Retail traders have surged into the options market, reshaping dynamics once dominated by institutions. In the U.S., we’re seeing platforms enabling amateur investors to trade complex instruments and data showing disproportionate activity from non-professional trading desks. For example, a high-frequency improvement in volume affected market makers and liquidity providers. Whether used for speculative bets or hedging positions, the impact is clear across brokerages and exchanges. Read on to explore detailed statistics and what they imply for the industry.

Editor’s Choice

- In Q3 2025, average daily U.S. options volume hit 59 million contracts, up ~22% from 2024.

- On the Chicago Board Options Exchange (Cboe) platform, single-stock option volume rose ~25% year-to-date through September 2025.

- On the MEMX Options venue, retail brokers accounted for nearly 27% of volume in August 2025.

- Retail investors purchased ~11% more bullish call options than institutional traders on certain heavy volume days.

- In July 2023, retail participation in options trading reached ~45% of the market.

- The number of retail-broker handled options orders (13 brokers) rose ~18.5% to 32 million orders/day in the year to June 30, 2025.

- Industry panels at the 2025 Options Industry Conference labelled U.S. options growth “remarkable”, driven partly by shorter expiries and technology.

Recent Developments

- Total U.S. listed options volume is on track to exceed 13.8 billion contracts in 2025, a sixth straight annual record.

- The number of days in 2025 that volume exceeded 70 million contracts struck 21 so far, and five of those days exceeded 80 million contracts.

- Index options volume rose ~17% YTD in 2025, and ETF options volume rose ~18%.

- FLEX options (customized-contract options) volume rose nearly 50% to ~1.3 million daily contracts.

- Retail brokers’ flow accounted for ~27% of MEMX Options trading volume in August 2025.

- Retail orders handled by 13 firms increased to 32 million orders/day by June 30, 2025, an ~18.5% rise.

- Retail traders bought ~11% more bullish calls and ~23% fewer puts compared to institutions in a recent high-activity period.

- The average trade size on Cboe’s exchanges has more than quadrupled since 2020, according to analysts.

Retail Global Market Size Forecast

- The retail market is projected to reach $30,623.01 billion in 2025, rising from $28,469.66 billion in 2024.

- Market growth continues steadily, reaching approximately $34 trillion in 2026 based on the chart’s bar height.

- Retail market size expands further to around $37 trillion in 2027, as illustrated in the chart.

- By 2028, the market will grow to nearly $39 trillion, reflecting consistent year-over-year expansion.

- The forecast peaks at $41,443.72 billion in 2029, marking significant long-term growth.

- The overall forecast period from 2024 to 2029 reflects a 7.9% CAGR, showing strong industry momentum.

Share of Retail vs. Institutional Trading

- Retail participation in options trading peaked at ~48% in July 2022, then measured at ~45% in July 2023.

- On MEMX Options, in August 2025, retail brokers’ share approached 27% of volume.

- Retail order flow across equity markets (not just options) reached ~36% of total order flow on April 29, 2025.

- Institutional trading of options continued growing, but retail growth outpaced many segments in 2024–25.

- On days of market stress, retail traders tend to favour call options more heavily than institutions, altering the usual balance.

- Among index options, 57% of SPX options’ average daily volume were zero-days-to-expiry (0DTE) in Q3 2025.

- Retail brokers have begun to dominate certain niche segments (e.g., short-dated contracts) relative to institutional activity.

- The average trade size uptick implies retail engagement may be shifting from small speculative trades to larger speculative positions.

Most Traded Options Contracts by Retail Traders

- 0DTE (zero-days-to-expiry) options captured ~57% of SPX index options ADV in Q3 2025.

- Single-stock options’ daily volume grew ~25% in 2025 vs. 2024.

- ETF options volume rose ~18% in 2025 vs the prior year.

- Retail traders showed high interest in bullish calls over bearish puts, ~11% more calls.

- Recent reporting suggests the average retail options trade size has increased markedly since 2020, multiples of prior years.

- Among the most active segments, FLEX contracts increased by ~50% in 2025.

- On MEMX Options, retail broker volume share suggests retail-traded contracts may include more speculative trades than institutional.

- Short-dated contracts (1-day or few-day expiries) dominate growth, driven by both retail and institutional traders.

Retail Options Market Share by Category

- Exchanges accounted for 48% of the total market share, handling a portion of retail trades via non-marketable limit orders.

