NFT lending and borrowing have surged into the financial mainstream, transforming digital collectibles from static assets to dynamic financial tools. Imagine owning a rare digital artwork but needing quick liquidity. NFT lending allows you to leverage this asset without selling it. While traditional assets have long enjoyed financing options, the rapid emergence of NFT-backed loans is reshaping the landscape of decentralized finance (DeFi). From innovative financing models to evolving regulatory frameworks, NFT lending is carving out a vital niche, setting new standards in the digital economy.

Editor’s Choice

- As of May 2025, GONDI accounts for about 54% of the NFT lending market, surpassing Blur, which holds roughly 30%

- NFT lending volume has collapsed to just over $50 million in May 2025, down ~97% from its January 2024 peak.

- On June 30, 2025, GONDI reported $100M in Total Value Locked (TVL), with around $45M in outstanding debt and an annualized loan volume above $400M, based on DeFiLlama’s platform metrics.

- Borrowers now obtain average NFT loans of about $4,000, a ~71% drop year‑over‑year from $14,000 in May 2024.

- The NFT lending market at approximately $2.3B in 2025, supported by the growth of lending platforms and emerging fractional ownership models.

- The NFT lending space comprises around 82 startups, with 53 having secured venture funding. Notable examples include Centrifuge, NFTfi, MetaStreet, Arch, and Arcade.

Global Market Growth Insights

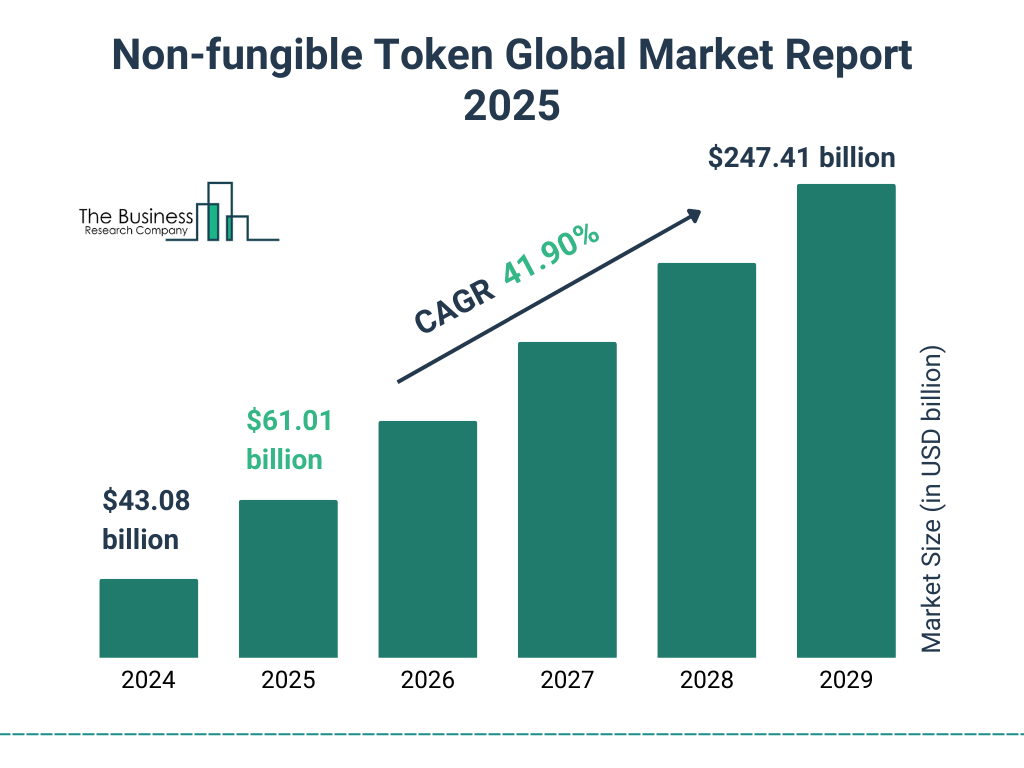

- The Non-fungible Token (NFT) market is projected to experience significant growth according to the 2025 Global Market Report by The Business Research Company.

