In today’s world of rising geopolitical instability, climate chaos, and space expansion, insurance has evolved into a high-stakes financial weapon. From celebrity body parts and mega-yachts to collapsed bridges and failed satellites, some policies now command payouts in the billions.

These ultra-high-value insurance contracts aren’t just about risk; they’re about power, legacy, and future-proofing ultra-wealth. Below, we explore the most extreme examples of insurance ever written.

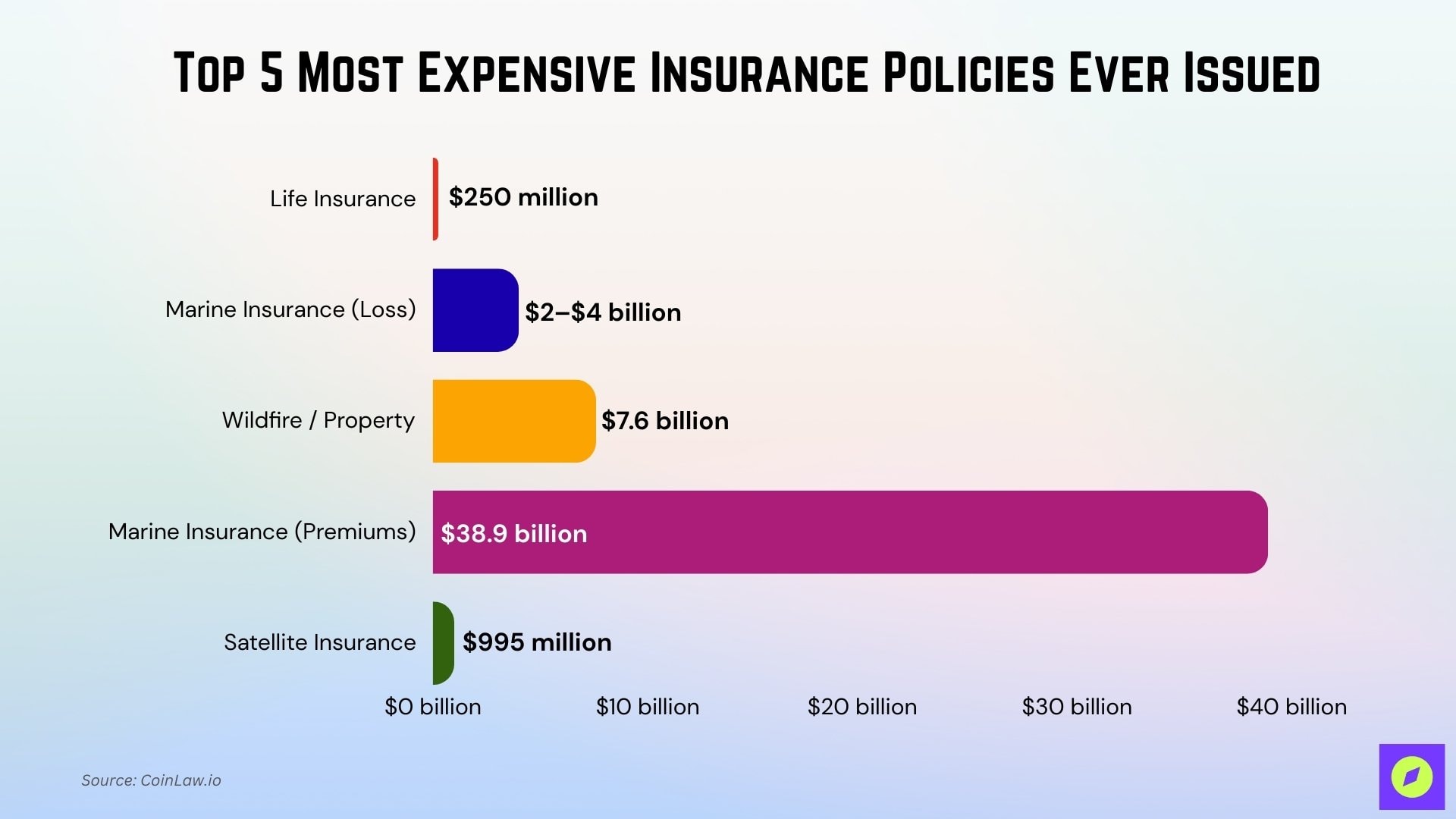

Key Takeaways

- $250 million is the world’s most expensive life insurance policy, issued by HSBC in Hong Kong.

- $7.6 billion was paid by State Farm for wildfire claims in LA, one of the largest property payouts ever.

- $2–$4 billion in marine insurance losses followed the 2025 Key Bridge collapse in Baltimore.

- The ViaSat-3 satellite failure led to $995 million in space insurance claims, a record for the sector.

- Global marine insurance premiums reached $38.9 billion in 2023, driven by shipping risks and high-value cargo.

