Imagine a world where contracts execute themselves without middlemen, automatically ensuring compliance and execution. That’s the promise of smart contracts. As the financial world grapples with decentralization, these self-executing agreements have taken center stage, revolutionizing traditional finance (TradFi). In 2025, the adoption of smart contracts is not just a trend, it’s a monumental shift influencing institutions, processes, and economies globally.

Editor’s Choice

- 90% of financial services companies are actively engaged in blockchain technology, with many implementing smart contracts to enhance transaction efficiency.

- The global smart contracts market size was valued at $2.14 billion in 2024 and is projected to reach $12.07 billion by 2032, exhibiting a CAGR of 23.9%.

- The stablecoin market could double in size by the end of 2025, reaching $400 billion, reflecting increased adoption and integration into various traditional financial systems.

- Global exchanges saw a remarkable 111.7% increase in spot trading volume compared to the previous quarter, totaling $6.45 trillion.

- FinTech Blockchain was valued at $3.4 billion in 2024 and is projected to reach $9.2 billion by 2030, growing at a CAGR of 55.9%.

- The US leads smart contract adoption, accounting for 45% of global usage, followed by Europe at 30%.

- Smart legal contracts account for approximately 43.0% of the global smart contracts market as of 2025. Their rising use is attributed to their speed and efficiency, as they automate contract execution without the need for intermediaries.

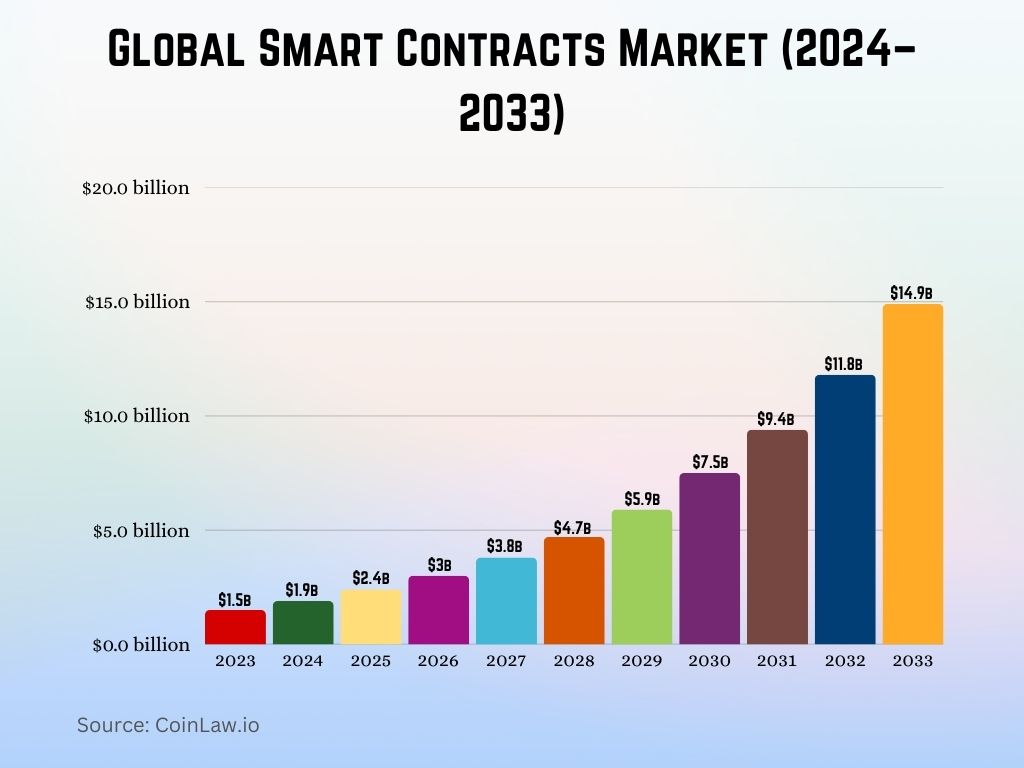

Global Smart Contracts Market Forecast (2024–2033)

- The global smart contracts market is projected to grow significantly over the next decade.

- In 2023, the market size was valued at $1.5 billion.

