Imagine you’ve just bought your dream car. You’re excited, perhaps a bit nervous, knowing it’s now up to you to keep this investment safe on the road. This is where auto insurance steps in, protecting not just your car but also your financial well-being in the event of an accident or loss. US auto insurance has grown into a complex industry, driven by consumer demand, regulatory changes, and ever-evolving technology.

Today, the landscape continues to transform with new trends and statistics that both consumers and industry players need to keep an eye on. Let’s dive into the essential statistics shaping the US auto insurance industry this year.

Editor’s Choice: Key Statistics and Milestones

- US auto insurance premiums totaled $308 billion in 2025, highlighting the industry’s sustained economic weight.

- The average US auto insurance cost rose to $2,437 per year in 2025, reflecting a surge driven by inflation and repair expenses.

- Insurers implemented an average premium hike of 7.5% in 2025, with several states experiencing increases above 15%.

- Collision claim frequency continued its long-term decline, supported by wider adoption of vehicle safety technologies.

- Over 30% of US drivers now use telematics-based insurance programs, promoting customized pricing tied to driving habits.

- Electric vehicle insurance premiums are, on average, 23% to 27% higher than gasoline vehicles, largely due to the higher cost of repairs and specialized parts

- State Farm remained the top US auto insurer in 2025, holding a market share of 16.2%.

- Auto insurance fraud is estimated to cost the industry over $29 billion annually, placing upward pressure on consumer premiums.

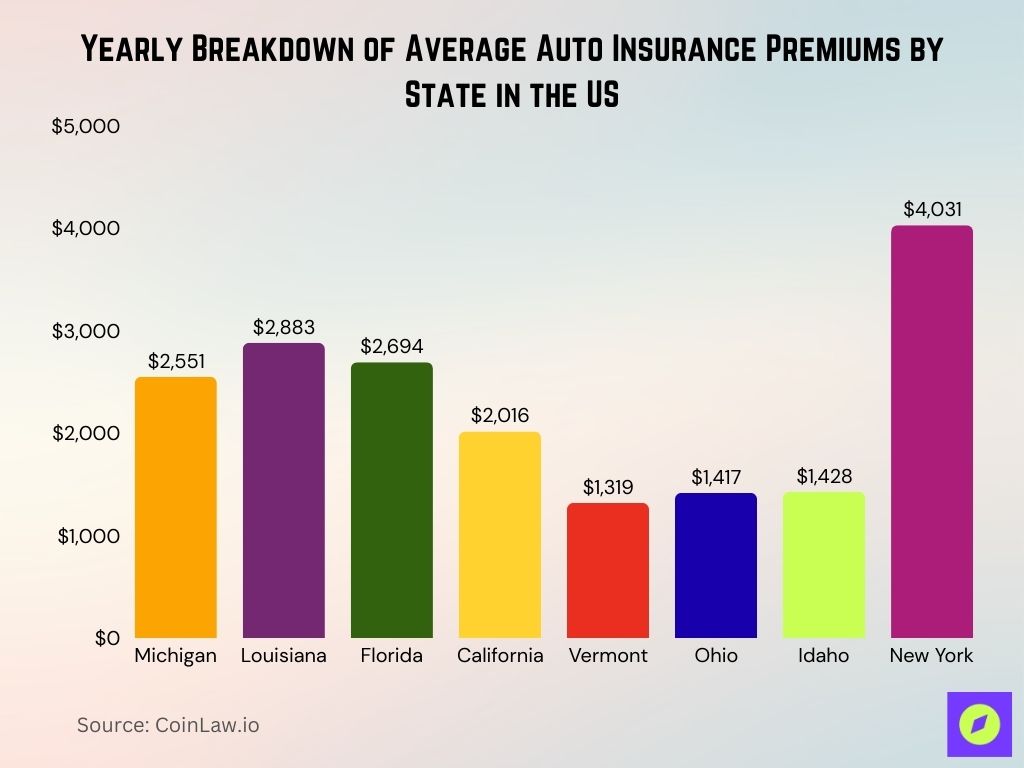

Auto Insurance Costs by State

- Michigan has an average premium of approximately $2,551 per year in 2025 due to its no‑fault laws and high claim costs.

- Louisiana with average premiums around $2,883 per year, driven by frequent severe weather and a high rate of uninsured drivers.

- Florida’s average premium is about $2,694 per year in 2025 as a result of dense urban areas, high accident rates, and an aging population.

