In recent years, commodities have experienced a groundbreaking transformation in the financial sector. The trend of tokenization, essentially converting tangible assets like gold, oil, or real estate into digital tokens on a blockchain, has opened new doors, making these traditional assets accessible to a broader range of investors. Imagine owning a slice of a gold bar or a portion of an oil reserve. This was previously accessible only to institutional investors or wealthy individuals. Blockchain can improve efficiency and expand access in financial markets by reducing intermediaries, settlement times, and costs, especially in cross-border transactions.

The tokenized commodities market is growing swiftly. It’s essential to understand the data, trends, and potential that define this evolving market. From the current market size to regulatory dynamics and innovative technology, this guide covers all critical statistics and insights into the tokenized commodities market.

Editor’s Choice: Key Milestones

- The global tokenization market could grow from $2–3 trillion in 2025 to potentially over $13 trillion by 2030.

- RWA tokenization stands at $24 billion in 2025, marking a 308% surge over three years.

- Total value locked (TVL) in tokenized real-world assets was estimated between $6 billion and $8 billion by early 2024; projections for 2025 vary based on methodology.

- The tokenized commodities market cap hit $1.9 billion in early 2025, with gold dominating.

- Tokenized U.S. Treasury and money-market assets surged to $7.4 billion in 2025, up about 80% year-to-date.

- Tokenized RWAs on public blockchains were near $18 billion in early 2025, part of a broader $24 billion RWA market.

- The tokenized asset market could reach $16–24 trillion by 2030, with some estimates assuming a compound annual growth rate of over 50%.

- Retail accessibility boosted, with tokenized assets expanding from $85 million in 2020 to over $21 billion by April 2025.

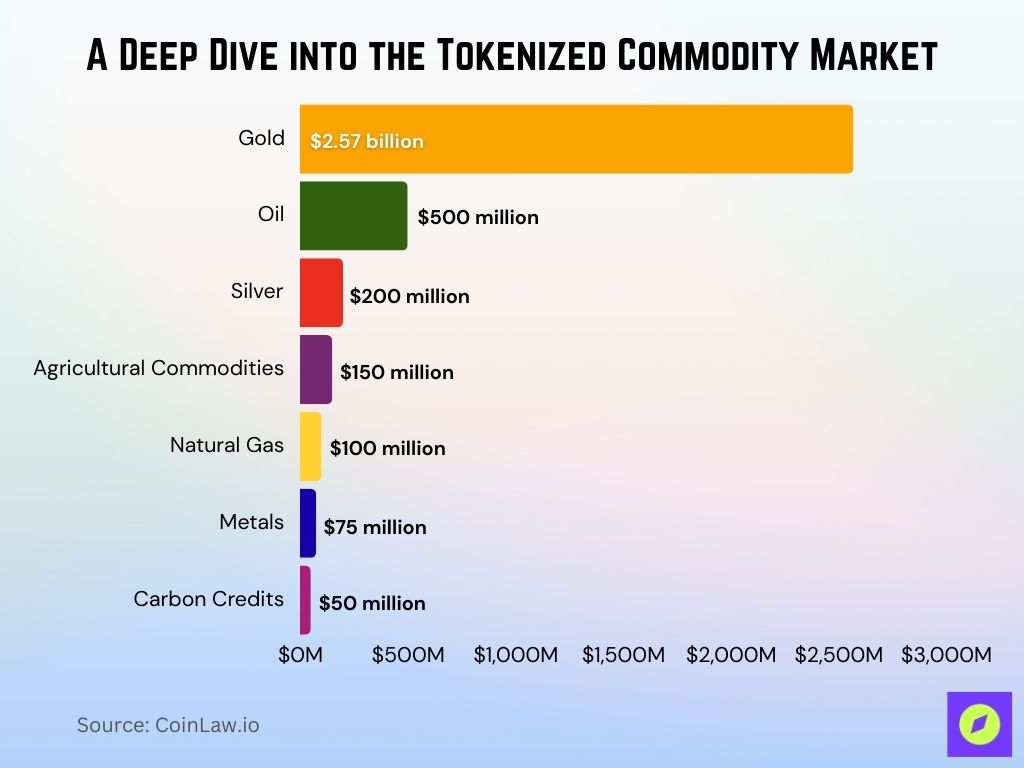

Leading Tokenized Commodities

- Gold leads the tokenized commodities market at $2.57 billion in 2025, driven by strong inflows into digital gold tokens.