- Retail Wholesalers (Non-ATS) represented 34% of the market, making them the primary channel for off-exchange retail activity.

- ATSs (Alternative Trading Systems) contributed 11%, facilitating a smaller but regulated share of trading.

- Other Off-Exchange venues made up 7%, some of which may not be strictly retail-related.

- The majority of retail trading volume in the U.S. is executed off-exchange, largely through wholesalers.

Retail Option Trading Loss Rates and Drawdowns

- Retail options traders typically realize losses of 5% to 9% around earnings announcements.

- For securities with high expected volatility, typical retail losses rise to 10% to 14%.

- The average retail option trade size is about $2,006, with a median size of $337, indicating many small bets.

- Active retail traders execute an average of 15.2 option trades per month.

- Zero-days-to-expiry (0DTE) options account for around 43% to 55% of average daily volumes in some indexes.

- Retail flow makes up roughly 50% to 60% of 0DTE options trading volume.

- Retail traders often pay bid-ask spreads of over 23%, decreasing net returns.

- Retail traders lose on average around 16.4% over three-day periods trading complex options around earnings.

- Retail turnover in high-risk options trading has grown nearly eightfold in recent years.

Retail Trader Demographics and Locations

- According to a broad survey, in 2025, about 62% of U.S. adults report owning stock, returning to pre-Great-Recession levels.

- For options trading specifically, one study shows that among new brokerage account holders in 2020, 22% were aged 18-29, and 66% were under age 45.

- A U.K.-based demographic survey found that among adults aged 18-34, approximately 41% of men and 20% of women had invested in 2025.

- While U.S. ethnic breakdowns for options traders are not widely published, broader data show substantial gaps. Median stock holdings for White households (~$67,800) are much higher than for Hispanic (~$24,500) and Black (~$16,500) households in 2025.

- Platform data show that odd-lot trades (smaller size trades often associated with retail activity) increased from 57% in January 2023 to 66% in August 2025 on the venue tracked.

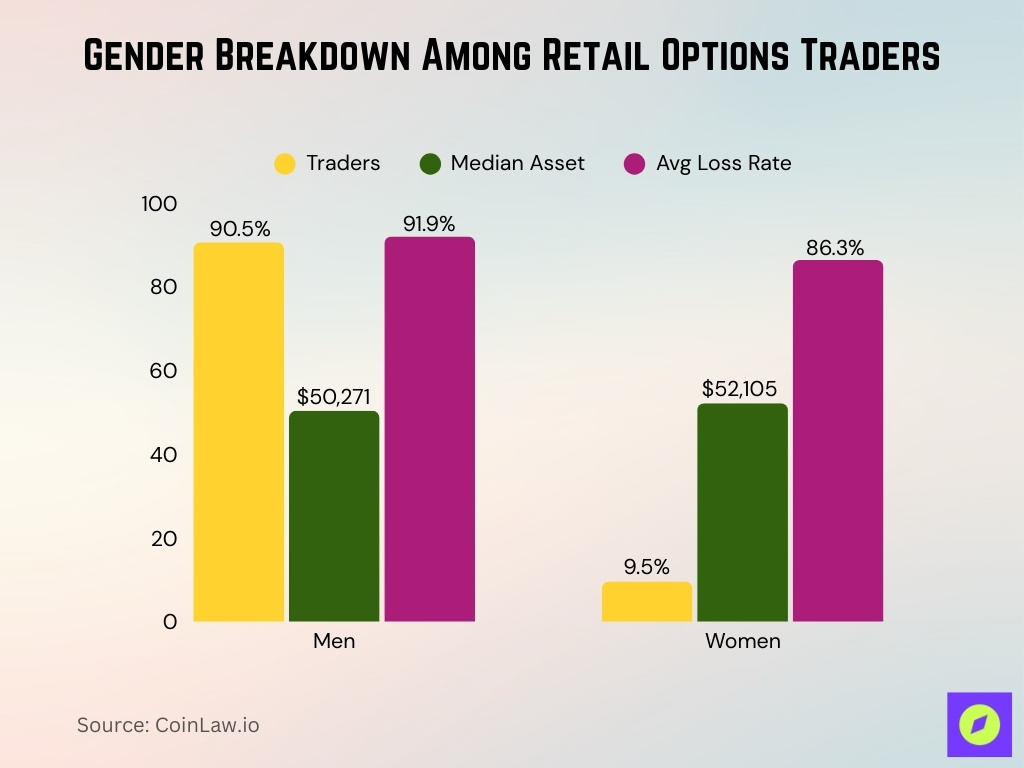

Gender Breakdown Among Retail Options Traders

- Men make up approximately 90.5% of retail day traders in the U.S., with women representing about 9.5%.

