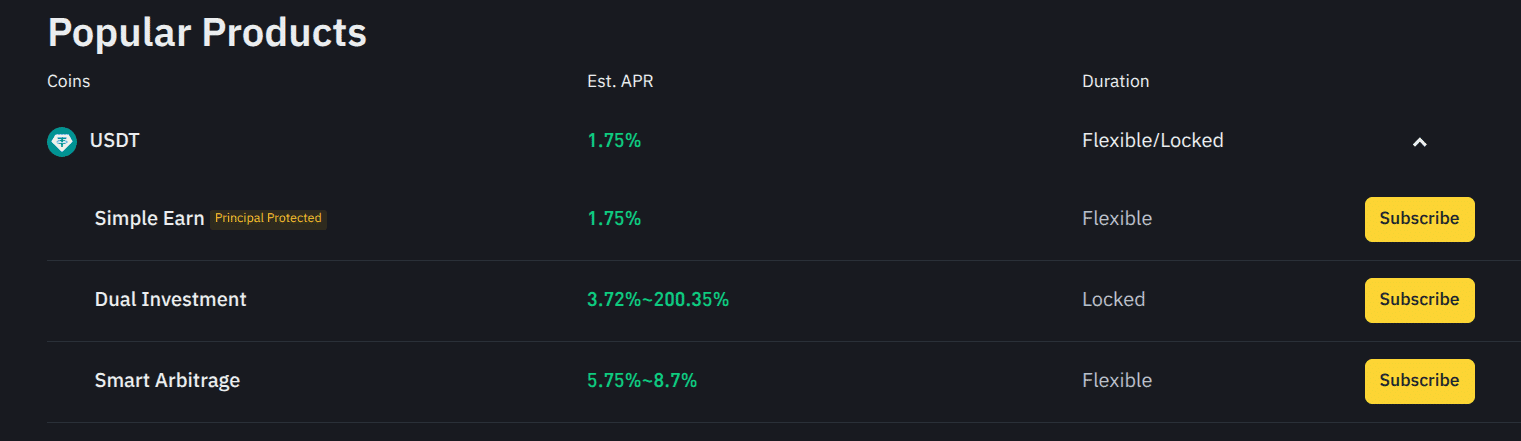

Binance USDT Yield Products

- Simple Earn offers a 1.75% APR on USDT with a flexible duration, providing low-risk, principal-protected earnings.

- Dual Investment yields range from 3.72% to 200.35% APR, but require a locked duration and carry market exposure depending on asset price movements.

- Smart Arbitrage provides returns between 5.75% and 8.7% APR, available on a flexible basis, targeting users who seek automated arbitrage-driven strategies.

Minimum and Maximum Staking Amounts

- Many centralized exchanges like Kraken and Binance allow no minimum or very low minimums (e.g., 1 USDT or $10 equivalent) for flexible staking or savings products.

- DeFi protocols such as Aave or Yearn may require higher amounts (e.g., 100 USDT or $100 worth) to enter, depending on gas economics.

- Lock‑up or structured products on platforms like SLEX often list minimum lock‑in periods with corresponding minimum deposits (e.g., $1,000 USDT for a 4‑month lock).

- Maximum staking amounts are typically unbounded at the retail level, limited by one’s balance or platform risk limits. Institutional offers may feature multi‑million USDT caps.

- Protocol-level caps may exist, for example, certain DeFi vaults impose per‑address caps to prevent concentration risk.

- Over the last year, the average wallet balance for USDT increased to $1,250, possibly reflecting participation thresholds in staking.

- New USDT addresses grew 14.5% YTD, indicating many smaller accounts are entering the ecosystem.

Flexible vs Fixed USDT Staking

- Flexible staking typically pays lower yields (~4%–7% APY) but allows instant withdrawals.

- Fixed or locked staking offers higher APY, up to 22% on long‑term products on platforms like SLEX.

