In the intricate tapestry of global finance, the private debt market has emerged as a compelling narrative, drawing the attention of investors, policymakers, and corporations alike. Imagine a world where traditional bank loans don’t suffice, and innovative financing bridges the gap. This is the essence of private credit. This market will not only reshape the financial ecosystem but also provide unique opportunities and challenges. This article explores the latest statistics, trends, and insights shaping this dynamic market.

Editor’s Choice

- The private credit market reached about $1.7 trillion globally in 2025 and is projected to grow further.

- In the US, private credit totaled around $1.34 trillion in 2025, taking a larger share of corporate debt.

- Direct lending remains the largest part of private credit and continues to show steady growth in 2025.

- In the first half of 2025, private credit fundraising hit $146.9 billion, surpassing previous years.

- Healthcare and technology remain leading sectors in 2025, holding over 40% of private credit allocations.

- Nearly half of institutional investors in 2025 still cite regulatory risk as a major concern.

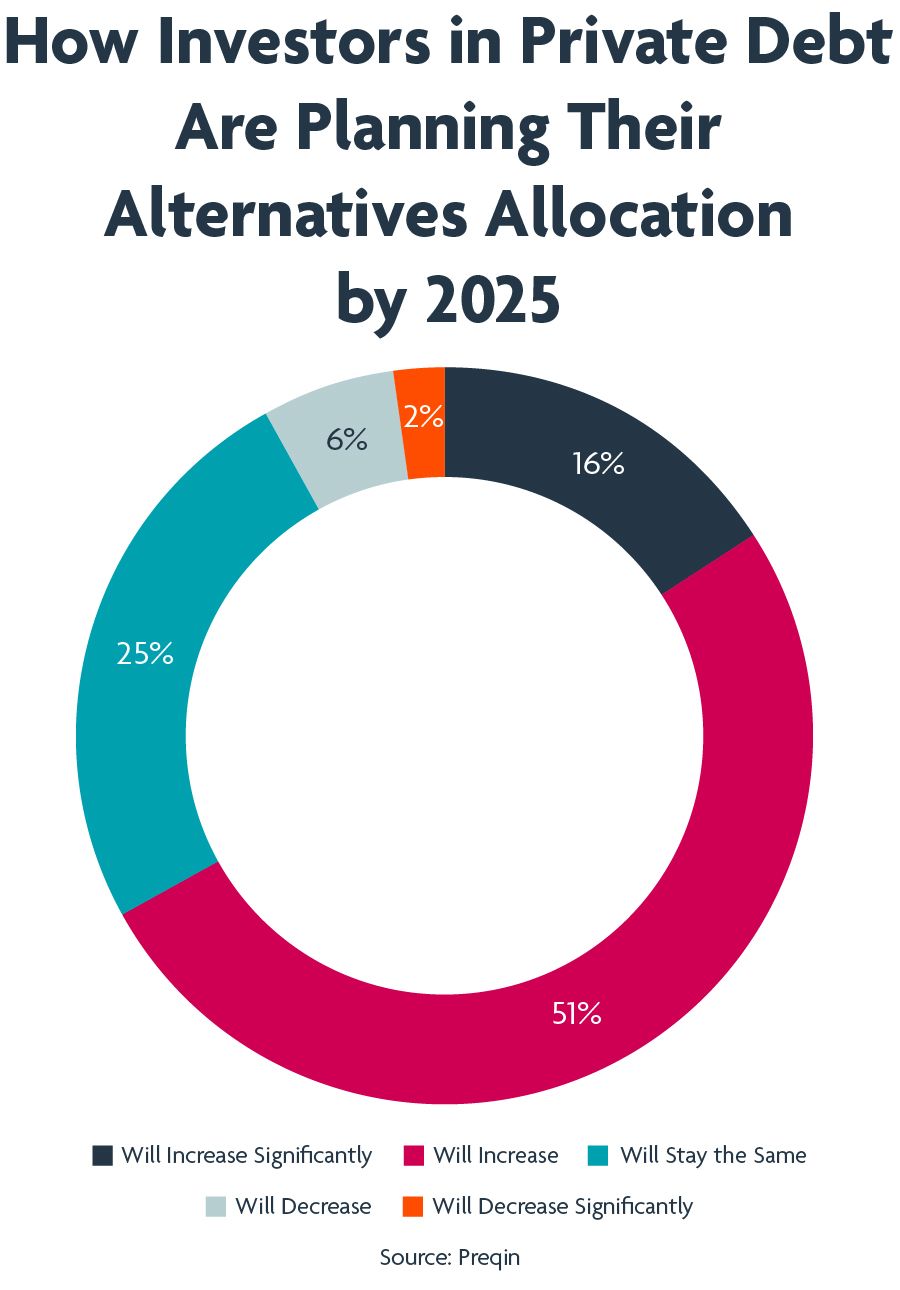

How Investors Are Allocating to Private Debt

- 51% of investors plan to increase their allocation to private debt.

- 25% expect allocations to stay the same as current levels.

- 16% say they will increase significantly, showing strong confidence in the market.

- Only 6% anticipate a decrease in their private debt allocation.

- Just 2% plan to decrease significantly, highlighting limited downside sentiment.

Fundraising Trends

- North America raised $85 billion in the first half of 2025, capturing ~55-60% of global private credit fundraising.

- Europe attracted €39.5 billion (~$46.2 billion) in H1 2025, nearly tripling year-on-year with ~37% share of global fundraising.

- Large and repeat managers dominate in 2025 with mega funds closing in Europe (for example €17.1 billion direct lending fund) driving momentum.

- Institutional investors (pension funds, sovereigns, etc) are increasing allocations in 2025, with European LPs and US pensions showing strong interest in European private debt.

- Direct lending remains highly attractive with several large Europe-focused direct lending funds closing recently and fundraising targets in the tens of billions in 2025.

- ESG/private credit with a focus on sustainability and climate risk is gaining strong traction among allocators in 2025, building on prior-year momentum.

