It started as a simple checkout button. A decade ago, that button connected a buyer and a seller with one click. Fast forward, and the payments landscape has evolved into a fierce digital battlefield, led by two giants: PayPal and Stripe.

These platforms have redefined how money moves in the online world. Whether you’re an indie Etsy seller or a Fortune 500 fintech, chances are your checkout flow runs through one of these engines. In this piece, we’ll walk you through the stats that really matter today, from market dominance and merchant adoption to pricing, mobile integration, and more.

Key Takeaways

- 1PayPal processed $1.92 trillion in total payment volume (TPV) globally in 2025.

- 2Stripe is now serving over 5.3 million active businesses globally in 2025.

- 3PayPal currently supports operations in over 200 countries and 25 currencies as of 2025.

- 4Stripe’s developer satisfaction rating hit 92% in a major platform usability survey in 2025.

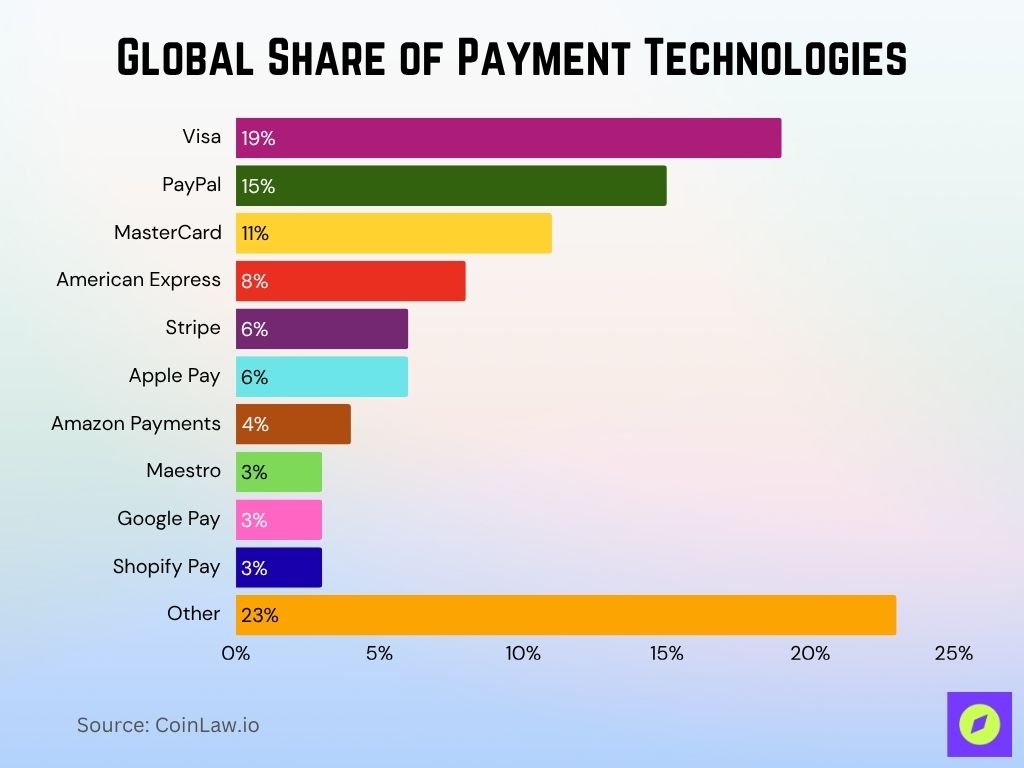

Global Share of Payment Technologies

- Visa leads globally with a 19% share of all payment technologies.

- PayPal follows closely, accounting for 15% of global usage.

- MasterCard holds an 11% share in the global payment space.

- American Express represents 8%, showing its continued relevance in select markets.

- Stripe and Apple Pay each capture 6%, highlighting growing digital and mobile payment adoption.

- Amazon Payments holds a 4% share, reflecting its e-commerce integration strength.

- Maestro, Google Pay, and Shopify Pay are tied with a 3% share each.

- Other payment technologies collectively dominate with the largest slice at 23%, indicating a fragmented market beyond the major players.

Total Payment Volume (TPV) Analysis

- PayPal’s TPV rose to $1.92 trillion in 2025, a 6.1% increase YoY.

