Tesla has approved a massive $29 billion stock-based compensation package for CEO Elon Musk in a bold move to retain its controversial leader and navigate growing challenges in AI and EV markets.

Key Takeaways

- 1Tesla’s board granted Musk 96 million shares worth $29 billion to ensure his continued leadership.

- 2The award is not tied to performance metrics but requires Musk to remain in a senior role for two years and hold shares for five.

- 3This interim package could be voided if a Delaware court reinstates Musk’s prior $56 billion award.

- 4The decision follows a court ruling that voided his 2018 package and comes amid falling sales and rising AI competition.

What Happened?

Tesla’s board of directors approved a new interim compensation package for CEO Elon Musk valued at approximately $29 billion, aiming to stabilize leadership at a pivotal time. The plan comes as Tesla navigates an AI talent war, a struggling vehicle lineup, and a high-stakes legal battle over Musk’s previous pay.

Tesla’s New Award to Musk

The new plan grants Musk 96 million restricted stock units, which will vest over two years if he stays in a senior leadership role at Tesla throughout the period. He is required to hold the shares for five years, with limited exceptions for taxes or purchase costs. Musk will pay $23.34 per share, echoing terms from the now-invalidated 2018 compensation deal.

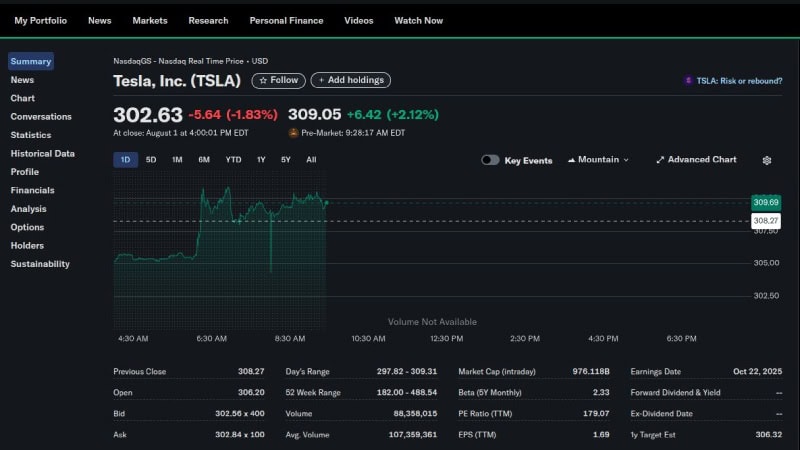

- At Tesla’s pre-market price of $309.56, the award’s value is around $29 billion.

- Tesla stock rose +2.29% or +6.93 points in the pre-market session following the announcement.

- The package was approved by a special board committee consisting of Robyn Denholm and Kathleen Wilson-Thompson.

- Both Elon and Kimbal Musk recused themselves from the decision-making process.

The company stated the deal was necessary due to “ever-intensifying competition for AI talent,” highlighting recent multi-billion dollar acquisitions and large cash offers in the industry.

Legal Cloud Still Looms

The award is an “interim CEO package,” contingent on the outcome of an appeal currently pending in the Delaware Supreme Court. A judge previously ruled Musk’s $56 billion 2018 compensation invalid due to behind-the-scenes influence and board member conflicts of interest.

If Musk’s original 2018 award is reinstated, the new package will be voided to avoid any “double dip,” Tesla clarified.

Judge Kathaleen McCormick’s decision, which voided the 2018 plan, criticized Tesla for lacking governance protections and not tying Musk’s reward to any time-bound commitment to the company. That issue is directly addressed in the new structure.

Strategic Stakes for Tesla

Tesla is facing a rough road in 2025. Sales are softening globally:

- July deliveries in China fell 8.4%, highlighting regional weakness.

- The Cybertruck, Tesla’s first new model since 2020, has underperformed in sales.

- Brand loyalty has dipped, with some investors pointing to Musk’s political associations, especially his support for Donald Trump.

Meanwhile, Musk has launched his own AI venture, xAI, and owns social media platform X, adding pressure to Tesla’s board to secure his attention. His recent comments stressed discomfort about growing Tesla’s AI business without 25% voting control, which this new package aims to address incrementally.

Tesla also faces structural industry shifts. With declining EV subsidies and increased competition from legacy automakers, the company is betting heavily on future technologies like robotaxis and humanoid robots.

CoinLaw’s Takeaway

I think Tesla’s move is risky but revealing. This $29 billion package shows just how valuable the board believes Musk still is, even when the company is under pressure. While critics question giving away so much equity without performance benchmarks, it’s clear Tesla fears losing Musk more than overpaying him. Whether this keeps him focused is the big question. And with AI heating up, I get why they acted fast. But if courts reinstate the 2018 award, the company may have just gone through a lot of drama for nothing.