- California averages $2,016 per year, influenced by its large population and regulations limiting rate adjustments based on credit.

- Vermont remains one of the lowest‑cost states at $1,319 per year, benefiting from low traffic density and fewer accident claims.

- Ohio and Idaho maintain low premiums at around $1,417 and $1,428 per year, respectively, thanks to rural landscapes and fewer accidents.

- High‑risk drivers in New York now pay about $4,031 annually, reflecting the impact of driving records in urban markets.

Premium and Rate Trends

- The average US car insurance cost rose to about $2,575 per year in 2025, reflecting ongoing inflation and repair cost pressures.

- Teen drivers pay approximately $3,770 per year, more than 250% higher than experienced adult drivers.

- Consumers who bundle auto and home insurance policies can save an average of 17%, with potential savings reaching up to 25%, depending on the provider.

- Telematics programs can reduce premiums by as much as 30%, especially for consistently safe drivers.

- Electric vehicle insurance costs are around 23% to 27% higher than gas-powered vehicles due to expensive parts and repairs.

- Insurance premiums may be reduced by up to 25% for vehicles equipped with advanced driver assistance systems (ADAS), including automatic braking and lane-keeping.

Costs and Expenditures

- Auto insurers in the US paid an estimated $225 billion in claims in 2025 as rising repair and liability costs drove payouts higher.

- Administrative expenses account for roughly 10% of total costs for insurers, indicating ongoing efforts to streamline operations.

- Legal and defense spending continues to climb, up about 12% annually over the past five years, driven by intensified litigation and social inflation.

- Auto repair costs remain elevated, rising approximately 8% per year, with rising parts and labor expenses contributing to claim growth.

- Average bodily injury claim payouts increased to around $30,400 in 2025, reflecting inflationary pressure in healthcare and legal settlements.

- Insurers spent approximately $4 billion on fraud prevention and detection technologies in 2025 to combat fraudulent claims and mitigate losses.

- Investment in digital claims processing reached about $1.5 billion in 2025 as insurers continued modernizing systems for greater efficiency and improved customer experience.

Global Automotive Insurance Market Growth

- The global automotive insurance market is projected to reach $1,750.09 billion by 2034, up from $774.04 billion in 2024.

- The industry is set to grow at a compound annual growth rate (CAGR) of 8.5% over the next decade.

- In 2025, the market is expected to hit $839.83 billion, showing steady post-pandemic expansion.

- By 2026, the value rises to $911.22 billion, driven by digital policy issuance and connected vehicle data.

- The market crosses the $1 trillion mark in 2028, reaching $1,072.71 billion amid rising telematics adoption.

- Growth continues with $1,163.89 billion in 2029, largely fueled by demand for comprehensive and collision coverage.

- In 2031, the market reaches $1,370.16 billion, supported by stricter road safety laws and advanced vehicle features.

- By 2033, total market value will rise to $1,612.99 billion, as personal injury protection gains traction in emerging markets.

- The 2034 forecast of $1,750.09 billion reflects ongoing expansion in third-party liability insurance and regulatory compliance policies.

Claim Frequency and Severity

- The average collision claim frequency declined by about 2.5% year-over-year, continuing the downward trend into 2025, supported by vehicle safety improvements.

- Severe weather–related claims grew nearly 14%, notably driven by rising incidents of hurricanes, floods, and wildfires.

- The average bodily injury claim severity rose approximately 9% year-over-year, increasing the financial burden on insurers.

- Total loss (vehicles deemed a total loss) frequency climbed to around 29% of all collision claims, reflecting higher repair thresholds and vehicle values.

- Hit-and-run accidents continue to compose about 10% of all claims, often resulting in elevated premiums for involved parties.

- Glass-related claims, particularly for windshields, remain extremely common, with over 11 million such claims filed in 2025.

- Theft-related claims increased by around 7%, with high-value SUVs and luxury vehicles frequently targeted.

Impact of Technology and Telematics

- Only about 12 % of U.S. drivers are currently enrolled in telematics-based insurance programs, though adoption is growing.

- ADAS features such as automatic emergency braking are reducing rear-end crashes by roughly 50 %, while other systems like blind‑spot monitoring are cutting collisions by up to 19 %.

- Adoption of mobile apps and online portals for claims processing now covers about 70 % of insurers, enabling faster and more convenient filing.