- Gate.com offers flexible products at ~14‑15% APR, indicating blurred lines between flexible and short-term fixed strategies.

- DeFi lending protocols like Aave or Compound offer effective, flexible exposure since users can withdraw when liquidity permits.

- Dual‑investment or structured tools impose fixed terms but are often functionally flexible via early‑exit penalties.

- Market dynamics (demand for liquidity) cause fixed yields to fluctuate more than flexible ones.

- Some platforms blend both approaches via tiered yield, base flexible + bonus for not withdrawing within a threshold.

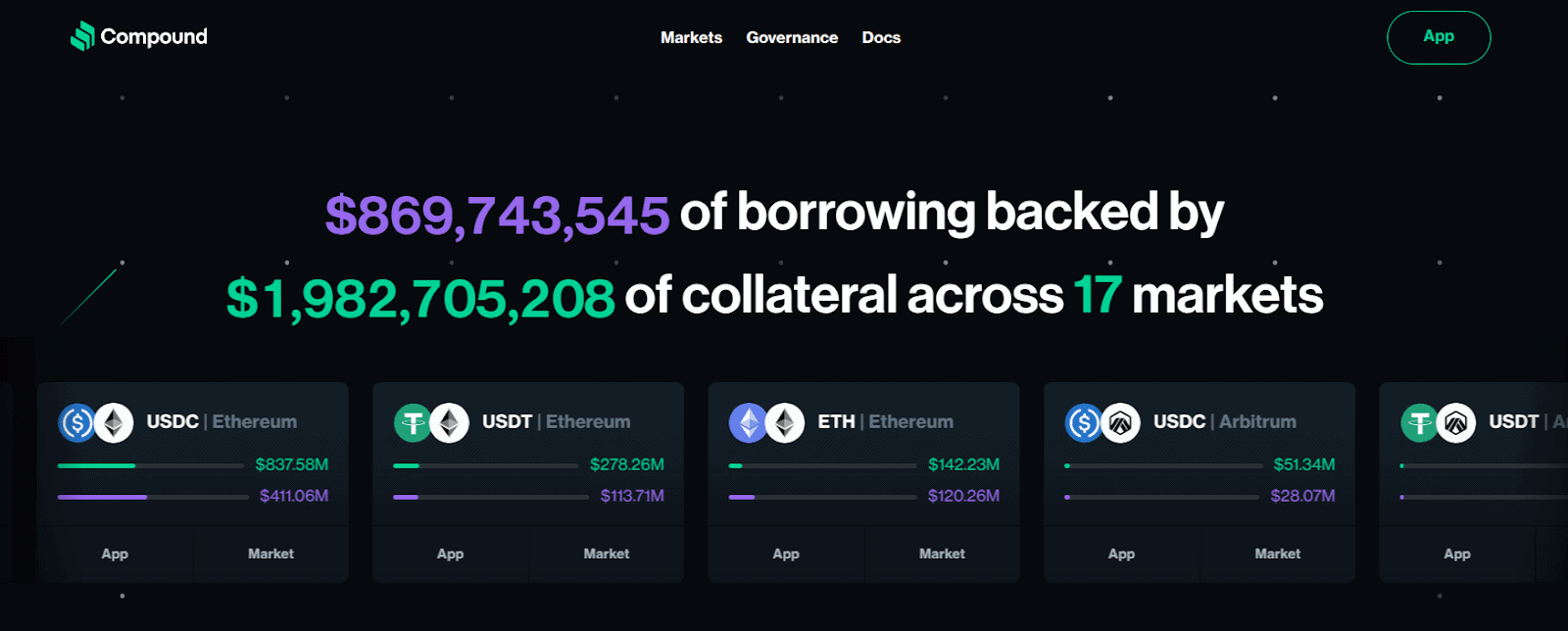

Compound Protocol: USDT & Stablecoin Lending Stats

- Compound currently has $869.74 million in active borrowing across all markets.

