The world of online payments has evolved dramatically over the last decade, transforming how we exchange money, purchase goods, and manage financial transactions. Imagine walking into a store, paying with just a tap on your smartphone, or splitting a dinner bill with friends using an app in seconds. Online payment technologies have not only made these scenarios possible but also mainstream. As we step into 2025, this trend is only accelerating, with more users embracing the convenience, speed, and security of digital payments.

Key Takeaways

- 1The number of digital wallet users worldwide surpassed 5.6 billion in 2025, with the strongest growth seen in Asia-Pacific and Latin America.

- 2Mobile payments are now preferred by 48% of consumers for daily purchases, showing continued decline in cash and card usage.

- 3Cryptocurrency payments grew, with 16% of online retailers now accepting crypto, compared to 5% just two years ago.

- 4AI-powered fraud detection now secures 78% of online payment systems, helping reduce fraud attempts significantly across platforms.

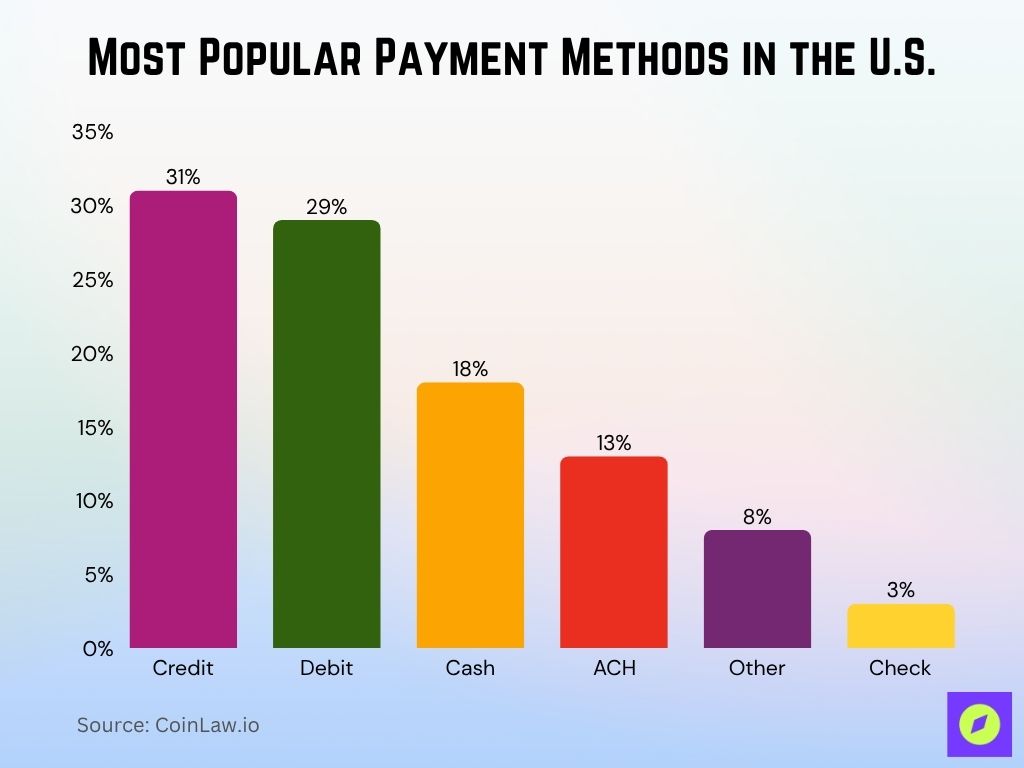

Most Popular Payment Methods in the U.S.

- Credit cards remain the top choice, used in 31% of transactions across the U.S.

- Debit cards follow closely, accounting for 29% of all payments.

- Cash is still widely used, making up 18% of payment methods.

- Automated Clearing House (ACH) transfers represent 13%, showing continued reliance on bank-to-bank transactions.

- Other methods collectively contribute to 8%, covering niche and alternative options.

- Checks are used in only 3% of payments, highlighting their steady decline.

Digital Wallet Usage and Market Penetration

Digital wallets have become a staple of modern online transactions, offering convenience and enhanced security. Their penetration varies by region and demographic, showcasing their broad appeal.

