Square, now a key business unit of Block, Inc., continues to redefine how merchants accept payments and manage commerce. With its products spanning POS hardware, software services, and banking features, Square is influencing both small-business operations and enterprise-scale commerce alike. Real-world applications of this reach include a neighborhood cafe using Square’s integrated POS and digital invoices to eliminate paper receipts, and a multi-location retailer leveraging Square’s software and analytics to unify online and in-store sales.

Editor’s Choice

- The company’s gross payment volume (GPV) in Q3 2025 grew 12% year-over-year.

- International GPV growth reached 26% in the same quarter, outpacing the U.S. segment.

- Square’s full-year 2025 gross profit guidance was raised to $10.243 billion, representing over 15% growth.

- For Q3 2025, gross profit increased by 18% year-over-year.

- Cash App, Block’s consumer business tied to Square’s ecosystem, reported gross profit per monthly active user of $94 (annualised) in Q3 2025, up ~25%.

- Seller cohorts who adopt Square’s full software ecosystem see about 9% higher sales.

- Square hardware revenue rose 14% in 2025, with upgraded POS systems and mobile readers contributing.

Recent Developments

- In Q3 2025, Square segment gross profit grew by 9% year-over-year.

- The company introduced “Square Handheld” in 2025, a portable POS device aiming to unify mobile and in-store operations.

- Square launched unified subscription plans in October 2025 (Free, Plus, Premium) to simplify its software ecosystem.

- Localisation efforts expanded: Square now supports more than eight countries, enabling wider reach beyond the U.S.

- Block raised its full-year 2025 guidance after strong Q3 results.

- Merchant software uptake improved: seller cohorts adopting Square’s software posted ~9% higher sales than peers.

- Tap-to-Pay on Android and other contactless technologies expanded, increasing accessibility for merchants.

