Stronghold Digital Mining (SDIG) stands at a pivotal crossroads as the bitcoin mining industry evolves rapidly in response to network changes, energy costs, and M&A activity. Over the past year, Stronghold’s performance has reflected broader shifts in mining economics, while its pending acquisition by Bitfarms suggests a strategic reshaping of its footprint.

Beyond mining, Stronghold’s integration of power infrastructure and energy assets highlights how digital mining companies are diversifying in a capital-intensive sector. From driving grid-scale energy usage to influencing venture capital flows into digital assets, the company’s data tells a story of adaptation and recalibration. Let’s explore the latest figures and performance indicators shaping Stronghold’s trajectory.

Editor’s Choice

- Bitfarms holds $698 million in net liquidity as of early 2026, supporting Stronghold expansions.

- Approximately 4.0 EH/s mining capacity was reported for Stronghold’s Pennsylvania sites prior to the Bitfarms acquisition.

- Pending merger with Bitfarms expected to expand capacity to approximately 950 megawatts.

- Net losses reported in key quarterly results are reflective of industry headwinds.

- Market cap fluctuated, with SDIG trading around $2.8 before delisting.

Recent Developments

- That quarter included a GAAP net loss of $22.7 million and an adjusted EBITDA loss of $5.5 million.

- The revenue mix included $0.5 million from energy sales and approximately $10.6 million from crypto operations.

- A pending merger with Bitfarms Ltd. was announced, targeting a combined energy and mining scale.

- Leadership changes announced alongside strategic hosting agreements with Bitfarms.

- SDIG was delisted from public trading in mid-2025 after the acquisition.

Bitcoin Mining Capacity and Hash Rate

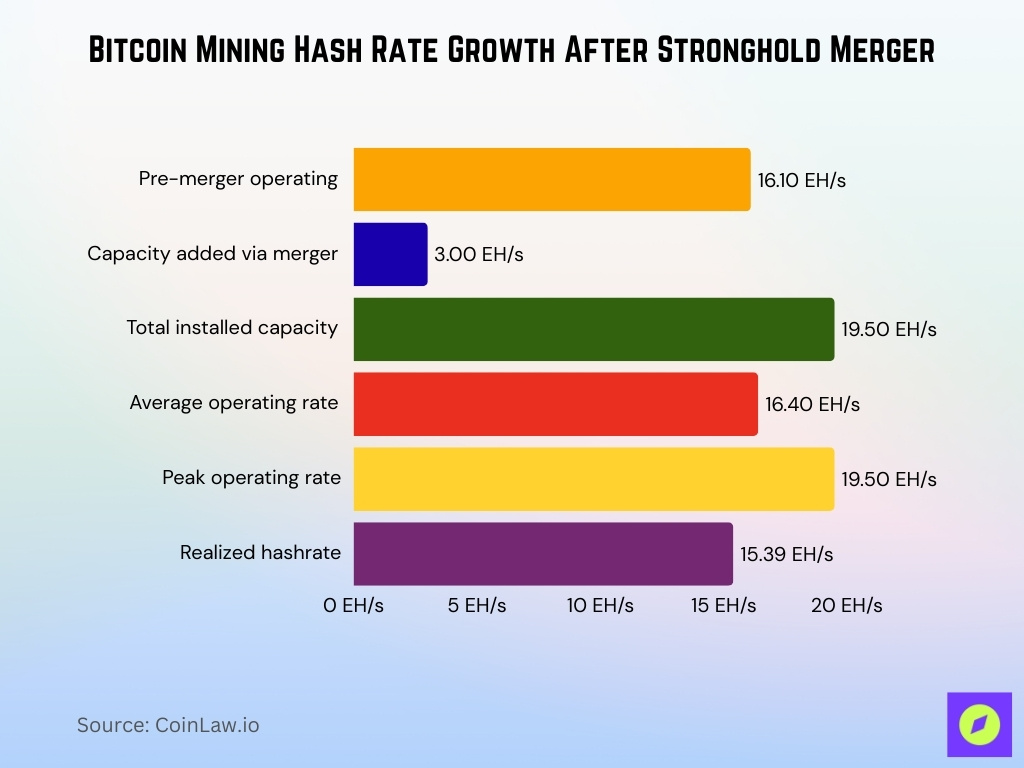

- Stronghold sites contributed to Bitfarms’ 16.1 EH/s operational hashrate in February 2025.

- Merger added ~3 EH/s installed capacity, boosting total from 16.1 EH/s to 19.5 EH/s by March 2025.

- Bitfarms’ average operating hashrate reached 16.4 EH/s with a peak of 19.5 EH/s in March 2025.