- By 2025, it is expected to reach $2.4 billion, indicating steady early-stage growth.

- A strong upward trend continues through the decade, hitting $5.9 billion in 2029.

- The market is forecasted to reach $14.9 billion by 2033, reflecting a nearly 10x growth from 2023 levels.

This expansion is being driven by growing adoption across platforms like Ethereum, Cardano, Polkadot, BNB Chain, and Other Platforms. - The market is expected to grow at a CAGR (Compound Annual Growth Rate) of 25.8% from 2024 to 2033.

Platforms such as Ethereum continue to dominate the space, but other emerging blockchain networks are capturing growing market shares.

Key Market Insights

- Financial services make up 46% of the total smart contract market in 2024, with significant penetration in payments and settlements.

- 2024 saw a 22% increase in mergers and acquisitions among blockchain startups focusing on TradFi solutions.

- $1 trillion worth of assets are now tokenized and managed via smart contracts, providing unprecedented liquidity.

- Smart contract adoption in cross-border payments has reduced processing times by up to 80%, from days to minutes.

- Fraud cases in TradFi reduced by 12% in 2024, thanks to blockchain’s immutability features.

- 50% of global regulatory bodies now recognize smart contracts, with 12% drafting specific guidelines for their use in finance.

- Real estate tokenization, driven by smart contracts, surpassed $85 billion in assets in 2024, a 25% annual growth.

| Insight | Statistic |

| Financial services’ market share | 46% |

| M&A activity among blockchain startups | 22% increase |

| Tokenized assets managed via smart contracts | $1 trillion |

| Cross-border payment processing reduction | 80% time savings |

| Fraud reduction in TradFi | 12% |

| Regulatory bodies recognizing smart contracts | 50%, with 12% drafting guidelines |

| Real estate tokenization | $85 billion, 25% annual growth |

Smart Contracts Market Size & Trends

- The global smart contracts market size is projected to reach $235 billion by 2027, growing at a CAGR of 21%.

- North America remains the largest market, accounting for 35% of global adoption in 2024.

- In 2024, 30% of all venture capital funding in fintech went to blockchain and smart contract startups, totaling $14.8 billion.

