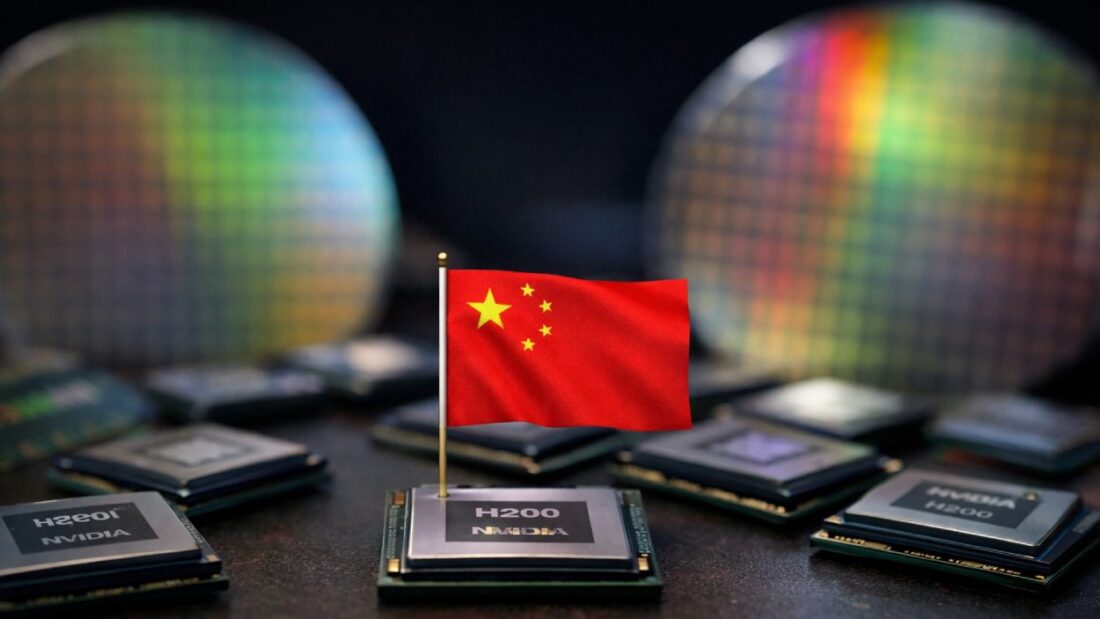

Beijing’s latest move to pause Nvidia H200 chip orders signals fresh uncertainty in the US-China tech standoff and may impact investor sentiment on Nvidia stock.

Key Takeaways

- China has instructed local tech companies to suspend purchases of Nvidia’s H200 AI chips while it deliberates future access policies.

- The pause follows a recent decision by the US to allow H200 exports to China, reversing previous restrictions.

- Nvidia CEO says demand in China remains strong, interpreting current orders as a sign of potential approval.

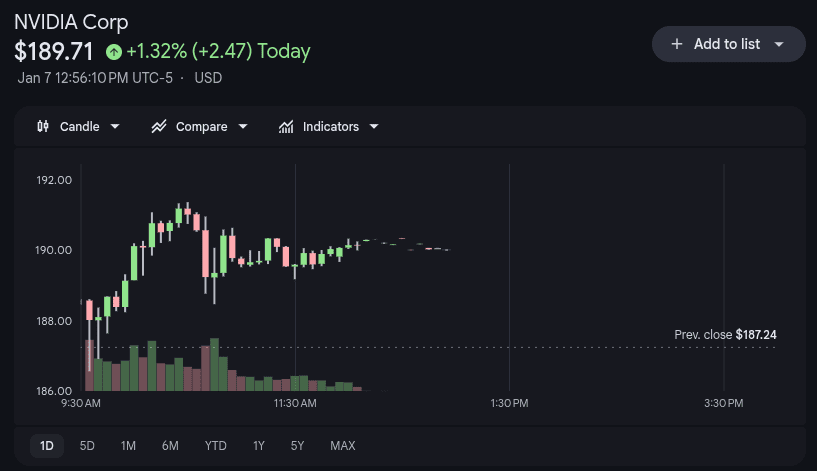

- The company’s stock was up 1.53 percent at $190.10 amid mixed investor reaction to the news.

What Happened?

The Chinese government has directed several of its tech firms to temporarily halt orders for Nvidia’s H200 artificial intelligence chips. The move is part of a broader strategy to evaluate whether and how to permit access to these high-performance semiconductors while also promoting domestic alternatives. The halt comes just weeks after a reversal by the Trump administration allowed Nvidia to sell the chips to China under new export rules.

China has suspended Nvidia, $NVDA, chip purchases and asked companies to halt H200 chip orders.

— Prosenjit (@mitrapredator) January 7, 2026

Boom 💥

China’s New Pause on Nvidia Chip Imports

The decision to pause purchases comes amid escalating tech trade tensions between the US and China, particularly around semiconductors which have become a strategic point of conflict. Beijing is reportedly aiming to discourage local companies from stockpiling US chips before finalizing its policy on AI hardware imports.

Two people involved in the directive told The Information that the halt is temporary and intended to give the government time to evaluate the impact and terms of potential access. Chinese authorities are also signaling a likely move toward mandating domestic AI chip purchases, further reducing reliance on US-designed technologies.

In response to the report, Chinese Embassy spokesperson Liu Pengyu stated:

Nvidia’s Position and Market Response

At the Consumer Electronics Show this week, Nvidia CEO Jensen Huang said that demand in China for the H200 chip remains high. He noted that the ongoing purchase orders from China are being interpreted by the company as a positive signal, even though no formal approval has been communicated by Beijing.

The H200 chip is a predecessor to Nvidia’s latest “Blackwell” flagship series and plays a key role in AI computing advancements. Despite the regulatory ambiguity, Nvidia’s stock rose 1.35 percent to $189.71, suggesting that investors may still see long-term potential, though some initial declines were observed following the news.

The Role of U.S. Export Policy

Late last year, the Trump administration granted approval for H200 exports to China, a shift from prior restrictions under the Biden administration. However, that approval came with conditions, including a 25 percent revenue-sharing tax paid to the US government on related sales. Export licenses for these chips are still being processed, and there is no set timeline for their final clearance.

Nvidia has been caught in the middle of geopolitical friction, lobbying for more consistent access to the Chinese market while managing evolving US regulatory pressures.

CoinLaw’s Takeaway

In my experience covering US-China tech conflicts, this kind of move from Beijing is more than just a pause. It’s a signal of shifting priorities. China is clearly preparing to pivot toward its own AI ecosystem, and Nvidia’s position as the dominant global AI chip provider is now being tested on multiple fronts. I found it interesting that Nvidia still sees demand as a good sign, but I’d be cautious. Policy shifts like these often become long-term trends. For investors and tech watchers, Nvidia’s next move in the Chinese market could shape the global AI hardware race.