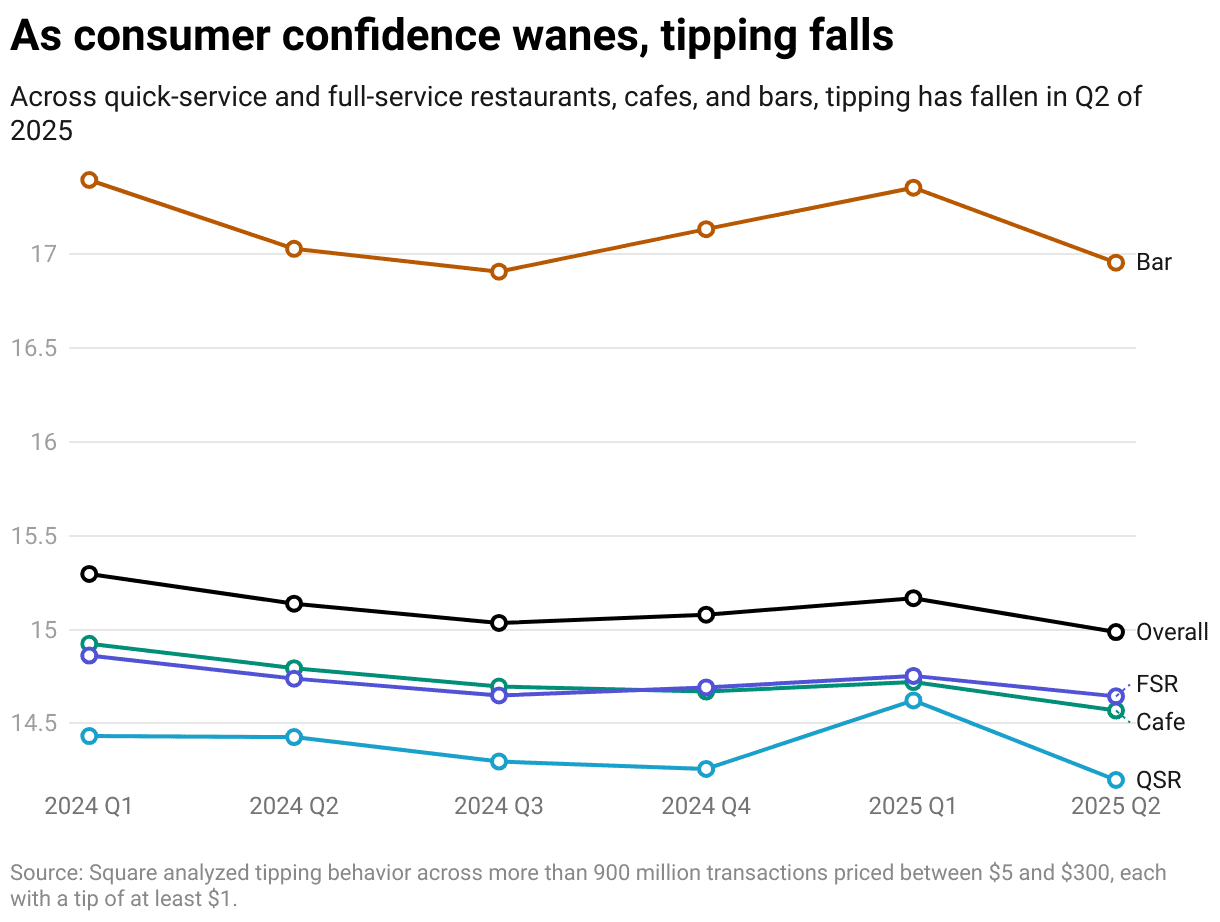

Decline in Tipping Rates Across Dining Categories

- Overall tipping fell from 15.4% in Q1 2024 to 15.0% in Q2 2025, signaling a gradual 0.4-point decline over five quarters.

- Bar tipping showed the most fluctuation, starting at 17.3% in early 2024, peaking at 17.4% in Q1 2025, then easing to 17.0% by mid-2025.

- Full-Service Restaurants (FSR) experienced a consistent drop from 14.8% to 14.6%, reflecting tighter consumer spending and reduced discretionary tipping.

- Cafe tipping slipped from 14.9% to 14.5%, mirroring lower spend per transaction as inflation squeezed disposable income.

- Quick-Service Restaurants (QSR) remained the lowest tipping category, declining slightly from 14.4% to 14.2%, highlighting limited tip culture in fast-service environments.

- The overall trend suggests that consumer confidence waned through 2025, with smaller average tip percentages seen across all service segments.

- According to Square’s 2025 analysis, the data covers over 900 million transactions between $5 and $300, underscoring broad behavioral shifts in tipping habits.

Gross Payment Volume (GPV) Statistics

- Square’s GPV in Q3 2025 was reported at $67.2 billion, up 12% YoY.

- U.S. GPV growth in Q3 2025 was approximately 8.9%.

- International GPV growth in Q3 2025 was about 26%.

- In Q3 2025, mid-market sellers (annualised GPV > $500k) accounted for 45% of GPV, up from 41% in Q3 2023.

- For the full year 2025, management expects gross profit growth of >15%, driven in part by GPV expansion.

- Small-to-medium businesses (SMBs) were responsible for roughly 70% of GPV in one estimate.

- Contactless payments (NFC/mobile wallets) represented ~58% of Square’s GPV in that same estimate.

Square Product Ecosystem

- Square supports more than 36 products across hardware, software, banking, and commerce tools.

- Seller software adoption correlates with ~9% higher sales growth for users of the full ecosystem.

- In 2025, Square’s hardware revenue increased by ~14% due to upgraded POS systems and mobile readers.

- Subscription and services revenue constituted about 33% of total revenue in one estimate.

- Square’s unified pricing plans (Free, Plus, Premium) launched in October 2025 and simplify access for sellers.

- Square Banking & Capital (merchant banking and lending) is integrated into its ecosystem, creating recurring revenue beyond transaction fees.

- The integration of analytics and automation tools in Square’s ecosystem helps merchants manage inventory, staff, and marketing from one platform.

