Japan’s SBI Shinsei Bank is taking steps to transform how corporate clients move money across borders by adopting tokenized deposit solutions in partnership with Singapore’s Partior and Japan’s DeCurret DCP. The goal is to enable faster, cheaper, and around the clock cross border transactions, expanding beyond Japan’s yen into multiple major currencies.

Key Takeaways

- SBI Shinsei has signed a memorandum of understanding with DeCurret DCP and Partior to explore tokenized deposit services and a multicurrency settlement framework.

- The DCJPY tokenised deposit platform currently operates in yen; the collaboration aims to expand tokenised deposits to other currencies.

- Partior’s platform already supports US dollars, euros, and Singapore dollars, and will add yen through the partnership.

- The move could reduce dependence on traditional correspondent banking, cutting settlement times and costs using distributed ledger technology.

What Happened?

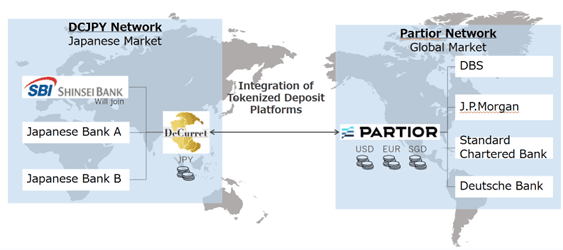

SBI Shinsei Bank, DeCurret DCP, and Partior have formalised a collaboration to study and build a tokenised deposit payments system for corporate clients. The three have signed an MoU to define detailed roles and responsibilities as they move toward a possible full scale business agreement. Under this framework, SBI Shinsei would issue tokenised deposits, DeCurret would connect the DCJPY platform to Partior’s global settlement network, and Partior would integrate the Japanese yen into its multi currency rails.

Expanding Tokenised Deposit Services

Currently, DeCurret operates DCJPY, a yen denominated tokenised deposit platform within Japan. SBI Shinsei intends to go beyond that by offering tokenised deposits in additional currencies. This reflects a larger demand for faster international payments among corporates. Partior will play a central role here by adding support for the yen to its settlement network.

Partior’s Role and Capabilities

Partior is a blockchain based clearing and settlement infrastructure that supports USD, EUR, and SGD currently. It is backed by founding banks including DBS, J.P. Morgan, Standard Chartered and Temasek. Additional currencies including Japanese yen are being onboarded. Its offerings include real time, atomic settlement, 24/7 operation, interoperability with local RTGS and payment systems, and improved transparency for transactions.

Implications for Cross Border Payments

If this collaboration succeeds, corporate clients in Japan and abroad could benefit from significantly faster and cheaper cross border payments. Some potential implications:

- Settlement times could be reduced from days or hours to minutes or less, thanks to real time clearing.

- Costs associated with correspondent bank fees and delays in compliance or message to money mismatches could decline.

- Availability of services around the clock for cross border value transfers, avoiding delays due to business hours in different time zones.

- Increased competition and innovation in international payments infrastructure, possibly influencing regulatory frameworks.

Other Players and Context

- Japan Post Bank has also expressed interest in tokenised deposits via DeCurret.

- Partior, beyond this partnership, has raised over USD 60 million in Series B funding to scale its global settlement network, onboard more currencies, and develop features like intraday FX swaps and improved liquidity management.

Challenges Ahead

There are several challenges to address before this becomes fully operational:

- Regulatory approval in multiple jurisdictions, especially as it relates to digital deposits, cross border transfers, anti money laundering, and financial stability.

- Technology integration between existing banking systems, DeCurret’s DCJPY, Partior’s rails, and counterpart institutions across borders.

- Liquidity management and currency risk when operating with multiple fiat currencies.

- Operational readiness such as ensuring uptime, settling disputes, and managing compliance processes continuously.

CoinLaw’s Takeaway

In my view this is a leap forward for Japan’s corporate payments industry. The collaboration among SBI Shinsei, DeCurret and Partior aims not just to tweak the old correspondent banking model but to reimagine cross border settlement. If they pull this off, it could mean real time deposits denominated in currencies beyond the yen, active around the clock, with lower overhead for corporates. That in turn could increase competitiveness for Japanese businesses operating globally. It will be important to watch how regulators respond and how well the technical integrations work out. In my experience projects that promise 24/7 cross border value movement often falter on the coordination among institutions, but the backing and expertise here are strong.