- Stripe’s estimated TPV reached $1.14 trillion, growing at a faster rate of 12.3% YoY.

- In mobile commerce, PayPal processed $760 billion in mobile payments globally in 2025.

- Stripe handled $520 billion in mobile transactions in 2025, led by adoption across Shopify and Amazon sellers.

- B2B payment volume on Stripe reached $312 billion, driven by integrations with NetSuite and Salesforce.

- PayPal‘s peer-to-peer (P2P) volume dropped slightly to $315 billion in 2025, as Venmo’s growth plateaued.

- Stripe’s recurring billing volume reached $190 billion in 2025, fueled by its Billing and Invoicing APIs.

- The average transaction value on PayPal was $84.60 per payment in 2025.

- The average Stripe transaction came in higher at $98.10, due to its B2B-heavy customer base.

- PayPal processed over 5.4 billion transactions in Q1–Q2 of 2025 alone.

Active Merchant and User Base

- PayPal had 435 million active users globally as of Q2 2025.

- Stripe reached 5.3 million business customers, marking a 14.8% increase YoY.

- PayPal added 6 million new business accounts in the first half of 2025.

- Stripe onboarded an average of 35,000 new businesses monthly in 2025.

- Stripe serves 92% of the Fortune 100 as of 2025.

- PayPal remains dominant in consumer-facing platforms, with 60% of top e-commerce stores offering PayPal checkout.

- Stripe powers the backend of 70% of top subscription platforms in 2025.

- PayPal’s small business adoption rate in the US stands at 64%.

- Stripe saw a 22% rise in solopreneur adoption due to low-code/no-code tools.

- PayPal has 87 million users based in the US, its largest single-country market.