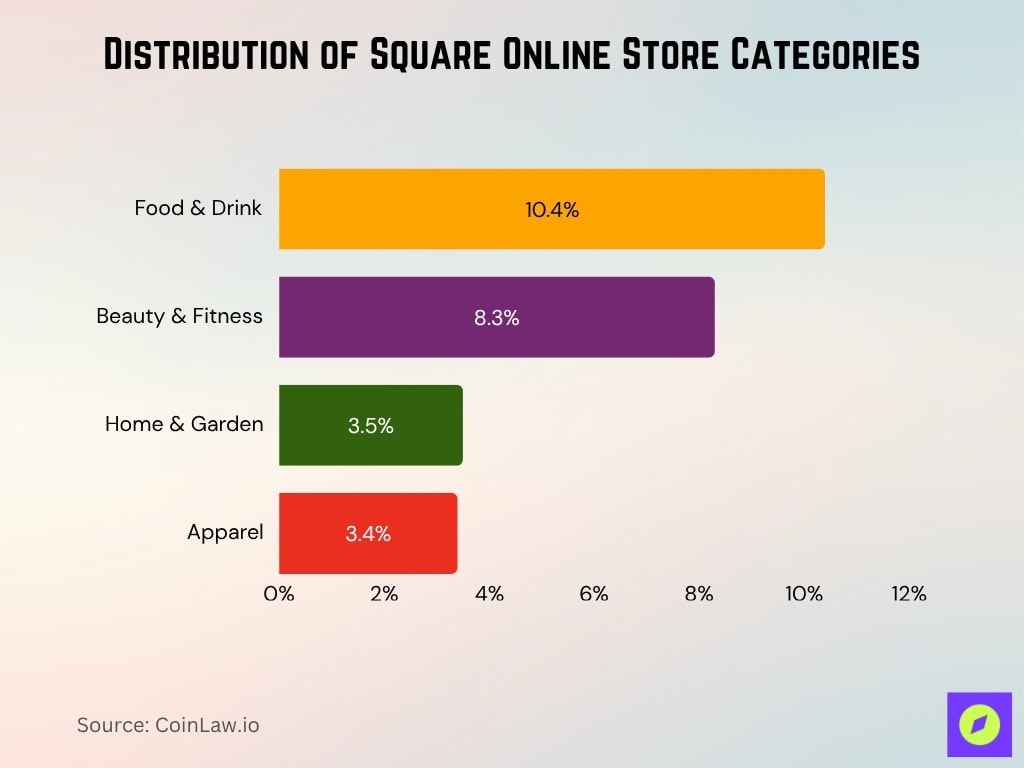

Most Popular Seller Categories

- Among stores using Square Online, 10.4% are in the Food & Drink category.

- 8.3% of Square Online stores operate in Beauty & Fitness.

- Home & Garden merchants represent 3.5% of Square Online storefronts.

- Apparel merchants constitute 3.4% of Square Online storefronts.

- Approximately 79.7% of Square Online stores are based in the United States.

- 7.8% of those stores are in Canada, while 5.7% are in Australia.

- A large portion of sellers are very small; 74.9% of Square Online stores sold 1-9 different products, highlighting a micro-merchant base.

- Among retailers, 78% say in-store experience is key to future success for 2025, while 83% of consumers report positive experiences with brick-and-mortar.

Payments Processed by Square

- The company processed a Gross Payment Volume (GPV) of approximately $210 billion in 2025, marking continued growth through its merchant-payments business.

- Square ranks first in the U.S. for the estimated number of merchants, serving about 4 million merchants.

- In U.S. merchant acquiring rankings, Square posted near-flat U.S. volume growth for 2024 but stronger international payment volume gains.

- In Q1 of FY25, the GPV growth rate was approximately 7.2% year-over-year, contributing to a 9% increase in gross profit for the same period.

- The share of SMBs remains dominant; an estimated 70% of GPV comes from small-to-medium-sized business customers.

- Contactless and mobile payments now account for roughly 58% of GPV in one estimate of Square’s payments business.

- Square expanded its “Tap-to-Pay” support to over 90% of Android models in 2025, increasing in-person payment accessibility.

- International markets contributed meaningfully; about 14% of Square merchants received payments from foreign customers in 2025.

Global Reach and International Operations

- Square reports being available in 8+ countries as part of its ecosystem description.

- In 2025, international transaction volume for Square grew by about 15%, driven by markets such as the UK and Australia.

- Cross-border payments, Square processes transactions in at least 8 major currencies in 2025.

- International merchant-payment revenues account for roughly 20% of the company’s GPV in one analysis.

- Canada serves as one of the largest non-U.S. markets, with 7.8% of Square Online stores based there.

- Australia likewise hosts 5.7% of Square Online storefronts, reflecting international adoption.

- Localisation efforts include support for GBP and AUD among other currencies and compliance with European regulations such as PSD2/SCA.

- Square plays a major role in global acquiring but still trails some incumbents in certain large-scale international markets.

