Picture this: you’re in a bustling coffee shop, and all you need to grab your morning latte is a quick tap of your smartphone. This seamless interaction is powered by Near Field Communication (NFC) technology, which has revolutionized payments worldwide. Over the past few years, NFC payments have surged in popularity, especially in a post-pandemic world where contactless transactions have become the norm. But how did we get here, and what trends will shape NFC payments today?

Editor’s Choice

- Over 95% of contactless payments globally are powered by NFC technology, sustaining its dominance.

- The number of NFC-enabled devices worldwide is projected to approach 4.5 billion by end-2025.

- In the US, NFC-based contactless payments represent approximately 58–65% of in-store digital transactions as of 2025, depending on device type and retailer adoption.

- The average NFC transaction value is estimated to range between $20–25, with fluctuations by region and use case, such as transportation vs retail.

- Global retailer NFC adoption is anticipated to exceed 75% by 2025, with higher penetration in regions like APAC and Europe.

- Mobile wallets using NFC, such as Apple Pay and Google Pay, are projected to surpass 2 billion active users globally by 2025.

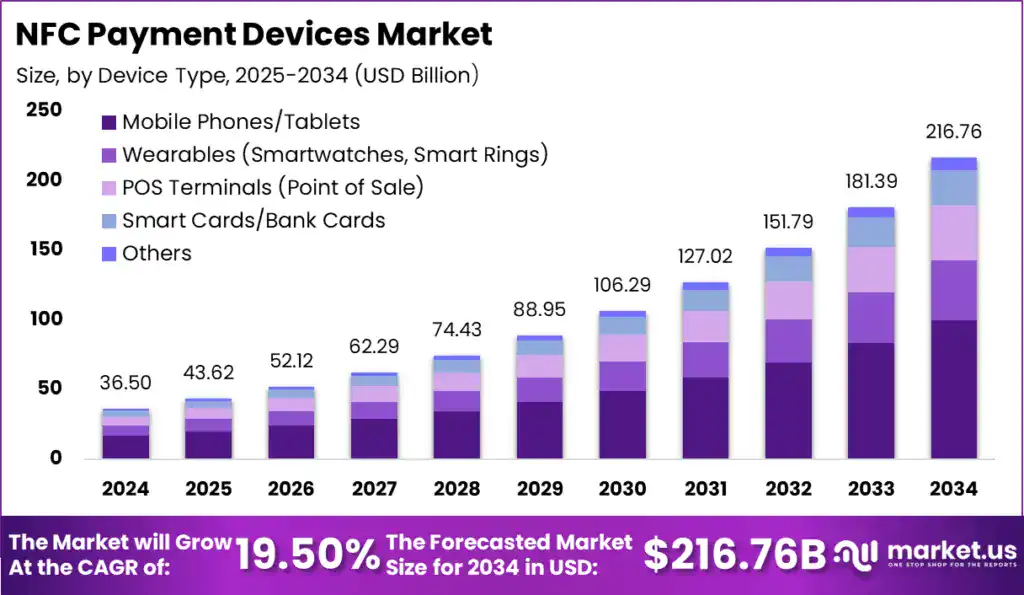

NFC Payment Devices Market Growth

- The global NFC payment devices market is projected to grow at a strong CAGR of 19.5% from 2025 to 2034.

- Market size is expected to rise from $43.62 billion in 2025 to $216.76 billion by 2034, showing nearly a 5x increase in value.

- Mobile phones and tablets dominate the market as the primary devices for NFC payments, driving the majority of revenue.

- Wearables such as smartwatches and smart rings are becoming key growth drivers, supported by the rise of contactless lifestyles.

- POS terminals continue expanding as retailers and merchants modernize payment infrastructure.

- Smart cards and bank cards remain relevant, though their share is slowly decreasing as mobile and wearable adoption grows.

- The market is forecast to surpass $150 billion by 2032, highlighting steady adoption across both developed and emerging economies.

- By 2034, NFC-enabled devices are expected to become a standard feature across most consumer electronics, powering seamless payments globally.

Consumer Digital Wallet Preference Statistics

- By the end of 2025, an estimated ~78% of smartphone users globally will have at least one digital wallet installed.

- The leading digital wallet, Apple Pay, is projected to have ≈ 624 million users in 2025, representing ~X% of the global wallet market.

