Nvidia could reach $800 per share by 2030, according to a bold projection from a Boston Consulting Group analyst, signaling massive potential upside despite already record-breaking growth.

Key Takeaways

- 1A Wall Street analyst from BCG predicts Nvidia’s stock could grow 370 percent to $800 by 2030.

- 2Nvidia currently holds around 30 percent of global data center spending, which is projected to hit $1.6 trillion by 2030.

- 3AI spending is accelerating, with cloud giants like Google and Amazon boosting infrastructure investments.

- 4Nvidia’s CUDA platform and Blackwell GPU chips help lock in market dominance, but revenue projections may fall short of the bold target.

What Happened

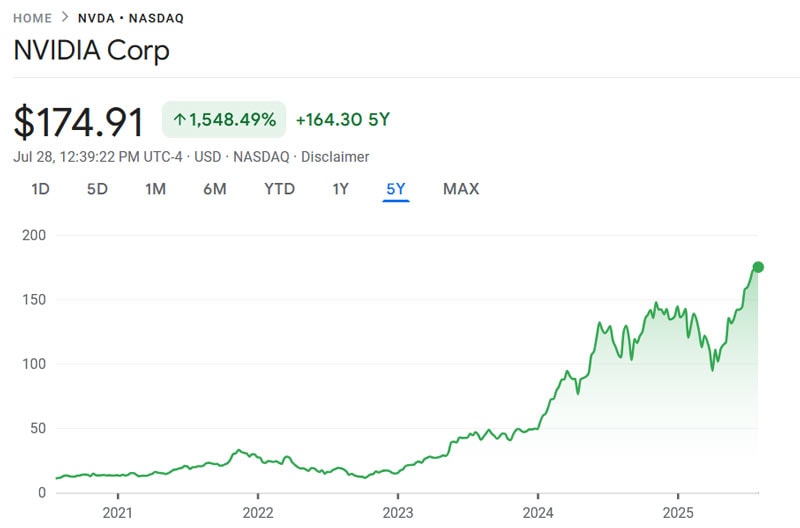

Phil Panaro, an analyst at Boston Consulting Group, believes Nvidia’s share price could reach $800 by the year 2030. That would represent a 370 percent jump from its current level, even after an incredible run that has already pushed the stock up over 1,000 percent since 2023. His bullish call is grounded in projections for explosive growth in global data center spending and Nvidia’s strong position in that market.

Analyst’s Bold Call on Nvidia’s Trajectory

Panaro made his prediction during an interview with Schwab Network, citing Nvidia’s latest earnings as a sign of what’s possible.

“They reported $35 billion in one quarter, which is three months. They had a total of $27 billion over 12 months last year,” Panaro said. “In three months, they exceeded their entire 2023 earnings by $8 billion.”

This puts Nvidia on a $140 billion annual revenue pace. To justify an $800 stock price, Panaro estimates Nvidia would need to reach $600 billion in annual revenue by 2030. That would be more than four times current levels, and significantly above the 217 percent growth that existing projections would suggest.

Data Center and AI Investment Booms

The foundation for the $800 target lies in massive investments expected in AI and cloud infrastructure. Third-party research cited by Nvidia suggests global data center capital expenditures reached $400 billion in 2024 and are projected to hit $1 trillion by 2028, growing at a 26 percent compound annual rate. If that growth continues through 2030, the market could hit $1.6 trillion.

Nvidia currently captures around 30 percent of this spending, having reported $115 billion in data center revenue during fiscal 2025. Maintaining that share could translate to $473 billion in revenue by 2030.

However, that figure still falls short of the $600 billion revenue needed for the stock to hit $800. This means Nvidia would have to either increase its market share or expand into new, lucrative business areas.

Nvidia’s Moats: Blackwell Chips and CUDA Ecosystem

One reason analysts remain optimistic is Nvidia’s strong competitive moat. The company’s CUDA platform, used by millions of developers worldwide, ties software development closely to Nvidia hardware. This makes switching to competitors expensive and complicated.

Nvidia’s latest Blackwell GPU architecture is another major advantage. It contributed nearly 70 percent of data center compute revenue in Q1 fiscal 2026, even though it only began volume shipping earlier this year.

With the CUDA software ecosystem and next-gen chips, Nvidia maintains its grip on the AI sector, despite competition from Google’s TPUs and Amazon’s Inferentia and Trainium chips.

Broader AI Momentum and Market Sentiment

Sylvia Jablonski, CEO of Defiance ETFs, noted on Bloomberg that trillions of dollars are waiting on the sidelines for AI investments. She called it “the biggest wealth transfer of our generation”, driven by millennial and Gen Z investors allocating funds toward AI and tech.

As companies like Alphabet raise capital spending by billions to build out cloud infrastructure, much of that money is expected to flow toward Nvidia hardware. Microsoft and Amazon are expected to follow the same path.

CoinLaw’s Takeaway

Honestly, I find this $800 target both exciting and challenging. Nvidia is undeniably the king of AI chips right now, and its dominance in data centers is unmatched. But to grow revenue by 350 percent in five years is an enormous leap. I think they’ll come close if AI demand keeps exploding, but hitting $800 will likely require some combination of market share growth and entirely new revenue lines. Still, if I were betting on any company to overdeliver, it’d be Nvidia.