Imagine a world where your bank fits in your pocket, no lines, no paperwork, no outdated bureaucracy. This is the promise of neobanks, digital-first financial institutions that have redefined banking as we know it. The neobank industry continues to transform, growing exponentially in user adoption and global reach. In this article, we’ll explore the most critical neobank industry statistics, uncovering the trends, challenges, and opportunities that shape this dynamic market.

Editor’s Choice

- North American neobanks are expanding at roughly 34.6% CAGR through 2026, led by millennial and Gen Z adoption.

- Monzo reported pre-tax profit of £113.9 million, revenue of about £1.2 billion, and deposits of £16.6 billion with 12 million customers globally in its latest full-year results.

- Wise now serves over 160 countries, lets users send money from Mexico to more than 40 currencies, and maintains a market value above $11.5 billion.

- Fewer than 5% of neobanks reach profitability within 18 months of launch, underscoring ongoing pressure on unit economics.

- U.S. neobank account holders are expected to hit about 34.7 million by 2026 as digital-only banking becomes mainstream.

Recent Developments

- AI-driven fraud systems now achieve 90–99% transaction-screening accuracy in leading digital banks, cutting false positives by up to 60% compared with rules-only tools.

- Neobank-focused SME platforms are helping tap a pool of over 400 million global small and medium-sized businesses underserved by traditional banks.

- Fintech revenues are projected to exceed $400 billion by 2028, growing about 3 times faster than the broader banking sector and reshaping neobank–fintech convergence.

- More than 70% of global banks now embed AI in daily operations, but fewer than 20% have reached scalable, end-to-end automation.

- Leading AI fraud models deliver up to 96% accuracy and reduce false positives by about 50%, significantly improving neobank risk management.

- Neobanks and fintechs increasingly target emerging regions where fintech revenues are expected to nearly double their global share from 15% to 29% by 2028.

