Picture this: A bustling street in Shanghai, where a single card unlocks the doors to shopping, dining, and travel across continents. This card isn’t just a payment method; it’s a global phenomenon ,UnionPay. Born in 2002 and backed by the People’s Bank of China, UnionPay has rapidly ascended the ranks of global payment systems. Today, it serves billions worldwide, marking a legacy of innovation and convenience in payment solutions.

UnionPay has evolved beyond traditional credit and debit card systems. As the world’s second-largest card payment network, it bridges gaps between nations, enabling seamless transactions. Let’s delve into the key statistics and insights shaping UnionPay’s remarkable journey.

Editor’s Choice: Key Milestones

- UnionPay now has over 10 billion cards issued globally, reaffirming its position as the most widespread payment network in 2025.

- Accepted in over 185 countries and regions, UnionPay continues to expand its global presence across emerging and mature markets.

- In 2025, UnionPay accounts for 36% of all global card transactions, maintaining dominance in the worldwide payment ecosystem.

- The network processed $23.4 trillion in transaction volume in 2025, reflecting an impressive 8.5% growth year-over-year.

- More than 55 million merchants worldwide now accept UnionPay, with continued growth in Europe, North America, and the Middle East.

- Mobile app usage surged by 18% in 2025, driven by enhanced wallet features, QR code payments, and platform partnerships.

- A significant 68% of Chinese tourists used UnionPay for international purchases, solidifying its lead in cross-border payments.

- UnionPay’s 2025 milestones showcase strong innovation, global accessibility, and sustained growth in digital financial services.

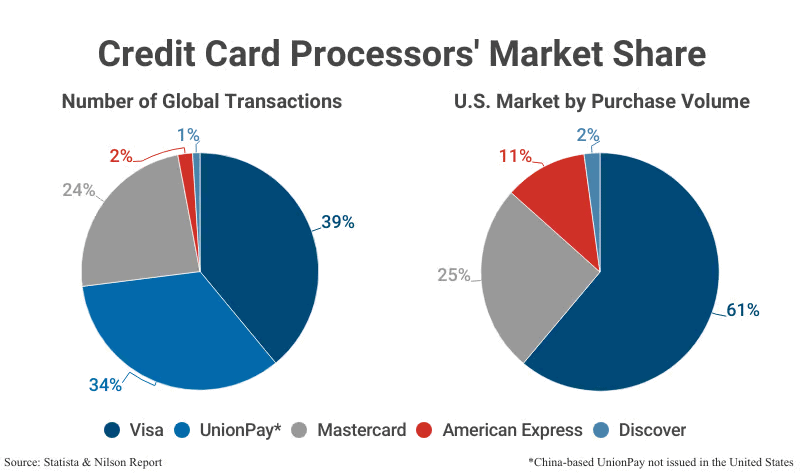

Global vs U.S. Market Share of Credit Card Processors

- Visa leads globally with a 39% share of global credit card transactions and dominates the U.S. market with 61% of purchase volume.

- UnionPay, mostly active in China, holds 34% of global transactions, but 0% U.S. market share as it’s not issued in the U.S.

- Mastercard has a 24% share globally and 25% in the U.S., showing consistent usage across markets.

- American Express accounts for only 2% of global transactions but has a stronger 11% share in the U.S. by purchase volume.

- Discover processes 1% globally and holds a 2% market share in the U.S., reflecting limited usage.

Global Transaction Volume

- UnionPay processed over $23.4 trillion in global transactions in 2025, showing a healthy 8.5% annual growth.

- Around 43% of UnionPay transactions now occur outside China, signaling stronger international adoption.

- The network processed 27.2 billion transactions in 2025.

- Over 92% of ATMs globally accept UnionPay, providing exceptional convenience to cardholders worldwide.

- Asia-Pacific still accounts for 70% of UnionPay’s volume, powered by rising digital commerce and regional economic momentum.

- The company reported that 40% of transactions in the e-commerce sector in China were processed through UnionPay, showcasing its digital influence.

With these figures, UnionPay’s expansion is a clear indicator of its strategic focus on global dominance and cross-border transaction facilitation.

Visa, Mastercard, and UnionPay Transaction Volumes

- UnionPay handled 36% of global card transactions in 2025, ahead of Visa at 30% and Mastercard at 19%.

- While Visa and Mastercard lead in North America and Europe, UnionPay commands 53% of Asia-Pacific’s market.

- UnionPay surpassed Visa in volume back in 2022 and has extended its lead for the third consecutive year in 2025.

- Mastercard’s global share slipped to 19%, allowing UnionPay to maintain its position as the second-largest network globally.