- Post-merger realized hashrate implied 15.39 EH/s from March 2025 production.

- Efficiency improved to 19 w/TH across fleet, including Stronghold deployments.

- Stronghold’s Pennsylvania plants support 165 MW energized mining capacity within 461 MW total.

- Planned expansions target 950 MW total power with Stronghold assets by mid-2026.

- 75% of Bitfarms hashrate is projected to be North America-based, including Stronghold, by H1 2025.

Stronghold Digital Overview

- Bitfarms completed the acquisition of Stronghold in March 2025, adding ~1 EH/s of hashrate from Pennsylvania sites.

- Stronghold contributed to Bitfarms’ 18.6 EH/s total hashrate reported end-2025.

- Post-merger integration boosted Bitfarms U.S. operations with Stronghold’s 165 MW power plants, expandable to 955 MW.

- Stronghold assets include a 1.1 GW growth pipeline for mining and HPC/AI in 2026.

- Energy revenue from Stronghold sites reached $2 million in Q1 2025 post-acquisition.

Energy Mix and Environmental Impact

- Scrubgrass and Panther Creek are classified as Tier II Alternative Energy Systems using coal refuse fuel.

- Coal refuse power qualifies for $8/ton tax credit, with a program cap of $55 million annually.

- Carbon capture projects at sites with the potential to capture 60,000 tons of CO2 annually.

- Waste coal combustion prevents 6.6 million tons of annual uncontrolled fires statewide.

- 840 coal refuse sites cover 9,000 acres with 220 million tons in Pennsylvania.

- Facilities reclaim legacy piles, mitigating a $2 billion remediation burden.

- Scrubgrass sells 62.5 MW capacity, yielding $6 million in revenue; Panther sells 69.2 MW, $7 million.

- Refuse-derived generation supports internal mining and PJM market sales.

- Energy mix lowers grid fossil reliance via onsite waste-to-energy.

Business Model and Operations

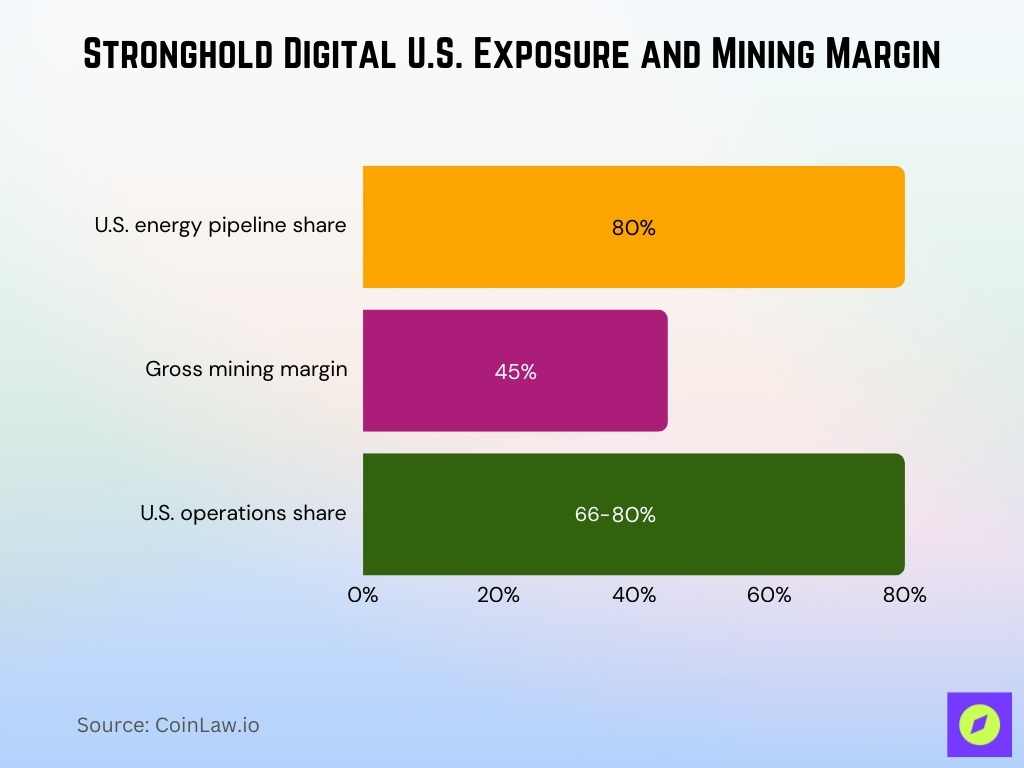

- 80% of the 1.4 GW energy pipeline U.S.-based by early 2026, leveraging PJM demand response for cost savings.