- The global NFT market size is expected to grow from $43.08 billion in 2024 to $247.41 billion by 2029.

- This represents an impressive Compound Annual Growth Rate (CAGR) of 41.90% over the forecast period.

- The market is anticipated to reach $61.01 billion in 2025, marking a key milestone in its expansion.

- The report highlights a steady increase in market size year-over-year, demonstrating growing interest and investment in NFT technology and digital assets.

- The market size (in USD billion) is forecasted as follows:

- 2024: $43.08 billion

- 2025: $61.01 billion

- 2029: $247.41 billion

- The strong growth trajectory reflects increased adoption of NFTs across sectors such as art, gaming, music, and collectibles.

Decoding NFT-Backed Financing

NFT-backed financing has introduced a novel way for NFT owners to leverage their digital assets. At its core, NFT lending involves borrowers using NFTs as collateral to secure a loan, usually in cryptocurrency.

- Collateralized Loan Structure: NFTs are typically held in smart contracts until the loan is repaid, safeguarding both borrower and lender.

- Non-Fungibility Challenges: Unlike traditional assets, NFTs vary significantly in value, making it challenging to establish fair collateral values.

- Smart Contract Automation: Smart contracts automate the lending process, executing loans, interest calculations, and collateral releases without intermediary involvement.

- Variable Loan Terms: NFT-backed loans often feature short-term durations (ranging from 7 days to 90 days), unlike the multi-year terms in traditional finance.

- Repayment Options: Borrowers may repay loans in lump sums or staggered installments, adding flexibility for different financial needs.

- Popular Blockchains for NFT Lending: While Ethereum remains dominant, Polygon and Solana are gaining traction for NFT lending due to their lower transaction fees.

- Default and Liquidation Protocols: In case of default, NFT-backed loans have liquidation protocols that automatically auction the NFT to recover the loan value.

NFT Trading Trends by Age Group

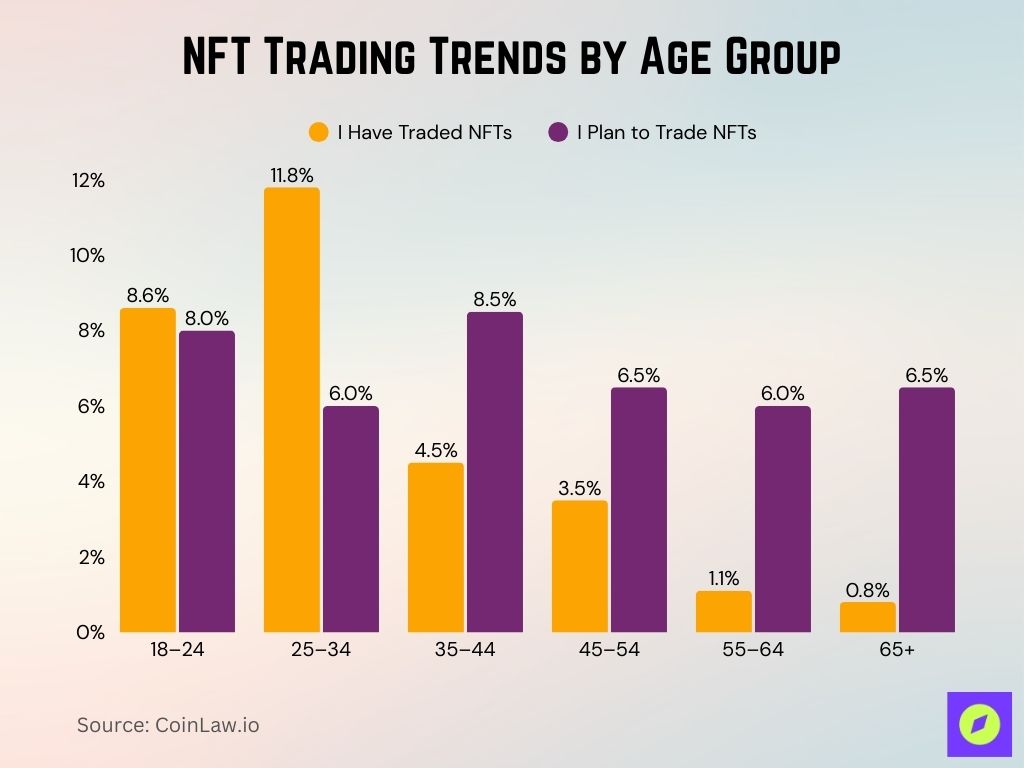

- 11.8% of respondents aged 25–34 have traded NFTs, the highest of any group.

