Nvidia gets U.S. approval to resume AI chip sales to China, recovering billions in potential lost revenue.

Key Takeaways

- 1Nvidia’s H20 AI chips cleared for export to China, reversing April restrictions

- 2Shares surged over 5% in pre-market trading, recovering on optimism

- 3Policy shift follows new U.S.-China trade deal easing tech and mineral export tensions

- 4Analysts expect Nvidia could regain up to $15 billion in lost or deferred revenue

What just happened?

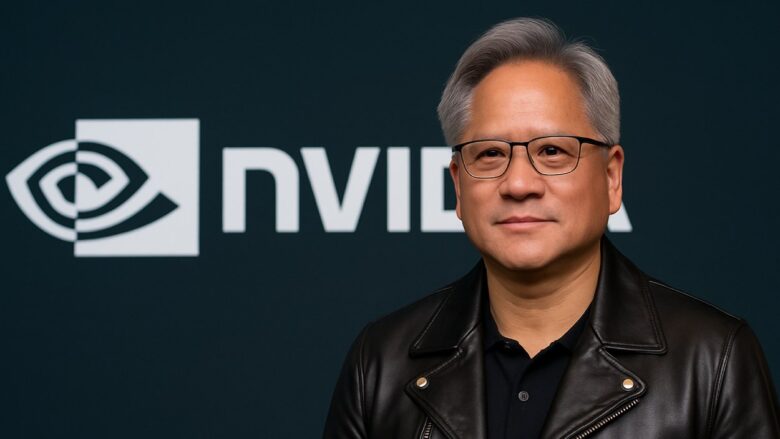

Nvidia is back in business with China. The U.S. government has reversed its earlier restrictions, now giving Nvidia the green light to export its downgraded H20 AI chips. With billions in lost revenue hanging in the balance, markets responded instantly, Nvidia stock shot up more than 5% in pre-market trading. Investors are thrilled, and so is CEO Jensen Huang.

Let’s break down what this means for the company, the global AI race, and U.S.-China tech diplomacy.

U.S. Reverses Course on Nvidia’s H20 AI Chip Exports

On July 14, 2025, Nvidia confirmed that the U.S. government will issue export licenses for its H20 AI chips to Chinese clients. These chips were originally designed to comply with earlier Biden-era restrictions but were still caught in an April crackdown under the Trump administration, effectively banning them without special licenses.

CEO Jensen Huang, speaking during a government-sponsored conference in Beijing, stated on Chinese broadcaster CCTV that the licenses would be granted. Nvidia’s statement reinforced this, saying, “The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon.”

A Massive Financial Rebound

Back in April, Nvidia wrote off $4.5 billion in inventory due to the sudden halt in exports. On top of that, it projected an additional $2.5 billion in sales losses. But analysts now believe the company could recover between $10 to $15 billion in lost or deferred revenue, potentially recapturing most of what was lost.

Some numbers to know:

- China made up 13% of Nvidia’s revenue in fiscal 2025, or roughly $17 billion

- Nvidia’s share price jumped to $172.75 in pre-market trading, up 5.3%

- The stock has surged over 28% in the past year, pushing market cap past $4 trillion

A New Trade Deal Calms Tech Tensions

This policy shift coincides with a broader U.S.-China trade agreement, which aims to ease months of rising tariffs and technology export restrictions.

Key elements of the deal:

- China will expedite export permits for rare earth minerals

- The U.S. will cancel restrictive measures on Chinese tech imports

- It opens access for U.S. firms to critical manufacturing materials

Treasury Secretary Scott Bessent called it a “de-escalation” that will help stabilize cross-border trade and tech flows. These minerals are vital to sectors like microchips, wind turbines, and robotics.

Nvidia’s China Strategy: Comply, Adapt, Thrive

Beyond the H20 chip, Nvidia is pushing ahead with a new export-compliant product, the RTX Pro GPU, tailored for smart factories and logistics in China. Jensen Huang recently met with both President Trump and Chinese officials, advocating for U.S. innovation while promoting safe AI collaboration across borders.

Critics of the earlier export ban argued it helped domestic Chinese firms like Huawei by removing Nvidia from the competitive field. Bernstein analysts noted that the H20 chip was already “well below” existing Chinese alternatives, making the initial ban counterproductive.

CoinLaw’s Takeaway

Honestly, this is a huge win for Nvidia and for common sense. Trying to ban slightly watered-down AI chips that already lag behind local Chinese versions was never going to contain China’s AI development. All it really did was hand the market to Huawei on a silver platter. Now, Nvidia can get back to doing what it does best: leading the AI revolution and making serious money while doing it. The new trade agreement shows that even amidst rivalry, pragmatism can prevail. I’m especially encouraged by how fast Nvidia adapted and pushed through new compliant products like the RTX Pro. That’s resilience in action.