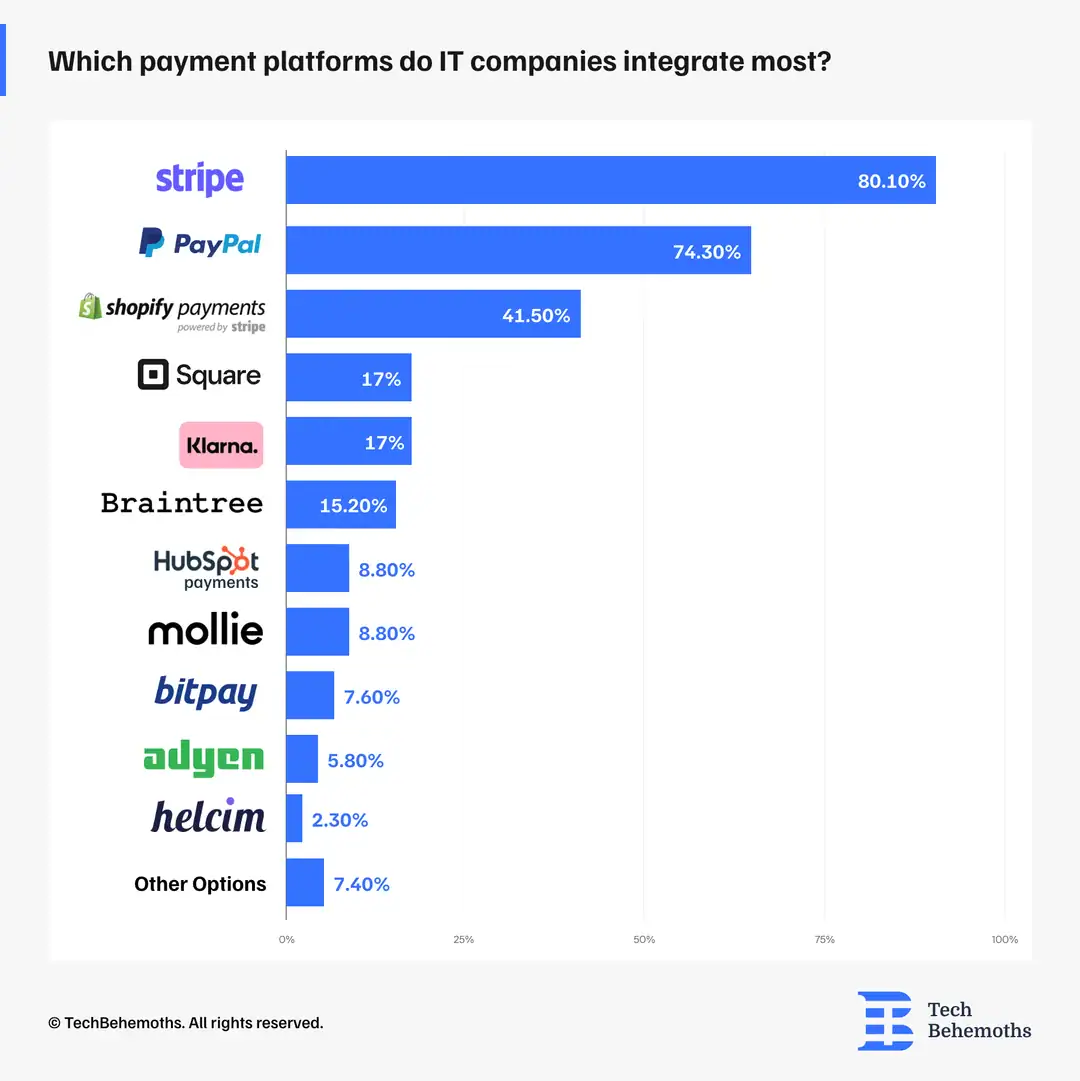

Most Integrated Payment Platforms by IT Companies

- Stripe dominates with 80.1% of IT companies integrating it into their systems.

- PayPal is the second-most popular, used by 74.3% of IT companies.

- Shopify Payments comes third with a 41.5% integration rate.

- Square and Klarna are tied at 17%, showing moderate adoption.

- Braintree is chosen by 15.2% of companies for integration.

- HubSpot Payments and Mollie each have an 8.8% adoption rate.

- BitPay is used by 7.6%, indicating interest in crypto-related payments.

- Adyen appears in 5.8% of integrations, reflecting niche use.

- Helcim is less commonly used, with just 2.3% integration.

- Other payment options account for 7.4%, showing a small but diverse share.

Transaction Fees and Pricing Models

- PayPal’s standard transaction fee remains 2.9% + $0.30 per domestic transaction in 2025.

- Stripe also charges 2.9% + $0.30, but offers volume-based discounts starting at $80,000/month in sales.

- PayPal’s micropayment rate is 5% + $0.05, ideal for low-value digital goods.

- Stripe provides custom pricing for enterprise accounts, with effective rates as low as 1.7% in 2025.

- PayPal charges an additional 1.5% for international transactions in 2025.

- Stripe integrates real-time exchange rates with a markup of 0.4%–1.2% depending on currency pair.

- PayPal introduced a flat-rate merchant subscription in 2025, starting at $25/month for advanced reporting and APIs

- Stripe’s terminal processing fee is 2.7% + $0.05, up from 2.6% in 2024.

- For crypto payments, PayPal charges a fee of 1%, while Stripe supports crypto with custom terms per partner.

- PayPal offers discounted nonprofit rates of 1.9% + $0.30 per transaction.

Mobile and E-commerce Integration

- PayPal processed $760 billion in mobile commerce transactions globally in 2025.

- Stripe’s mobile SDKs power 72% of US-based app-based commerce platforms.

- PayPal One Touch adoption reached 310 million users in 2025, facilitating faster mobile checkout.

- Stripe‘s in-app checkout solutions reduced cart abandonment rates by 19% on average in 2025.

- Stripe supports Google Pay, Apple Pay, and Samsung Pay natively across 100% of its integrations.

- PayPal’s express checkout improved mobile conversion rates by an average of 28% in A/B tests across top US retailers.

- In 2025, Stripe Terminal handled over $11.3 billion in physical in-store payments across the US and EU.

- PayPal‘s QR code payments saw a 12% drop in usage post-pandemic but remain popular in small businesses.

- Stripe’s mobile optimization features led to a 41% increase in completed transactions via mobile in the retail and food delivery sectors.

- PayPal’s mobile checkout speed is now under 1.3 seconds, down from 2.1 seconds in 2023.

