In the fast-paced world of compliance and technology, RegTech has emerged as a game-changer, simplifying the complex terrain of regulatory processes for businesses worldwide. Picture this: a global financial institution juggling ever-changing compliance rules across dozens of countries. Now imagine a seamless, automated system that ensures adherence to regulations without missing a beat. That’s RegTech. The industry is poised for transformative growth, driven by advancements in AI, blockchain, and big data analytics. This article dives deep into the latest RegTech industry statistics, unraveling its market size, applications, and trends shaping its future.

Editor’s Choice

- Financial services are projected to account for approximately 45% to 48% of the RegTech market revenue in 2025, continuing to lead adoption due to heightened compliance demands and digital transformation

- Global RegTech funding reached $2.3 billion in Q1 2025, and total funding is expected to surpass $7 billion by year-end.

- In North America, RegTech spending is set to exceed $10.7 billion in 2025, with usage adopted by over 50% of financial institutions.

- Blockchain adoption in RegTech is projected to represent 18% of solutions in 2025, driven by transparency needs in auditing.

- Cloud-based implementations account for over 65% of RegTech deployments in 2025, reflecting greater scalability and cost efficiency.

RegTech Market Growth Highlights

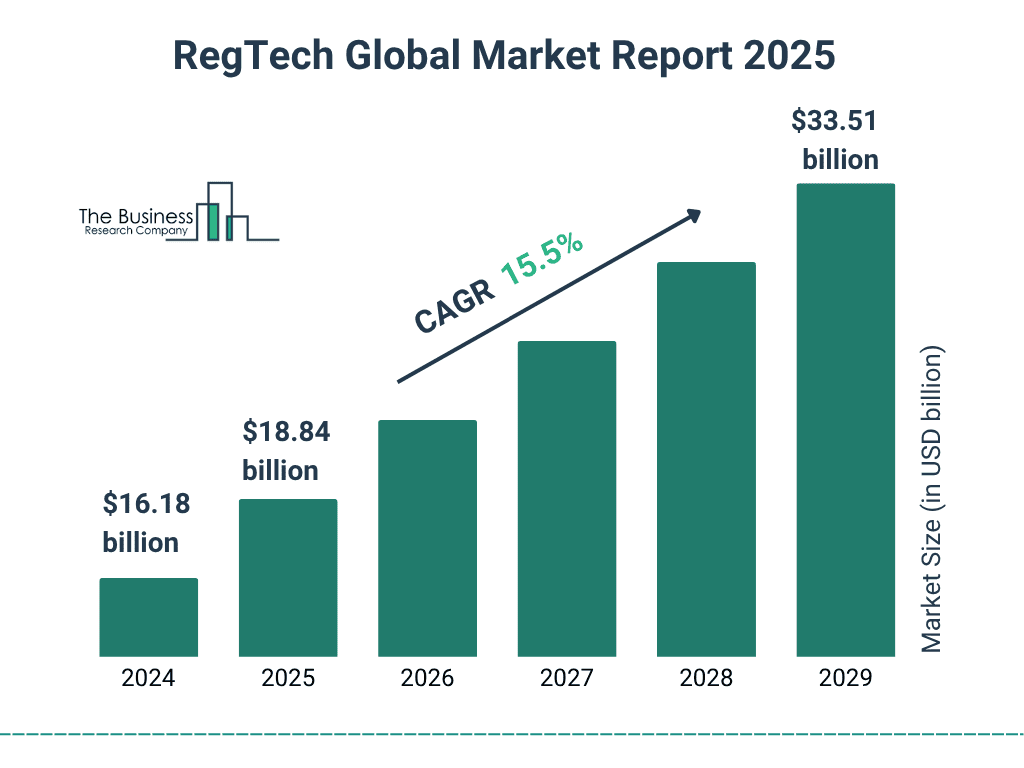

- The global RegTech market was valued at $16.18 billion in 2024, reflecting rising demand for automated compliance tools.

- In 2025, the market grew to $18.84 billion, marking a significant year of adoption and regulatory transformation.

- The market is projected to reach $33.51 billion by 2029, showcasing strong long-term momentum.

- This trajectory reflects a 15.5% CAGR between 2025 and 2029, driven by innovations in AI, cloud computing, and blockchain.

- Between 2024 and 2029, the RegTech industry is expected to more than double in size, highlighting its critical role in financial services and beyond.

Key Applications and Solutions

- Anti-Money Laundering (AML) and Know Your Customer (KYC) sector dominates RegTech in 2025, valued at $8 billion as regulatory automation surges.