- UnionPay’s average global transaction value hit $102 in 2025, outpacing both Visa and Mastercard.

- The global growth rate for UnionPay transactions reached 8.5% in 2025, versus 4.8% for Visa and 3.9% for Mastercard.

- UnionPay’s mobile payment transactions surged past $2.1 trillion in 2025, outstripping Mastercard’s digital volume significantly.

- These 2025 milestones reinforce UnionPay’s ascent, backed by innovation, cross-border payment strength, and digital adoption.

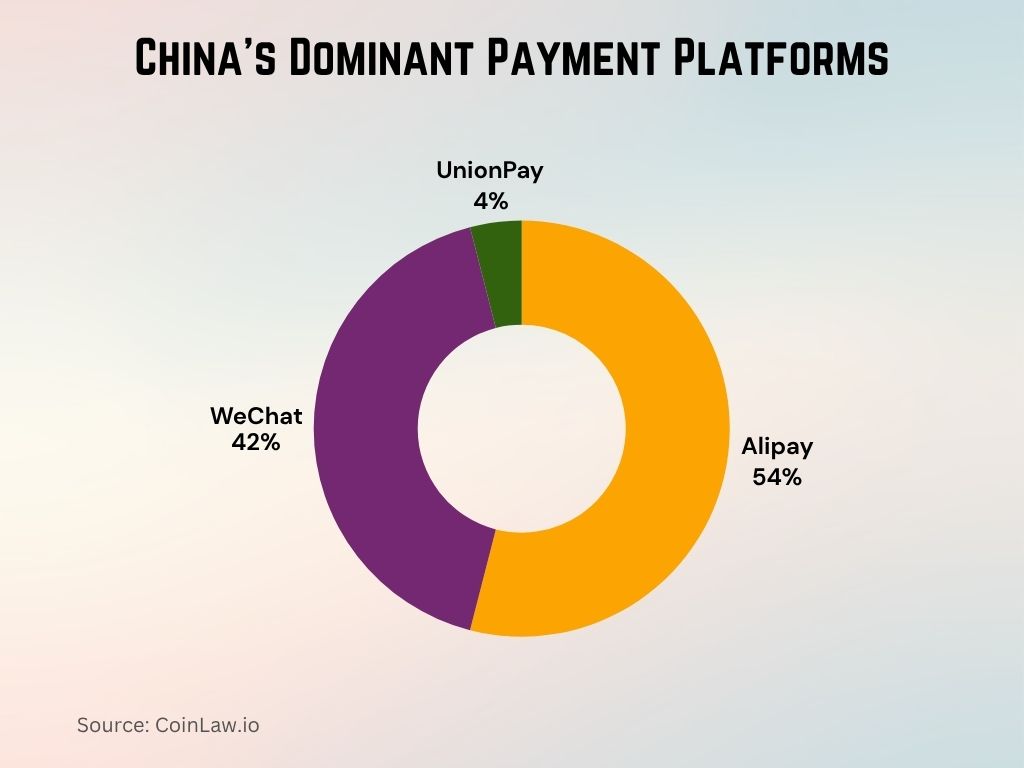

China’s Dominant Payment Platforms

- Alipay led the market with a commanding 54% share, maintaining its position as the top digital payment platform in China.

- WeChat Pay followed closely, capturing 42% of the market, highlighting its strong integration within social and e-commerce ecosystems.

- UnionPay held a modest 4% share, indicating limited use in comparison to its mobile-first competitors.

Market Share and Global Presence

- UnionPay held a 39% market share in global card transactions in 2025, maintaining a strong lead behind Visa’s 41%.

- 83% of retail merchants in Europe now accept UnionPay in 2025.

- The network saw a 14% increase in North American merchant acceptance, especially in tourist-heavy regions.

- UnionPay controls 96% of China’s payment card market, reinforcing its domestic dominance.

- In the Middle East, UnionPay reported a 24% rise in transaction volume, driven by partnerships with local banks.

- UnionPay cards are accepted in 192 countries and regions, with notable growth in Africa and Latin America.

- Digital wallets linked to UnionPay saw a 22% global adoption increase, strengthening their digital presence.

- This global footprint underscores UnionPay’s strategic 2025 expansion while preserving strength in Asia.