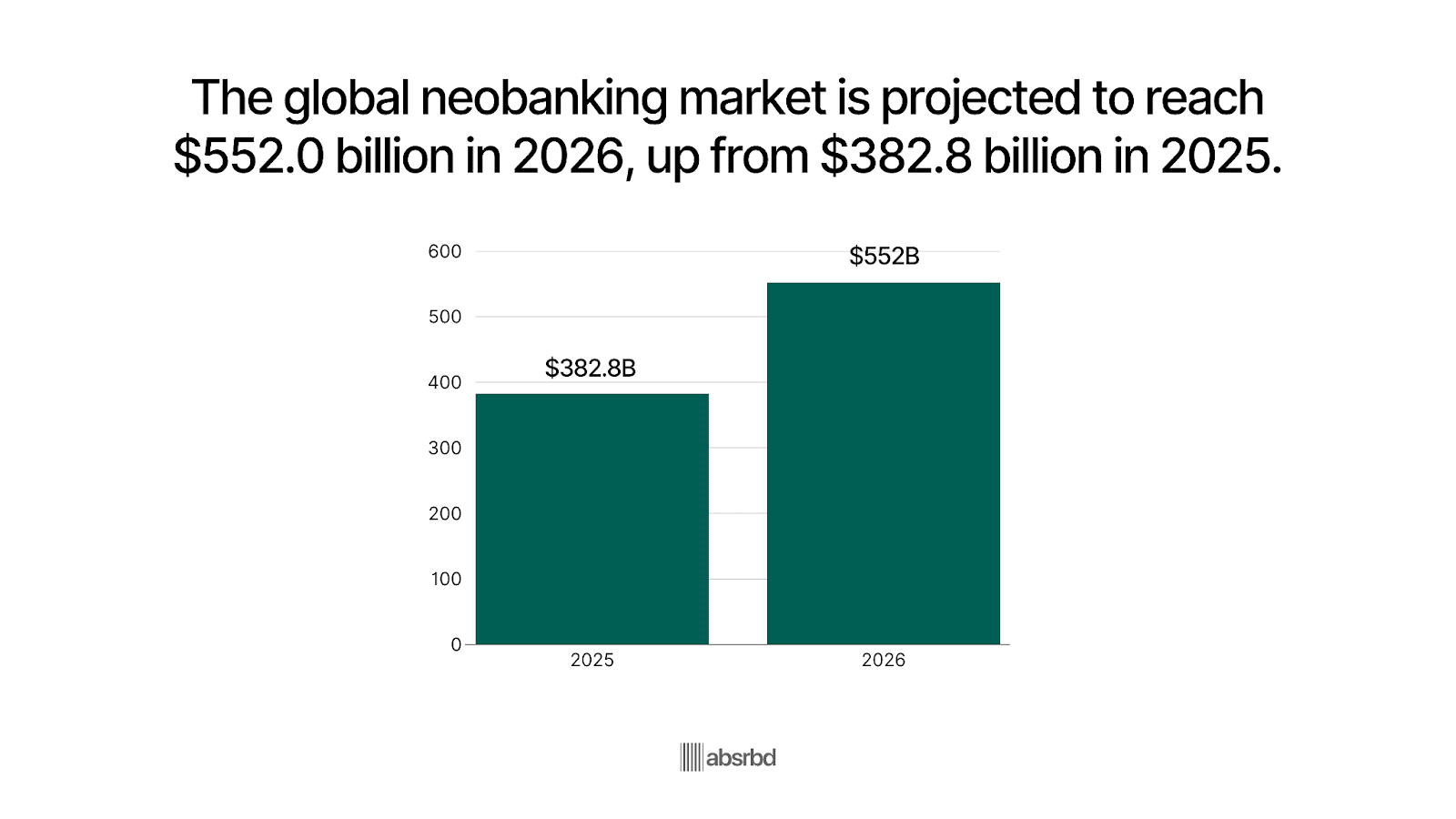

Global Neobanking Market Growth Outlook

- The global neobanking market is projected to reach $552.0 billion in 2026, highlighting strong momentum in digital-first banking adoption worldwide.

- Market size stood at $382.8 billion in 2025, reflecting a solid base driven by rising mobile banking usage and fintech innovation.

- The market is expected to grow by $169.2 billion year over year, signaling rapid expansion across consumer and business digital banking services.

- This sharp increase underscores accelerating demand for app-based financial services, lower-cost banking models, and improved user experience.

- Continued growth is fueled by younger demographics, underbanked populations, and enterprises shifting toward fully digital banking platforms.

Revenue and Profitability

- In the US, top neobanks like Chime project $2.17 billion in revenue in 2025, with Q3 2026 growth at 26%.

- Revolut targets $9 billion in revenue and $3.5 billion profit in 2026.

- Chime forecasts Q4 2025 revenue at $572-582 million, signaling 2026 acceleration.

- US neobanks average revenue per user remains $70-80 annually amid profitability struggles.

- Global neobanking market surpasses $550 billion in 2026, with low ARPU under $30/customer for many.

- Over 76% neobanks are unprofitable in 2026 due to high acquisition costs.

- Neobanks capture 40% new US account openings, driving revenue pools higher.

- Venture funding for neobanks persists, with on-chain examples like Veera raising $10 million+.

User Base and Demographics

- Millennials and Gen Z comprise 78% of global neobank users.

- Over 62% of neobank users are aged 18-35.

- 34% of Gen Z state tthat raditional banks fail to meet their needs.

- 80% of Gen Z and 81% of millennials prioritize digital banking.

- Women account for 48% of neobank users worldwide.

- 35% of users rely on freelancing or gig work as their primary income.

- Rural neobank adoption surges 27% yearly via mobile access.

- 72% prefer neobanks’ superior budgeting tools over traditional banks.

- Neobank users hit 350 million globally.

- 42% of ages 18-24 favor online-only primary accounts.