- Tokenized oil is estimated at $500 million in 2025, with gradual expansion expected.

- Silver-backed tokens hover around $200 million, maintaining appeal for retail investors.

- Agricultural commodities, including wheat, corn, and soybeans, are valued at $150 million, supported by digital supply-chain transparency.

- Natural gas tokenization totals about $100 million in 2025, with growth tied to rising global energy demand.

- Industrial metals like copper and lithium hold around $75 million in tokenized value, fueled by EV and tech adoption.

- Carbon credit tokens are valued at $50 million, attracting sustainability-focused investors.

RWA Tokenization Market Snapshot

- Global RWA token market surged to over $25 billion in Q2 2025.

- On-chain RWA value reached approximately $23 billion by mid-2025, up from $8.6 billion at the start of the year.

- Overall, RWA token value grew about 85% year-on-year to $15.2 billion in early 2025.

- Total RWA assets on public blockchains neared $18 billion in early 2025.

- Commodity-backed token market cap climbed by $774 million (+67.8%) since 2024 to reach $1.9 billion.

Asset Tokenization Market Trends

- Fractional ownership expansion is rising by an estimated 30 % annually in 2025.

- Regulatory clarity is bringing roughly $300 billion in new investments by 2026.

- Institutional involvement climbs with 60 % of asset managers in the US and Europe planning to offer tokenized assets by 2025.

- Commodity-backed stablecoins are circulating at around $500 million.

- Cross-border accessibility power boosts international investor participation by 45 % by 2025.

- Blockchain is projected to be integrated into over 20% of global supply chains by 2030, particularly for provenance tracking and transparency.

- Tokenization of environmental assets like carbon credits is growing, with an estimated 50 % increase.

- Digital asset allocations by institutions reach 86 % of investors in 2025.

- RWA tokenization market value doubles to $18 billion in 2025, up from $10 billion in 2024.

- Global RWA market jumps to $25 billion in 2025, headed toward a multi-trillion-dollar opportunity by 2030.