- In the US, about 70% of millennials now show a preference for using digital wallets for NFC payments.

- Google Pay adoption is expected to grow by ~35% in 2025, with strong traction in markets like India.

- Roughly 68% of global consumers in 2025 cite “convenience” as the primary reason for adopting digital wallets.

- Digital wallets typically reduce checkout time by 10–30 seconds compared to chip or swipe-based card payments, contributing to a faster and smoother transaction experience.

- In North America, the average number of digital wallet transactions per user per month is expected to rise to ≈ 15 in 2025.

User Segment

- Millennials are still the largest mobile payments demographic, comprising about 50% of all users in the US in 2025.

- Gen Z usage of P2P apps and mobile payments rose by 30–35% in recent years, with over 70% reporting frequent use of services like Venmo, CashApp, and NFC-based wallets.

- 85% of small business owners now use mobile payment apps to accept transactions as of 2025.

- Around 65% of baby boomers reported trying mobile payments by 2025, driven by contactless ease.

- Gen X users reportedly spend over $1,500 monthly via mobile payment apps, though usage levels vary by income and geography.

- Consumers earning over $100,000 annually are twice as likely to use NFC-enabled wallets in 2025 compared to lower-income groups.

- 82% of urban residents use mobile payments regularly in 2025, while rural adoption is now ~48%, with further growth expected.

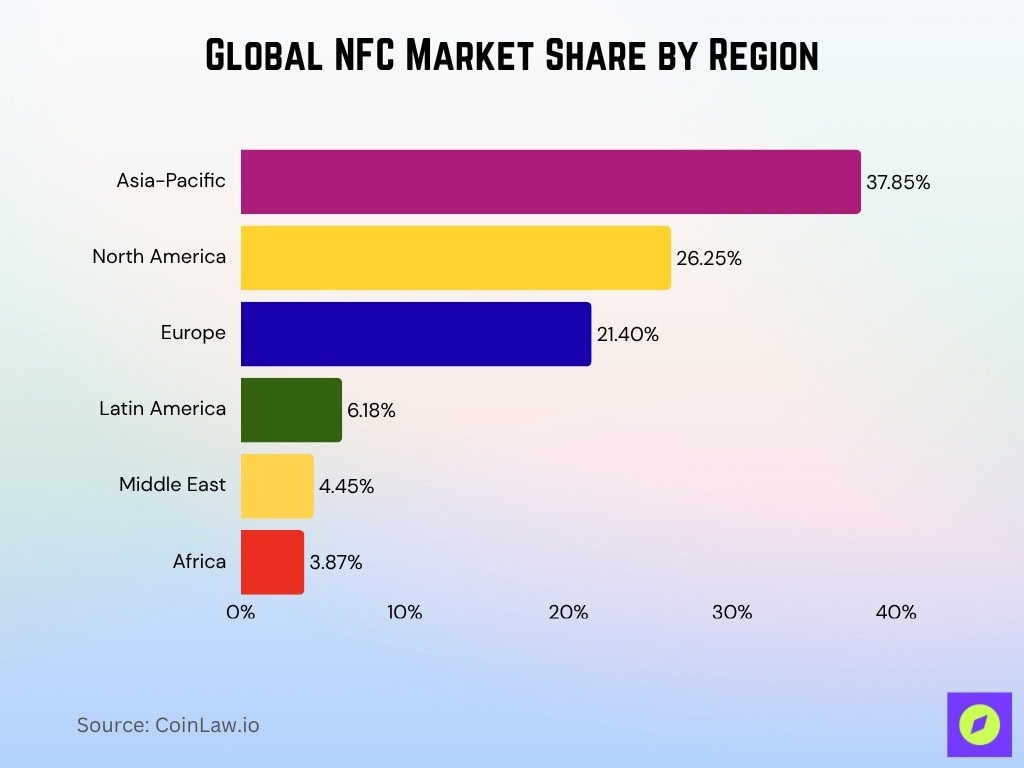

Regional Market Analysis

- Asia-Pacific leads with ≈ a 37.85% share of the global NFC market revenue in 2025.

- Europe holds about 21.40% of the NFC market share in 2025.

- North America accounts for ≈ 26.25% of the NFC payment market in 2025.

- Latin America contributes roughly 6.18% to the NFC market in 2025.