- Gross mining margin 45% in Q2 2025 amid post-halving pressures and network difficulty.

- U.S. operations projected 66-80% of total at the end of 2025, enhancing scale and transparency.

- Bitfarms’ model integrates BTC mining, hosting, energy sales, and HPC/AI infrastructure post-Stronghold acquisition.

- Revenue streams include mining ($71 million) and hosting/electricity ($7 million) in Q2 2025.

- Hosting agreements with Canaan feature 50% profit split, adding ~1 EH/s to Bitfarms’ 18 EH/s total.

- Energy portfolio expanded to 623 MWuM with Stronghold’s 165 MW active capacity and 1.1 GW growth pipeline.

- Pivot to HPC/AI at Stronghold sites, partnering with WWT and ASG for nearly 1 GW campuses.

- Operational efficiency at 19 W/TH, supporting self-mining from prior hosting deals.

Capital Raised and Funding Rounds

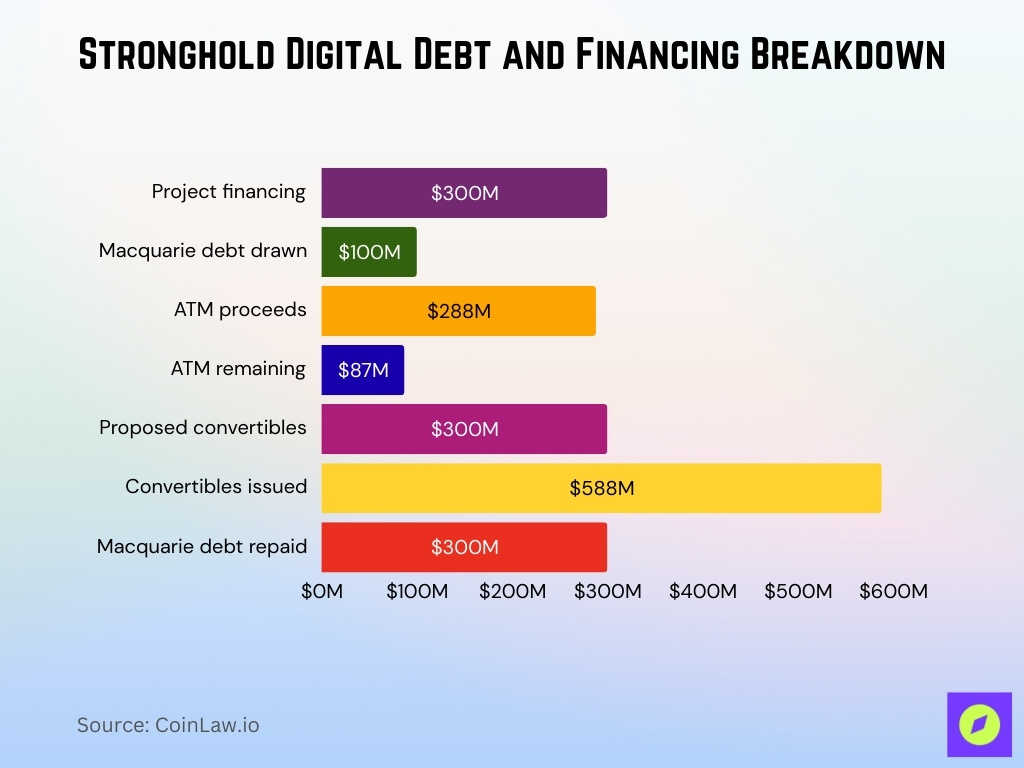

- $500 million convertible senior notes closed October 2025, $568 million net proceeds.

- $375 million ATM program: $288 million raised from 165 million shares at $2.27 avg.

- $300 million convertible notes proposed for October 2025, plus $60 million option.

- $248 million raised via ATM by October 2024, $127 million remaining pre-upsizing.

- Stronghold acquisition issued 59.7 million Bitfarms shares plus 10.6 million warrants, $44.5 million debt retirement.

- Macquarie $300 million facility drawn $100 million for U.S. expansions.

- Total equity issuances funded infrastructure, with $363 million net from ATM.

Balance Sheet and Net Cash Position

- Total assets $801.28 million as of Q4 2025, down 3.22% QoQ.

- Total liabilities $189.92 million in Q4 2025, up 14.78% QoQ.

- Cash and equivalents $146.84 million at Dec 2024; $59.54 million latest.

- Total debt $23.41 million end-2024, yielding -$36.13 million net cash.

- Total equity $608 million end-2024, up from $294.76 million prior year.

- $698 million net liquidity as of February 5, 2026, mostly cash and BTC.