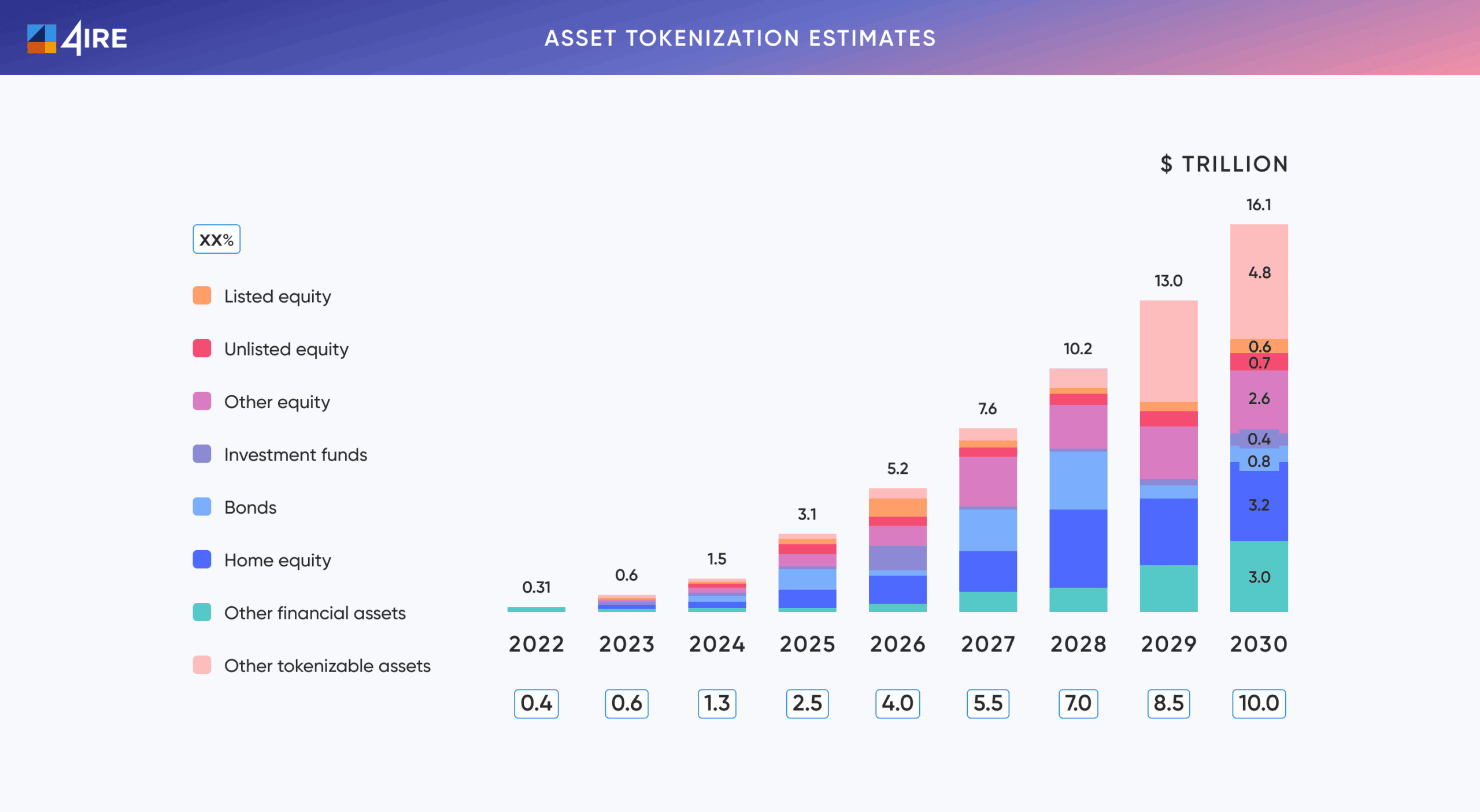

Asset Tokenization Market Estimates

- The asset tokenization market is projected to grow to an impressive $16.1 trillion by 2030.

- Growth accelerates sharply after 2025, with the market expanding from $3.1 trillion in 2025 to $13.0 trillion in 2029.

- By 2030, the largest share comes from Other tokenizable assets at $4.8 trillion, highlighting new categories of digitalized value.

- Home equity and Other financial assets remain significant, valued at $3.2 trillion and $3.0 trillion, respectively, by 2030.

- Other equity reaches $2.6 trillion, while Unlisted equity and Listed equity contribute $0.7 trillion and $0.6 trillion each.

- Bonds and Investment funds form smaller segments, with $0.8 trillion and $0.4 trillion by 2030.

- The rapid rise in tokenized assets underscores mainstream adoption of blockchain-based finance, bridging traditional assets with digital markets.

Technological Advancements

- Blockchain scalability improved with Ethereum 2.0 and Polygon, enabling faster transactions and lower costs in 2025.

- Smart contract adoption increased with a 40% annual rise in tokenized commodity transactions.

- Interoperability expanded through Polkadot and Cosmos cross-chain solutions, enhancing liquidity across networks in 2025.

- Enhanced security protocols using zero-knowledge proofs and multi-signature wallets strengthened fraud protection.

- DeFi integration grew with 9% of DeFi applications focused on asset tokenization in 2025.

- AI adoption surged with platforms using AI for risk assessment to provide real-time analytics.

- Oracle usage became widespread with 85% of tokenized platforms leveraging oracles for accurate real-world price feeds in 2025.