- Africa’s share of the NFC payment market is ~3.87% in 2025.

- The Middle East accounts for about 4.45% of the NFC market share in 2025.

User Demographics and Behavior

- Millennials and Gen Z account for over 70% of NFC payment users in 2025, driven by speed and convenience.

- In the US, about 80% of consumers aged 25-34 use NFC payments regularly for retail transactions in 2025.

- Globally, women make up 53% of NFC users and men 47%, with women favoring grocery and lifestyle NFC purchases and men focusing on travel, dining, and tech-related NFC uses in 2025.

- The average global NFC user makes around 12–15 transactions per month, with higher activity in urban regions and advanced economies.

- NFC payment adoption among older people grew by ~22% in recent years, aided by enhanced accessibility features.

- Consumers in urban areas use NFC payments about twice as often as rural users in 2025.

- Surveys suggest that over 60% of users perceive NFC payments as safer than magnetic stripe cards, primarily due to tokenization and biometric authentication.

The Evolution of POS Payments Technology

- By 2025, about 88% of global POS systems will support NFC as a standard feature.

- Cloud-based POS systems integrating NFC see ~32% adoption growth annually, helping small businesses reduce costs.

- Retailers with NFC-enabled POS terminals report a ~27% increase in transaction speed, boosting customer satisfaction.

- AI-enhanced POS systems process ~21% of NFC payments with predictive analytics for inventory management.

- NFC compatibility in self-checkout kiosks grows ~19% year-over-year as consumers demand contactless shopping.

- Hospitality sectors adopt ~22% more NFC-enabled portable terminals to streamline room service and dining payments.

- As of 2025, ≈ 88% of POS manufacturers make NFC compatibility a default feature.

Global E-commerce Payment Methods Forecast

- Digital/Mobile Wallets dominate with a 53% share of all global e-commerce payments, cementing their role as the leading online payment method.

- Credit and charge cards account for 19%, showing a gradual decline as consumers shift toward mobile-first solutions.

- Debit cards maintain a steady 13% share, remaining a preferred option in regions with strong banking penetration.

- Bank transfers represent 6%, reflecting continued usage in regions with traditional banking habits.

- Buy Now, Pay Later (BNPL) grows to 5%, driven by flexible financing options and consumer preference for deferred payments.

- Cash on delivery drops to just 1%, highlighting the decline of cash-based e-commerce transactions.

- Direct debit, PrePay, and Prepaid cards each hold 1% or less, showing minimal adoption in digital retail environments.

- PostPay virtually disappears by 2025, emphasizing the global shift toward instant, digital-first payment methods

Embedded Contactless Technology

- Embedded NFC in smartwatches and fitness trackers accounts for ~12% of NFC transactions in 2025.

- Smart home devices with NFC payment capabilities see ~28% adoption growth in urban households by 2025.

- Retailers embed NFC into product packaging to facilitate instant purchases and product info access at scale in 2025.

- Embedded NFC in healthcare (e.g., smart insulin pens) is projected to grow by ~40% by 2025.

- Transportation systems globally processed ~6 billion NFC transactions by 2025 through systems like Suica and Oyster.

- Car manufacturers integrating NFC for keyless entry and payments report ~17% higher sales in 2025.

- NFC in gaming (e.g., Amiibo-type use) generates ~$300 million in revenue in 2025.