- Infrastructure private credit is increasingly included in investment plans, with over half of investors surveyed in early 2025 expecting to increase exposure.

Asset Under Management (AUM)

- Global private debt AUM reached $1.7 trillion in 2025 and is projected to surpass $2.6 trillion by 2029.

- Direct lending holds over 40% of total private debt AUM in 2025.

- Distressed debt strategies manage about $325 billion in AUM in 2025.

- ESG-focused private credit funds have grown to around $140 billion in AUM in 2025.

- Pension funds control more than 25% of total private debt AUM in 2025.

- Private real estate credit expanded to nearly $100 billion in AUM in 2025.

- North America accounts for over 55% of global private debt AUM in 2025, while Europe holds about 30%.

Private Debt Entry Opportunities for Institutional Investors

- 41.8% of institutional investors access private debt through co-investments, making it the most popular entry route.

- 22% choose fund of funds, showing continued reliance on diversified structures.

- 9.9% prefer a single investor-managed account with a multi-manager approach.

- 8.8% use single investor-managed account GP structures for direct exposure.

- Another 8.8% participate via the secondary market, highlighting growing interest in liquidity options.

- 4.4% invest through single funds, indicating niche preferences.

- Only 4.4% pursue direct investments, reflecting more selective strategies.

Characteristics of Private Credit

- Illiquidity premium remains around 3-4% above public markets in 2025.

- Customizable deal structures continue to offer high flexibility compared to traditional loans in 2025.

- Most private credit instruments in 2025 have maturities between 3 and 7 years.

- Correlation with public markets stays low, boosting diversification in 2025 portfolios.

- Senior secured loans comprise 70–90% of private credit deal structures across a wide range of funds, with certain core direct lending strategies leaning higher depending on risk appetite and manager mandate.

- Entry barriers remain high in 2025, with most opportunities limited to institutional investors.

- Risk-adjusted returns are targeting 9-13% in 2025 for many direct lending and senior private credit strategies.

Role of Banks in Private Credit

- Banks partner in syndications much more in 2025, with institutions like JPMorgan setting aside $50 billion for direct lending platforms.

