The mutual fund industry has long been a cornerstone of investment strategies, offering a reliable way for individuals and institutions to diversify their portfolios. Today, the industry continues to evolve, responding to global economic shifts, regulatory changes, and technological innovations. This article will explore the latest statistics, trends, and insights into the mutual fund market, ensuring you have a clear understanding of its current and future trajectory.

Editor’s Choice

- Global mutual fund assets under management (AUM) reached $147 trillion in 2025, driven by modest growth and strong market resilience.

- The U.S. mutual fund market size climbed to $30.09 trillion, remaining the largest worldwide.

- Long-term mutual fund flows showed net inflows of around $75 billion by mid-2025.

- Equity funds experienced net outflows of $23.3 billion, while bond funds recorded net inflows of $4.8 billion.

- About 60% of the U.S. mutual fund market is now in passive funds.

- The average mutual fund expense ratio dropped to approximately 0.38% in 2025.

- ESG funds saw outflows of $944 million, though environmental-focused funds gained $805 million in new investments.

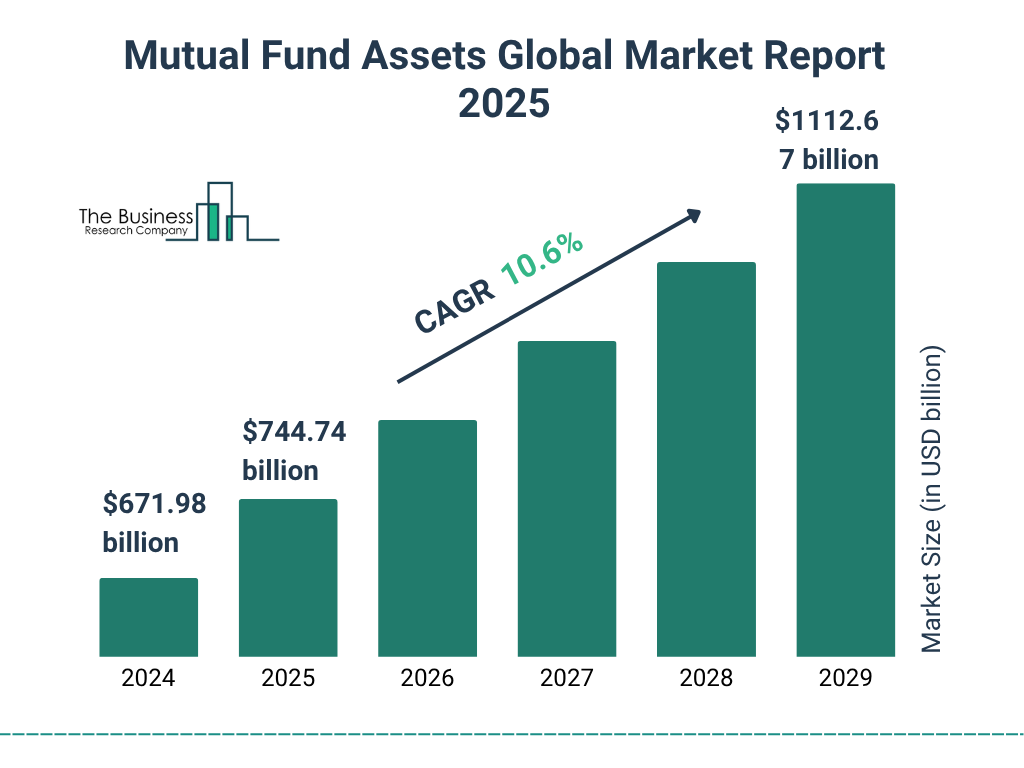

Global Mutual Fund Market Forecast

- The global mutual fund market reached $671.98 billion in 2024, showing strong investor confidence.

- Market size is expected to climb to $744.74 billion in 2025, driven by portfolio diversification and digital access.

- By 2029, the mutual fund market is projected to hit $1,112.67 billion, reflecting rapid global expansion.

