NVIDIA Delivers Record Q2 Results but Faces Market Skepticism Over AI and China Tensions.

Key Takeaways

- NVIDIA reported $46.7 billion in Q2 FY2026 revenue, up 56% year-over-year, beating Wall Street expectations.

- Profit hit a record $26.4 billion, boosted by strong AI chip sales, but data center revenue slipped slightly.

- No H20 chip sales to China, as geopolitical tension and export controls continue to weigh on NVIDIA’s business there.

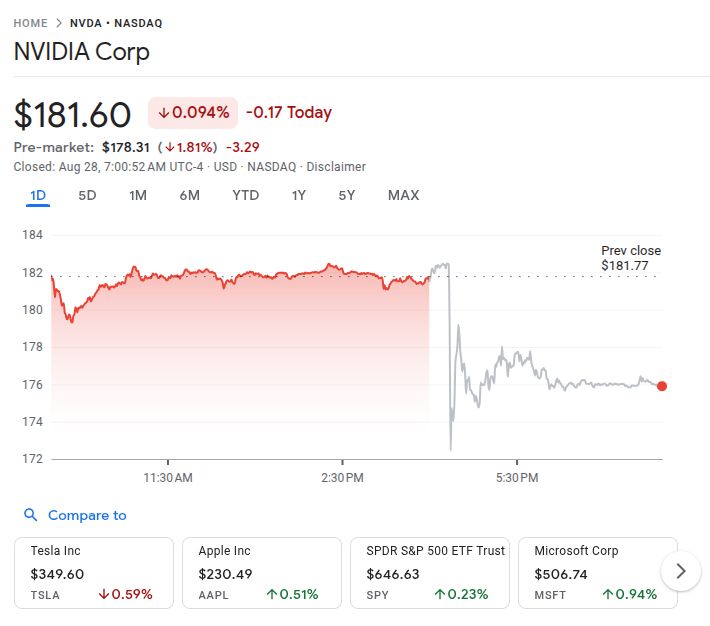

- Despite strong results, NVIDIA stock dropped 1.82% in pre-market trading, fueled by investor concerns over a possible AI investment bubble and regulatory risks.

What Happened?

NVIDIA just reported blowout results for the second quarter of fiscal 2026, with both revenue and profit shattering records. However, despite the blockbuster numbers, investors were spooked by geopolitical risks in China and growing doubts about long-term AI spending. The stock slid over 3% in after-hours trading and was down another 1.82% in the pre-market session at $178.29.

Financial Results Defy Gravity

NVIDIA posted $46.7 billion in revenue, up 6% from the previous quarter and a massive 56% increase from a year ago. Net income reached $26.4 billion, while diluted earnings per share rose to $1.08 GAAP and $1.05 non-GAAP. Operating income was equally impressive at $28.4 billion, marking a 31% sequential increase.

- Gross margins came in at 72.4% GAAP and 72.7% non-GAAP

- Data Center revenue reached $41.1 billion, though sales of H20 chips to China fell by $4 billion

- Gaming revenue climbed to $4.3 billion, up 14% quarter-over-quarter

- NVIDIA returned $24.3 billion to shareholders through buybacks and dividends in the first half of the year

CEO Jensen Huang called Blackwell “the AI platform the world has been waiting for” and noted that production of Blackwell Ultra is ramping fast with extraordinary demand.

China Woes and H20 Sales Stall

Despite its global momentum, NVIDIA is still grappling with major challenges in China. The company recorded no sales of H20 chips to Chinese customers in the quarter, due to U.S. export restrictions and regulatory uncertainty.

President Trump recently announced that NVIDIA and AMD would have to pay a 15% tax on certain AI chip sales to China. While the H20 chips are now labeled “obsolete,” tensions remain high. Beijing has raised security concerns and urged local companies to turn to domestic suppliers.

Jensen Huang remained optimistic, saying the China market could represent a $50 billion opportunity and “there is interest in our H20s,” but he also acknowledged that several unresolved geopolitical issues remain.

Market Reaction and Investor Sentiment

Despite the blockbuster quarter, investors appeared cautious. Analysts pointed to a 1% dip in Data Center compute product revenue, which was partly blamed on the H20-related sales decline.

$NVDA

— amit (@amitisinvesting) August 27, 2025

NVIDIA Q2 2025 EARNINGS:

– $46.7B revenues, +56% YoY

– $26.4B net income, +59% YoY

– 72% gross margins, +20% QoQ

– $60B buybacks

– $54B revenue guide Q3

The most exciting thing about this quarter is that Nvidia did NOT include China sales in guidance.

Outstanding. pic.twitter.com/HohSwsHDVQ

Jacob Bourne, an analyst at eMarketer, commented that “while the data center results are massive, they showed hints that hyperscaler spending could tighten at the margins if near-term returns from AI applications remain difficult to quantify.”

This sentiment was reflected in NVIDIA’s stock price, which fell over 3% in post-market trading and currently sits at $178.29, down 1.82%.

Expanding Global AI Footprint

Beyond the numbers, NVIDIA continued to broaden its reach:

- Launched Blackwell-powered GeForce RTX 5060, now its fastest-ramping x60-class GPU ever

- Expanded partnerships with OpenAI and other major firms

- Revealed collaborations in Europe to build AI infrastructure and sovereign language models

- Partnered with Novo Nordisk for AI drug discovery and announced performance leadership on all MLPerf Training benchmarks

The company also introduced new tools like NVFP4, a 4-bit format for efficient AI inference, and revealed quantum computing links via Quantinuum, which may include NVIDIA support in future hybrid systems.

CoinLaw’s Takeaway

In my experience, when a company crushes earnings like this and the stock still falls, it is not about the numbers anymore. It’s about the story investors are telling themselves. NVIDIA’s results are stunning, but Wall Street is asking, “Can this growth last?” The data center slip and stalled China sales are yellow flags. I found the optimism around Blackwell and the AI ecosystem very convincing, but I also understand why traders are hedging their bets. If you are bullish on AI in the long run, NVIDIA is still the core engine of that future.