Elon Musk just made his biggest-ever purchase of Tesla shares, sending the stock soaring and signaling renewed confidence in the EV maker’s future.

Key Takeaways

- Musk bought 2.57 million Tesla shares worth about $1 billion, his largest insider purchase to date

- This is Musk’s first open-market buy since February 2020

- Tesla shares surged more than 7% following the disclosure

- The purchase comes just weeks ahead of a major shareholder vote on Musk’s new $975 billion pay package

What Happened?

Tesla CEO Elon Musk bought 2.57 million shares of his company on September 12, spending around $1 billion in total. This is his first open-market purchase in over five years and the largest insider buy of Tesla stock by dollar value.

Elon Musk just bought over 2.56 million of $TSLA shares in surprise Form 4 filing worth over $1 billion

— Special Situations 🌐 Research Newsletter (Jay) (@SpecialSitsNews) September 15, 2025

Stock up another 3.5% premarket pic.twitter.com/ffbrlheF1T

Massive Buy Signals Confidence

According to an SEC filing, Musk paid between $372 and $396 per share. This transaction increased his Tesla stake by about 0.6%, moving him closer to the 25% voting control he has openly sought. Prior to this purchase, Musk owned roughly 13% of Tesla.

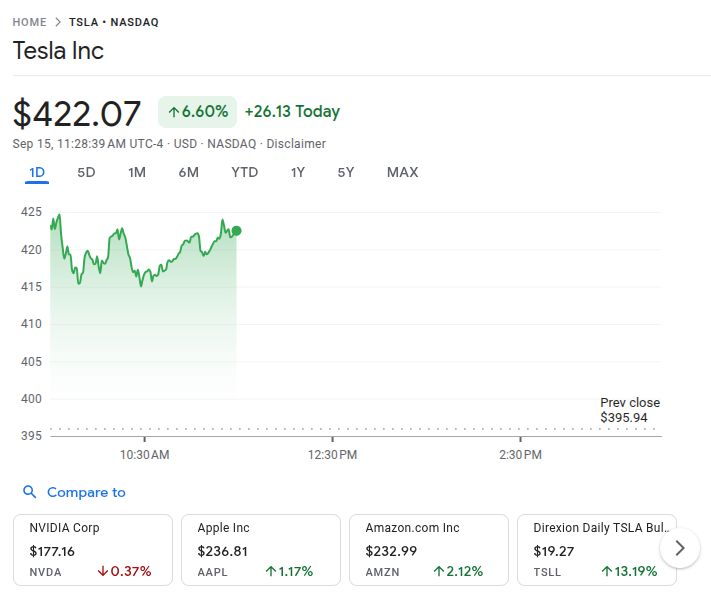

Investors took this as a powerful show of confidence. Tesla shares jumped 7.36% to close at $395.94 on the day of the announcement, and continued to rally in pre-market trading, climbing another 6.60% to reach $422.08.

Wedbush analyst Dan Ives described the move as “a huge sign of confidence for Tesla bulls,” emphasizing Musk’s commitment to Tesla’s AI and robotics ambitions.

The insider purchase “is a huge sign of confidence for Tesla bulls and shows Musk is doubling down on his Tesla A.I. bet,” said Dan Ives, global head of tech research at Wedbushhttps://t.co/d7YJf5MZ9M @CNBC 🏆🔥🐂🍿

— Dan Ives (@DivesTech) September 15, 2025

Other analysts echoed similar sentiments, calling the purchase a major morale boost for long-term investors.

Pushing for Greater Control

The timing of the purchase is key. It comes just ahead of a November shareholder vote on Musk’s proposed compensation plan, which could be worth up to $975 billion if Tesla hits a series of highly ambitious targets. These include growing Tesla’s market value to $8.5 trillion and selling one million humanoid robots over the next decade.

Musk has been vocal about his desire for at least 25% voting power. He has said he would be reluctant to scale Tesla’s AI and robotics ventures without greater control, suggesting he might pursue those efforts outside the company if shareholders do not approve the package.

Analysts believe this $1 billion stock buy strengthens Musk’s position ahead of the vote, both in terms of actual stake and market sentiment.

Tesla’s Challenges Remain

Despite the optimism surrounding Musk’s purchase, Tesla faces ongoing headwinds. Sales have slumped in part due to reduced EV incentives under the Trump administration and concerns that Musk’s political activity may have alienated some buyers.

Financially, Tesla remains a powerhouse with $92.72 billion in trailing revenue and $5.88 billion in net income. The company’s market cap is $1.28 trillion, and it holds $36.78 billion in cash with relatively low debt. However, its lofty valuation has drawn scrutiny, with a forward P/E ratio of 156.25.

Tesla’s stock has gained over 72% in the past year, but is still down around 2% for 2025, making it one of the laggards among the so-called “Magnificent 7” mega-cap tech stocks.

CoinLaw’s Takeaway

I found Musk’s massive buy-in to be more than just a financial move. In my experience, insider purchases of this scale are rare and almost always strategic. Musk knows the market watches his every move, and this $1 billion bet feels like a loud statement: he’s all in. It’s not just about owning more shares. It’s about regaining control, shaping Tesla’s future, and pushing forward with his vision for AI and robotics. If nothing else, this sends a clear message to investors and shareholders that he’s not stepping back anytime soon.