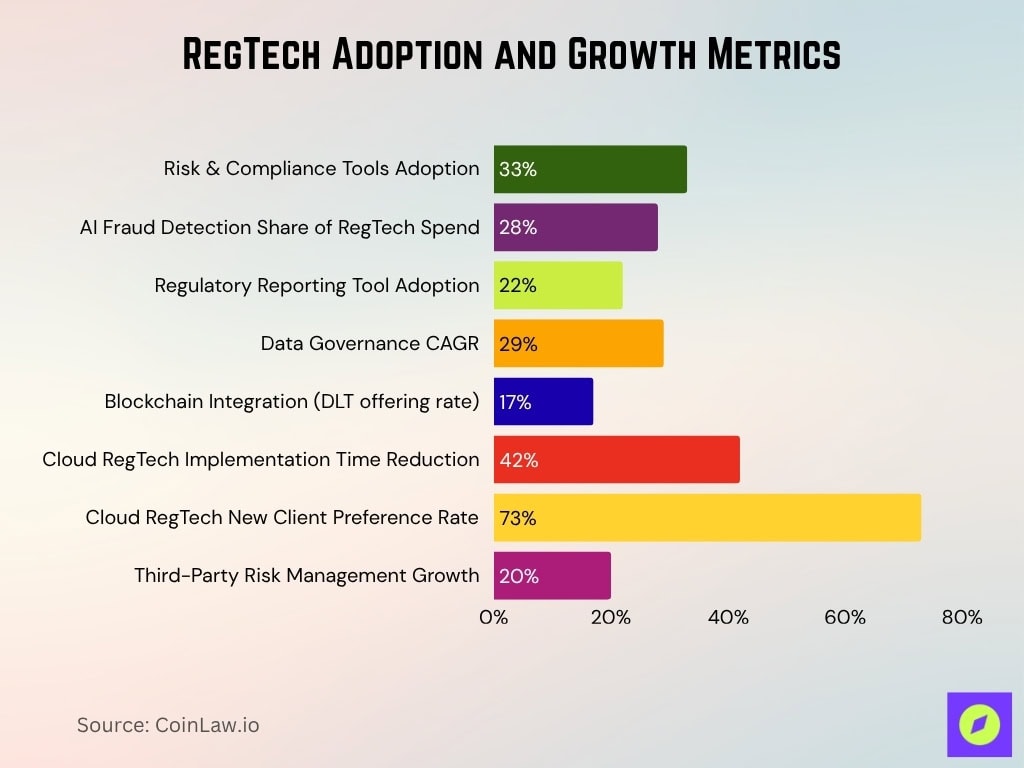

- Risk and Compliance Management Tools adoption rose 33% globally in 2025, powering risk quantification and automated oversight.

- AI-powered fraud detection systems account for 28% of all RegTech spending in 2025, enabling rapid real-time financial crime monitoring.

- Regulatory reporting tools reached 22% market adoption in 2025, saving companies an estimated $1.3 billion annually through automation.

- Data governance solutions are projected to grow at a 29% CAGR through 2028 due to stricter privacy regulations globally.

- Blockchain integration for transaction auditing sees 17% of RegTech providers offering DLT capabilities in 2025.

- Cloud-enabled RegTech solutions reduced implementation time by 42% in 2025, preferred by 73% of new clients.

- Third-party risk management tools expanded 20% in 2025, helping organizations manage supply chain and vendor compliance.

- Cybersecurity compliance tools surged as cybercrime costs exceeded $10 trillion globally in 2025, prompting industry-wide adoption.

Regional Insights

- North America contributes 41% of global RegTech revenues in 2025, driven by financial sector tech adoption and regulatory pressure.

- Europe holds 30% of the RegTech market in 2025, with growth fueled by GDPR, MiFID II, and accelerated cloud-based compliance.

- Asia-Pacific is on track to reach $10.3 billion in 2025, led by rapid adoption in India, China, and Japan.

- Latin America’s RegTech investment grew 19% YoY in 2025, focusing on banking modernization and anti-fraud technologies.

- UK-based RegTech firms generated $521 million in revenue in 2024, with growth expected at 18.5% CAGR through 2033.

- Australia and New Zealand reported 8% CAGR in 2025 RegTech growth, with over 40% of financial institutions deploying solutions.

- Canada’s RegTech market was valued at $499.9 million in 2024 and is projected to reach $877.6 million by 2029, supported by rising budgets in 2025.

- Germany and France lead European adoption, with Germany accounting for 21% of Europe’s RegTech revenues in 2025.