- The sector is forecast to grow at a 10.6% CAGR between 2024 and 2029, indicating long-term momentum.

- This growth trajectory highlights increased cross-border investments, AI-enhanced fund management, and retail investor inflows.

Global Assets Under Management

- Total AUM stands at $147 trillion in mid‑2025, marking about a 2.2% increase since mid‑2024.

- Equity mutual funds dominate the AUM distribution, comprising roughly 50‑55% of the total, while fixed‑income funds account for about 20‑25% of the total.

- Asia‑Pacific markets saw the fastest growth with organic growth around 4.2% in 2025, driven by rising investor participation, especially in emerging economies.

- Europe’s share of global AUM is about 30% with slight stagnation or modest decline due to macroeconomic headwinds.

- Emerging markets led by India and Brazil are growing faster than developed markets, contributing organic growth rates exceeding 6‑8% year over year.

- The U.S. maintains leadership with about a 50‑55% share of global AUM, reflecting its robust infrastructure and large institutional investor base.

- Alternative investment funds such as private equity, real assets, and real estate funds hold about 15% of global AUM, evidencing growing diversification trends.

Regional Market Distribution

- The North American market holds about $32.71 trillion of mutual fund assets in 2025, representing roughly 22‑23% of global AUM.

- China’s mutual fund industry reached $4.82 trillion in AUM in 2025, showing steady expansion.

- India’s mutual fund industry hit ₹72.2 lakh crore (~$860‑900 billion) in AUM in mid‑2025, marking about 22.5% growth yoy.

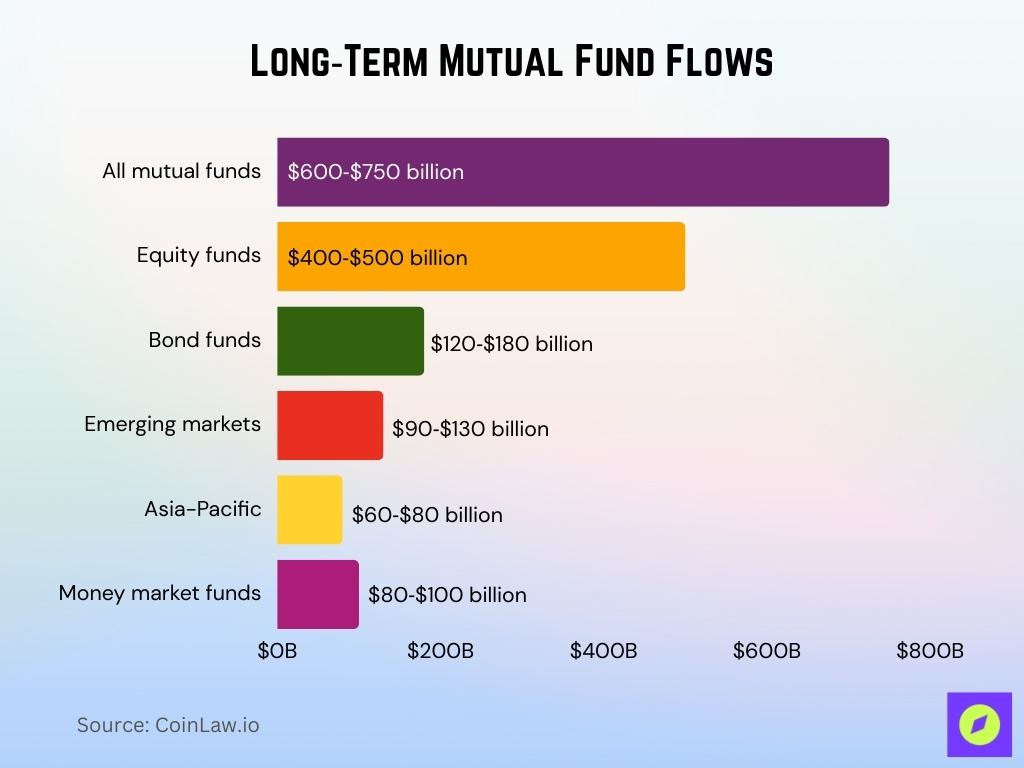

Estimated Long‑Term Mutual Fund Flows

- Net inflows are now estimated at around $600‑$750 billion annually by end‑2025 based on current growth patterns.