- The current ratio implied a low pre-merger at 0.27 for Stronghold.

- PPE expanded with $16.3 million Sharon investments post-acquisition.

Mining Infrastructure and Power Assets

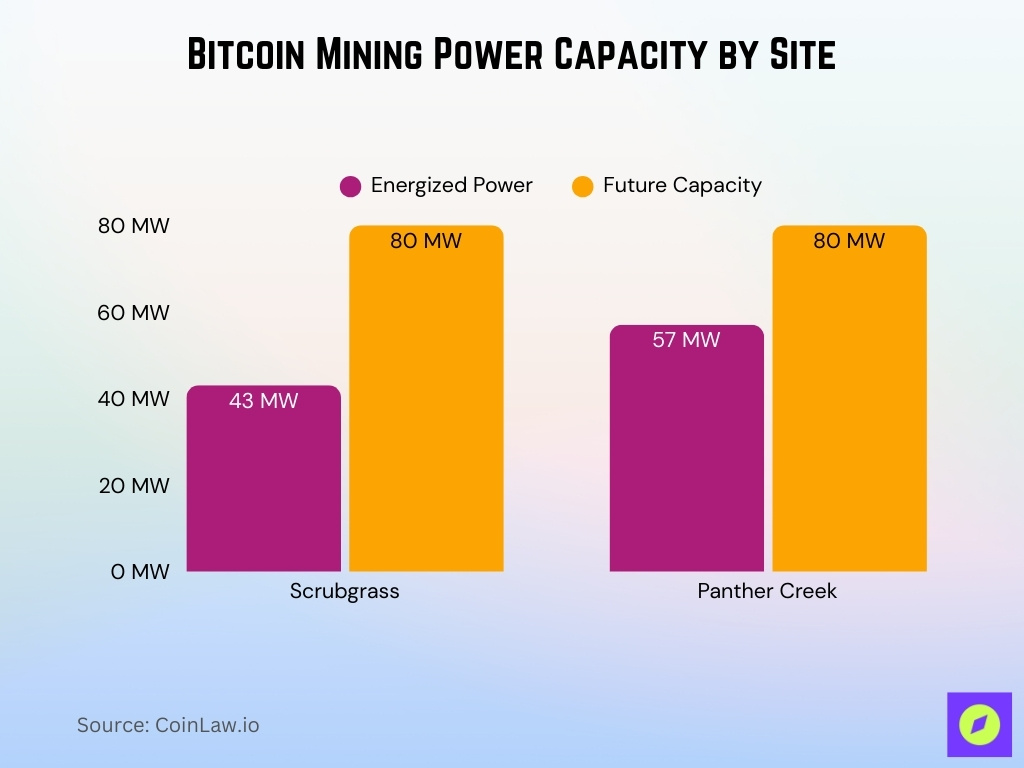

- Scrubgrass plant: 43 MW energized, 80 MW future capacity; Panther Creek: 57 MW energized, 80 MW future.

- Stronghold facilities provide 165 MW active generating capacity and 142 MW immediate grid import.

- Pennsylvania growth pipeline secures 1.1 GW for mining and HPC/AI infrastructure.

- Sharon site reaches 110 MW substation by end-2026, up from 30 MW.

- Total power capacity projected to 950 MW by the end of 2025 with Stronghold integration.

- 80% portfolio rebalanced to North America by the end of 2025 via Stronghold.

- PJM demand response programs reduce electricity costs for Stronghold sites.

- $16.3 million PPE placed at Sharon data center, enhancing infrastructure.

Operating Costs and Cost per Bitcoin Mined

- Gross mining margin 45% Q2 2025, down from 51% prior year.

- Adjusted EBITDA $14 million (18% margin) Q2 2025 amid cost pressures.

- G&A expenses $20 million Q1 2025, up 53% YoY, including non-recurring.

- Gross margin negative 1% Q1 2025 due to $29.7 million depreciation.

- Operating margin negative 48% Q1 2025 post-impairment $17.2 million.

- Average direct cost per BTC is $48,200 in Q3 2025, mining 520 BTC.

- Total cash cost per BTC $77,100 Q2 2025, up from $72,300 Q1.

- Direct cost per BTC $47,800 Q1 2025 for 693 BTC produced.

Bitcoin Production and Reserves

- Q1 2025 production totaled 693 BTC at $47,800 average direct cost per BTC.

- March 2025 mined 280 BTC with an average of 16.4 EH/s, peak 19.5 EH/s.

- February 2025 earned 213 BTC at an average of 13.4 EH/s, 16.1 EH/s end-of-month.

- January 2025 produced 201 BTC at 15.2 EH/s operating, treasury 1,152 BTC.