- Banks will provide bridge and credit lines increasingly in 2025, with bank lending to non-bank financial institutions reaching about $1.2 trillion by Q1 2025.

- Many banks in 2025 serve as advisors structuring private credit deals, especially in co-investment and hybrid models.

- Hybrid financing is growing in 2025 with banks and private funds co-investing to share risk and returns across larger deals.

- Regulatory shifts continue in 2025 under Basel III endgame, pushing banks toward more partnerships and shifting risk off their balance sheets.

- In 2025, banks will remain key origination channels, especially through referrals and bespoke lending platforms.

- Banks provide leverage facilities to private credit funds in 2025, helping them scale exposure, especially in real estate and infrastructure sectors.

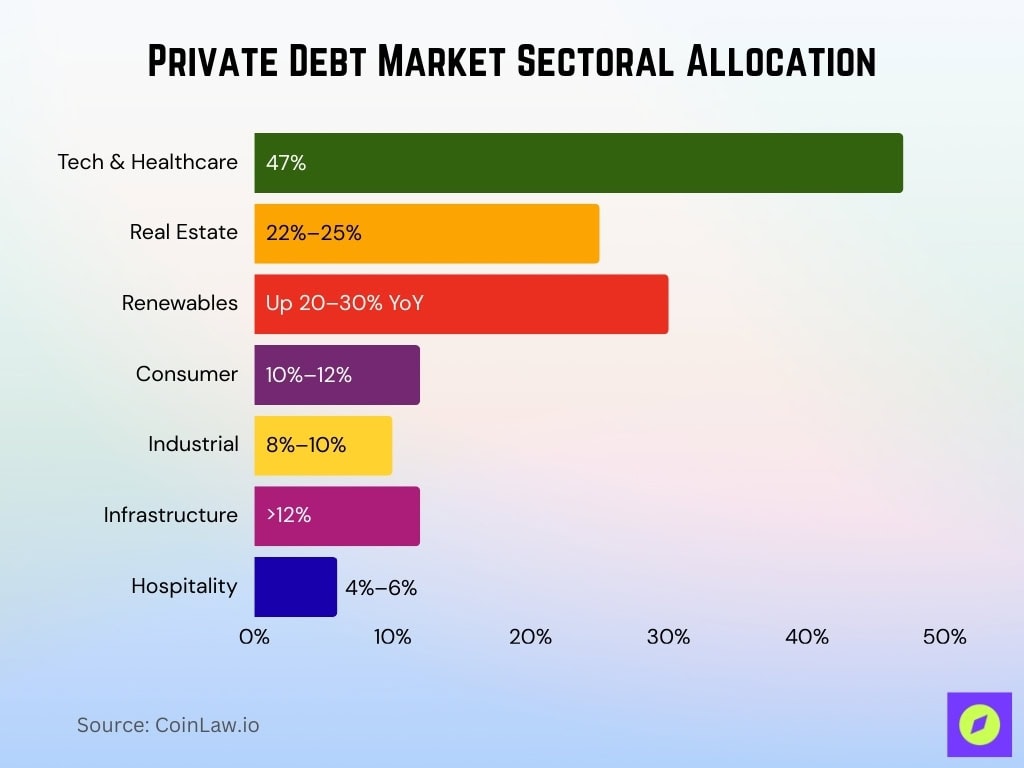

Sectoral Allocation

- Technology and healthcare together are preferred by 47% of LPs in 2025, making them the top sectors for private credit investments.

- Real estate-related private credit strategies attracted approximately 22–25% of new capital commitments in early 2025, particularly in transitional assets and opportunistic lending.

- Renewables and clean energy smart infrastructure are seeing increased flows in 2025, with funding to green energy projects up 20-30% year-over-year.

- Consumer sector allocations in 2025 hover around 10-12% as growth capital demand persists in consumer goods businesses.

- Industrial and manufacturing sectors earn 8-10% of allocations in 2025, driven by automation and supply-chain investments.

- Infrastructure-focused private credit is growing fast in 2025, with over 12% of new private credit funds targeting infrastructure projects.

- Hospitality investments in private credit vehicles accounted for approximately 4–6% of portfolio allocations in early 2025, largely within real estate-backed strategies and recovery-focused funds.