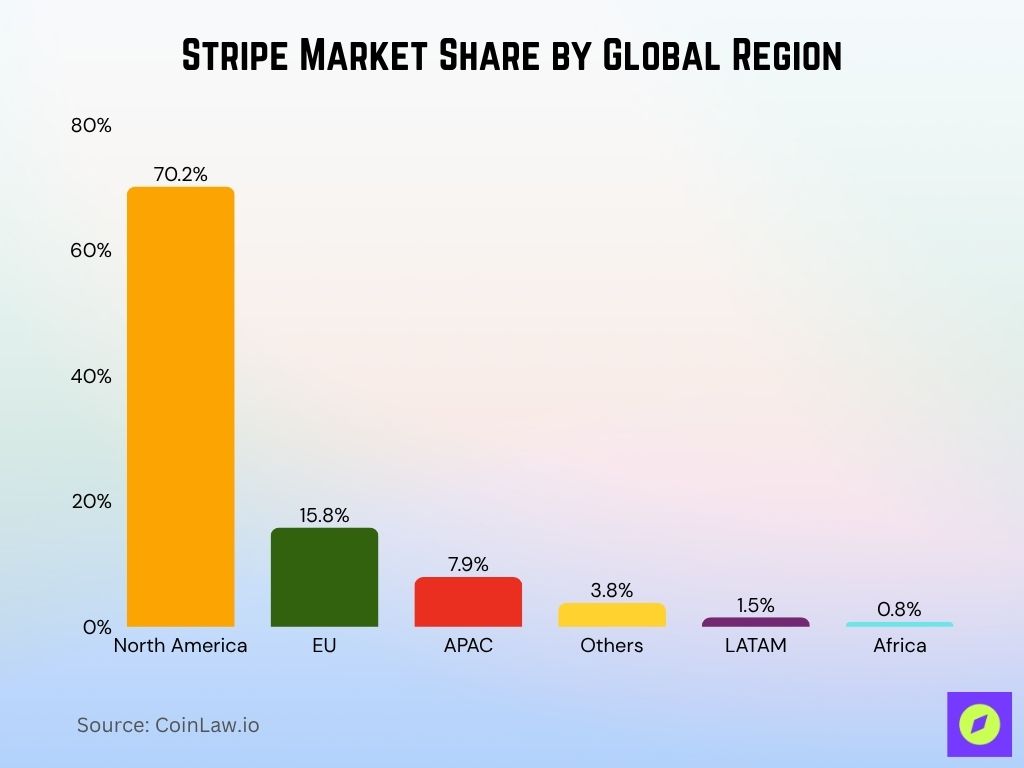

Stripe Market Share by Global Region

- North America holds the largest market share for Stripe at 70.2%, showing overwhelming dominance in this region.

- European Union (EU) accounts for 15.8%, highlighting strong adoption across European markets.

- APAC (Asia-Pacific) represents 7.9% of Stripe’s global footprint, indicating a moderate presence in the region.

- Others make up 3.8%, suggesting a small but diverse set of users outside the core regions.

- LATAM (Latin America) contributes 1.5% to Stripe’s overall market share.

- Africa holds the smallest share at just 0.8%, showing limited integration so far.

Adoption Rates Among Startups and Enterprises

- Stripe powers 92% of all Y Combinator startups launched since 2019, including the new 2025 cohorts.

- PayPal remains a preferred option for solo entrepreneurs, used by 64% of US-based side hustlers.

- Stripe Atlas saw a 19% increase in usage in 2025, helping global founders incorporate in the US easily.

- PayPal’s Braintree unit handled transactions for 33% of venture-backed e-commerce platforms in North America.

- Stripe is the default payment processor for 58% of SaaS platforms with ARR above $5 million.

- PayPal continues to dominate on marketplaces, integrated in 9 out of 10 top platforms globally.

- Stripe’s new AI-powered revenue recovery tools improved startup retention rates by 22% YoY in 2025.

- Among newly incorporated Delaware C-Corps in 2025, 56% chose Stripe as their payment setup at launch.

- PayPal’s in-house lending division grew by 15%, offering microloans to over 700,000 small sellers globally.

- Stripe Capital issued over $3.9 billion in financing to startups and SMBs in 2025, with an average payback rate of 97%.