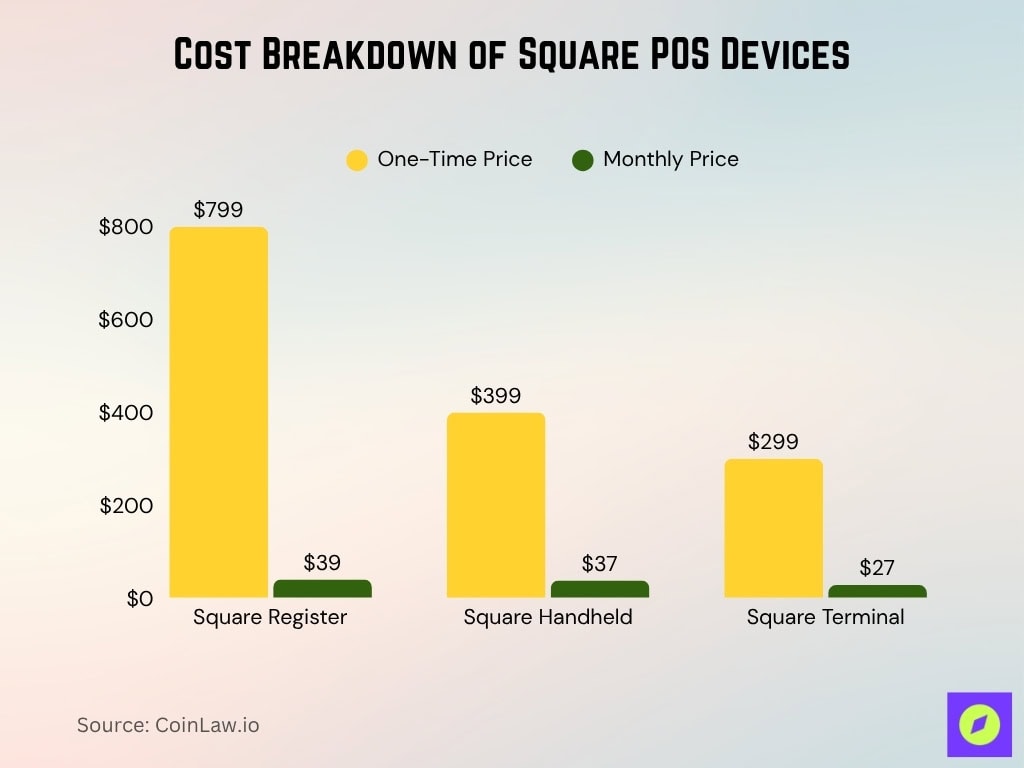

Square POS Hardware Statistics

- Square offers a range of hardware, including the dual-screen “Square Register” at $799 or $39/mo, the “Square Handheld” at $399 or $37/mo, and the “Square Terminal” at $299 or $27/mo.

- Square’s hardware revenue rose ~14% in 2025, driven by upgraded POS systems and mobile readers.

- The global POS systems market was estimated at $116 billion in 2024, with cloud-based POS systems dominating (~60% adoption).

- Stand-alone payment terminals still represented ~48% of small retailers’ primary payment hardware in 2024.

- Square’s hardware is integrated with its software ecosystem, reducing friction for sellers who purchase both.

- Square’s hardware is designed for both in-store and mobile use, supporting contactless, magstripe, chip, and tap-to-pay methods.

- Pricing tiers show that Square targets small and micro-businesses with lower upfront costs, aligning with its merchant base.

- Hardware roll-out and service-upgrade velocity give Square a competitive advantage in hardware-plus-software bundles.

Mobile and Digital Payments Impact

- Contactless payment methods accounted for ~58% of Square’s GPV in a recent estimate.

- Square extended Tap-to-Pay support to over 90% of Android models in 2025.

- The affiliated Cash App surpassed 58 million monthly active users in 2025.

- Customer inflows via Cash App reached ~$71 billion in Q4 2024.

- 75% of restaurant leaders plan to invest in technology such as loyalty and automation in 2025.

- Square’s platform supports both e-commerce and in-person mobile checkout.

- The payment-processing market is forecast to grow ~12% annually.

Square Banking & Financial Services

- Square’s subscription and services revenue made up about 33% of total revenue in a recent year.