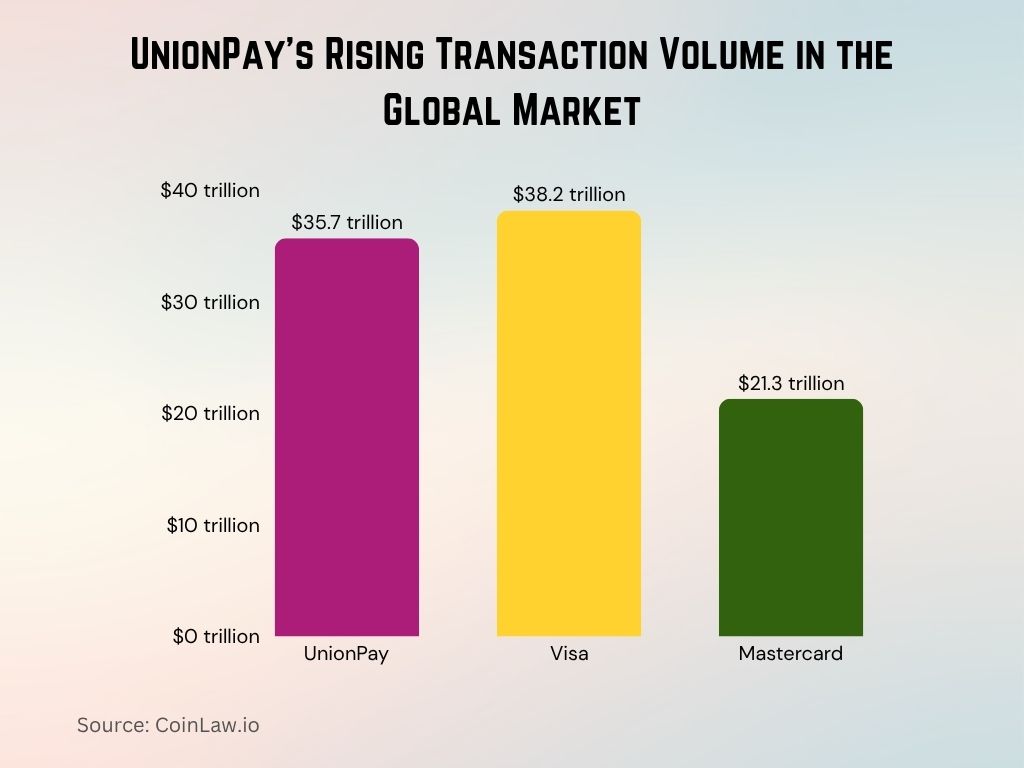

UnionPay Now #2 in Global Card Transactions

- UnionPay reached $35.7 trillion in transaction volume in 2025, closing in on Visa’s $38.2 trillion.

- Mastercard’s volume remained at $21.3 trillion, keeping UnionPay clearly ahead in second place.

- UnionPay surpassed 9.6 billion cards issued, far exceeding Mastercard’s 3 billion.

- Growth continues through QR code innovations and mobile wallet adoption across key global markets.

- UnionPay led the world with a 98.3% transaction approval rate, reflecting its reliability and infrastructure.

- 32% of new UnionPay cards in 2025 were issued outside China, signaling deeper global expansion.

- The network saw a 52% increase in business transactions, fueled by global e-commerce and retail partnerships.

- UnionPay’s trajectory in 2025 reinforces its role in reshaping global payments through innovation and reach.

Technological Developments and Innovations

- UnionPay’s real-time cross-border payment tech cut transaction times by 55% in 2025, boosting global remittance efficiency.

- The QR code payment system saw a 45% surge in usage, especially in Southeast Asia, Africa, and Central Asia.

- UnionPay expanded its blockchain integration for high-value settlements, strengthening end-to-end transaction security.

- 125 million UnionPay cards were linked to mobile wallets in 2025, marking a 27% growth in digital adoption.

- AI-powered fraud detection reduced fraud cases by 63%, reinforcing UnionPay’s leadership in secure payment systems.

- The “Pay+” platform added support for crypto-linked wallets, opening new use cases in Web3-enabled commerce.

- Contactless payments jumped 38% in 2025, driven by tap-to-pay rollouts across transport and large retail chains.

- The multi-currency virtual card now supports 24+ global currencies, enabling seamless international transactions.

- UnionPay partnered with major e-commerce apps to roll out voice-activated payments across Asia and the Middle East.

- With these advancements, UnionPay remains at the forefront of smart, secure, and scalable digital payment innovation.