- The borrowing is backed by a total of $1.98 billion in collateral, spread across 17 different markets.

- On Ethereum, USDC is the most supplied asset with $837.58 million deposited and $411.06 million borrowed.

- USDT on Ethereum holds $278.26 million in supply and $113.71 million in active borrowing.

- ETH on Ethereum is also active, with $142.23 million supplied and $120.26 million borrowed.

- On Arbitrum, USDC shows $51.34 million supplied and $28.07 million borrowed.

- USDT on Arbitrum is listed, but exact supply and borrow values are not shown in the snapshot.

USDT Staking Volume and Growth

- The stablecoin market cap nearly hit $300 billion, with USDT alone at around $169 billion, reflecting a base for possible staking capital.

- USDT’s supply rose by 9.2% in the first half of 2025.

- Stablecoins processed over $8.9 trillion in on‑chain volume during H1 2025.

- USDT accounted for nearly 80% of stablecoin trading volume, indicating massive liquidity.

- Average daily trading volume exceeded $102 billion on some days in August 2025.

- Trading volumes for USDT and USDC combined totaled $23 trillion in 2024, a jump from 2023.

- The share of USDT use in regions with high staking activity (Asia, Africa) is increasing.

USDT Circulating Supply and Distribution

- Circulating supply of ~168.9 billion USDT as of mid‑2025.

- USDT’s total supply in July 2025 was 96.7 billion tokens, though this may refer to specific issuance or a partial metric.

- Supply increased 9.2% in H1 2025, largely due to demand in Asia and Africa.

- Over 72% of the USDT supply is held on Ethereum and Tron combined.

- TRC‑20 tokens (Tron) grew to represent 44% of USDT issuance.

- Other blockchains (Solana, Avalanche, Arbitrum) also carry portions of the supply but are less dominant.

- Layer‑2 networks now account for 9.3% of all Tether volume.

