In the heart of rural America, banking services have long been a lifeline for small-scale farmers, entrepreneurs, and families striving to build a better future. However, the landscape of rural banking is evolving rapidly. Advances in technology and an increased focus on financial inclusion are transforming how communities interact with financial institutions. This shift is not just about convenience; it represents a critical step towards ensuring equitable economic growth and sustainability for rural populations.

This article delves into the most compelling rural banking statistics, exploring the impact of rural banking on credit markets, penetration rates, and economic resilience. Whether you’re a policymaker, a financial expert, or a curious reader, these insights will offer a comprehensive understanding of rural banking dynamics.

Editor’s Choice: Key Rural Banking Statistics

- Over 30 million rural customers may have gained banking access by 2025, contributing to a 6–7% rise in financial inclusion.

- Rural banking deposits likely exceeded $550 billion in 2025, continuing the steady upward trend seen in recent years.

- Loan approval rates for rural borrowers increased to around 70%, supported by government-backed guarantee schemes.

- Rural education loans surged by 30%, with $12 billion disbursed to support higher education in non-urban areas.

- Collateral‑free loans for small‑scale farmers increased by 25%, totaling $15 billion under new credit guarantee schemes.

- 5,000 new financial literacy workshops were conducted in rural regions, educating 1.2 million residents about savings, credit, and investment.

Key Players in the Rural Banking Market

- NABARD (National Bank for Agriculture and Rural Development) is India’s apex rural development bank, driving credit and financial inclusion for farmers and rural entrepreneurs.

- Bharatiya Mahila Bank (merged with State Bank of India) focused on empowering women through specialized rural and small-scale financing programs.

- The Kangra Central Cooperative Bank Ltd. plays a major role in cooperative banking for rural Himachal Pradesh, supporting agriculture and small businesses.

- Bandhan Bank Ltd. is a leading microfinance-driven bank in India, serving millions of low-income households in rural and semi-urban areas.

- Rabobank is a Dutch multinational bank known for strong rural and agricultural financing expertise worldwide.

- Grameen Bank of Bangladesh pioneered microcredit and remains a global icon for rural poverty alleviation through small loans.

- CRDB Bank Plc in Tanzania has become a vital rural financial services provider, especially in East African agricultural financing.

- Rural Development Bank Ltd. supports rural economic growth with tailored credit products for farmers and small-scale rural industries.

- Agribank (Vietnam) is one of the largest rural banks in Asia, with a strong focus on agriculture and rural development lending.

- BRAC Bank Limited in Bangladesh combines rural banking with SME financing, empowering small enterprises and rural communities.

Economic Resources and Rural Credit Markets

- Community and rural banks collectively manage close to $1 trillion in assets, comprising about 15% of the U.S. banking sector as of 2025.

- The agricultural credit market grew by 9.8%, with rural banks disbursing $230 billion in loans to farmers.

- 40% of small businesses in rural areas rely on loans from community banks, highlighting their key role in local economies.

- Average interest rates on rural loans hovered around 4.5% in 2025, compared to a national average slightly above 5%.

- Non‑performing assets in rural banking dropped to 2.3%.

- Government support for rural credit programs increased by $20 billion, focusing on renewable energy and sustainable farming.

- Rural credit card issuance surged by 25%, driven by incentives like cashback on farming equipment and fuel.

Rural Banking Penetration Rates

- 82% of rural households now have access to at least one banking facility within a 10‑mile radius in 2025, up from 79% last year.

- Branchless banking services expanded by about 12–15% in 2025, including mobile units and agent-based outreach.

- Community banking institutions now provide 70% of rural banking services, underscoring their dominance in non‑urban markets.

- 14 million new rural accounts were opened in 2024, marking a 10% year‑on‑year increase driven by financial inclusion efforts.

- States such as Texas, Iowa, and Kentucky reported penetration rates exceeding 85%, leading the nation in rural banking coverage.

- Mobile banking usage among rural youth surged by 30%, reflecting shifting preferences and smartphone adoption trends.

- Partnerships between rural banks and microfinance institutions grew by 18%, widening outreach to underserved populations.

Loan Disbursement and Credit Access in Rural Areas

- Rural banks disbursed $450 billion in loans, reflecting a 15% increase from the previous year.

- Agricultural lending approached $240 billion in 2025, with growing portions allocated to sustainable and climate-smart agriculture.

- Microloans for rural entrepreneurs reached $40 billion, a 20% increase, especially supporting women-led and small businesses.