- Interestingly, the 35–44 age group shows strong future interest, with 8.5% saying they plan to trade NFTs, despite only 4.5% having done so already.

- Young adults aged 18–24 show balanced engagement, with 8.6% having traded NFTs and 8.0% planning to do so, indicating consistent interest.

- Among those aged 45–54, 3.5% have traded NFTs, but 6.5% plan to trade, suggesting a growing curiosity in this older demographic.

- The 55–64 group has a notably low past engagement at 1.1%, yet 6.0% still plan to explore NFTs, a surprising sign of potential growth.

- Only 0.8% of older people (65+) have traded NFTs, though about 6.5% indicate future interest.

Market Growth and Lending Volume

- NFT lending volumes have crashed by ~97%, falling from nearly $1 billion in January 2024 to just over $50 million in May 2025.

- Active borrowers and lenders have plunged dramatically, with borrowers down ~90% and lenders down ~78% since January 2024.

- Average NFT loan size has shrunk to around $4,000, marking a ~71% drop year-over-year from $14,000 in May 2024.

- NFT ownership remains strongest among ages 25–34 at 38% of holders, followed by 28% for ages 35–44.

- Regional distribution remains concentrated, with North America and Europe together representing over 60% of NFT lending activity, while Asia contributes about 25%.

- DeFi lending platforms in general hold $51.2 billion in outstanding loans as of mid-2025, highlighting broader lending trends.

Main Platforms

Several platforms have pioneered NFT lending, each offering unique features to cater to diverse borrower and lender needs.

- NFTfi: Established in 2020, NFTfi is one of the largest platforms, facilitating over $300 million in NFT loans with a streamlined, peer-to-peer approach.

- Arcade: Arcade specializes in high-value loans, enabling users to access larger credit against rare and valuable NFTs, typically with LTVs up to 70%.

- BendDAO: BendDAO provides an alternative by integrating decentralized auction mechanisms, ensuring fair market values for liquidated assets.

- Blend by Blur.io: Known for its speed and low fees, Blend offers loans across multiple blockchain networks, including Ethereum and Solana, setting a new standard for accessibility.

- PawnFi: PawnFi enables loans against both physical and digital collectibles, making it a hybrid platform in the NFT and luxury markets.

- Drops: Drops leverages DeFi liquidity pools to secure loans, reducing reliance on individual lenders and enhancing platform liquidity.

- Yield Guild Games (YGG): Although not a traditional lending platform, YGG allows NFT holders to monetize assets in the gaming world, showcasing NFTs’ versatility beyond lending.

Types of NFT Lending Protocols

NFT lending platforms use diverse protocols to accommodate varying risk levels and liquidity needs. Understanding these protocols is crucial for borrowers and lenders alike.

- Peer-to-Peer Lending: Platforms like NFTfi use a peer-to-peer model, where individual lenders fund loans directly, allowing customized terms and higher borrower flexibility.

- Peer-to-Pool Lending: Protocols like Drops aggregate lenders’ funds into liquidity pools, offering borrowers quick access to funds while minimizing lender risks.

- Collateralized Debt Positions (CDPs): CDPs allow borrowers to lock up NFTs as collateral to create synthetic assets or stablecoins, similar to MakerDAO’s model in DeFi.

- Flash Loans: While less common in NFT lending, some platforms offer flash loans that must be repaid within a single transaction, often used for arbitrage opportunities.

- Dynamic Loan Terms: Protocols like Blend provide dynamic terms, allowing lenders to adjust interest rates based on market volatility, benefiting both borrowers and lenders.