Regional Analysis

- The private credit market size in 2025 is about $1.67 trillion, with North America holding the largest share.

- Asia Pacific is the fastest-growing region in 2025 with a CAGR of about 11-12% expected through 2030.

- Europe continues to expand in 2025, driven by non-bank financing and regulatory shifts.

- Latin America shows rising activity in 2025, especially in infrastructure and SME financing.

- The Middle East and Africa remain smaller but see growing capital deployment from sovereign wealth funds in 2025.

Private Credit Returns

- Private credit delivered a 10-year net internal rate of return of about 8.4% as of March 2025.

- Direct lending & senior structures are generating returns in the low double digits in 2025 under favorable credit conditions.

- Mezzanine and opportunistic credit strategies are expected to target returns around 10-14% in 2025 if risk-premium persists.

- Distressed debt funds are forecasted to post elevated returns in 2025, driven by restructuring opportunities.

- ESG-focused private credit funds in 2025 are delivering net IRRs in the 6–9% range, with some outperforming benchmarks in infrastructure and climate-aligned strategies.

- Senior secured loans remain the more conservative strategy with returns around 6-9% in 2025 under senior risk profiles.

- Volatility of private credit has stayed lower than public credit markets in 2025, supporting steady risk-adjusted performance.

Competitive Landscape

- Blackstone’s credit platform managed about $484 billion in AUM by mid-2025, making it the largest global private credit manager.

- Apollo’s private credit AUM reached around $480 billion in 2025, placing it among the top firms.

- Blackstone’s BCRED became the largest non-traded private credit fund in 2025 with about $66.6 billion in AUM.

- The top 20 private credit managers held over $138 billion in dry powder in early 2025, representing about 36% of the global total.

- Specialized managers like HPS grew strongly in 2025, with AUM of about $148 billion, focusing on niche credit strategies.

Risks to Financial Stability from Private Credit Markets

- The default rate for senior secured and unitranche private credit loans in the US was about 1.76% in Q2 2025.

- Overall, private credit loan defaults ranged between 2-5% in 2024, with stress persisting into 2025.

- Interest coverage ratios have declined in 2025, with many borrowers at around 1.5x or lower.

- Leverage levels remain high with median debt to EBITDA near 5.9x in 2025.

- Use of payment in kind and liability management tools has increased in 2025, signaling borrower liquidity strain.

- Banks’ credit lines to private credit funds have expanded to tens of billions of dollars in 2025, raising interconnected risk.

- Disclosure gaps and opaque valuations continue in 2025, making risks harder to assess.

Recent Developments

- Private credit fundraising in the first half of 2025 reached about $124 billion, putting the year on track to surpass 2024.

- Emerging markets private credit yields in 2025 are around 9-12% with flexible structures gaining appeal.

- Retail investor access is expanding in 2025 through business development companies and private credit ETFs.

- Banks retreating from higher risk profiles in 2025 are driving more issuers toward private credit financing.

- Evergreen private credit fund structures continue to gain momentum, with assets estimated at $400–450 billion globally in 2025.

- Product innovation in 2025 includes blended funds, lower retail minimums, and new structures under EU regulations.

- Technology integration, such as AI and advanced analytics, is streamlining private credit operations in 2025.

Frequently Asked Questions (FAQs)

Global private debt AUM is a little over $1.6 trillion in 2025.

Funds raised $146.9 billion worldwide in the first half of 2025.

US senior-secured and unitranche loans posted a 1.76% default rate in Q2 2025.

Committed bank lending to private credit vehicles reached about $95 billion by Q4 2024, with continued growth noted in 2025.

US private credit outstanding is roughly $1.34 trillion.

Conclusion

The private debt market continues to solidify its role as a transformative force in global finance. Its consistent growth, diversified opportunities, and resilient returns make it an essential asset class for modern portfolios. However, navigating its complexities requires a keen understanding of evolving trends, regional dynamics, and inherent risks. By leveraging its potential while staying vigilant, investors can unlock the unique value that private credit markets offer in today’s economic landscape.