Regulatory Landscape

- The CLARITY Act has been proposed in the U.S. Congress to define regulatory jurisdiction over digital assets, but as of 2025, it has not yet been enacted.

- EU’s MiCA regulation fully implemented by 2025 to standardize crypto regulation across member states.

- Japan’s regulatory clarity has boosted investor interest in tokenized commodities by approximately 35 %.

- Singapore maintains its progressive stance with MAS regulations, fostering a favorable environment for tokenized commodity innovation.

- AML and KYC mandates are now strictly enforced worldwide to uphold compliance and reduce risks.

- China continues limited adoption of tokenized assets through state-backed blockchain frameworks within approved channels.

- Emerging markets like the UAE and Bahrain support tokenized commodity projects via regulatory sandboxes.

Key Use Cases of Tokenized Commodities

- Digital Gold Savings Accounts allow investors to hold fractional gold securely, making gold ownership more accessible and liquid.

- Industrial Raw Material Procurement leverages tokenized assets to streamline purchases, improving efficiency and transparency in supply chains.

- Farmer-to-Market Token Sales connect agricultural producers directly with buyers, ensuring fair pricing and faster settlements.

- Collateralized Loans in DeFi use tokenized commodities as backing, enabling secure lending and borrowing on decentralized platforms.

- Cross-Border Trade Settlement becomes faster and cheaper, reducing reliance on intermediaries and cutting transaction costs significantly.

- Access to Tokenized Real Estate Portfolio enables fractional property investment, opening up real estate markets to smaller investors.

- Automated Supply Chain Replenishment uses smart contracts and tokens for real-time inventory and financing, reducing delays.

- Hedging Tools for Retail Investors provide opportunities to manage risk and volatility with commodity-backed assets.

- Institutional Investment Products expand diversification by offering structured funds based on tokenized commodities.

Institutional Adoption and Infrastructure

- Around 60% of institutional investors in the US and Europe expect to adopt or explore tokenized assets within the next few years.

- RWA tokenization market surged to $27.9 billion by Q2 2025, supported by institutional demand and compliant infrastructure.

- Institutional funds for tokenized assets hold around $350–$400 million in AUM in 2025.

- Institutional infrastructure adoption expands with custodial platforms, fund products, and insurance growing by 30% annually.

- RWA tokenization has increased 245-fold from $85 million in 2020 to over $21 billion by April 2025.

- Commodities account for 7% of total tokenized assets by April 2025, while private credit and treasuries lead the market.

- On-chain tokenized RWAs on public blockchains amount to nearly $18 billion in early 2025.

Benefits of Commodities Tokenization

- Enhanced liquidity boosts trading with 25% more liquidity added to the traditional commodities sector.

- Fractional ownership growth brings 30% more retail investors into commodities markets.

- Investor confidence rises thanks to transparency, with blockchain traceability increasing trust by 25%.

- 24/7 global trading access expands market participation, enabling continuous liquidity and flexibility.

- Lower transaction costs from automated smart contracts reduce barriers for smaller investors.

- Cross-border accessibility grows with 150% increased adoption of tokenized commodities in emerging markets.

- Portfolio diversification increases as 30% of the tokenized commodity market share now comes from retail investors.