- Flexible Repayment Options: Unlike traditional loans, NFT-backed protocols often allow partial repayments, reducing the likelihood of default.

- Bundling Mechanism: Some protocols allow borrowers to bundle multiple NFTs as collateral, increasing the loan value and appealing to collectors with diverse portfolios.

Peer-to-Peer Lending and Borrowing

Peer-to-peer (P2P) lending remains a popular model in NFT finance, allowing borrowers and lenders to negotiate terms directly.

- Direct Negotiations: P2P lending allows borrowers and lenders to negotiate interest rates, loan durations, and LTVs, fostering flexibility and personalized terms.

- Higher Interest Rates: P2P loans tend to carry higher interest rates, averaging 15-25%, as individual lenders often demand a premium for increased risk.

- Risk-Based LTVs: Most P2P loans maintain LTV ratios around 50-60% to mitigate risks, with lower LTVs for highly volatile assets.

- Collateral Escrow: NFTs used as collateral are securely held in smart contract escrows, reducing the risk of theft or fraud during the loan term.

- Popular P2P Platforms: NFTfi and Arcade dominate the P2P NFT lending market, with a combined market share of nearly 60%.

- Cross-Collateralization: Some platforms allow users to combine multiple NFTs as collateral in a single loan, helping them maximize loan value and flexibility.

- Default Risk: If borrowers default, lenders can claim the NFT collateral, which is often auctioned or held for future price recovery.

Interest Rates and Loan Terms

- NFT lending offers unique interest rate structures and loan terms that differ significantly from traditional finance, driven by the asset’s inherent volatility.

- Higher Interest Rates: Due to the volatile nature of NFTs, interest rates in NFT lending generally range from 10-25%, higher than many traditional asset-backed loans.

- Short-Term Loans: NFT-backed loans often have short durations, typically from 7 to 90 days, balancing borrower needs with lender risk tolerance.

- Flexible Repayment Options: Borrowers may choose between full or partial repayments, making NFT-backed loans suitable for those seeking short-term liquidity.

- Fixed vs. Variable Rates: Some platforms offer both fixed and variable interest rates, with variable rates adjusting based on NFT market trends.

- Grace Periods: To reduce defaults, many platforms provide grace periods, allowing borrowers additional time to repay loans without penalty.

- Early Repayment Incentives: Several platforms encourage early repayments by offering reduced interest rates, creating a more borrower-friendly ecosystem.

- Customizable Loan Terms: Platforms like Arcade allow lenders to set custom loan terms, including interest rates and repayment schedules, making it easier to manage risk and attract borrowers.

Risks and Challenges in NFT Lending

NFT lending presents unique challenges for both borrowers and lenders, particularly given the asset’s high volatility and nascent regulatory landscape.

- Asset Volatility: NFTs are subject to extreme price fluctuations, with values that can change by 20-30% in a single day, increasing the risk for both parties.

- Liquidity Risk: Since NFTs are often less liquid than other digital assets, lenders may struggle to sell or auction off collateral in the event of a default.

- Valuation Challenges: Determining fair value for NFTs is complex, as these assets lack historical pricing data and can vary widely based on rarity and demand.

- Smart Contract Vulnerabilities: Security flaws in smart contracts could lead to asset theft or loan manipulation, making robust auditing a priority.

- Platform Insolvency: If an NFT lending platform becomes insolvent, borrowers risk losing their collateralized assets, while lenders face potential losses.

- Default rates for NFT-backed loans tend to average 8–12%, reflecting the risks of short-term loan structures and NFT market volatility.

- Legal Uncertainty: The lack of clear legal frameworks makes it difficult for lenders to enforce claims or recoup losses if borrowers default, especially across jurisdictions.