- AI-driven claims assessment tools are trimming processing time by up to 60 %, significantly enhancing efficiency and customer experience.

- The connected vehicle technology market in 2025 is valued at $39.8 billion, reflecting insurers’ growing interest in internet-enabled vehicle policies.

- Among drivers under 35, about 41 % use telematics apps to secure better insurance rates, highlighting early adoption.

- Predictive analytics tools are now used by approximately 87 % of top insurers to forecast claims and fine-tune premiums.

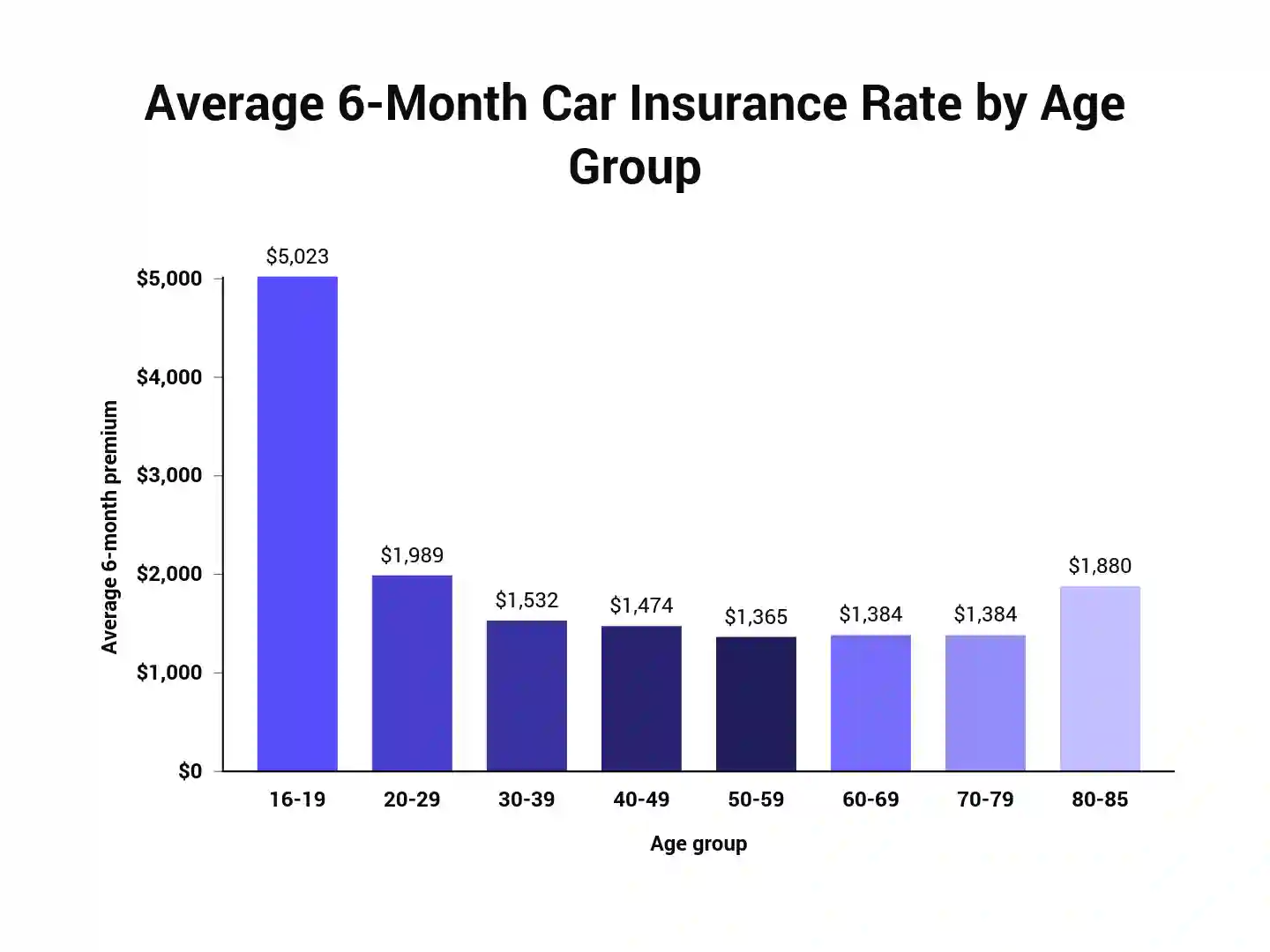

Average 6-Month Car Insurance Premiums by Age Group

- Drivers aged 16–19 pay the highest premiums, with an average 6-month rate of $5,023 due to inexperience and risk factors.