- Apple Pay remains the leader in the US with 43% of mobile wallet users, followed by Google Pay at 29% and Samsung Pay at 18%.

- In China, WeChat Pay and Alipay hold a combined 91% share of the mobile wallet market, driven by tight integration with e-commerce and social apps.

- India experienced a 28% increase in digital wallet usage in 2025, led by PhonePe and Paytm, supported by strong government-backed UPI growth.

- In Europe, PayPal holds 48% of wallet transactions, while Klarna and Revolut have expanded their reach among millennials and Gen Z.

- Latin America saw digital wallets power 42% of online transactions in 2025, with Brazil and Argentina leading fintech adoption.

- Security features influenced 72% of users in 2025, with biometric tools like face ID and fingerprint scans driving trust in digital wallets.

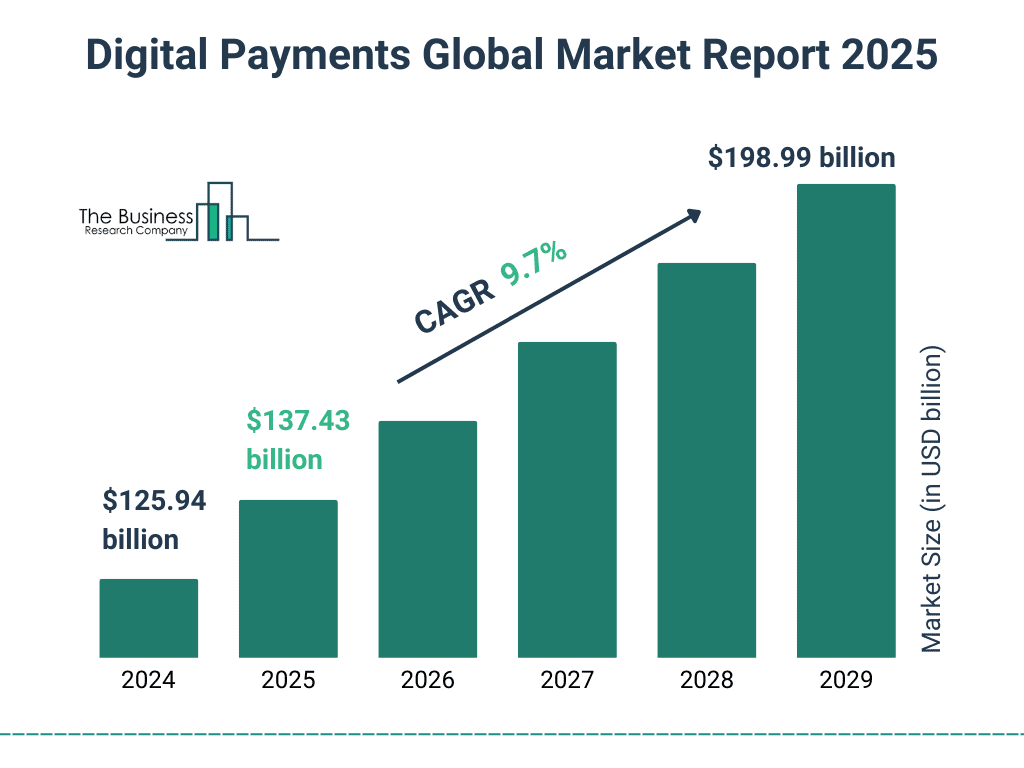

Digital Payments Market Growth Forecast

- The global digital payments market is projected to grow from $125.94 billion in 2024 to $198.99 billion in 2029.

- In 2025, the market is expected to reach $137.43 billion, reflecting strong year-over-year growth.

- A compound annual growth rate (CAGR) of 9.7% is forecasted over the five-year period.

- The steady increase underscores a rising global shift toward cashless transactions and digital payment solutions.

Mobile Payment Adoption and Transaction Volume

Mobile payments are becoming a cornerstone of the online payment ecosystem, allowing consumers to make quick and secure transactions on the go.

- In 2025, mobile payment transaction volume reached $1.62 trillion, reflecting continued momentum as consumers move further away from cash-based methods.