Global NFT Market Growth Outlook

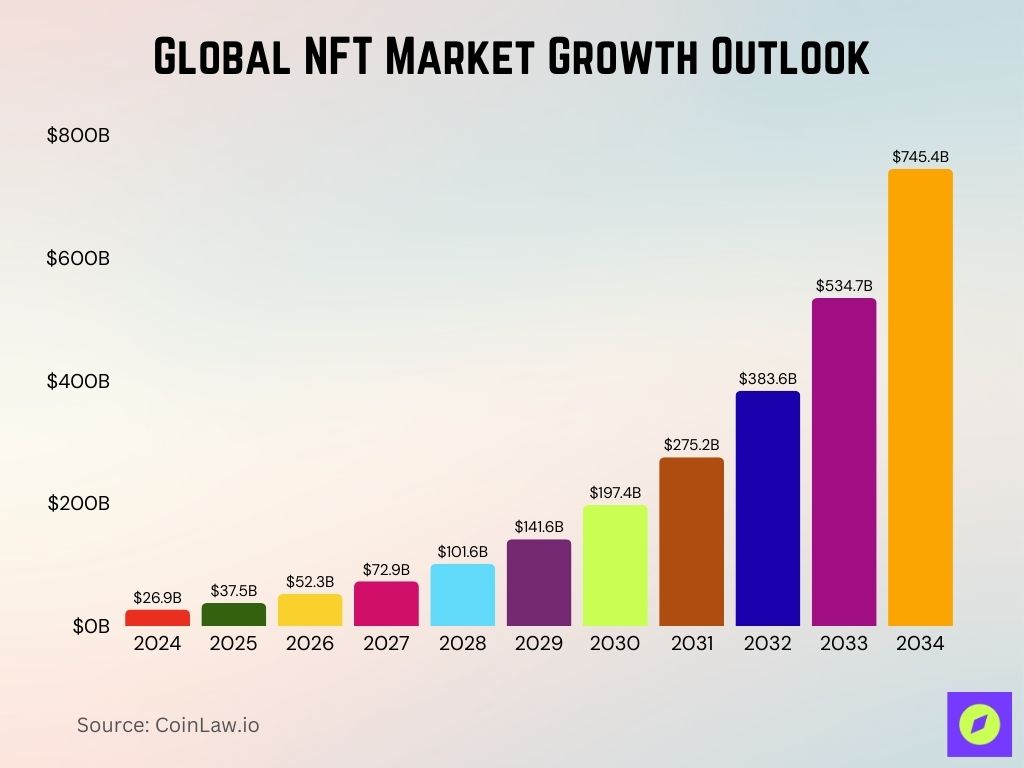

- The Global Non-Fungible Token (NFT) market is expected to skyrocket from $26.9 billion in 2024 to $745.4 billion by 2034.

- This growth reflects a Compound Annual Growth Rate (CAGR) of 39.4%, highlighting the explosive potential of NFTs over the next decade.

In just five years (2024 to 2029), the market is projected to grow more than 5x, reaching $141.6 billion by 2029. - By 2030, the market is expected to surpass the $197 billion mark, led by increasing demand for both digital and physical NFT assets.

- The biggest leap is projected between 2032 and 2034, with the market growing from $383.6 billion to $745.4 billion in just two years.

This surge underscores the growing relevance of NFTs across industries, from art, gaming, and music to real estate and collectibles.

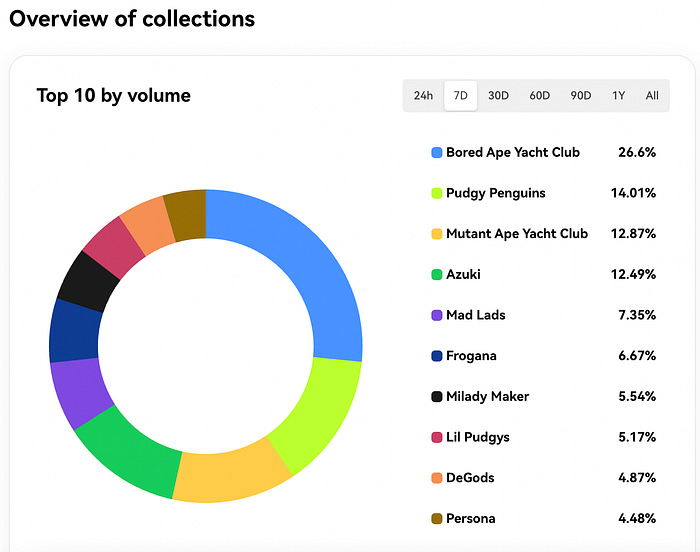

Top 10 NFT Collections by Trading Volume

The NFT market continues to evolve with dynamic shifts in collection popularity and trading volumes. Based on the latest data, here’s an overview of the top 10 NFT collections by trading volume:

- Bored Ape Yacht Club (BAYC) dominates the rankings with a massive 26.6% share of the trading volume, maintaining its position as a leader in the NFT space.