- Equity funds are likely to capture about $400‑$500 billion in inflows in 2025, given renewed optimism in global markets.

- Bond funds may see moderate inflows of roughly $120‑$180 billion in 2025, reflecting continued caution over rates.

- Emerging markets may attract inflows on the order of $90‑$130 billion in 2025, with Asia‑Pacific leading at about $60‑$80 billion.

- Money market funds are expected to retain inflows of around $80‑$100 billion in 2025 as investors seek safety.

Mutual Funds in the U.S. and Global Trends

- U.S.-based mutual funds account for approximately $30.09 trillion in AUM in 2025, representing around 22% of global assets.

- Passive index strategies are expected to capture about 58% of total U.S. fund assets by 2025.

- Target-date fund assets grew to $4.2 trillion in 2025, driven by 401(k) allocations.

- ESG investing trends remain mixed, with environmental-focused funds seeing net inflows of $805 million in mid-2025.

- ETFs globally hold around $14.7 trillion in assets, with inflows nearing $1.9 trillion in 2024.

- Hybrid funds continued to grow, though detailed 2025 figures remain limited.

- The average mutual fund holding period rose to about 4.5 years, signaling long-term investment preferences.

Mutual Fund Assets Market Trends

- Sustainable and ESG-focused mutual funds reached around $3.5 trillion in 2025 with annual growth of about 10%.

- Passive funds continued gaining traction with indexed assets rising to approximately $17.5 trillion.

- Thematic fund inflows declined by over 50% in 2025, signaling waning short-term investor interest.

- Active funds saw net outflows of roughly $6.6 billion, reflecting preference for passive strategies.

- Global sustainable fund assets stood at around $3.16 trillion in early 2025 amid mixed inflow performance.

- Equity mutual funds in India recorded inflows of approximately $50–60 billion, supported by strong retail participation.

