Elon Musk’s SpaceX has transferred 1,163 Bitcoin worth around $105 million to a new Coinbase Prime-linked wallet, prompting speculation about a strategic custody reshuffle.

Key Takeaways

- SpaceX moved 1,163 BTC valued at $105 million to a new Coinbase Prime-linked wallet, according to blockchain analytics firm Arkham Intelligence.

- Analysts believe the transfer reflects a custody reorganization rather than a sell-off, with no signs of liquidation from the receiving wallets.

- The company’s crypto wallet had been dormant for three years before resuming activity in July 2025.

- SpaceX now holds 6,095 BTC, down from 25,000 BTC in 2022, placing it fourth among privately held firms with Bitcoin holdings.

What Happened?

SpaceX moved 1,163 BTC during early Asian trading hours on November 27, with data indicating the destination was a Coinbase Prime-linked wallet. The transfer follows a similar one in October involving 1,215 BTC. Despite the large sums, analysts agree there’s no indication SpaceX is selling its Bitcoin holdings.

The company has not commented on the motive behind the move, but industry experts suggest it’s part of a larger custody and security strategy.

SpaceX(@SpaceX) transferred out another 1,163 $BTC($105.23M) 2 hours ago, possibly to Coinbase Prime for custody.https://t.co/zW62EKM2RD pic.twitter.com/vrbu6tPGR4

— Lookonchain (@lookonchain) November 27, 2025

SpaceX’s Bitcoin Strategy: Reshuffling, Not Selling

The recent 1,163 BTC transfer, worth about $105 million, adds to a pattern seen in October when SpaceX moved 1,215 BTC to new addresses totaling $133.7 million. According to Arkham Intelligence, these transfers are likely for custody purposes through Coinbase Prime, rather than for liquidation.

- SpaceX’s crypto wallet had not been active since 2022 until it resumed transactions in July 2025.

- After holding a peak of 25,000 BTC in 2022, its current holdings have reduced to 6,095 BTC, worth approximately $553 million.

- BitcoinTreasuries data places SpaceX as the fourth-largest Bitcoin-holding private company.

There have been no outgoing transfers or exchange interactions from the new wallets, supporting the theory of a custody realignment rather than a sale.

Community and Market Response

Online users have speculated that the move may signal strategic positioning. One user posted on X that while such transfers might be routine custody operations, they still add “a layer of uncertainty.” Another noted, “When institutions like SpaceX move Bitcoin, they don’t do it impulsively… quiet transfers sometimes speak louder than announcements.”

Meanwhile, Tesla, also owned by Elon Musk, holds 11,509 BTC valued at roughly $1.05 billion. It ranks 11th among public companies with Bitcoin exposure, according to BitcoinTreasuries.

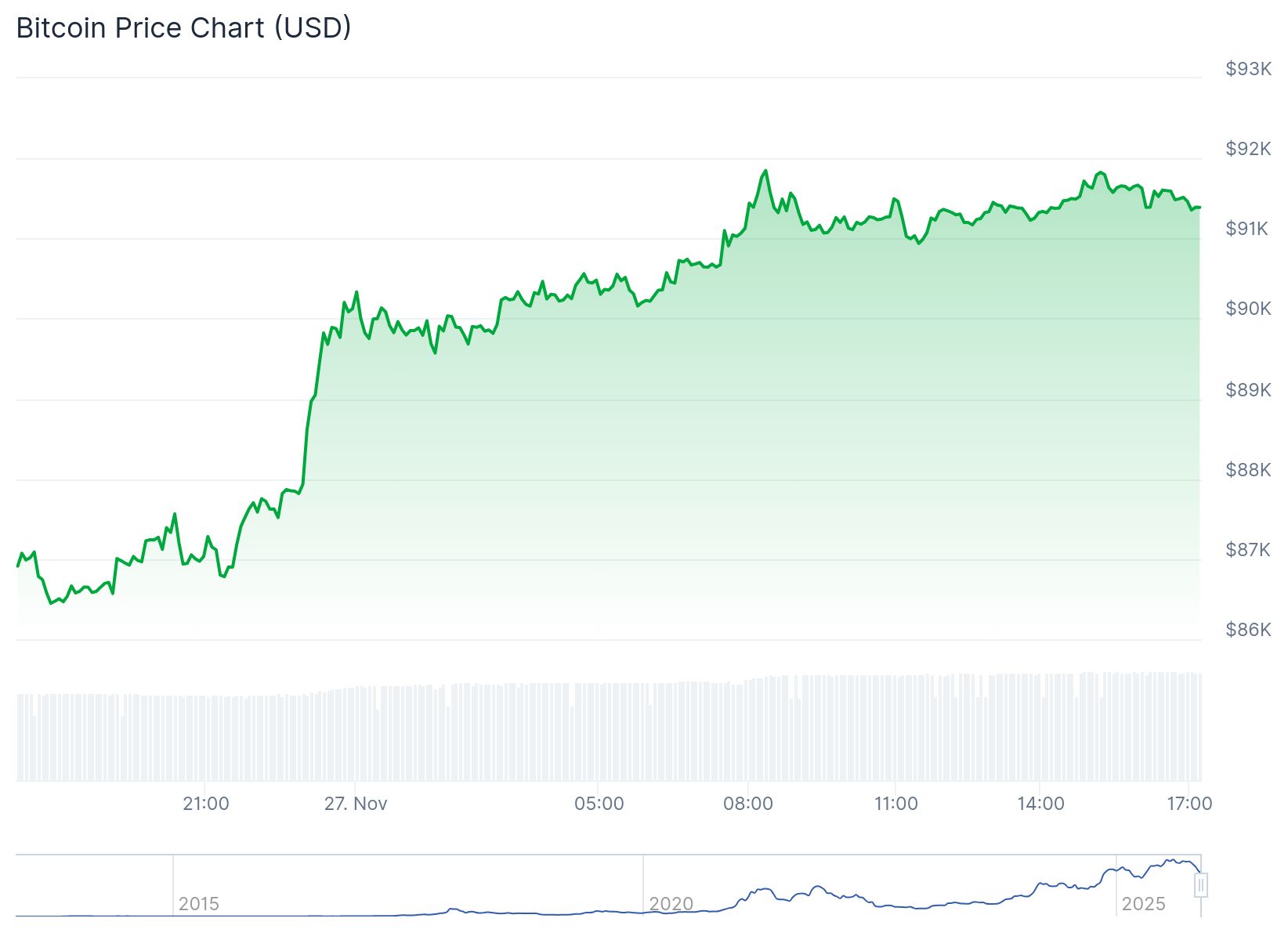

Bitcoin Market Rebounds Past $91K

The move coincides with a broader recovery in the crypto market. Bitcoin has rebounded by 4.35 percent in the last 24 hours, trading above $91,000 after a 19.76 percent monthly drop. Analysts see support at $86,000 and resistance around $89,000, with targets set near $93,000 if momentum continues.

This rising price environment further supports the theory that SpaceX is not preparing to liquidate assets but instead securing them ahead of potentially bullish conditions.

CoinLaw’s Takeaway

In my experience, when companies like SpaceX move large sums of Bitcoin without any follow-up sales, it almost always points to a back-end reshuffle for security or compliance reasons. The fact that these wallets have remained untouched post-transfer backs that up. I found it especially telling that these moves are happening just as Bitcoin is regaining strength in the market. It looks more like SpaceX is tightening up its crypto custody rather than cashing out. To me, this is just smart crypto treasury management.