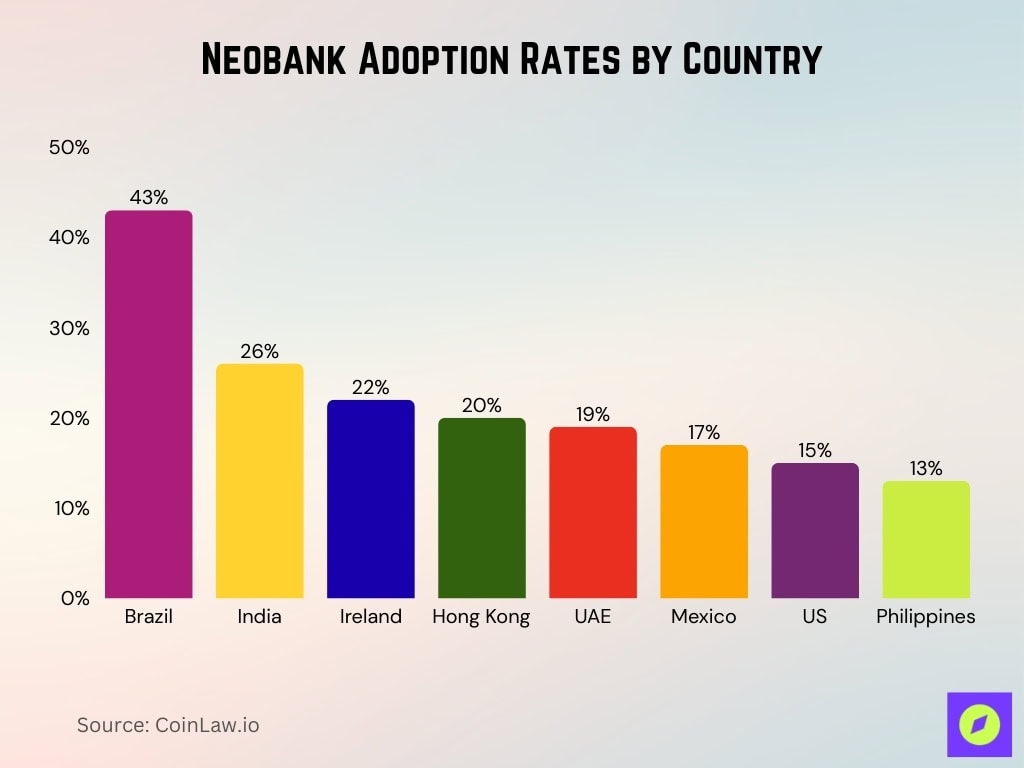

Neobank Adoption Rates by Country

- Brazil leads global neobank adoption, with 43% of its population actively using neobanking services, making it the world’s most mature neobank market.

- India ranks second at 26% adoption, driven by mobile-first banking behavior and rapid fintech penetration among younger users.

- Ireland records 22% neobank usage, reflecting strong acceptance of digital banking alternatives across Europe.

- Hong Kong follows closely with 20% adoption, supported by high smartphone usage and advanced financial infrastructure.

- The United Arab Emirates reaches 19% adoption, highlighting growing demand for digital banking among tech-savvy and expatriate populations.

- Mexico reports 17% neobank penetration, signaling expanding access to digital financial services in emerging markets.

- The United States shows 15% adoption, indicating steady growth despite the dominance of traditional banks.

- The Philippines records 13% neobank usage, reflecting increasing digital banking uptake as financial inclusion improves.

Average Transaction Value per User

- Average monthly transaction value per user reaches $1,400.

- Global average annual transaction value per user hits €19,570 (~$21,000).

- Affluent users drive 25% of volume at a $2,500 monthly average.

- Gen Z transaction value grows 15% YoY to $950 per month.

- Small business accounts average $16,200 monthly processing.

- E-commerce transactions average $185 per use.

- P2P transfers average $320 amid 25% growth.

- International remittances average $1,120, with 33% adoption rise.

- N26 users average over $32,000 annual transactions.

Global Neobanking Brand Share Statistics

- Cash App commands 45% US neobank market share.

- Nubank dominates Latin America with 32% regional share.

- Revolut holds 60 million users across Europe.

- Chime secures 10% of the US neobank market.

- Nubank leads globally with 100+ million users.

- Monzo reports 8 million+ users in the UK.