- The 20–29 age group sees a significant drop, with an average premium of $1,989.

- For drivers aged 30–39, the average rate falls further to $1,532, reflecting improved driving history.

- Those in the 40–49 range pay around $1,474, showing continued rate stability through mid-life.

- The lowest premiums are seen among the 50–59 group, averaging just $1,365 for six months.

- Both the 60–69 and 70–79 age groups pay around $1,384, indicating little change through retirement age.

- Premiums rise again for older people aged 80–85, averaging $1,880 due to elevated risk factors in older age.

Trends in Electric Vehicle Insurance

- EVs represent 9.6 % of new light‑duty vehicle sales in early 2025, highlighting their growing, but still limited, market share.

- Insurance premiums for EVs are now about 49 % higher than those for gas‑powered cars, reflecting elevated repair and replacement costs.

- Battery-related repairs account for close to 50 % of an EV claim’s cost, significantly driving up premiums.

- Tesla remains among the priciest to insure EV brands, with EV premiums on average roughly 49 % higher overall than gas vehicles.

- Many EV owners show a willingness to pay for eco-conscious coverage, indicating growing interest in green insurance options.

- Insurers are increasingly offering specialized coverage for damage related to EV charging stations at home or in public facilities.

- Discounts for installing home charging stations are becoming more common as insurers recognize their role in reducing charging‑related risk.

Key Market Indicators

- The auto insurance industry’s total assets stand at approximately $3.08 trillion in early 2025, underscoring its substantial financial foundation.

- Insurer expense ratios are holding steady at around 28 %, even as firms continue investing in technology for greater efficiency.

- Policy retention rates have declined to about 78 %, reflecting heightened policy shopping and customer churn.

- Direct written premiums surged 13.6 % year-over-year to $359 billion, driven by rising rates and vehicle replacement costs.

- The industry’s loss ratio has improved and stabilized, pointing toward a balanced underwriting environment.

- Reinsurance remains vital, with around 40 % of insurers depending on it to mitigate high-risk exposures.

- Customer satisfaction among auto insurance buyers sits at 644 out of 1,000, with 38 % expressing dissatisfaction and actively shopping around.

Auto Insurance Switching Intent by Provider

- State Farm policyholders are the least likely to switch, with only 23% likely to change and 77% not at all likely.

- Progressive customers show slightly higher churn potential, with 29% likely to change and 71% remaining loyal.

- Allstate sees 35% of its users considering a switch, while 65% are not planning to change providers.

- GEICO mirrors Allstate’s trend, with 34% likely to change and 66% staying put.

- Farmer’s Insurance faces rising turnover, with 43% of customers likely to switch in the next 90 days.

- Liberty Mutual shows a similar risk, as 45% of policyholders are likely to change providers.

- USAA follows closely, with 47% likely to change and just 53% showing loyalty.

- Nationwide experiences the highest churn risk, with 53% of customers likely to change and only 47% not at all likely to switch.

Recent Developments

- InsurTech funding surged in Q1 2025 with $1.31 billion invested globally.

- Since 2012, approximately $10.98 billion has been invested in auto/motor InsurTech firms worldwide.

- Just over 14 % of motor insurance policies now include telematics or usage-based features, reflecting growing innovation in pricing models.

- USAA is rolling out its revamped Pay-As-You-Drive offering called SafePilot Miles, available in more states by late 2025, offering up to 20 % off at purchase and another 20 % at renewal.

- Automakers like Honda are launching in-house insurance programs; Honda’s notably will not track driving behavior, diverging from others who incorporate telematics.

Conclusion

The US auto insurance industry today is shaped by advancements in technology, shifting consumer expectations, and a growing emphasis on sustainability. As electric vehicles become more prevalent, insurers must adjust their models to cater to these new demands. Meanwhile, digital innovation is simplifying the insurance process, enhancing customer satisfaction, and improving efficiency.

Consumers benefit from a wide array of options, from telematics-based policies to regional providers, that cater to diverse needs and preferences. With challenges such as climate risks and rising costs, the industry remains dynamic, responding to both regulatory changes and consumer-driven shifts. The future of auto insurance is bright, but insurers must continue adapting to the fast-paced changes ahead.