- 85% of US consumers aged 18-34 made at least one mobile payment in 2025, with Venmo and Cash App remaining the top choices.

- China leads globally with 88% of retail payments now processed through WeChat Pay and Alipay, sustaining dominance in urban and rural areas.

- Europe recorded a 34% increase in mobile payment usage in 2025, led by Sweden, Norway, and the Netherlands, where cash is nearly obsolete.

- In Africa, mobile money transaction volume rose 45% to $814 billion in 2025, powered by M-Pesa, Tigo, and Airtel Money.

- Latin America saw mobile payments rise 46%, with Brazil’s PicPay and Mexico’s Mercado Pago expanding rapidly across metro hubs.

- Proximity payments grew 55% globally in 2025, favored in regions with high smartphone and NFC-enabled device penetration.

Key Factors Influencing Online Purchase Decisions

- Promotional offers or discounts were the top driver, influencing 53.6% of online shoppers.

- Advertising impacted 39.2% of respondents, highlighting its continued effectiveness.

- 38% of consumers relied on recommendations from friends or family before making a purchase.

- Brand reputation or loyalty played a role for 33.6% of shoppers.

- 22% used comparison tools or price match guarantees to make informed decisions.

- 17.6% were influenced by social media posts from influencers.

- 11.2% made decisions based on organic posts from brands or stores.

- Live shopping sessions drove purchases for 8.4% of respondents.

- 4.4% cited other factors, suggesting niche influences still play a role.

Buy Now, Pay Later (BNPL) Trends

The Buy Now, Pay Later model has transformed the online shopping landscape, providing consumers with a flexible payment alternative that reduces upfront costs.

- BNPL transactions grew by 33% in 2025, following consistent retailer integration and increased consumer preference for split-payment options.

- Younger consumers aged 18-24 now make up 63% of BNPL users, favoring platforms like Afterpay, Klarna, and Affirm for online purchases.

- In the US, BNPL accounted for 18% of all e-commerce transactions in 2025, with 34% of major retailers now offering it.

- Europe continues to lead BNPL adoption, with Sweden, Germany, and the UK reporting 28% of consumers using it regularly.

- In Australia, 65% of millennials used BNPL in 2025, solidifying it as the top online payment choice for that age group.

- BNPL usage in Asia surged by 56% in 2025, led by fintech expansion in Japan, Singapore, and South Korea.

- The average BNPL transaction size rose by 14% in 2025, reflecting increased consumer trust in using it for higher-value items.

Innovations in Online Payment Security and Fraud Prevention

As online payments grow, so does the importance of securing transactions and preventing fraud; the industry continues to embrace advanced technologies to protect users and systems.

- AI-powered fraud detection systems have reduced fraudulent activities by 36% in 2025 across major digital payment platforms.

- Biometric authentication, such as fingerprint and face recognition, is now integrated into 52% of digital wallets, improving user security.

- Two-factor authentication (2FA) is enforced by 84% of e-commerce sites for high-value purchases, strengthening transaction verification.

- Blockchain technology is now used in 7% of cross-border payment systems, providing immutable and transparent transaction records.

- Tokenization adoption rose, with 68% of online transactions in 2025 secured via tokenized card details to prevent data breaches.

- EMV 3-D Secure (3DS2) boosted authorization rates by 12% in 2025, adding robust protection for merchants and consumers.

- AI-driven predictive analytics detect and block suspicious payments in real-time on platforms like Stripe, PayPal, and Square, improving fraud defense.