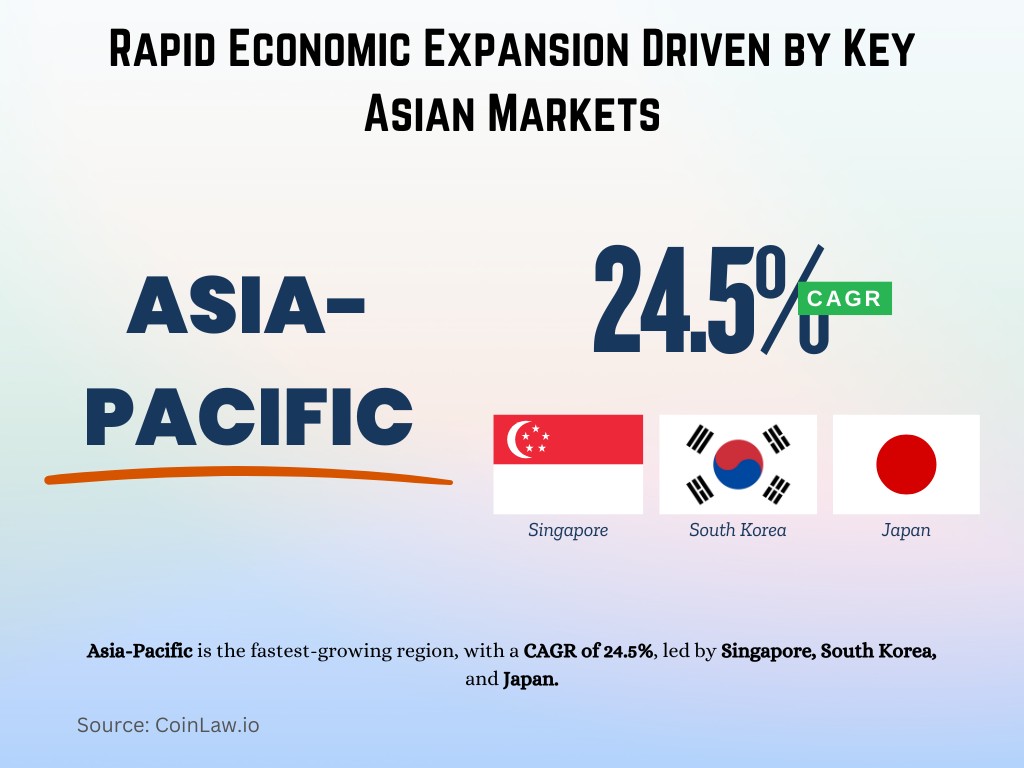

- Asia-Pacific is the fastest-growing region, with a CAGR of 24.5%, led by Singapore, South Korea, and Japan.

- Ethereum dominates the market, supporting 80% of all active smart contracts in TradFi.

- Energy sector tokenization through smart contracts is gaining traction, with a 28% annual growth in renewable energy credits.

- Smart contract-powered payroll systems are now used by 12% of multinational corporations, ensuring instant and transparent payments.

Platform Insights

- Ethereum leads in TradFi smart contract platforms with $300 billion in transaction volume processed in 2024.

- Hyperledger Fabric is a preferred choice for private financial institutions, offering enhanced privacy and scalability.

- Polygon’s Layer 2 scaling solutions processed over 2 billion transactions in 2024, reducing costs by up to 85% compared to Ethereum.

- Avalanche Blockchain saw a 30% increase in adoption due to its sub-second transaction finality.

- Cardano Blockchain experienced a 45% growth in TradFi partnerships, with banks using its secure proof-of-stake mechanism.

- Smart contracts executed on Algorand Blockchain increased by 35%, particularly in remittance services.

- Decentralized finance platforms running on Solana Blockchain achieved a throughput of 65,000 transactions per second (TPS) in 2024.

| Platform | Key Statistic |

| Ethereum | $300 billion transaction volume (2024) |

| Hyperledger Fabric | Preferred for privacy and scalability |

| Polygon | 2 billion transactions, 85% cost reduction |

| Avalanche | 30% adoption growth |

| Cardano | 45% growth in TradFi partnerships |

| Algorand | 35% increase in remittance services |

| Solana | 65,000 TPS in DeFi platforms |

Key Issues in Traditional Financial Contracts

- 4+ million faxes were sent for syndicated loans in 2012, which is an outdated process.

- Loan settlements take 20+ days in the US and 48 days in Europe – slow and inefficient.

- $40+ billion/year lost to non-health insurance fraud; $2 billion in diamond fraud alone.

$4–$5 billion in overhead costs for Australian equity markets.

£277 billion/day handled by UK’s RTGS – went offline in 2014, delaying billions in deals.

Blockchain Type Insights

- Public blockchains power 65% of smart contracts in TradFi, prioritizing transparency and trust.

- Private blockchains dominate insurance and enterprise lending, securing $80 billion in financial contracts in 2024.

- Hybrid blockchains, combining public and private elements, are favored by 42% of new adopters, ensuring data security without compromising transparency.

- Permissioned blockchains like Corda saw adoption in 25% of global trade finance platforms in 2024.

- 43% of real-time payment systems rely on public blockchains, offering near-zero latency and seamless cross-border capabilities.

- Blockchain interoperability platforms saw a 28% increase, enabling multi-chain smart contract operations.

- Supply chain finance contracts on blockchains doubled in 2024, valued at $230 billion.

| Blockchain Type | Statistic |

| Public blockchains | 65% of TradFi adoption |

| Private blockchains | $80 billion secured in 2024 |

| Hybrid blockchains | Favored by 42% of new adopters |

| Permissioned blockchains (e.g., Corda) | 25% of trade finance platforms |

| Real-time payment reliance on public blockchains | 43% |

| Supply chain finance on blockchains | $230 billion, doubled in 2024 |

Contract Type Insights

- Payment and settlement contracts make up 45% of smart contract use cases in traditional finance.

- Insurance smart contracts processed over $100 billion in claims in 2024, automating validation and payouts.

- Loan agreements governed by smart contracts reached $150 billion, a 20% year-over-year growth.

- Escrow services leveraging smart contracts reduced transaction fees by 65% for international real estate deals.