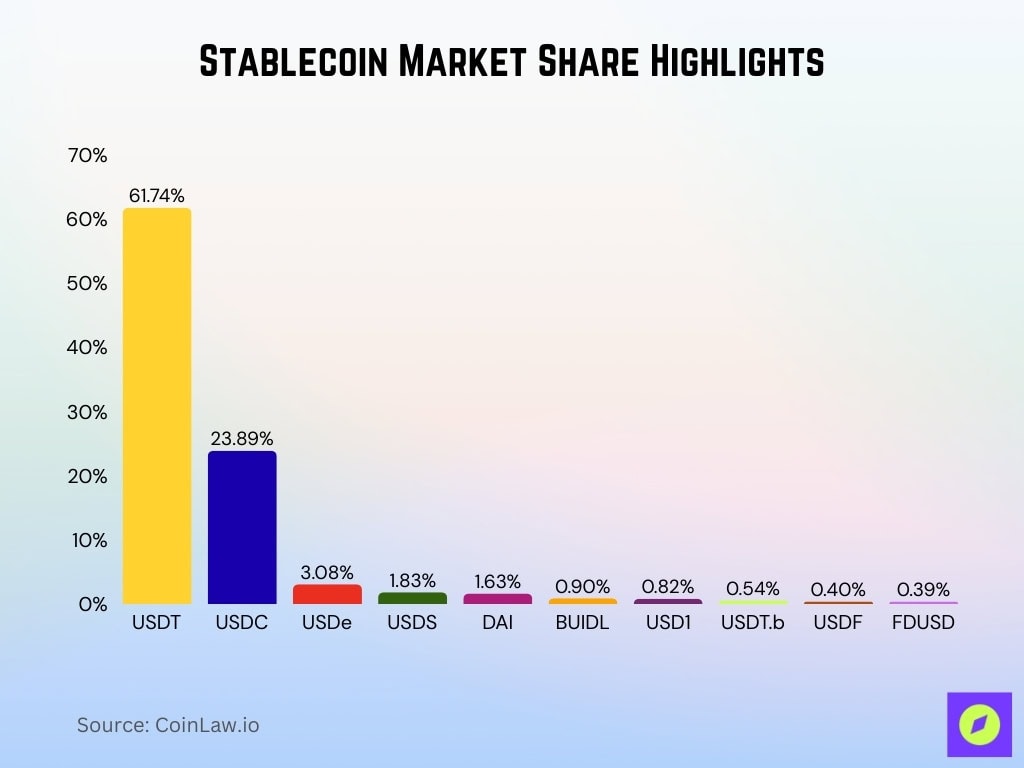

Stablecoin Market Share Highlights

- USDT leads the stablecoin market with a commanding 61.74% share, maintaining its position as the most dominant stable asset globally.

- USDC holds the second-largest share at 23.89%, continuing to appeal to institutions and regulated markets.

- USDe, a rising player, captures 3.08% of the market, signaling emerging demand for newer stablecoin models.

- USDS and DAI account for 1.83% and 1.63% respectively, reflecting the sustained presence of both custodial and decentralized stablecoins.

- BUIDL (0.9%), USD1 (0.82%), and USDT.b (0.54%) hold niche positions, collectively showing minor adoption.

- USDF and FDUSD each claim less than 0.5% market share, indicating early-stage adoption or limited usage.

Wallet Distribution and On-Chain Activity

- Average USDT wallet balance rose to $1,250, up from previous year benchmarks.

- New USDT addresses grew by 14.5% year‑to‑date, signaling rising participation.

- USDT operates on 13 blockchains, including Ethereum, Tron, Solana, Avalanche, and Polygon.

- Tron accounts for 49% of on‑chain activity, and Ethereum is close behind.

- On-chain activity on Layer‑2s is visible, with about 9.3% of USDT volume flows on L2 networks.

- Bridging volume across ecosystems exceeded $3.4 billion in the past 12 months.

- Avalanche and Arbitrum each carried more than $1.1 billion in USDT, largely used in DeFi.

Network Breakdown, Where USDT Is Staked

- Ethereum and Tron together hold over 72% of the USDT supply; these are likely the main networks where staking products operate.

- Layer‑2 networks now account for 9.3% of USDT volume, indicating growing staking and usage there.

- Avalanche and Arbitrum each handle more than $1.1 billion in USDT, often within DeFi protocols that offer staking-like yields.

- Solana, Polygon, BSC, and Base also host staking-relevant DeFi products, though no precise USDT asset stats.

- Bridges enabling staking across chains saw $3.4 billion bridged in 12 months, facilitating liquidity flows.

- Growth in emerging chains like Sui and Aptos shows rising demand for integrations, though the current USDT on-chain activity there is smaller.

Staking Returns Comparison, USDT vs Other Stablecoins

- USDC yields are often comparable, though many platforms offer slightly lower APY than USDT due to perceived risk and compliance.

- USDT’s broader liquidity and availability across chains often mean more staking choices versus DAI or BUSD.

- Yield-bearing stablecoins like USDe have surging growth; their market cap grew over 5,284% Feb‑Feb, indicating intense yield demand.

- USDT accounts for 79.7% of stablecoin trading volume, surpassing others. More volume often translates to more yield opportunities.

- Platforms sometimes favour USDT over other stablecoins with promotional bonuses, creating temporary APR advantages.

- Differences in asset backing may influence platform preferences and yields.

- Regulatory clarity around USDC may shift yield parity in the coming year.

Risks and Security of USDT Staking

- USDT staking typically involves counterparty risk, especially on CeFi platforms where solvency matters.

- DeFi staking exposes users to smart‑contract risk, especially if yield strategies involve complex protocols.

- 81.5% of reserves are now in U.S. Treasuries, repo, and short‑term assets, yet 18.5% in other assets increases reserve risk.