- Square’s full-year 2025 gross profit guidance is approximately $10.243 billion, signaling strong banking and services cross-sell.

- Seller spending via Square Checking debit cards grew 29% year-over-year to $3.6 billion in 2024.

- More than 1 million business owners trust Square Banking for their financial needs as of 2025.

- Sellers saved an average of $156 per month in banking fees using Square Checking compared to traditional banks.

- Square Loans facilitated over 2.2 million loans, with more than $16.2 billion loaned or advanced since launch.

- Merchant cohorts using Square banking services show higher average spending and 44 hours saved monthly in cash flow management.

- Square Banking customers report an average customer satisfaction score of 86%, over 20% higher than major U.S. banks.

- Banking products contributed 23% to Square’s total gross profit in Q1 2024, up from 11% in 2021.

- Mid-market merchants now account for 45% of Square’s Gross Payment Volume, with a 20% annual growth in this segment in 2025.

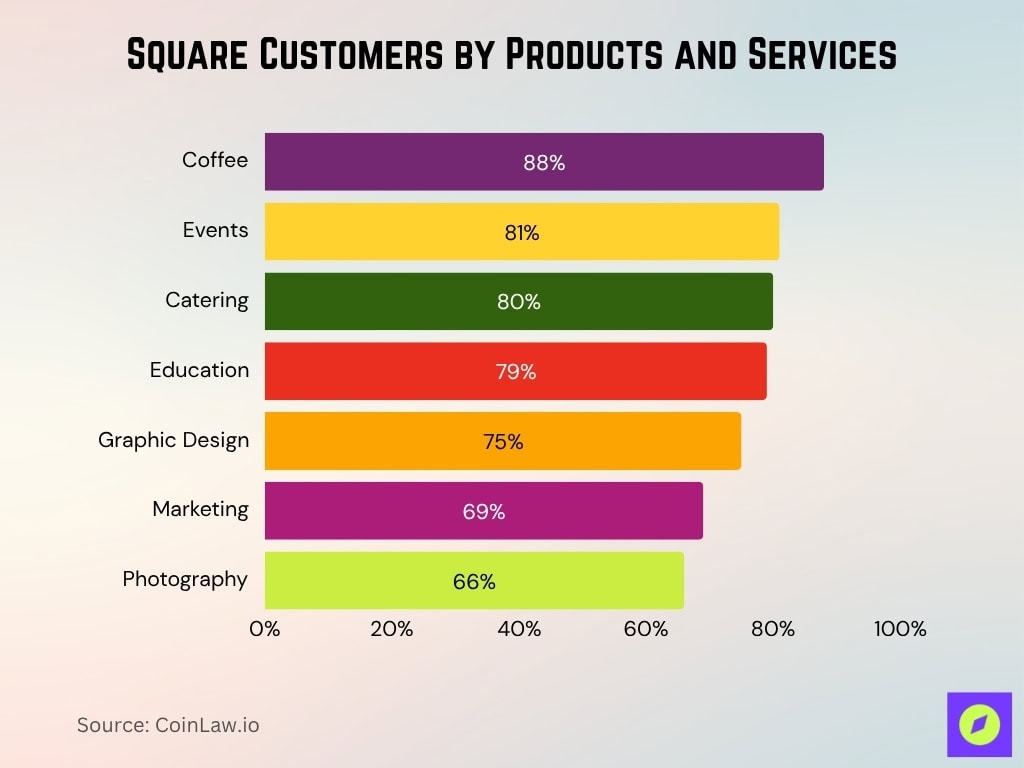

Square Customers by Products and Services

- Coffee businesses lead Square’s customer base with 88%, highlighting strong adoption among cafés and beverage outlets.

- Event services follow at 81%, reflecting Square’s role in handling mobile and temporary payment setups.

- Catering services come in at 80%, driven by flexible billing and on-site payment solutions.

- Educational institutions account for 79%, showing growth in tuition, training, and workshop payments through Square.

- Graphic design professionals represent 75%, utilizing Square for creative service invoicing.

- Marketing agencies stand at 69%, emphasizing Square’s integration with subscription and retainer-based billing models.

- Photography services make up 66%, often using Square for client sessions, bookings, and print sales.

Sales Trends and Breakdown

- In Q2 2025, the Block Inc. “Square” segment reported GPV growth of 10% year-over-year, with U.S. GPV up ~7% and international GPV up ~25%.