- Pudgy Penguins secures second place, accounting for 14.01% of the market volume. Their unique and community-driven appeal has driven consistent interest.

- Mutant Ape Yacht Club (MAYC) follows closely with 12.87%, further solidifying the Yuga Labs ecosystem’s influence.

- Azuki takes fourth place with 12.49% of trading volume, continuing its strong performance in the anime-inspired digital art niche.

- Mad Lads captures 7.35%, highlighting its growing traction among collectors and traders.

- Frogana holds 6.67%, showing momentum in the gamified NFT sector.

- Milady Maker, often noted for its unique aesthetic, represents 5.54% of the trading volume.

- Lil Pudgys, the companion collection to Pudgy Penguins, takes 5.17%, emphasizing the popularity of this broader ecosystem.

- DeGods, an established player in the NFT space, makes up 4.87% of the weekly volume.

- Persona rounds out the list with 4.48%, a collection gaining attention with its distinct identity focus.

Regulatory Landscape

With the rise of NFT lending, regulatory bodies worldwide are starting to evaluate and implement potential guidelines. Regulations could impact platform operations, interest rates, and user protections.

- US Regulation: In the United States, the Securities and Exchange Commission (SEC) is considering classifying certain NFT-backed loans as securities, which would subject platforms to stringent regulations.

- Europe’s MiCA Legislation: The Markets in Crypto-Assets (MiCA) regulation, set to be implemented by the European Union, may cover NFT lending under its digital asset framework, focusing on transparency and investor protection.

- AML and KYC Requirements: Some jurisdictions, including Singapore and the EU, now require NFT lending platforms to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols to prevent illicit activity.

- Tax Implications: NFT loans may be subject to taxation as capital gains or income, though tax policies vary by country, and many jurisdictions are still clarifying their positions.

- Consumer Protection: Regulators may enforce consumer protection measures to ensure fair interest rates and transparent lending terms, providing more security for borrowers.

- Platform Licensing: Platforms may soon require financial licenses to operate, especially in countries like Japan and South Korea, where crypto regulations are evolving rapidly.

- Cross-Border Challenges: Since NFTs are traded globally, cross-border lending involves navigating complex regulatory landscapes, complicating legal recourse in cases of default.

Recent Developments

- Monthly NFT lending volume has collapsed to just over $50 million in May 2025 after plunging ~97% from its January 2024 peak of nearly $1 billion.

- Total NFT lending volume in Q1 2025 fell to approximately $446 million.

- Average monthly loan origination dropped from $307 million in January 2025 to only $47 million in March 2025.

- Gondi now holds the largest share of outstanding NFT lending, about 54%, overtaking Blend (formerly dominant).

- Borrower and lender participation has declined sharply, with borrower numbers down ~90% and lender numbers down ~78% since January 2024.

- Average NFT loan size is now around $4,000, reflecting a ~71% year-over-year decrease.

Conclusion

NFT lending has swiftly transformed the digital asset landscape, unlocking unprecedented opportunities for collectors and investors to capitalize on their digital holdings. As the market matures, platforms are innovating with new protocols, advanced valuation tools, and multi-chain capabilities to cater to growing demand. However, the challenges of volatility, regulatory uncertainty, and valuation complexity remain significant obstacles. Continued security, regulation, and platform functionality advancements will be essential for sustainable growth in the NFT lending space. This sector, marked by rapid evolution and increasing mainstream interest, holds immense potential as part of the broader decentralized finance ecosystem.