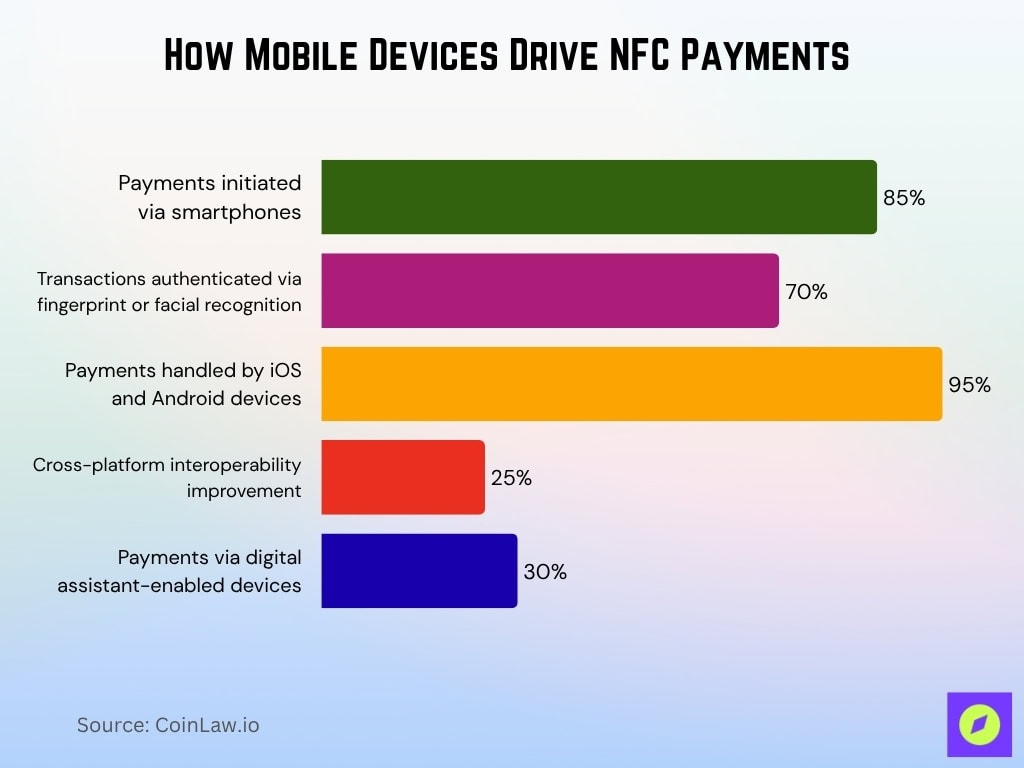

Making NFC Payments Using Mobile Devices

- About 85% of NFC payments globally in 2025 are initiated via smartphones, reflecting their central role.

- The average transaction time for NFC payments has dropped to ~0.5 seconds in 2025, enhancing user experience.

- Fingerprint and facial recognition authenticate ~70% of NFC transactions in 2025, minimizing unauthorized payments.

- Devices running iOS and Android collectively handle ~95% of global NFC payments in 2025.

- Cross-platform NFC payment interoperability improves by ~25% in 2025, enabling smoother transactions between devices.

- Payments via digital assistant-enabled devices (e.g., Echo, Nest) rise by ~30% in 2025.

- Consumers rank battery efficiency and app reliability as the top two factors influencing their choice of NFC-enabled devices in 2025.

Security Measures and Concerns

- Tokenization technology secures ~89% of NFC transactions in 2025, replacing sensitive data with encrypted tokens.

- NFC fraud rates remain low at ~0.02% globally in 2025, thanks to stronger authentication protocols.

- Biometric authentication for NFC payments increase by ~34% by 2025, reducing concerns over PIN theft and card loss.

- Banks offering real-time fraud alerts for NFC transactions see ~20% higher consumer trust in 2025.

- Consumers cite proximity risks (e.g., skimming) as the top concern, prompting ~28% of users to seek more information about NFC safety in 2025.

- Contactless credit cards with dynamic CVV codes grow by ~19% in 2025, offering extra security for NFC transactions.

- Awareness campaigns by fintech firms reduce misconceptions about NFC payment security by ~25% in 2025.

Recent Developments

- Visa and Mastercard will integrate AI fraud detection into their NFC platforms by mid-2025.

- Samsung Pay expands its rewards program, offering 1% cashback on NFC purchases in 2025.

- Adoption of wearable NFC devices grows by ~13% in 2025, especially in fitness and healthcare.

- EU governments enforce new standards for NFC interoperability to boost cross-border transactions in 2025.

- Walmart and Target will enable NFC payments at 100% of their locations by 2025.

- New players like Stripe roll out NFC-enabled terminals, lowering costs for small businesses in 2025.

- Global investment in NFC R&D reaches ~$3 billion in 2025.

Frequently Asked Questions (FAQs)

$69.7 billion with a 20.5% CAGR from 2024 to 2025.

About $49.28 billion.

Roughly 624 million worldwide.

Approximately 11.2 billion transactions.

Conclusion

NFC technology continues to revolutionize how we pay, making transactions faster, safer, and more convenient. The integration of biometric authentication, AI advancements, and blockchain technology highlights the potential of NFC to lead the digital payments frontier.