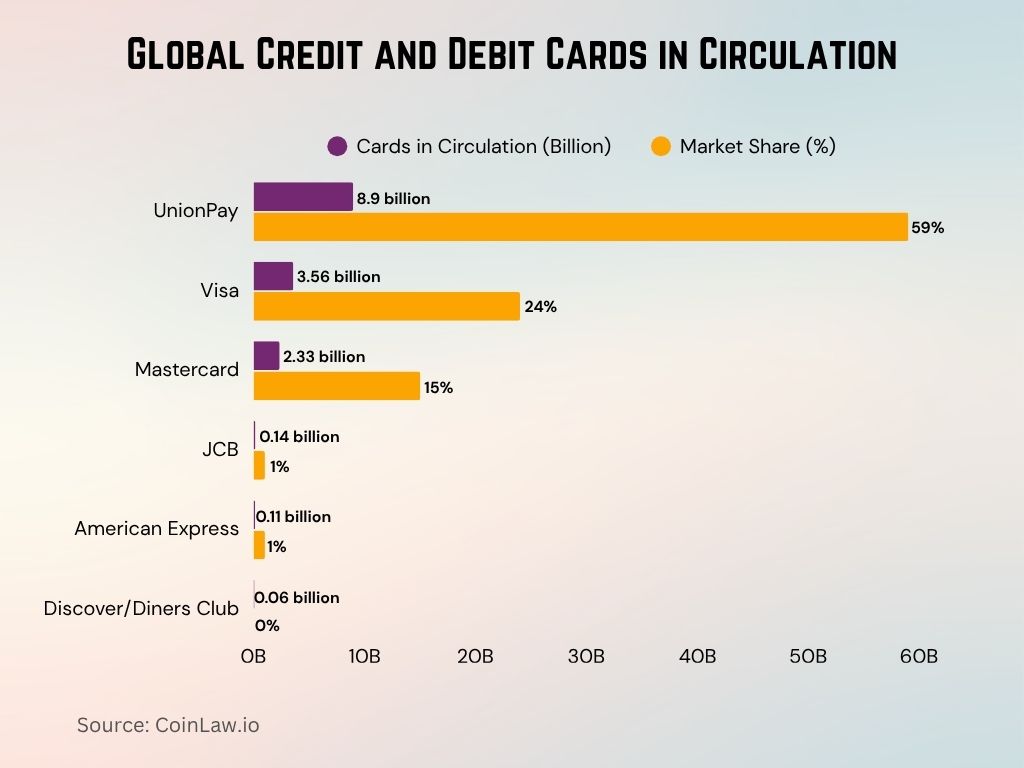

Global Credit and Debit Cards in Circulation

- UnionPay dominates globally with 8.96 billion cards, making up a massive 59% of all cards in circulation.

- Visa follows with 3.56 billion cards, accounting for 24% of the global total.

- Mastercard holds a 15% share, with 2.33 billion cards in use worldwide.

- JCB has 0.14 billion cards, making up 1% of the global card count.

- American Express contributes 0.11 billion cards, also representing 1% of total circulation.

- Discover/Diners Club trails with 0.06 billion cards, holding a minimal 0% market share.

- The total number of global cards in circulation reached 15.17 billion.

Recent Developments

- In 2025, UnionPay secured partnerships with over 65 financial institutions across Europe, North America, and the Middle East.

- The UnionPay Business+ platform expanded globally, offering localized SME payment tools in 14 major markets.

- UnionPay rolled out biometric payment cards in 5 countries, following successful pilots in Singapore and Hong Kong.

- The network deepened its presence in Africa, signing with 15 major banks to boost access in underserved regions.

- UnionPay’s Latin American market share grew by 14% in 2025, fueled by fintech partnerships and mobile-first strategies.

- Strengthened ties with Alipay and WeChat Pay enhanced UnionPay’s cross-border payment dominance in Asia and beyond.

- A new app for international students was launched in 2025, streamlining remittances and tuition payments in 30+ countries.

- By March 2025, UnionPay surpassed 9.6 billion cards issued, continuing its growth as a global network leader.

- These 2025 moves reflect UnionPay’s agility in adapting to market shifts while scaling global influence.

Conclusion

As the payments landscape becomes increasingly digital and global, UnionPay stands out as a leader in innovation, accessibility, and security. With $21 trillion in transaction volume and partnerships spanning 190 countries and regions, the network has solidified its position as a cornerstone of the global financial ecosystem.

UnionPay’s commitment to technological advancements, such as its AI fraud detection systems and blockchain integration, ensures it remains future-ready. Its focus on user-centric innovations, including multi-currency virtual cards and biometric payment options, highlights its adaptability to evolving consumer demands.

From being a regional player in China to becoming a global payment powerhouse, UnionPay’s journey reflects its resilience, strategic foresight, and dedication to excellence. UnionPay’s impact on the global economy will likely grow stronger, setting benchmarks for the future of payments.