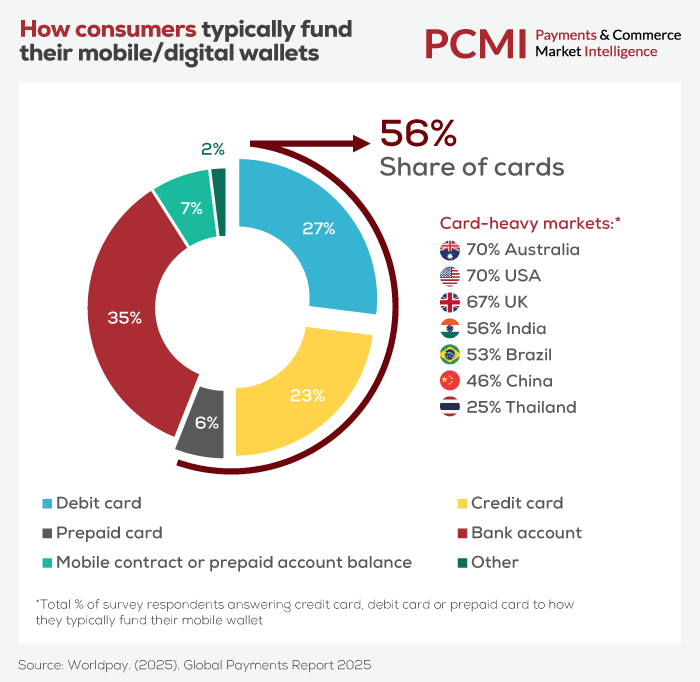

How Consumers Fund Their Mobile/Digital Wallets

- Cards account for 56% of mobile/digital wallet funding methods globally.

- Bank accounts are the top funding method, used by 35% of consumers.

- Debit cards follow at 27%, making them the most common card-based method.

- Credit cards contribute 23%, showing strong preference among users.

- Prepaid cards are used by 6% of respondents.

- Mobile contract or prepaid balances fund 7% of wallets.

- Other methods make up just 2% of funding sources.

- Card-heavy markets include Australia (70%), USA (70%), and UK (67%), showing a strong reliance on card funding.

Impact of Government Policies on Online Payments

Government regulations play a crucial role in shaping the online payment landscape, influencing everything from transaction fees to security standards and accessibility.

- In 2025, the US government finalized regulations for digital wallet providers, improving consumer transparency and fraud liability disclosures.

- The EU’s PSD2 directive helped reduce unauthorized transactions by 17% across Europe, driven by stricter multi-factor authentication rules.

- India’s RBI extended its 2024 policy to cap transaction fees, resulting in a 22% rise in digital payment use among SMEs in 2025.

- China’s oversight of cross-border digital payments led to a 28% drop in overseas transaction fees via WeChat Pay and Alipay.

- Brazil’s PIX system reached 138 million users in 2025, offering instant, zero-cost payments for individuals and low fees for merchants.

- The UK’s Open Banking framework now supports 7.2 million active users, streamlining access to third-party payment integrations.

- With tighter enforcement of data privacy laws like GDPR, 84% of payment providers in 2025 adopted enhanced data security and compliance protocols.

Recent Developments in the Online Payment Industry

The online payment industry continues to innovate rapidly, bringing forth new products, services, and strategies that redefine how consumers and businesses interact.

- 1 in 4 US merchants now accept at least one cryptocurrency for online transactions, signaling mainstream adoption of digital assets in 2025.

- BNPL providers expanded into B2B, helping businesses manage cash flow with installment-based payment solutions.

- Voice-activated payments are projected to reach $21.4 billion in transaction volume in 2025, driven by AI and smart assistant growth.

- Instagram, TikTok, and YouTube expanded in-app shopping with integrated payments, boosting user engagement by 35% in 2025.

- Real-time payment networks (RTP) are now active in 61 countries, providing instant fund transfers for global e-commerce and payroll.

- Subscription-based models now power 68% of online services, offering seamless monthly or annual digital experiences.

- Financial inclusion efforts enabled 1.35 billion people in 2025 to access digital payments for the first time, especially in Africa and Southeast Asia.

- Sustainable fintech is growing, with firms launching carbon-neutral payment systems that offset emissions per transaction to attract eco-aware users.

Conclusion

The rapid growth of online payments in 2025 reflects a fundamental shift in how we transact, shop, and manage finances. Consumers worldwide are increasingly turning to digital wallets, mobile payments, and contactless options for convenience, speed, and security. Innovations in payment security, cross-border solutions, and government policies continue to drive the industry’s evolution, addressing consumer demands for transparency and accessibility.

As payment methods diversify and adapt to regional preferences, the online payment landscape will remain dynamic, setting new standards for convenience and security across the globe. The future of online payments promises even more integration, innovation, and accessibility, shaping a truly global, connected economy.