- Q3 2025 mined 535 BTC with a direct cost of $48,200, cash cost of $82,400 per BTC.

- Q2 2025 earned 718 BTC, sold 1,052 BTC at $95,500 average.

- Treasury held 1,827 BTC, as of late, valued amid pivot to AI/HPC.

- April 2025 mined 268 BTC at 17 EH/s realized hashrate.

Debt, Financing, and Capital Structure

- Converted Macquarie debt facility to a $300 million project financing for Panther Creek HPC/AI in October 2025.

- Drew an additional $50 million from Macquarie, totaling $100 million drawn by February 2026.

- ATM program raised $288 million gross proceeds from 128.8 million shares, $87 million remaining.

- Proposed $300 million convertible senior notes due 2031 for corporate purposes.

- $588 million convertible notes issued recently to fund expansions.

- Repaid the full $300 million Macquarie debt using strong liquidity in February 2026.

- Debt-to-equity 0.12, current ratio 3.2, reflecting improved structure.

- 7.8% debt-to-equity ratio supports low leverage post-Stronghold integration.

Hash Rate Efficiency and Uptime

- Fleet efficiency steady at 19 w/TH across Q1-Q2 2025 operations.

- March 2025 average operational 16.4 EH/s, month-end 19.5 EH/s, energized 461 MW.

- February 2025 operational 16.1 EH/s end-month, average 13.4 EH/s, efficiency 20 w/TH.

- April 2025 maintained 19.5 EH/s operating, average 17.2 EH/s, 19 w/TH efficiency.

- June 2025 operated 17.7 EH/s under management across facilities.

- Q2 2025 fleet efficiency 17 w/TH, aligning industry-leading ASICs.

- Uptime supported by 21% monthly hashrate growth in March 2025, ahead of 19 w/TH target.

- Argentina Rio Cuarto shutdown in September 2025 impacted 1.8 EH/s capacity.

Strategic Acquisitions and Divestitures

- Stronghold acquisition completed March 14, 2025, issuing 59.7 million Bitfarms shares and 10.6 million warrants.

- Stronghold shareholders received 2.52 Bitfarms shares per SDIG share in the stock-for-stock merger.

- $44.5 million paid at closing to retire Stronghold’s outstanding debt obligations.

- Yguazu 200 MW data center sold to HIVE for $63.3 million in early 2025.

- Rio Cuarto, Argentina, site shutdown September 2025, eliminating 1.8 EH/s capacity.

- Paso Pe facility classifiedas held-for-sale as part of the North America pivot.

- The acquisition added 165 MW of active power and a 1.1 GW Pennsylvania growth pipeline.

- Strategic realignment targets 66-80% U.S. operations by end-2025.

- Divestitures funded a $375 million ATM program supporting HPC/AI infrastructure.

Risk Factors and Operational Challenges

- Rio Cuarto shutdown in May 2025 idled 13% total mining capacity due to a power supplier halt.

- The $300 million Macquarie facility requires a $50 million minimum cash covenant.

- Convertible notes capped calls limit dilution to 125% premium over the pricing share price.

- Network difficulty rises, putting pressure on the cost per BTC amid BTC price volatility.

- Regulatory risks include SEC/CFTC jurisdiction overlaps, MiCA DeFi volume drop 18.9% Q1 2025.

- Capex for expansions exposes financing risk in volatile capital markets.

- Argentina’s power dependency led to an indefinite Rio Cuarto pause, 58 MW offline.

- Equity dilution from 59.7 million shares issued in the Stronghold merger.

Frequently Asked Questions (FAQs)

Stronghold’s energy assets contributed 165 megawatts of active generating capacity and 142 megawatts of immediate grid import capacity to Bitfarms’ portfolio.

Stronghold shareholders received 2.52 Bitfarms shares per share of Stronghold as part of the merger agreement.

The transaction was valued at approximately $125 million in equity value, with an additional $50 million in assumed debt in the merger structure.

Following the Stronghold acquisition, Bitfarms expected between 66% and 80% of its operations to be U.S.‑based by year‑end 2025.

Conclusion

Stronghold Digital’s integration into Bitfarms has reshaped the narrative, bringing larger-scale production, diversified energy infrastructure, and expanded computing ambitions. Production statistics show incremental growth in BTC output and hashrate efficiency, but profitability challenges linger as margins tighten and costs rise post-acquisition.

Strategic moves like divestitures and refocusing toward HPC/AI infrastructure bring both potential and risk, reinforcing that digital asset mining companies must balance growth with cost discipline. Despite volatility, the combined entity’s footprint in North America and evolving operational profile position it for continued relevance in global mining economics.