- Loan approval rates for rural borrowers climbed to 72%, supported by relaxed criteria and government guarantees.

- The average rural housing loan size rose to $160,000, driven by rising property values and demand for affordable homes.

- Rural education loans surged 30% to reach $12 billion, expanding funding for higher education in non-urban areas.

- Collateral-free loans for small-scale farmers increased 25%, with $15 billion disbursed under new credit guarantee programs.

Financial Inclusion Through Rural Banks

- Banking penetration among rural women rose to 55%, due to outreach programs.

- Over 30 million rural customers accessed formal banking services, contributing to a 7% rise in financial inclusion nationwide.

- Digital wallets and prepaid card usage in rural areas increased by 40%, improving transaction speed and security.

- 5,000 new financial literacy workshops were held across rural regions, educating 1.2 million residents about savings, credit, and investment.

- Government schemes such as DBT channeled $100 billion through rural banking systems, ensuring funds reached intended beneficiaries.

- The share of rural accounts linked to digital ID systems rose to 85%, boosting transparency and accountability.

Partnerships and Regulatory Support for Rural Banks

- Federal and state governments provided $50 billion in subsidies to rural banks in 2025, fostering economic stability and growth.

- Partnerships between rural banks and non‑profit organizations increased by 18%, supporting loans for renewable energy and clean water projects.

- Rural banks collaborated with fintech companies to launch 500 new financial products targeting underserved markets.

- Public‑private partnerships led to the development of 3,000 new banking touchpoints, improving accessibility in remote areas.

- Regulations mandating that 25% of commercial banks’ lending portfolios support rural sectors drove significant resource allocation.

- Tax incentives for rural banking investments spurred an 8% growth in private sector involvement in rural finance.

- Federal Reserve policies encouraging rural banking innovation resulted in the launch of $10 billion in pilot programs, including low‑interest and green finance initiatives.

Rural Banking Market Segmentation

- Customer Type includes individual customers, small business owners, farmers and agricultural enterprises, cooperative societies, and local government entities.

- Technology Adoption spans tech-savvy users, traditional banking users, mobile banking users, online loan applicants, and non-tech users.

- Financial Product Offering covers savings accounts, loans and credit facilities, investment services, mobile banking solutions, and insurance products.

- Income Level segments include low-income households, middle-income families, high-income individuals, self-employed individuals, and retired individuals.

Technological Innovations in Rural Banking

- Blockchain remains in early adoption phases among rural banks, with less than 10% experimenting with it in 2025.

- AI‑powered credit scoring systems enabled rural banks to evaluate 25% more loan applications, cutting approval times by 50%.

- Biometric authentication usage rose by 35% providing rural customers with secure and easy account access.

- Mobile banking apps tailored for rural users saw downloads increase by 40% driven by user‑friendly interfaces and local language support.

- Digital kiosks in villages expanded by 15% offering essential services like cash withdrawal, deposit, and bill payments.

- AI chatbots reduced customer service costs by 20% handling inquiries and guiding customers in local dialects.

- Remote deposit capture (RDC) adoption grew by 25% enabling farmers and small businesses to deposit checks via mobile devices without visiting a branch.

Adoption of Banking Services Over Time

- Rural banking account growth is significant; estimates place the figure well under 100 million accounts.

- Rural savings accounts now constitute 40% of all personal accounts, illustrating rising participation by rural households.

- The adoption of mobile banking among rural populations surged by 25%, reaching 60 million users.

- Rural fixed deposits saw a 15% year‑on‑year growth with total deposits amounting to $120 billion.

- Over the past decade, the average number of banking products per rural customer has doubled, reaching 3.2 products per person.

- Surveys indicate increasing banking participation among rural youth, with under-30s comprising around 40–45% of new digital account registrations.

- Access to credit for first‑time borrowers has increased by 18% reflecting greater trust and reduced entry barriers in rural banking systems.