- Financial derivatives trading using automated contracts increased by 30%, exceeding $50 billion in trading volume.

- Tokenized asset contracts represent 15% of global smart contract volume, particularly in securitized loans.

- Micro-lending platforms powered by smart contracts disbursed $1.3 billion, extending financial inclusion to underserved communities.

Gas Costs of Different Smart Contracts

ACC smart contract:

- Execution Gas: 2,950,000

- Transaction Gas: 3,980,000

– Highest gas usage among the contracts analyzed.

JC smart contract:

- Execution Gas: 950,000

- Transaction Gas: 1,340,000

– Lowest execution cost, ideal for lightweight operations.

RC smart contract:

- Execution Gas: 1,170,000

Transaction Gas: 1,590,000

– Balanced option with moderate gas consumption.

Enterprise Size Insights

- Large enterprises account for 60% of smart contract adoption, primarily driven by cost-saving measures in payment systems.

- Small and medium-sized enterprises (SMEs) increased their adoption rate by 35% in 2024, leveraging blockchain for affordable cross-border payments.

- 44% of startups in the fintech sector utilize smart contracts for payroll and vendor management.

- In 2024, 22% of Fortune 500 companies reported integrating smart contracts into their operations, up from 17% in 2023.

- SMEs in the US and Europe reported a 20% reduction in operational costs through automation enabled by blockchain-based contracts.

- Large financial institutions adopted multi-signature smart contracts to enhance internal transaction security.

- 32% of enterprises deploying smart contracts highlighted scalability and compliance as critical drivers for adoption in 2024.

End-Use Insights

- Banking and financial services dominate the end-use segment, accounting for 48% of total adoption in 2024.

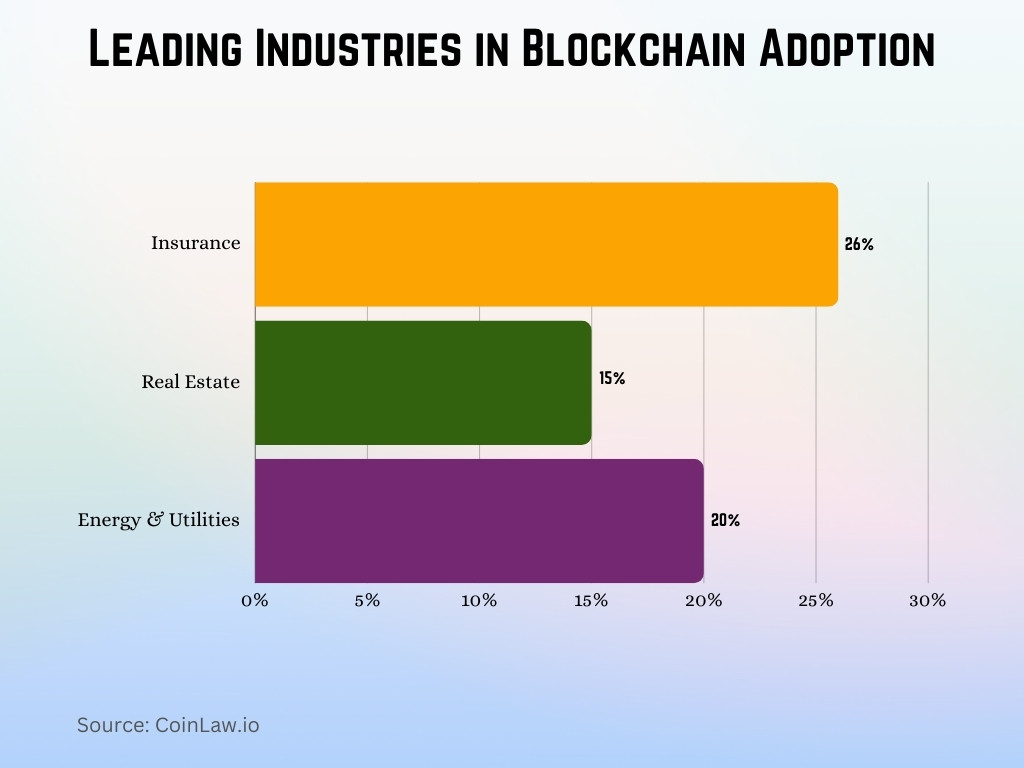

- The insurance sector uses 26% of all deployed smart contracts, with rapid automation in claims processing and fraud detection.