- Tether’s exposure in U.S. Treasury Bills places it among the top non‑sovereign holders; sudden market moves may impact its liquidity.

- Bridges can be exploited; the $3.4 billion bridge increase also raises the probability of a hack or mismanagement.

- Regulatory uncertainty remains a risk, though clarity is improving.

- Platforms offering >20% yields may indicate unsustainable models or hidden risk factors.

Regulatory Updates for Staking USDT

- The U.S. passed the GENIUS Act in mid‑2025 to define licensing, reserve backing, and audit requirements for stablecoins.

- MiCA regulation in the EU is fully applicable, setting compliance standards for issuers, indirectly influencing staking platforms.

- SEC guidance in May, August 2025 clarified liquid staking and reward mechanisms, easing some uncertainty for platforms.

- USDC’s regulatory clarity has strengthened in the U.S. and EU, increasing its adoption in DeFi and staking.

- Some platforms have begun requiring stricter KYC, AML for staking USDT, aligning with regulations.

- Stablecoin issuers now disclose reserve data more frequently, improving transparency across staking services.

- Global countries introduced stablecoin‑specific frameworks by mid‑2025, affecting international staking platforms.

Taxation of USDT Staking Rewards

- U.S. IRS treats staking rewards as ordinary income at fair market value when received, taxed at the individual’s marginal rate.

- If USDT staking rewards are later sold, any gain/loss triggers capital gains tax, with short‑ or long‑term holding periods applying.

- Platforms often don’t issue 1099‑MISC/1099‑NEC; users must self‑report income, increasing compliance burden.

- International users face similar treatment, but rules vary greatly by jurisdiction.

- Recent guidance in mid‑2025 emphasizes tracking the cost basis of each reward to properly compute gains.

- Some platforms are beginning to offer tax‑reporting tools, but coverage is limited for USDT products.

- Auditing firms warn of higher IRS scrutiny on staking income, especially where platforms lack transparent reporting.

Environmental Impact of USDT Staking

- Since USDT itself isn’t PoW or PoS, staking USDT generally happens via lending or derivatives, not energy‑intensive consensus.

- Platforms built on Ethereum (PoW to PoS since 2022) now use largely renewable energy, thus staking on Ethereum is quite efficient.

- Tron and Solana use PoS or delegated PoS consensus, leading to low per‑transaction energy consumption.

- Bridging and cross‑chain activity add compute cost, $3.4 billion bridged implies network usage, but still tiny compared to PoW chains.

- DeFi yields on USDT avoid mining‑based rewards and thus have a smaller carbon footprint than PoW mining.

- If platforms use Proof‑of‑Stake networks for staking infrastructure, their incremental energy use is minimal.

- Overall, USDT staking’s environmental footprint is modest, especially compared to Bitcoin mining.

Frequently Asked Questions (FAQs)

5.5% APY.

Over $3.4 billion.

Approximately 76%.

About $168.9 billion (circulating supply and market cap approximate to this number).

Conclusion

USDT staking today reflects a maturing ecosystem where liquidity, yield, and regulatory clarity converge. While official metrics on total stake volume and earnings remain limited, the overall growth in USDT supply, trading volume, and network distribution points to rising passive‑income adoption. Platforms are increasingly offering varied options, flexible or locked, high or moderate yields, distributed across Ethereum, Tron, and emerging Layer‑2 networks.

However, de‑risking remains essential; users must weigh return against counterparty, smart‑contract, and regulatory risks, especially in yield‑heavy offerings. Supply transparency, robust reserve backing, and evolving tax frameworks now shape staking decisions. Encouragingly, the environmental footprint remains low due to PoS and DeFi mechanisms. As stablecoins evolve under regulatory frameworks like MiCA and the GENIUS Act, USDT staking is poised to become more accessible, secure, and integrated into mainstream finance. Readers interested in detailed annual yield modeling, comparative tables with USDC, or the latest platform-specific staking terms can explore deeper resources.