SharpLink Gaming has reentered the crypto market spotlight with an $80 million Ethereum purchase, boosting its holdings to over 859,000 ETH.

Key Takeaways

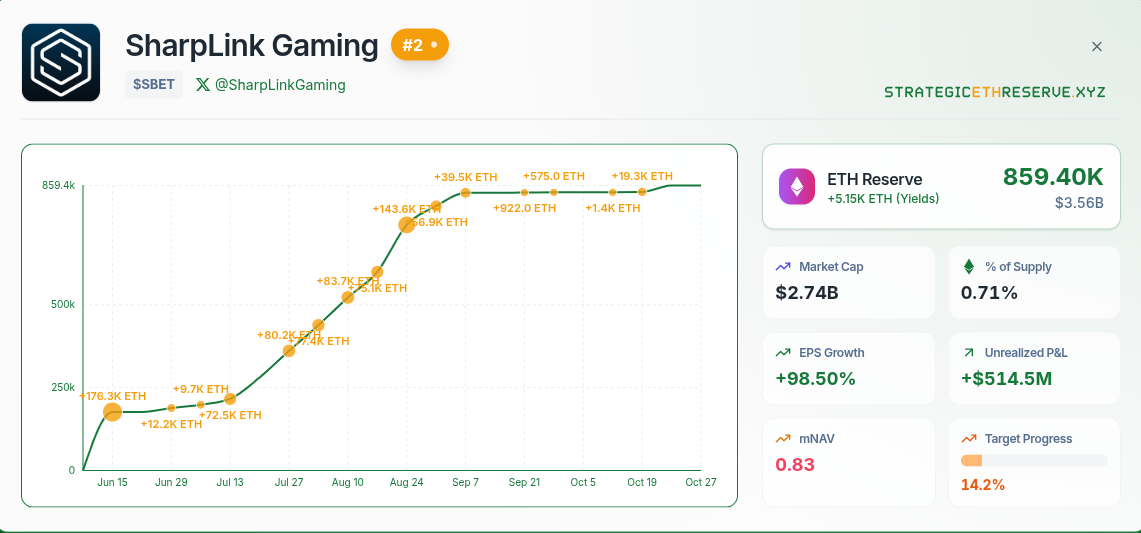

- SharpLink Gaming purchased 19,271 ETH worth approximately $80 million, ending a one-month pause in its accumulation strategy.

- The company now holds over 859,000 ETH valued at more than $3.6 billion, making it the second-largest corporate Ethereum holder after BitMine.

- The purchase was partially funded by a $76.5 million equity offering sold at a 12 percent premium, highlighting investor confidence.

- SharpLink is also planning to tokenize its Nasdaq-listed shares on Ethereum, signaling deeper blockchain integration.

What Happened?

SharpLink Gaming, a Nasdaq-listed U.S. company, has resumed its aggressive Ethereum buying strategy after a month-long break. The company purchased 19,271 ETH, worth approximately $80 million, at a time when Ethereum prices are rebounding above $4,200. This latest buy brings its total Ethereum holdings to over 859,000 tokens, securing its spot as one of the top corporate holders of the digital asset.

Sharplink Gaming (@SharpLinkGaming) has added another 19,271 $ETH, worth $80.37M, to its Strategic $ETH reserve.

— Onchain Lens (@OnchainLens) October 26, 2025

They now hold 859,395 $ETH, worth $3.58B.

Address: 0x5e3b62e38808fc9582c23bc05e8a19a091d979c9

Data @nansen_ai pic.twitter.com/HPPEW1SYpm

SharpLink’s Massive Ethereum Bet

SharpLink’s total Ethereum stash now stands at around 859,400 ETH, currently valued at over $3.6 billion. According to multiple on-chain analytics sources like OnChainLens and Lookonchain, this latest buy is one of the largest single purchases by any corporation this year.

- The company trails only BitMine in Ethereum holdings, with BitMine holding approximately 3.24 million ETH worth $13.5 billion.

- SharpLink’s buy occurred when Ethereum was trading at $4,204 to $4,240, marking a 7 percent intraday gain.

The move was likely timed strategically, with analysts from ACY Securities suggesting that it could be positioning ahead of possible Ethereum ETF inflows or shifting economic conditions.

Funding Strategy and Corporate Moves

To fund this major crypto acquisition, SharpLink leveraged a recent capital raise:

- It raised $76.5 million through an equity offering, selling 4.5 million shares at $17 each.

- This price represented a 12 percent premium over the October 15 closing price of $15.15.

In addition, SharpLink had previously signed securities purchase agreements worth $400 million with five institutional investors. This cash influx has not only empowered its treasury operations but is also supporting longer-term initiatives, including its blockchain integration plans.

Tokenizing Public Shares

Beyond just holding Ethereum, SharpLink is doubling down on its blockchain commitment by announcing plans to tokenize its Nasdaq-listed SBET shares. The company is partnering with blockchain firm Superstate to bring its shares onto the Ethereum network, a move that could pave the way for programmable equity and digital capital management.

This signals a major shift from passive crypto holding to active blockchain infrastructure development.

Corporate Ethereum Holdings Continue to Rise

SharpLink’s purchase is part of a growing trend. Corporate treasuries collectively now hold 5.98 million ETH, accounting for nearly 4.94 percent of Ethereum’s total supply, according to Strategic ETH Reserve data.

This underscores a broader move toward institutional Ethereum adoption, especially as more firms seek to diversify their balance sheets with yield-bearing digital assets.

Market Conditions and Price Action

Ethereum’s price surged following SharpLink’s announcement. The token was trading near $4,240, testing a critical resistance level around $4,250. Technical indicators such as the RSI suggest bullish momentum, with upside targets between $4,730 and $4,750.

- Ethereum is up 7.53 percent in the past 24 hours and 4.61 percent over the week.

- Support levels remain near $3,750, with a break below potentially triggering a correction toward $3,600.

Overall, the technical outlook appears constructive, supported by strong volume, rising prices, and continued institutional interest.

CoinLaw’s Takeaway

I find SharpLink’s strategy fascinating. They are not just hoarding Ethereum, they are weaving it into their business model. In my experience, companies that combine bold treasury strategies with real tech integration stand to gain the most in the long run. Tokenizing public shares is a major step. It’s not just bullish for Ethereum but also a glimpse into how legacy finance could evolve. If more public firms follow SharpLink’s lead, we could see a wave of blockchain-powered corporate finance that changes how companies raise and manage capital.