Security and Fraud Detection Metrics

- Stripe Radar blocked over $7.1 billion in fraudulent transactions in 2025, using machine learning detection.

- PayPal prevented over $5.8 billion in potential fraud using proprietary behavioral analytics systems.

- Stripe achieved 99.999% platform uptime in 2025, maintaining its streak from 2023 and 2024.

- PayPal’s fraud-to-volume ratio remains below 0.20%, well under industry benchmarks.

- In 2025, Stripe Identity verified over 48 million users through biometric and ID document validation.

- PayPal introduced advanced 2FA and adaptive risk scoring in 2025, resulting in a 36% reduction in account takeovers.

- Stripe flagged 43% more synthetic identity fraud cases compared to 2024, with emphasis on real-time risk scoring.

- PayPal maintains PCI DSS Level 1 compliance and added ISO/IEC 27001 certification in 2025.

- Stripe invested over $180 million in platform security this year, with upgrades to its internal audit tooling.

- As of Q2 2025, PayPal users reported 18% fewer phishing incidents, a testament to email verification enforcement.

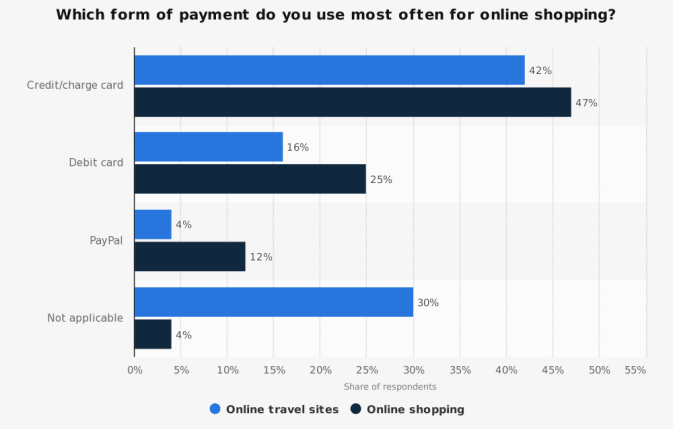

Most Used Payment Methods for Online Shopping vs. Online Travel Sites

- Credit/charge cards are the top choice for both categories, used by 47% for online shopping and 42% for online travel sites.

- Debit cards are more commonly used for online shopping (25%) than for online travel sites (16%).

- PayPal is used by 12% of online shoppers, compared to only 4% on online travel sites.

- 30% of respondents chose “Not applicable” for online travel sites, while only 4% did for online shopping.

Revenue Growth and Profitability Trends

- PayPal’s total revenue reached $32.1 billion in 2025, growing 8.6% YoY.

- Stripe’s projected revenue for 2025 stands at $18.9 billion, up 11.2% from $17 billion in 2024.

- Stripe posted its first-ever quarterly profit in Q1 2025, driven by enterprise growth and infrastructure cost optimizations.

- PayPal’s operating margin held steady at 19.4%, while Stripe grew to 12.2% in 2025.

- Stripe Treasury became profitable for the first time, handling $3.1 billion in business balances and payouts.

- PayPal’s revenue from Braintree grew 13.5%, contributing $7.4 billion to its topline.

- Stripe’s Revenue Intelligence tools brought in $1.2 billion in new upsell-driven income in 2025.

- PayPal saw net income of $5.3 billion in 2025, while Stripe posted an estimated net income of $2.6 billion.

- PayPal‘s recurring revenue streams made up 42% of total revenue, indicating successful diversification efforts.

- Stripe launched a new tax reporting API, adding $320 million in ARR from enterprise usage alone.

Customer Satisfaction and Support Ratings

- Stripe achieved a 92% developer satisfaction rating in 2025, leading the industry for platform usability.

- PayPal maintained a 78% overall customer satisfaction score, with improvements in resolution times noted in Q1 2025.

- Stripe’s support chat resolution time now averages 2.7 minutes, down from 4.1 minutes in 2024.

- PayPal introduced a new AI-powered help assistant in 2025, improving resolution rates by 31%.

- Stripe‘s Net Promoter Score (NPS) rose to 67, up from 61 in the previous year.

- PayPal‘s NPS stands at 54 in 2025, bolstered by its renewed mobile app experience.