Deployment Insights

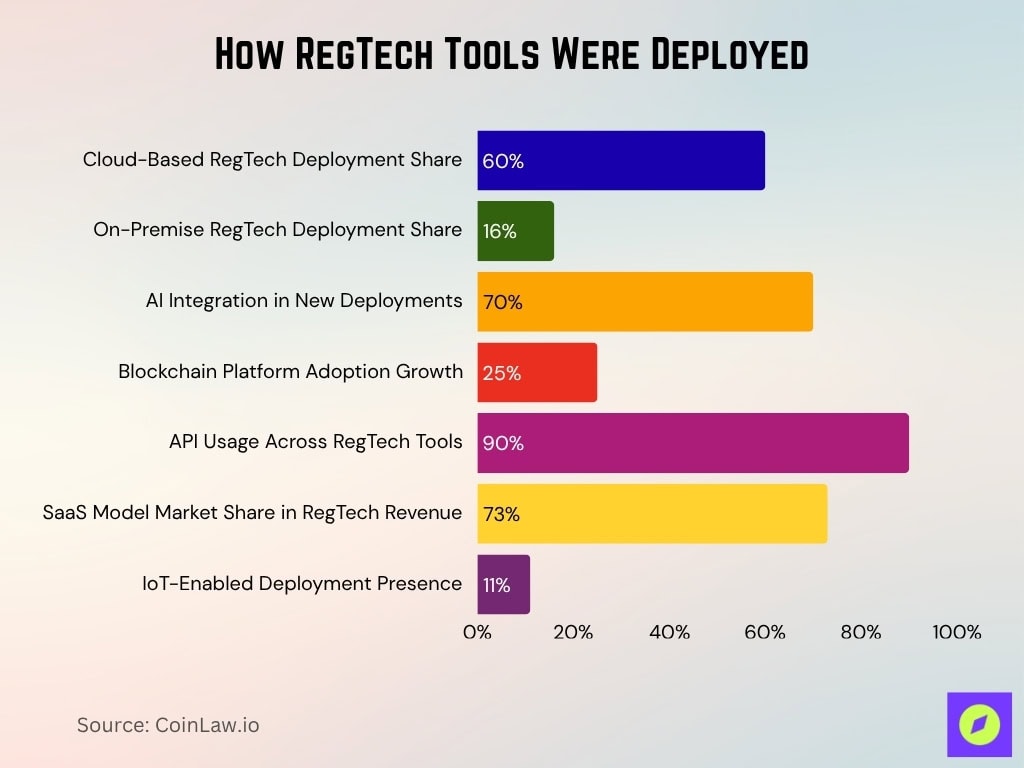

- Cloud-based solutions accounted for 60% of RegTech deployments in 2025, offering unmatched scalability and integration.

- On-premise solutions represent 16% of the market in 2025, primarily used by large enterprises for security and control.

- Artificial intelligence tools dominate RegTech software, with 70% of new deployments in 2025 featuring AI-powered compliance and fraud prevention.

- Blockchain-enabled platforms saw a 25% increase in adoption in 2025, providing transparency and tamper-proof records.

- APIs are used by 90% of RegTech tools in 2025, making seamless data exchange standard across solutions.

- SaaS models lead RegTech revenue with 73% market share in 2025, driven by cost efficiency and regular updates.

- IoT-enabled RegTech tools are now present in 11% of deployments in 2025, supporting real-time monitoring in sectors like energy and manufacturing.

Challenges and Restraints

- High implementation costs remain a barrier, with average RegTech deployment expenses at $250,000 for mid-sized enterprises in 2025.

- Data privacy concerns are rising as 55% of businesses report challenges complying with cross-border data laws.

- Lack of standardization in regulations elevates compliance complexity for multinational firms in 2025.

- Legacy system integration is a hurdle, with 30% of companies reporting adoption delays due to outdated infrastructure in 2025.

- Shortage of skilled RegTech professionals is expected to create a talent gap of 15% by 2025.

- Cybersecurity risks deter 20% of potential adopters as cloud breaches and vulnerabilities remain top concerns.

- Smaller firms struggle with ROI justification as 30% of surveyed SMEs report difficulty quantifying RegTech benefits in 2025.

- Regulatory inertia in emerging markets is delaying the adoption of innovative RegTech solutions in 2025.

- Interoperability challenges affect efficiency, with 40% of users seeking more seamless integrations in 2025.