- Mid-market sellers represented 44% of Square’s total GPV, up from 41% a year earlier.

- In Q3 2025, Total GPV for the Square business increased by 12% YoY, driven by international growth of ~26%.

- Revenue mix for Square in 2023 was: transactions $5.82 billion, subscriptions & services $1.06 billion, hardware $0.157 billion.

- Block reported $6.03 billion in revenue in the quarter ending December 2024.

- Quick-service restaurants using Square’s data showed sales growth between 8.7% and 9.1% in early 2025.

- Fast-casual restaurant EBITDA margins were about 23.6% in Q1 2025.

- In Canada, 62% of retailers believe subscription models could generate ROI in 2025.

Reporting and Analytics Insights

- The Square Dashboard added metrics definitions and export capabilities in May 2025.

- 53% of Canadian consumers engaged with a brand’s mobile app in 2025.

- 66% of Canadian consumers favor self-checkout experiences.

- Retailers’ top automation investment areas include inventory management and automated email marketing, cited by over 60%.

- 72% of UK merchants identify high transaction fees as a major challenge.

- 45% of merchants plan to prioritize investments in fraud prevention and security.

- About 33% of merchants expect more adoption of AI-driven personalization tools soon.

- Seller cohorts using the full Square software ecosystem see, on average, ~9% higher sales growth.

- Combining online and in-store data is cited by 78% of retailers as essential to compete in 2025.

Competitive Position in Fintech

- The global fintech market is projected to be worth $394.88 billion in 2025, with North America holding over 34% share.

- 69% of publicly listed fintech firms became profitable in 2024.

- Square’s chargeback rate in 2025 is under 0.35%, well below industry peers.

- Merchant satisfaction ratings in 2025 show Square with an NPS of 48, compared to PayPal’s 31.

- The company’s inclusion in the S&P 500 Index underscores its rising stature.

- Square’s U.S. growth is moderating, but its mid-market and international focus is viewed as a strategic lever.

Security, Fraud & Compliance Metrics

- Fraud losses reported by U.S. consumers rose by 25% year-over-year to over $12.5 billion in 2024.

- 60% of financial institutions noted increasing fraud attempts in the past 12 months.

- Square’s AI-based fraud detection reduced false declines by ~27% YoY in 2025.

- 73% of Square merchants said they feel “highly protected” from fraud.

- Square’s Seller Protection covered over $96 million in dispute-related payouts in 2025.

- Less than one-third of financial organisations detect most fraud at onboarding.

- 66% of merchants find compliance challenging or somewhat challenging in 2025.

- Regulatory scrutiny is intensifying, influencing compliance costs.

Customer Feedback & Satisfaction

- 86% of Square users rated the product experience as “excellent” or “very good”.

- On Trustpilot, Square’s rating stood at 4.5/5 based on over 23,000 reviews in 2025.

- Square POS product review aggregate gave a 7.7/10 overall score, with 9/10 likelihood to recommend.

- Among beauty and personal care professionals, Square Appointments earned a 92% approval rating.

- The merchant-reviewed ease of onboarding for Square in 2025 scored 89/100, compared to 73 for PayPal.

- In 2025, 52% of PayPal business users said they would consider switching providers if simpler pricing were available.

- Loyalty among Square merchants remains strong net emotional footprint for Square POS users was +86.

Frequently Asked Questions (FAQs)

GPV grew 12% year-over-year in Q3 2025.

Full-year 2025 gross profit is guided at $10.243 billion, with an expected margin of 20% via adjusted operating income of $2.056 billion.

Gross profit grew 9% year-over-year in Q3 2025.

Conclusion

The numbers behind the Square business reflect a company moving decisively into its next phase. From robust GPV growth internationally, through deeper analytics adoption by merchants, to competitive strengths in fraud mitigation and customer satisfaction, the data show Square is shifting from foundational growth toward scale and resilience.

While U.S. growth has slowed and profitability remains under pressure, the shift toward mid-market sellers, richer software services, and international expansion positions the company to capture broader opportunities. For merchants and investors alike, Square’s evolving ecosystem holds lessons in integration, data strategy, and customer-centric commerce. The coming years will tell whether Square can convert this structural progress into sustained profitability and market leadership.