- Starling Bank serves 3.6 million+ customers.

- PayTM tops with 60 million MAUs worldwide.

- Venmo retains 6% global share via PayPal integration.

- KakaoBank and Nubank each claim 3% global presence.

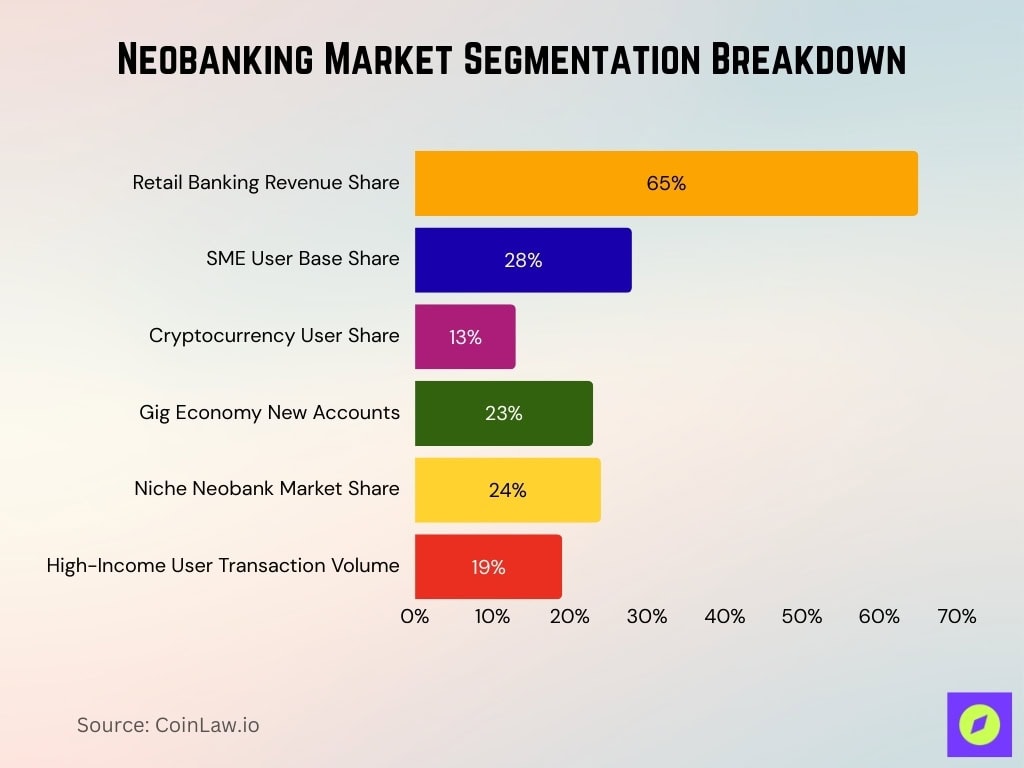

Neobanking Market Segmentation

- Retail banking dominates with 65% of total neobank revenue.

- SMEs comprise 28% of the neobank user base.

- Cryptocurrency users represent 13% of total customers.

- Gig economy drives 23% of new account openings.

- Niche neobanks boost market segmentation 24%.

- High-income users contribute 19% transaction volume.

Account Type Insights

- Business accounts command 68.32% of the total neobanking market share, driven by SME digital adoption.

- Traditional savings and checking accounts maintain 50.23% dominance among personal offerings.

- Basic savings accounts constitute 62% of all neobank products launched.

- Premium-tier accounts capture 23% market penetration through cashback and travel rewards.

- Small business and freelancer accounts expanded 44% with advanced invoicing tools.

- Cryptocurrency-linked accounts surged 56% amid digital asset trading integration.

- Teen banking solutions achieved 39% growth via parental financial education features.

- Salary-linked accounts rose 33% through seamless urban payroll connectivity.

- Joint family accounts increased 21%, reflecting collaborative banking demand.

Application Insights

- Neobanking apps record 1.45 billion global downloads.

- 87% users rate apps “highly intuitive” for navigation.

- 94% neobanks implement biometric authentication standards.