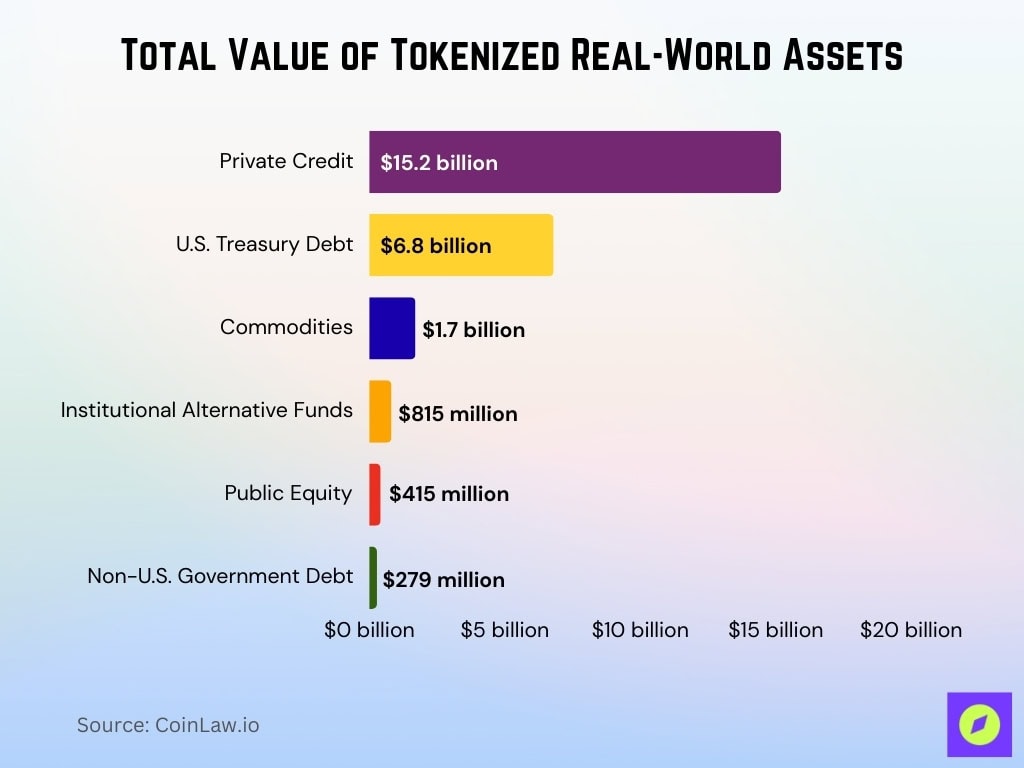

Total Value of Tokenized Real-World Assets

- Private Credit leads the tokenized RWA market with $15.2 billion, accounting for the majority share.

- U.S. Treasury Debt follows at $6.8 billion, highlighting strong institutional interest in tokenized government securities.

- Commodities represent $1.7 billion, showing the growing role of gold, oil, and other tangible assets in tokenization.

- Institutional Alternative Funds stand at $815 million, reflecting early adoption in structured investment products.

- Public Equity accounts for $415 million, signaling initial experimentation with tokenized stock ownership.

- Non-U.S. Government Debt contributes $279 million, a small but emerging segment in cross-border tokenized finance.

Recent Developments

- New platforms such as Securitize and Tokeny Solutions continue to launch tokenized commodity services, including gold, oil, and carbon credits.

- Venture capital investment in tokenized commodities platforms reached $1.8 billion in the past year.

- Commodity-backed stablecoins now account for a small niche, with gold-pegged tokens like PAXG and XAUT dominating this space.

- Integration with DeFi continues to expand with tokenized commodities increasingly used for collateralized lending and staking, driving DeFi involvement by around 20%.

- ESG momentum strengthens as tokenized carbon credits remain prominent, valued at approximately $50 million, aligning sustainability with investing.

- Traditional finance institutions such as Goldman Sachs and Citadel Securities combined have contributed over $135 million in funding toward infrastructure like the Canton Network, enhancing tokenized asset capabilities.

Conclusion

The tokenized commodities market today represents a confluence of technology, regulation, and market demand, transforming traditional commodities investing. By enabling fractional ownership, enhancing liquidity, and attracting institutional investors, tokenized commodities are reshaping access to markets that were once reserved for large-scale players.

Looking ahead, advancements in blockchain scalability, regulatory clarity, and institutional infrastructure will further drive the market, making tokenized commodities an increasingly integral part of diversified investment portfolios. With continued innovation and the backing of major financial institutions, tokenized commodities stand poised to redefine the commodities investment landscape, offering both accessibility and resilience in an ever-evolving financial world.

CEClayton Elliott

Wow thanks for the insight.