- Tokenized real estate transactions surged, making up 15% of the real estate market by transaction volume in 2024.

- Healthcare and pharmaceutical industries adopted smart contracts to secure supply chains and maintain patient data privacy, growing adoption by 18% year-over-year.

- Smart contracts in retail and e-commerce facilitated over $75 billion in transactions, offering trustless payment gateways.

- Logistics and supply chain sectors saw a 22% rise in smart contract usage for real-time tracking and automation.

- The energy and utilities sector reported that 20% of energy credits are now exchanged via blockchain-based contracts.

Regional Insights

- North America leads smart contract adoption with a 38% global market share, thanks to favorable regulations and robust technological infrastructure.

- Europe follows with 29% of the market share, driven by blockchain hubs in Switzerland and the UK.

- The Asia-Pacific region showed the highest growth rate in 2024, increasing by 24%, with India and Singapore at the forefront.

- Latin America saw a 20% adoption surge, particularly in cross-border payments and remittance solutions.

- The Middle East and Africa reported a 15% increase, with financial inclusion initiatives powered by blockchain gaining traction.

- The US alone accounted for $60 billion in smart contract transaction volume in 2024.

- Countries like Japan and South Korea implemented national strategies to expand blockchain ecosystems, supporting 3,000+ startups by 2024.

| Region | Statistic |

| North America | 38% global market share |

| Europe | 29% global market share |

| Asia-Pacific | 24% growth rate |

| Latin America | 20% adoption surge |

| Middle East and Africa | 15% increase in adoption |

| US contribution | $60 billion transaction volume (2024) |

Popular Use Cases of Smart Contracts in Fintech

- Lending and borrowing platforms accounted for 45% of smart contract use cases in fintech, with platforms like Aave leading the way.

- Decentralized exchanges (DEXs) processed over $150 billion in transactions, with smart contracts ensuring trustless trading.

- Payment gateways using smart contracts reported a 65% reduction in transaction time, benefiting cross-border commerce.

- Tokenized investments made up 20% of venture capital allocations, streamlining equity issuance and dividends.

- Peer-to-peer lending platforms increased accessibility, disbursing over $3 billion in micro-loans using smart contracts.

- KYC processes automated through smart contracts reduced onboarding time by 30% for financial institutions.

- Smart contract-driven insurance protocols handled claims worth $200 million in 2024, ensuring efficiency and transparency.

Key Features of Smart Contracts

- Immutability ensures that executed agreements cannot be altered, providing unmatched trustworthiness.

- Automation eliminates manual intervention, reducing processing time by up to 50%.

- Decentralization ensures no single point of failure, increasing system reliability.

- Cost efficiency is achieved by cutting out intermediaries, saving businesses an estimated $15 billion annually in 2024.

- Transparency enhances user trust, with all transactions recorded on public or private blockchains.

- Smart contracts support programmability, allowing customization for industries like insurance and supply chain management.

- Interoperability across multiple blockchains expanded in 2024, with 40% of new contracts supporting cross-chain functionality.

Smart Contracts Market by Enterprise Size

- Large Enterprises dominated the market with a 69.5% share.

- Small & Medium Enterprises (SMEs) held the remaining 30.5%.

- The market is expected to grow at a strong 25.8% CAGR (2024–2033).

Benefits and Efficiency Improvements

- Financial institutions saved $10 billion in operational costs in 2024 through automated smart contract systems.

- Processing times for loans were reduced by up to 70%, as automated validations replaced manual workflows.

- Fraud detection improved by 35%, using blockchain’s transparency to flag suspicious activities.

- Smart contracts enabled 24/7 operations, allowing cross-border settlements even during non-business hours.

- By eliminating intermediaries, transaction costs dropped by 40% in international trade settlements.

- Regulatory compliance processes were streamlined, reducing manual errors by 25% through automated reporting features.

- Customer satisfaction rates in financial services improved by 15%, driven by faster claim processing and dispute resolution.