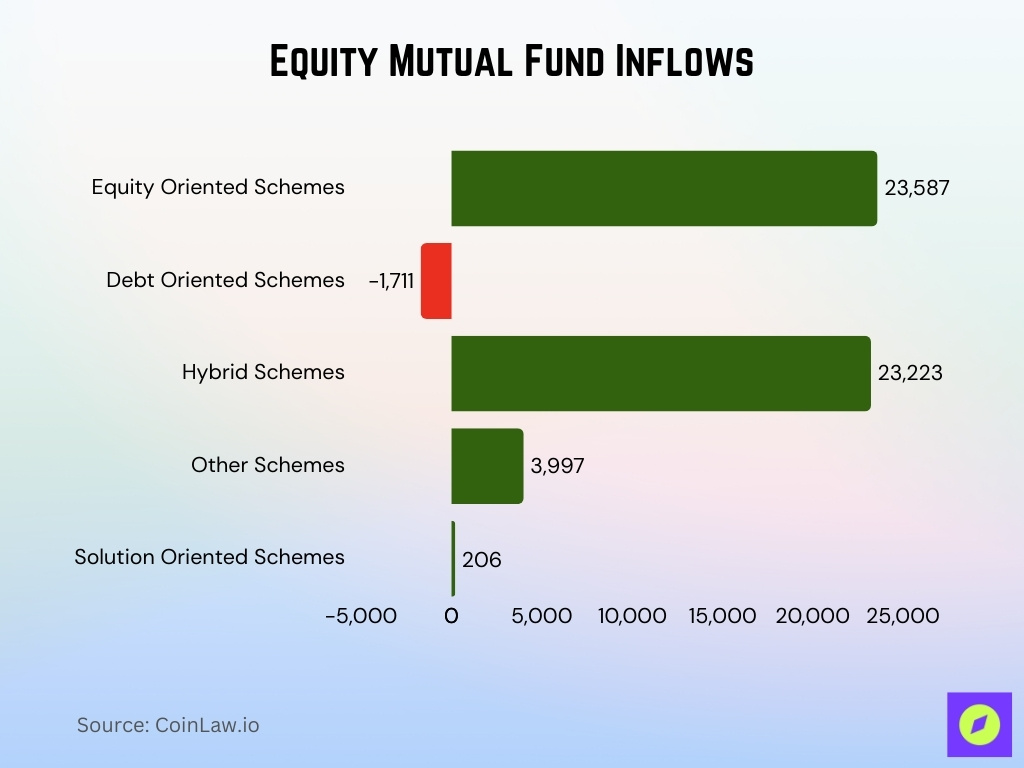

Equity Mutual Fund Inflows

- Equity-oriented mutual funds saw a strong net inflow of ₹23,587 crore in June 2025, showing robust investor confidence.

- This inflow surpassed most other categories, reaffirming equity MFs as the top choice for retail and institutional investors.

- The surge reflects continued interest in growth-oriented assets, amid positive market sentiment and economic recovery trends.

- Equity MF inflows were slightly higher than hybrid schemes (₹23,223 crore), showing a preference for pure equity exposure.

- Compared to debt schemes, which had a net outflow of ₹1,711 crore, equity MFs attracted significantly more capital.

Mutual Fund Assets Market Share

- The U.S. mutual fund industry held about 53% of global regulated fund assets in 2025.

- European funds represent an estimated 20% of the global market share, with Germany and France as leading contributors.

- Asia-Pacific accounts for roughly 17% of the global market, led by growth in China and India.

- ETFs make up about 25% of the global mutual fund space, favored by both retail and institutional investors.

- Sustainable funds represent close to 10% of total assets, reflecting continued demand for ESG options.

- Hybrid funds hold around 5.5% of the global market share, balancing between equity and fixed income.

- Alternative investment funds account for about 15% of total assets, including real estate, hedge funds, and private equity.

Fund Categories and Asset Allocation

- Equity funds are estimated to represent about 50‑55% of global mutual fund assets in 2025.

- Fixed‑income funds make up around 20‑25% of the global fund industry in 2025.

- Money market funds’ assets hit a record of about $7.03 trillion in early 2025, reflecting their role as a stability anchor.

- Hybrid funds are estimated to have grown to about $4‑5 trillion globally in 2025.

- Sector‑specific funds, such as technology and healthcare, saw growth slowing with estimated increases of ~25‑30% year over year.

- Real asset funds, including infrastructure and commodities, are estimated at around $600‑$800 billion globally in 2025.

- Balanced funds have shown modest growth of about 5‑7% in assets under management in 2025 as investor preference shifts toward risk mitigation.