- Stripe now supports 24/7 live support across all enterprise tiers, launched officially in March 2025.

- PayPal‘s Trustpilot average rating improved to 4.3 stars, based on over 92,000 reviews globally.

- Stripe’s user dashboard received a UX rating of 9.5/10, particularly for invoice and revenue analytics features.

- PayPal resolved 94% of disputes within 72 hours, up from 88% last year.

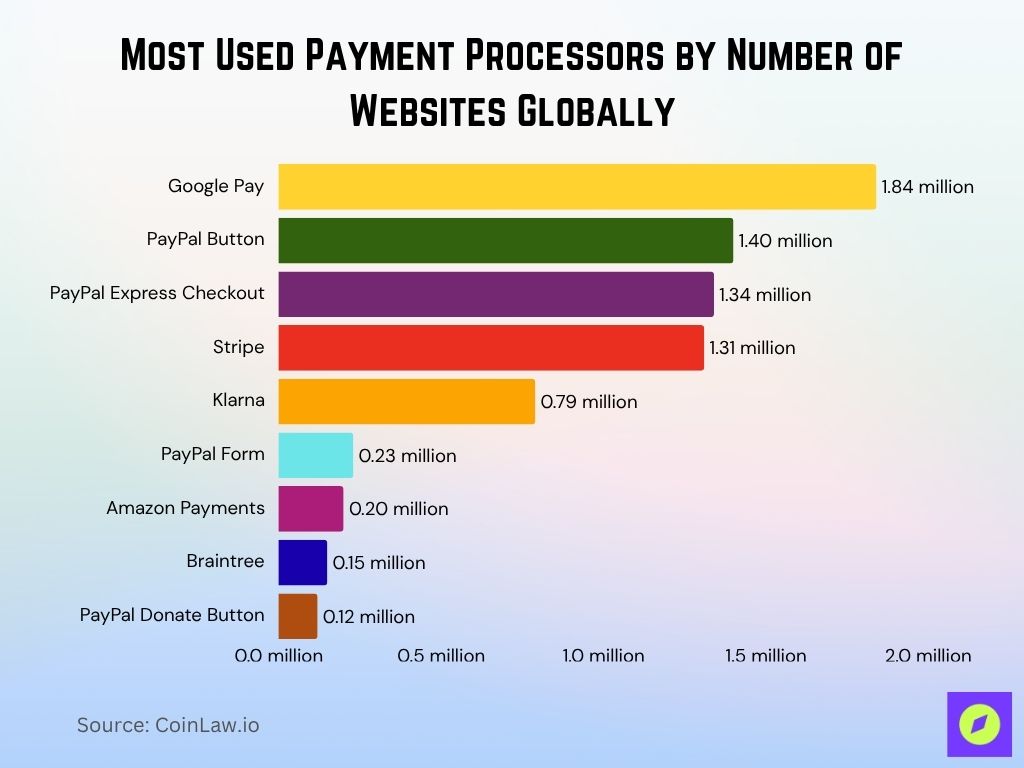

Most Used Payment Processors by Number of Websites Globally

- Google Pay leads the global chart, integrated into 1.84 million live websites.

- The PayPal Button is used on 1.40 million websites, showing wide adoption.

- PayPal Express Checkout follows with 1.34 million website integrations.

- Stripe is close behind with 1.31 million websites using the platform.

- Klarna is featured on 0.79 million websites worldwide.

- The PayPal Form is found on 0.23 million websites.

- Amazon Payments is used by 0.20 million websites.

- Braintree powers payments for 0.15 million sites globally.

- The PayPal Donate Button appears on 0.12 million websites.

PayPal vs. Stripe: Credit Card Processing Comparison

- Both PayPal and Stripe charge a base rate of 2.9% + $0.30 for domestic credit card transactions in 2025.

- Stripe offers better scalability for high-volume merchants, with custom pricing as low as 1.7%.

- PayPal’s processing time for credit card transactions is typically 1–2 business days, slightly slower than Stripe’s T+1 clearing structure.

- Stripe supports instant payouts with a 1% fee, while PayPal charges 1.5% for instant transfers to eligible bank accounts.

- Stripe’s smart routing system reduced transaction declines by 18% for US cardholders in 2025.