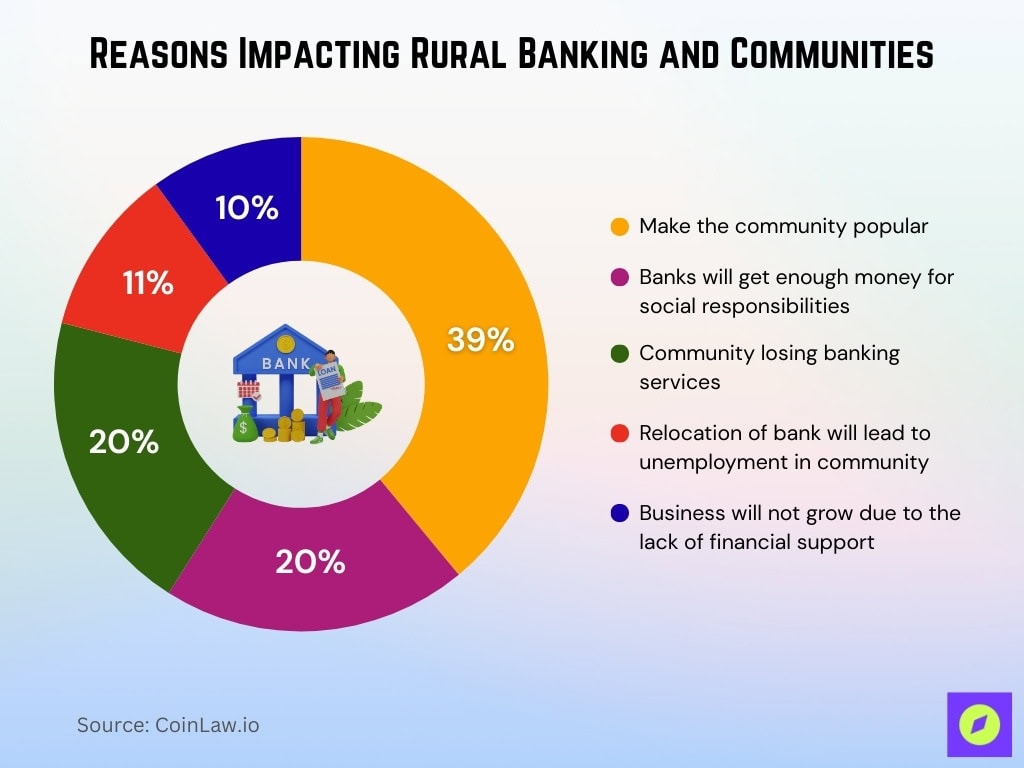

Reasons Impacting Rural Banking and Communities

- 39% believe banks help make the community popular, strengthening local visibility and economic identity.

- 20% say banks ensure enough money for social responsibilities, funding welfare and development projects.

- 20% highlight the risk of the community losing banking services, reducing financial access for residents.

- 11% warn that relocation of banks causes unemployment, directly affecting local jobs.

- 10% stress that business growth stalls without financial support, limiting entrepreneurship and small enterprises.

Increasing Use of the Internet for Banking in Rural Areas

- Internet banking penetration among rural households reached approximately 50% in 2025, boosted by federal broadband access programs.

- Rural regions accounted for a 30% increase in digital transaction volume, totaling $85 billion.

- Cybersecurity campaigns expanded in rural regions in 2025, contributing to a 10–15% decline in digital fraud incidents.

- Mobile banking apps in regional languages grew by 20%, catering to diverse linguistic needs.

- QR payment usage in rural areas saw a 30–35% surge in 2025, driven by mobile POS expansion and simplified payment interfaces.

- Broadband and internet penetration in rural areas reached 75%, providing a strong foundation for online banking.

- Partnerships between banks and telecom operators enabled more households to access digital banking platforms through affordable internet access.

Recent Developments

- Ten new fintech partnerships were launched in 2024, enhancing rural banking with innovations in AI and blockchain technologies.

- Pilot green finance programs for renewable energy in rural areas disbursed $5 billion in loans this year.

- The establishment of regional banking hubs in underserved zones reduced travel time to branches by 20%.

- The Rural Digital Banking Initiative, supported by the government, allocated $3 billion to expand digital banking infrastructure.

- Micro‑savings accounts with zero minimum balance attracted 8 million new rural account holders.

- Investment in solar‑powered ATMs rose by 25%, addressing energy challenges in remote areas.

- While AI is increasingly used in rural banking, estimates suggest it currently assists in handling around 60–70% of routine inquiries.

Conclusion

The evolving landscape of rural banking highlights significant strides in financial inclusion, technological adoption, and innovative partnerships. As rural communities gain greater access to financial services, they are better positioned to contribute to national economic growth and resilience. Despite challenges like limited infrastructure and digital literacy gaps, the increasing integration of technology and policy support is helping bridge these divides.

Moving forward, the continued focus on rural banking will not only enhance individual livelihoods but also foster sustainable development across the country. Policymakers, financial institutions, and technology providers must collaborate to ensure that these advancements are inclusive, impactful, and enduring.