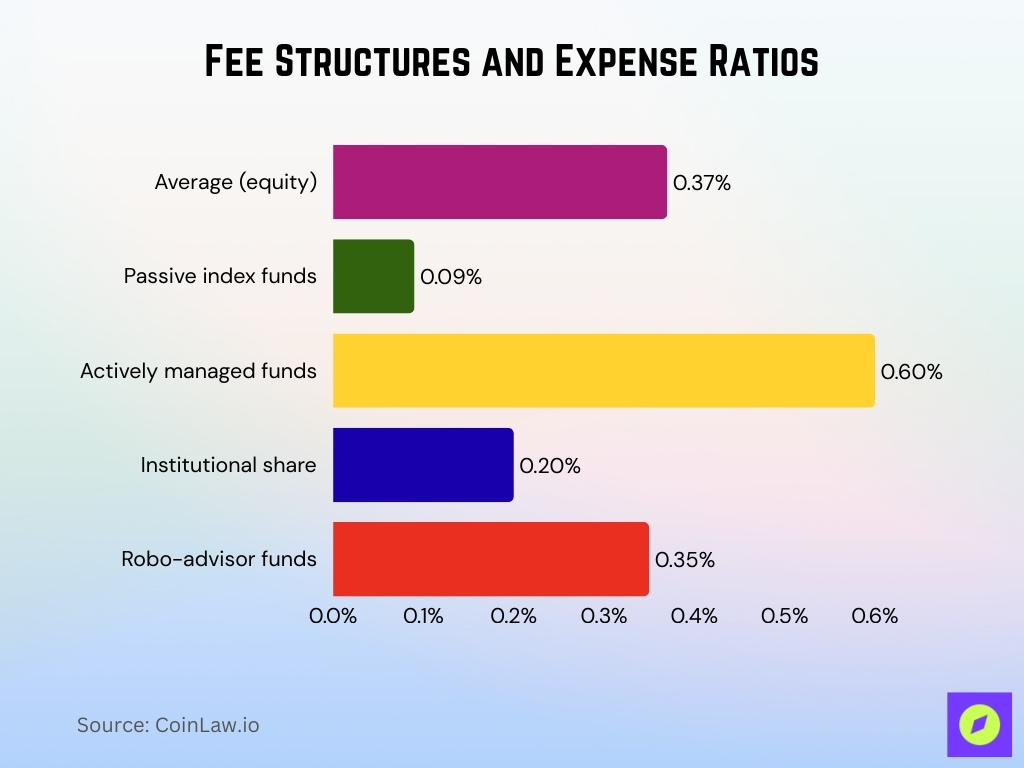

Fee Structures and Expense Ratios

- The average expense ratio for equity mutual funds dropped to 0.37%.

- Passive index funds remain the most cost-effective, with average fees of 0.09%.

- Actively managed funds still average higher fees at 0.60%, though competition is driving reductions.

- Institutional share classes offer significantly lower fees, averaging 0.20%, attracting large-scale investors.

- Robo-advisors offer mutual funds with 0.25%-0.35% average advisory fees, appealing to cost-sensitive millennials.

Investment Strategy Insights

- Diversification remains key, with 68% of investors holding a mix of equity and fixed-income funds.

- Growth-oriented strategies dominate, with 45% of equity fund investments focused on high-growth sectors like technology and clean energy.

- Income-focused strategies have gained traction, with 20% of assets in bond and dividend-focused funds.

- Defensive strategies, including investments in value funds and blue-chip equities, have risen by 12% amid market volatility.

- Quantitative and algorithm-based funds now control 8% of AUM, reflecting the rise of technology in fund management.

- Long-term strategies are preferred, with average holding periods increasing to 4.2 years.

- Ethical investing strategies dominate the ESG space, driving inflows of $1.5 trillion globally.

Type Insights

- Open-ended funds continue to lead, representing 80% of global AUM due to their liquidity and accessibility.

- Close-ended funds, while less popular, hold 10% of assets, catering to investors seeking fixed tenure and returns.

- ETFs represent 25% of U.S. mutual fund assets, reflecting their role in diversifying portfolios.

- Actively managed funds account for 40% of global AUM, despite growing competition from passive funds.

- Index funds saw their AUM grow by 15%, appealing to cost-conscious investors.

- Target-date funds have reached $3.5 trillion, favored for retirement planning.

- Regional and sector-specific funds hold $1.8 trillion, addressing niche investor interests.

Distribution Channel Insights

- Online platforms dominate, facilitating 70% of retail mutual fund sales, driven by robo-advisors and digital brokers.

- Traditional financial advisors still manage 40% of mutual fund assets, catering to high-net-worth individuals.

- Direct channels, such as fund websites, now account for 20% of retail inflows, reflecting a shift toward self-directed investing.

- Employer-sponsored plans, like 401(k), contribute $8 trillion to U.S. mutual fund AUM.

- Bank-managed funds have a significant footprint in Europe and Asia, managing 30% of regional assets.

- Mobile apps have revolutionized fund distribution, with 45% of millennials preferring app-based investments.

Investment Style Insights

- Growth investing remains strong, capturing about 50‑55% of equity AUM, with sectors like technology and healthcare still leading.

- Value‑oriented funds are seeing renewed interest with inflows rising by ~4‑7% in 2025.