Technical Risks of Smart Contracts

- Coding vulnerabilities in smart contracts led to $2.3 billion in losses from hacks in 2024.

- Inadequate testing before deployment caused 12% of smart contract errors, leading to financial disputes.

- Smart contract reliance on oracles for off-chain data introduces risks, with 10% of failures attributed to inaccurate feeds.

- Limited scalability on some blockchains resulted in 17% slower transaction times during peak usage.

- Security flaws in multi-signature wallets accounted for 5% of reported breaches in 2024.

- Smart contracts tied to volatile cryptocurrencies faced 25% more disputes in 2024 due to fluctuating values.

- Lack of standardization across blockchains remains a challenge, affecting 30% of cross-chain contract implementations.

Economic Risks and Security Concerns

- $4 billion worth of assets were compromised in 2024 due to smart contract vulnerabilities, highlighting the need for better auditing.

- 50% of financial institutions list hack-proofing smart contracts as their primary challenge in adoption.

- The reliance on decentralized oracles led to a 22% rise in data manipulation attacks, compromising contract accuracy.

- Gas fees on Ethereum surged by 15% during high demand, impacting the cost-effectiveness of small-scale transactions.

- The lack of universal compliance standards caused 35% of cross-border smart contract failures, slowing global adoption.

- Market volatility in crypto assets caused 20% of disputes in contracts tied to tokenized currencies in 2024.

- Cybersecurity risks increased by 25%, primarily affecting smart contracts on public blockchains without multi-signature security.

Challenges and Regulatory Considerations

- Regulatory uncertainty remains a significant barrier, with 60% of TradFi institutions citing unclear guidelines as a deterrent.

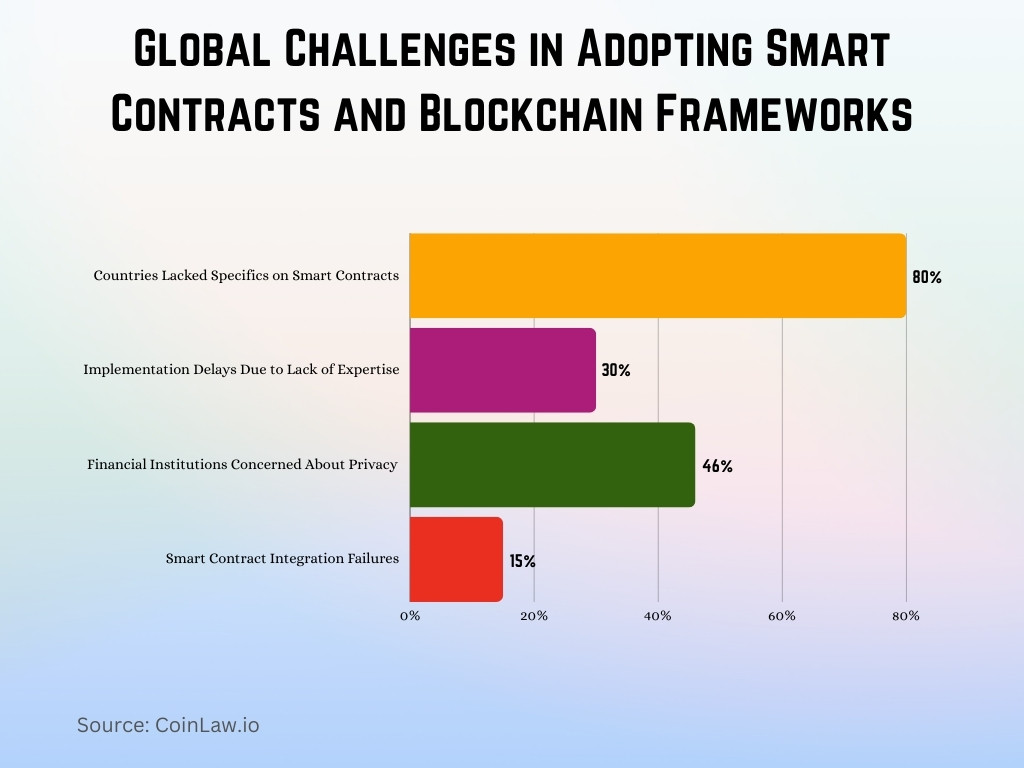

- 12 countries introduced new frameworks for blockchain in 2024, but 80% lacked specifics on smart contracts.