- PayPal now supports major card networks in 200+ markets, including AMEX, Visa, Mastercard, and local cards like Bancontact.

- Stripe supports over 135 currencies and has full compliance with SCA (Strong Customer Authentication) across Europe.

- PayPal saw a 9.2% drop in chargeback rates due to new pre-authorization checks added in Q1 2025.

- Stripe lowered its average card authorization latency to 0.8 seconds, improving payment success rates.

- PayPal released tokenized card storage capabilities for all users in April 2025, allowing repeat purchases without re-entry.

How are Stripe and PayPal different?

- Stripe is built primarily for developers and businesses, while PayPal appeals to both consumers and sellers.

- Stripe provides modular tools like Stripe Elements, Radar, Billing, and Treasury, offering a full-stack solution.

- PayPal offers a more plug-and-play experience, ideal for non-technical users and small business owners.

- Stripe supports global tax automation, real-time FX, and bank payouts, making it suitable for enterprise-level international commerce.

- PayPal provides direct buyer protection, which has been cited as a key trust driver by 61% of global buyers in a 2025 survey.

- Stripe allows deep backend integrations with platforms like AWS, Shopify, Salesforce, and NetSuite.

- PayPal integrates with e-commerce platforms like eBay, Walmart, BigCommerce, and WooCommerce.

- Stripe‘s API-first infrastructure is preferred by fintech developers, with over 2 million API calls per second in 2025.

- PayPal offers peer-to-peer features like Venmo and Xoom that Stripe doesn’t support directly.

- In 2025, Stripe released its Terminal SDK for Unity, a unique offering for cross-platform payment hardware development.