- Income‑focused funds emphasizing dividends now represent around 25% of total equity AUM.

- Momentum strategies have a modest presence, capturing ~8% of total fund inflows in recent periods.

- ESG-driven investment styles comprise approximately 20% of new fund launches in 2025.

- Thematic strategies such as clean energy and AI helped fuel the growth of thematic funds by around 15‑20% year over year.

- Risk parity strategies are used in about 7% of hybrid funds globally as balanced risk approaches gain popularity.

Investor Type Insights

- Retail investors make up 70% of mutual fund holders, with growing participation from younger demographics.

- Institutional investors, including pension funds and insurance companies, hold 50% of the total AUM, focusing on stability and long-term growth.

- High-net-worth individuals represent 20% of mutual fund assets, favoring bespoke and alternative fund options.

- Small businesses increasingly utilize mutual funds for 401(k) plans, contributing $2.5 trillion in assets.

- Nonprofits and endowments are allocating 10% of their portfolios to mutual funds for steady returns.

- International investors now contribute 15% of U.S. mutual fund inflows, driven by the appeal of a strong and regulated market.

- Tech-savvy investors using robo-advisors account for 35% of new retail fund purchases.

Investors’ Rising Expectations

- In 2025, about 88% of active investors say sustainable investing is important.

- Nearly 61% of asset owners believe ESG considerations are now part of their fiduciary duty.

- Nearly 85% of investors expect ESG‑related AUM to grow over the next two years.

- Close to two‑thirds of surveyed investors plan to assess carbon footprint or climate strategy in their portfolios.

- About 40‑50% of individuals in recent surveys prefer digital or video summaries for performance updates over traditional reports.

- Around 80% of investors believe fee transparency is essential when choosing investment funds.

- Roughly 50% of tech‑savvy investors expect real‑time market insights to be integrated into their investment apps.

Technological Innovations in Fund Management

- Blockchain systems are delivering up to 80‑90% reduction in settlement times for certain financial services as adoption broadens in 2025.

- Robo‑advisors now manage over $1 trillion in assets globally in 2025 as they continue to democratize fund access.

- Mobile‑first fund platforms have expanded by about 40‑50% year‑over‑year as investor demand for on‑the‑go tools increases.

- Big data integration is used by roughly 70‑80% of fund managers for real‑time risk assessment.

- Thematic and AI‑focused funds (e.g., clean energy, big data) saw assets swell to $40 billion+ by early 2025, marking very strong growth.

- Use of digital simulation tools (digital twins) is still emerging, with estimated cost savings of about 15‑25% in strategy testing environments.

Recent Developments

- Sustainable fund inflows rebounded in Q2 2025 with net inflows of about $4.9 billion globally.

- The SEC approved new generic listing standards to fast‑track crypto‑based ETFs under a streamlined regulatory framework.

- Cross‑border fund registrations and ETF filings rose due to eased rules and broader crypto product approvals.

- Grayscale’s Digital Large Cap Fund was converted to the first multi‑token crypto ETF under the new listing regime.

- In‑kind creation and redemption structures for crypto ETPs are now permitted to facilitate institutional participation.

- Regulatory reforms have improved transparent disclosures, benefiting a majority of retail investors.

- Sustainable finance remains under pressure with global ESG funds still experiencing volatility in investor sentiment and flows.

Frequently Asked Questions (FAQs)

~$147 trillion with an organic growth rate of ~2.2%.

Passive funds are projected to reach $36.6 trillion, making up ~25% of global AUM.

~6.86% CAGR from 2025 to 2034.

Long‑term active funds had net outflows of $6.61 billion, while long‑term index funds saw net outflows of $218.38 billion.

Conclusion

The mutual fund industry today exemplifies adaptability and growth, shaped by technological advancements, regulatory shifts, and evolving investor expectations. Whether you’re a retail investor exploring low-cost ETFs or an institution seeking sustainable investment options, the opportunities are vast. With innovation and transparency at the forefront, the mutual fund sector is poised to thrive in the coming years.