- Compliance costs for implementing smart contracts in regulated industries rose by 18% in 2024.

- Lack of technical expertise in smart contract programming led to 30% of implementation delays in TradFi.

- Cross-border legal disputes involving smart contracts increased by 25%, reflecting jurisdictional challenges.

- 46% of financial institutions expressed concerns about privacy issues when using public blockchains.

- Efforts to integrate smart contracts with legacy systems failed in 15% of cases, showing the difficulty of retrofitting new technologies.

The Role of Blockchain Technology in DeFi

- Decentralized Finance (DeFi) platforms, powered by smart contracts, accounted for $300 billion in assets under management (AUM) in 2024.

- DeFi lending protocols reduced credit processing time by 80%, enabling instant approvals and fund transfers.

- Liquidity pools using smart contracts processed over $500 billion in transactions in 2024, providing seamless fund access.

- Yield farming initiatives grew by 35%, as automated contracts enabled better APY tracking and rewards distribution.

- Over 50 million wallets participated in DeFi activities in 2024, a 25% increase from the previous year.

- Flash loan services, enabled by smart contracts, executed transactions worth $1.2 billion, facilitating arbitrage and liquidity solutions.

- Integration between DeFi and TradFi sectors surged, with 15% of traditional banks experimenting with DeFi-driven platforms.

Case Studies of Implementation

- JP Morgan Chase successfully used smart contracts for collateral management, reducing operational costs by 30%.

- AXA Insurance leveraged smart contracts to automate travel insurance claims, processing 94% of claims within 48 hours.

- A consortium of European banks deployed blockchain to streamline $12 billion in trade finance transactions, saving 10% in costs.

- Singapore-based DBS Bank launched a tokenized bond platform using smart contracts, issuing $3 billion in bonds in 2024.

- A major US-based real estate firm utilized smart contracts for $1.5 billion in property tokenization, enabling fractional ownership.

- HSBC Hong Kong reported a 15% increase in efficiency by integrating smart contracts into cross-border payment systems.

- Walmart used blockchain-based contracts to track and verify 100% of its global supply chain transactions, enhancing trust and transparency.

Recent Developments

- Tokenization of Real-World Assets (RWAs): Financial institutions are increasingly tokenizing assets like real estate and securities, enhancing liquidity and accessibility in financial markets.

- Integration with Decentralized Finance (DeFi): Traditional banks are exploring DeFi platforms to offer services such as lending and borrowing, aiming to provide flexible financial solutions.

- Approval of Cryptocurrency ETFs: Regulatory bodies have approved Bitcoin and Ethereum ETFs, facilitating institutional investment in cryptocurrencies through traditional financial instruments.

- Growth of the FinTech Blockchain Market: The FinTech blockchain market is projected to grow from $3.4 billion in 2024 to $49.2 billion by 2030, indicating a compound annual growth rate (CAGR) of 55.9%.

- Enhanced Data Security in Accounting: Blockchain technology is improving data security and fraud prevention in accounting by providing immutable records and transparent transactions.

Conclusion

Smart contracts are no longer the future, they are the present driving the transformation of traditional finance. By automating processes, reducing costs, and enhancing transparency, they’ve opened doors for innovation and growth. However, challenges like regulatory uncertainty and security concerns remain. As global adoption rises and technology evolves, 2025 marks a pivotal year in bridging TradFi with decentralized finance (DeFi), reshaping how financial systems operate for decades.

TPTrevor P.

The segment on blockchain’s role in DeFi really stood out. Blockchain’s decentralization not only adds layers of security but essentially reshapes what’s possible in finance today. It’s a fascinating evolution, challenging traditional systems and opening new avenues for innovation.

MLMaggie Lynn

Barry Elad, your article provides a comprehensive overview of smart contracts which I found incredibly enlightening. As a small business owner, the section on Benefits and Efficiency Improvements has given me a lot to think about in terms of operational efficiency and transparency. It’s clear that embracing these technologies could streamline many of our processes. Thank you for the insights!