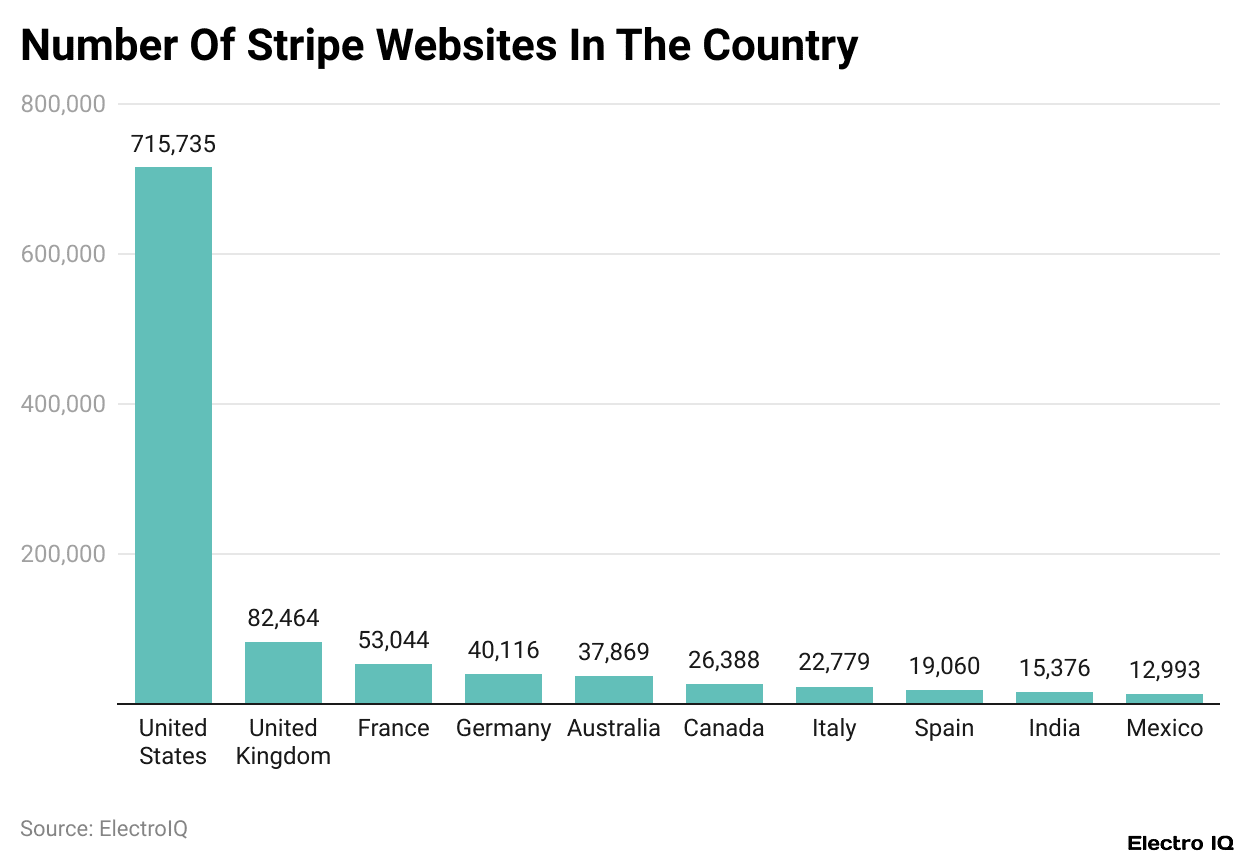

Number of Stripe-Enabled Websites by Country

- The United States leads with 715,735 Stripe-powered websites, far ahead of all other countries.

- The United Kingdom follows at 82,464, indicating strong adoption across UK businesses.

- France has 53,044 websites using Stripe, showing a solid user base in Western Europe.

- Germany and Australia show similar usage levels with 40,116 and 37,869 sites, respectively.

- Canada has 26,388 Stripe-integrated websites.

- Italy hosts 22,779 sites, while Spain has 19,060, both showing moderate usage.

- India is growing steadily with 15,376 websites using Stripe.

- Mexico rounds out the list with 12,993 Stripe-powered sites.

Choosing a Payment Gateway Provider

- For scalability, Stripe is favored by 78% of SaaS and subscription-based companies in 2025.

- For ease of setup, PayPal is preferred by 68% of first-time digital merchants globally.

- Stripe is used by 93% of the top 500 DTC e-commerce brands as of Q2 2025.

- PayPal remains the #1 checkout option among US buyers, with 84% recognition and trust rate.

- Stripe customers report an average ROI improvement of 21% when migrating from legacy payment gateways.

- PayPal still dominates donation platforms, used by 71% of nonprofits on platforms like GoFundMe and JustGiving.

- Stripe’s ability to handle complex recurring billing made it the preferred gateway for 42% of US B2B tech firms.

- PayPal is fully integrated with platforms like QuickBooks, Xero, and FreshBooks, which are useful for small biz accounting.

- Stripe provides unified payment reporting, allowing finance teams to reconcile multi-country payments in under 2 hours monthly.

- For mobile-first businesses, Stripe’s embedded UI SDKs reduced time-to-launch by 37% on average in 2025.

Recent Developments and Strategic Partnerships

- In 2025, Stripe entered a strategic partnership with SAP, integrating billing infrastructure into enterprise ERP systems.

- PayPal launched a collaboration with Meta to support integrated shopping and payments across Facebook Shops and Instagram.

- Stripe acquired Paystack Kenya, expanding its influence across East Africa with new banking integrations.

- PayPal announced a partnership with Apple in Q2 2025, allowing Apple Wallet top-ups via PayPal balance in 12 countries.

- Stripe signed a deal with Amazon Web Services to streamline cloud billing for sellers through embedded finance.

- PayPal introduced Smart Receipts, AI-driven post-purchase analytics, improving customer retention by 16%.

- Stripe invested in AI compliance tooling, helping regulated industries launch faster under US and EU fintech rules.

- PayPal now supports CBD and hemp businesses in 42 US states, after compliance changes approved in March 2025.

- Stripe collaborated with OpenAI to embed GPT-powered financial insights into its enterprise dashboard.

- PayPal expanded its crypto services, adding ETH staking and BTC off-chain transfer options by July 2025.

Conclusion

The numbers don’t lie; PayPal and Stripe each bring their strengths to the digital payments world today. Whether you’re a solo creator, a scaling startup, or a global enterprise, the platform you choose could hinge on subtle but meaningful differences in features, pricing, reach, and flexibility.

PayPal thrives on simplicity, consumer trust, and global name recognition. Stripe thrives on engineering elegance, scalability, and innovation. In the end, your decision may not come down to which is better, but which is better for you.