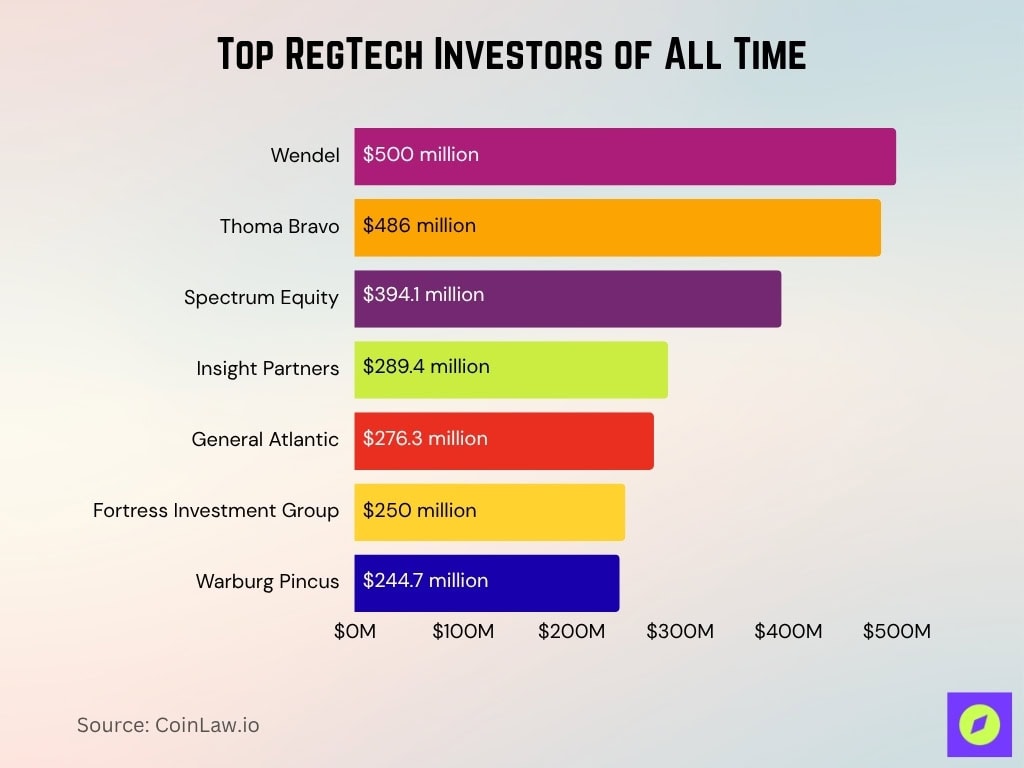

Top RegTech Investors of All Time

- Wendel leads all-time RegTech investments with a massive $500 million committed to the sector.

- Thoma Bravo follows closely, having invested $486 million, highlighting its deep involvement in compliance-focused technology.

- Spectrum Equity holds third place with $394.1 million in total funding, backing data-centric RegTech platforms.

- Insight Partners has poured in $289.4 million, supporting scalable RegTech startups across growth stages.

- General Atlantic invested $276.3 million, emphasizing long-term bets on regulatory transformation.

- Fortress Investment Group contributed $250 million, reinforcing confidence in automation and risk analytics.

- Warburg Pincus rounds out the list with $244.7 million, showing strategic interest in enterprise governance tools.

Recent Developments

- In 2025, the US SEC’s new compliance mandates drove a 27% surge in regulatory technology updates across major RegTech firms.

- Open banking initiatives in Europe led to 17% growth in RegTech investments, accelerating API-driven compliance solutions.

- Ethereum-based systems account for 13% of blockchain-enabled RegTech tools in 2025, leading sector adoption.

- The Biden Administration announced $520 million in grants in 2025 to drive RegTech adoption among American SMEs.

- Singapore’s regulatory sandboxes enabled 15% of startups to pilot new RegTech solutions safely in 2025.

- Cyber insurance partnerships expanded with AXA and Zurich, covering 40% of RegTech-using financial institutions in 2025.

- Partnerships between RegTech and FinTech companies rose 20% in 2025, streamlining compliance for onboarding and transaction monitoring.

- AI-driven sentiment analysis tools launched by four major RegTech firms in 2025 enhanced real-time fraud detection accuracy by 92%.

- The UK FCA introduced sustainable finance guidelines in 2025, pushing RegTech towards green compliance and ESG reporting.

Frequently Asked Questions (FAQs)

Total RegTech funding in 2025 is expected to reach $9-10 billion globally.

Financial services account for 45% of the RegTech market revenue in 2025.

North America contributes 41% of the global RegTech revenue in 2025.

The industry is forecast to grow at a 19.2% CAGR from 2025 to 2035.

Conclusion

The RegTech industry is no longer a niche player but a vital pillar in the global regulatory ecosystem. With advancements in AI, blockchain, and data analytics, RegTech is enabling businesses to tackle compliance challenges more efficiently and at scale. However, costs, standardization issues, and integration challenges remain barriers that the industry must overcome to unlock its full potential. The increasing investment in AI-powered tools, blockchain transparency, and global collaboration signals a bright future for RegTech, positioning it as a cornerstone of sustainable business operations.