- Women hold a median investment asset of $52,105, slightly higher than men’s $50,271 in general investing.

- Women tend to experience lower average losses in options trading; one survey showed 86.3% of female traders incurred losses versus 91.9% of male traders.

- In the U.K., among 18-34 year-olds, 41% of men and 20% of women reported investing in 2025.

- Female traders account for roughly 10% to 14% of retail options traders on many platforms.

- Women trade less frequently during high volatility, lowering exposure to steep losses but limiting speculative gains.

- Men are more likely to engage in high-leverage, short-dated options, whereas women prefer longer-dated, simpler trades.

- Female retail traders’ deposits were found to be about 34% smaller than those of males across some online brokerages.

Retail Trader Risk Appetite and Behaviors

- Retail investor flows increased about 50% from 2023 to early 2025, signaling higher risk-taking.

- Options with five or fewer days to expiry represent approximately 56% of retail volume, up from ~35% in 2019.

- The average retail risk tolerance score is 3.7 on a 1–5 Likert scale, with a standard deviation of 1.2.

- Retail traders favor short-dated contracts like 0DTE, amplifying their risk appetite and potential losses.

Popular Strategies in Retail Options Trading

- Options with five days or fewer to expiration represent over 56% of retail contracts.

- Bullish call options make up approximately 65% of retail options trades.

- Income strategies like covered calls have grown by around 15% among retail traders since 2023.

- Thematic and sector-based options strategies have seen a 20% increase in use among retail traders.

- Multi-leg strategies (butterfly, iron condor) account for roughly 18% of retail options activity.

- Intraday and same-day expiry trades have increased to about 42% of retail options volume.

- Social media influences 25% of retail options trading ideas, driving speculative moves.

Retail Trading Around Earnings Announcements

- Options trading volume spikes by 20% to 35% on earnings announcement days.

- Retail short-dated options post-earnings represent over 60% of total retail options volume.

- Earnings days see retail options volume increases of up to 40%, according to Cboe Global Markets.

- Retail traders using short-dated options around earnings reports average losses between 5% and 9%.

- Implied volatility typically rises by 15% to 25% in the week leading up to earnings announcements.

- Retail directional bets on earnings have nearly 70% higher risk compared to hedged strategies.

- Liquidity around earnings events drops, causing bid-ask spreads to widen by 12% to 18%.

- Retail traders face a 30% higher likelihood of rapid loss during earnings-driven option trades.

- Protective strategies during earnings season are adopted by less than 20% of retail traders.

- Retail-driven earnings trades contribute to short-term price impacts affecting market prices by 1-2% transiently.

Retail Influence on Market Liquidity and Volatility

- U.S.-listed options volume is projected to hit a record 13.8 billion contracts in 2025.

- Average daily options volume increased by about 22% from 2024 to 59 million contracts.

- Retail traders’ share in short-dated (≤5 days expiry) options rose from ~35% to ~56%.

- 0DTE options trading now accounts for 40% to 50% of total retail options volume.

- Retail flow influences intraday market swings, amplifying volatility around earnings and macro announcements.

- Rapid entry and exit by retail traders lead to less stable order books on key expiration days.

- Bid-ask spreads can widen by 15% to 20% on liquidity stress days due to retail-heavy trading.

Frequently Asked Questions (FAQs)

Retail brokers accounted for about 27 % of volume on the MEMX Options venue in August 2025.

So far in 2025, total volume has exceeded 70 million contracts on 21 days.

About 57% of SPX index options ADV in Q3 2025 were 0DTE contracts.

The survey reported an average retail risk-tolerance score of 3.7 (with a standard deviation of 1.2).

Conclusion

Retail options trading has moved well beyond being a fringe activity. With record volumes, rising participation in short-dated contracts, and a surge in speculative strategies, the retail segment now exerts a meaningful influence on market dynamics. At the same time, elevated risk appetite, behavioural biases, and regulatory red flags underscore that this is not simply about access; it’s about the responsibility and awareness that come with it. For market participants, brokers, and regulators alike, the key will be balancing innovation and access with informed risk management and structural safeguards.