Nvidia shares climbed after Microsoft received approval from the U.S. government to export advanced Nvidia chips to the United Arab Emirates, reinforcing a deepening tech alliance in the Gulf.

Key Takeaways

- Nvidia stock jumped 2.17% after Microsoft secured export licenses for tens of thousands of advanced AI chips.

- The U.S. Commerce Department approved the export of Nvidia’s cutting-edge GB300 GPUs to the UAE in September.

- Microsoft will increase its total investment in the UAE to $15.2 billion by 2030, including AI infrastructure and partnerships.

- The move aligns with the UAE’s strategy to become a global artificial intelligence hub and deepens U.S.-UAE tech ties.

What Happened?

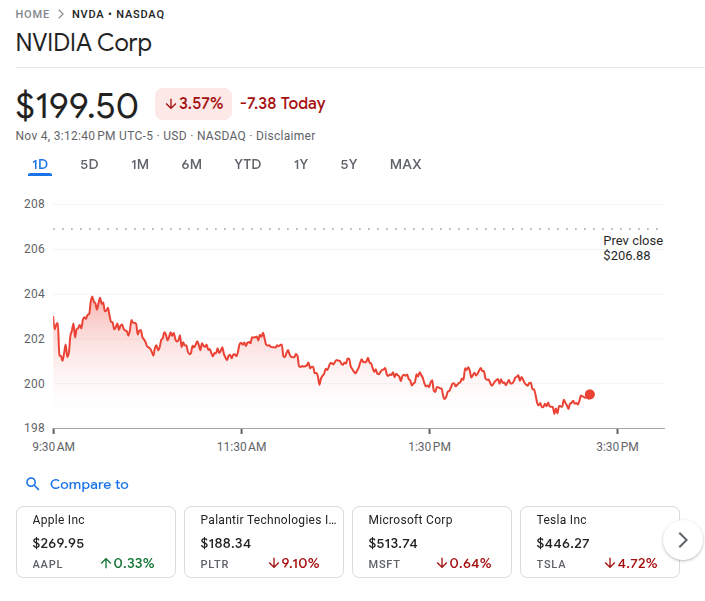

Microsoft became the first company under the Trump administration to secure licenses from the U.S. Department of Commerce to export Nvidia’s powerful chips to the UAE. The approval, granted in September, allows Microsoft to ship the equivalent of 60,400 A100 chips, utilizing Nvidia’s advanced GB300 GPUs. This decision drove Nvidia stock up 2.17% in the following trading session.

Microsoft $MSFT said it has received approval from the United States 🇺🇸 to ship Nvidia $NVDA chips to the United Arab Emirates 🇦🇪 for the company to use in the country

— Evan (@StockMKTNewz) November 3, 2025

“Microsoft says it the first company this year under the Trump administration to secure export licenses from… pic.twitter.com/ZObPC7AmYv

U.S. Greenlights Major AI Chip Exports

The U.S. government’s approval marked a significant move in international technology trade. The Commerce Department based its decision on “updated and stringent technology safeguards”, ensuring compliance with national security standards.

Brad Smith, President of Microsoft, thanked Commerce Secretary Howard Lutnick for facilitating the approval, noting the bipartisan cooperation involved. He highlighted that the license was a result of evolving safeguards and built on longstanding relationships across several U.S. administrations.

The licenses follow an earlier clearance that allowed Microsoft to accumulate the equivalent of 21,500 Nvidia A100 GPUs, a mix of A100, H100, and H200 chips. The newly approved batch represents a much larger allocation of GB300 GPUs, Nvidia’s latest generation for advanced AI processing.

After this news, NVIDIA Stock experienced surge in price and reached $203. It’s currently trading at $199.39.

Microsoft’s UAE Commitment Hits $15 Billion

Microsoft confirmed plans to increase its total investment in the UAE to $15.2 billion by the end of 2030. This includes a $1.5 billion equity stake in G42, an Abu Dhabi-based AI company, which also gave Microsoft a seat on G42’s board.

The tech giant is also channeling over $5.5 billion into AI and cloud infrastructure in the region, with a particular focus on expanding AI data centers. Smith said this investment is crucial to meeting the rising demand for AI services in the Gulf.

During the ADIPEC energy conference in Abu Dhabi, Smith emphasized that Microsoft is investing in “technology, talent and trust” to help fuel the UAE’s economic and technological ambitions.

Strategic Implications for U.S.-UAE Relations

The UAE has positioned itself as a future hub for artificial intelligence, spending billions to attract global tech leaders. Nvidia’s chips are key to this strategy.

Azad Zangana of Oxford Economics noted that access to top-tier AI chips gives UAE developers a crucial edge. “Access to the world’s leading AI chips provides the hardware that will give developers the leading edge that is needed in an incredibly competitive global landscape,” he wrote.

Despite concerns in Washington over G42’s past ties with China, Microsoft stated that the Emirati firm had made “enormous progress” in aligning with U.S. compliance standards. Smith indicated that G42 is likely to gain direct access to U.S. chips in the future.

However, some lawmakers remain cautious. Representative John Moolenaar, chair of the U.S. House Select Committee on China, warned that such cooperation should only proceed if the UAE “verifiably and irreversibly” aligns itself with the U.S. over China.

CoinLaw’s Takeaway

In my experience, this is more than just a chip export deal. It shows how strategic tech collaboration is becoming the backbone of international diplomacy. Microsoft is not just selling servers, it’s cementing influence in a region vying to lead in AI. Nvidia’s chips are powering not only apps but also geopolitical shifts. And let’s be honest, that 2.17% jump in Nvidia’s stock? It reflects Wall Street’s confidence in the long game here. I found the U.S. government’s shift toward trust-based export approvals particularly revealing. It’s a signal that AI diplomacy is now fully in play.