- 79% users leverage real-time transaction tracking.

- 35% neobanks integrate financial education modules.

- Daily app usage grows 29%, averaging 27 minutes per session.

- Third-party integrations rise 31% with PayPal/Stripe.

- App retention hits 82% after the first month of onboarding.

- Push notification engagement reaches 67% open rates.

Technological Innovations

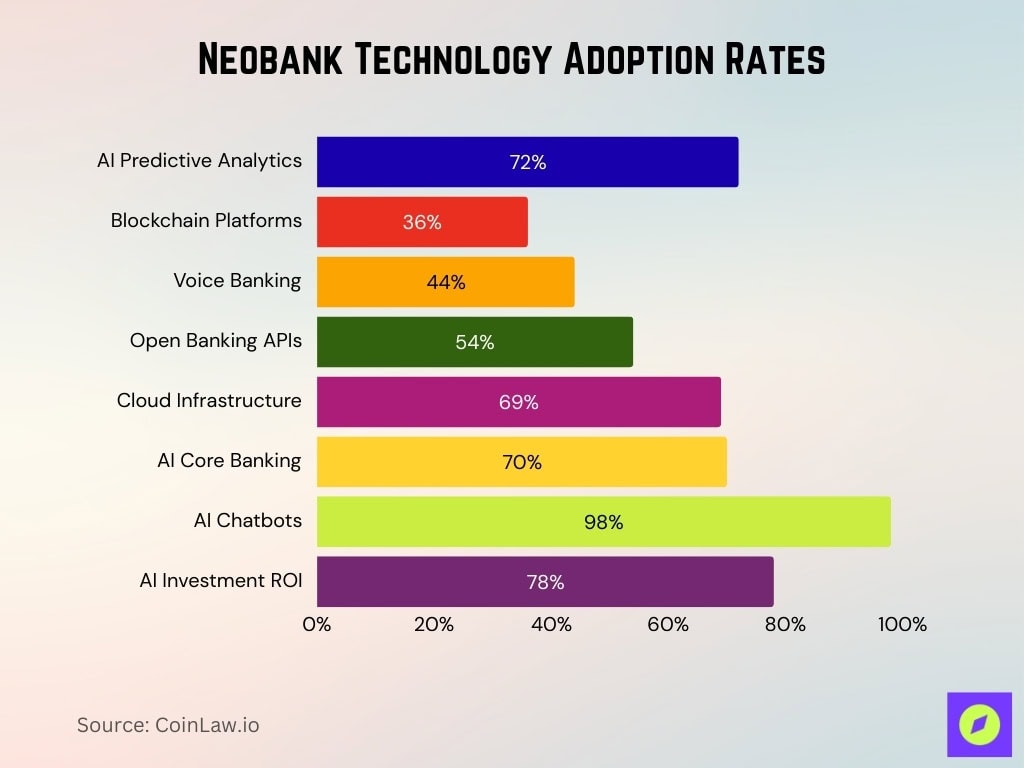

- 72% neobanks integrate AI predictive analytics.

- Blockchain adoption surges 36% in platforms.

- Voice-activated banking hits 44% user adoption.

- 54% neobanks use Open Banking APIs.

- 69% migrate to cloud infrastructure.

- 70% commercial banks adopt AI core functions.

- AI chatbots handle 98% customer queries.

- 78% AI-investing banks see positive ROI.

Frequently Asked Questions (FAQs)

Neobank penetration is projected to rise from around 3.9 % in 2024 to 4.8 % by 2028.

Total neobank transaction values are expected to exceed approximately €9.76 trillion by 2028.

Projections show growth from around $382.8 billion in 2025 to about $552 billion in 2026.

The neobanking industry is forecast to grow at a CAGR of around 47–49% through 2032.

Conclusion

The neobank industry is at the forefront of financial innovation, reshaping how individuals and businesses manage money. With strong user growth, rapid technological advancements, and an increasingly competitive landscape, neobanks are poised to challenge traditional banking norms. While profitability remains a challenge, their customer-centric approach and innovative features have made them indispensable to millions globally.