What Makes an Insurance Policy So Expensive?

Not all insurance is created equal; some policies exist in a class of their own, priced in the hundreds of millions due to how they’re structured, who they protect, and what’s at stake. Here’s what drives the cost sky-high:

- High-Value Coverage Amounts ($100 million and Up): These aren’t your typical million-dollar policies. Ultra-premium coverage often spans $100 million to $1 billion, designed to protect intergenerational assets, multi-country real estate portfolios, or rare high-liability events.

- Unique Underwriting Risks: From a Formula 1 driver’s legs to an astronaut’s mission exposure, some lives and occupations present non-standard, catastrophic risk profiles. Actuaries can’t rely on traditional mortality tables or property assessments; custom modeling is required.

- Custom Terms and Bespoke Clauses: No boilerplate here. These policies come with highly negotiated language, often involving multiple legal jurisdictions, tax regimes, and payout triggers. Many are integrated into trusts, offshore structures, or collateralized lending tools.

- Rare or Irreplaceable Asset Protection: Think priceless art collections, vintage Ferraris, crypto seed vaults, or even genetic material stored off-planet. Insuring the irreplaceable requires specialty reinsurers, complex loss protocols, and massive capital reserves.

Top 5 Most Expensive Insurance Policies

These extraordinary cases showcase how insurance adapts to cover risks that are rare, costly, and often global in scale. From individual wealth protection to infrastructure and space, they reveal the extremes of financial safeguarding in modern society.

| Policy Type | Event / Policy | Year | Amount / Loss | Insight |

| Life Insurance | HSBC Life’s record whole-of-life policy | 2024 | $250 million | Shows how insurance can act as both protection and a legacy wealth tool. |

| Marine Insurance (Loss) | Francis Scott Key Bridge collapse, Baltimore | 2025 | $2–$4 billion | Demonstrates the massive economic ripple effect of maritime disasters. |

| Wildfire / Property | Los Angeles wildfires, State Farm exposure | 20245 | $7.6 billion | Highlights the financial impact of climate-linked catastrophes on insurers. |

| Marine Insurance (Premiums) | Global marine insurance premium base | 2023 | $38.9 billion | Reflects the essential role of marine coverage in global trade security. |

| Satellite Insurance | ViaSat-3 satellite claim | 2023 | $995 million loss | Underscores the high stakes of insuring space assets in an unpredictable frontier. |

1. Life Insurance (Ultra High Net Worth)

Life insurance at this level demonstrates how financial protection can double as a tool for global wealth strategy. Such policies highlight how legacy planning extends beyond families into business empires and dynastic wealth.

- Policy Type: Whole-of-life coverage

- Insurer: HSBC Life (International), Hong Kong

- Insured Amount: $250 million

- Notability: Recognized by Guinness World Records as the most valuable life insurance policy ever sold.

- Why It’s Expensive: Tailored for ultra-high-net-worth individuals with intergenerational wealth planning needs and asset protection across global jurisdictions.

2. Marine Insurance (Property Damage)

The scale of marine losses reveals how interconnected trade, infrastructure, and liability truly are. It underscores the reality that a single event can ripple across global commerce and insurance markets.

- Policy Type: Marine liability & cargo/property insurance

- Insured Event: Collision of container ship Dali with the Key Bridge in Baltimore

- Estimated Loss: $2 to $4 billion in total insurance payouts

- Why It’s Expensive: Covers massive structural damage, lost shipping cargo, port closure impacts, and liability claims under global marine coverage policies.

3. Wildfire / Property Insurance

Mega-payouts in property insurance show how climate-linked disasters are reshaping financial resilience. Insurers increasingly factor environmental volatility into pricing models, making coverage more critical than ever.

- Policy Type: Residential & commercial property insurance

- Insured Event: Wildfires across Los Angeles County

- Claims Total: $7.6 billion (State Farm exposure before reinsurance offsets)

- Why It’s Expensive: Dense real estate concentration, luxury home damage, and large-scale loss from extreme weather events tied to climate risk models.

4. Marine Insurance (Industry Premium Base)

Premium totals at this scale reflect the essential role marine coverage plays in safeguarding global supply chains. It demonstrates how the industry adapts to geopolitical shifts, cargo values, and evolving maritime risks.

- Policy Type: Global marine insurance industry (cargo, hull, liability)

- Event/Metric: Industry-wide premiums collected

- Total Value: $38.9 billion in premiums during 2023

- Why It’s Expensive: Reflects the rising value of cargoes, increased geopolitical risk at sea, and demand for customized underwriting in shipping logistics.

5. Satellite Insurance (Space Sector)

Space insurance represents a frontier where risk meets innovation. These record-setting losses remind investors and insurers alike that the cosmos remains one of the most unpredictable arenas for modern finance.

- Policy Type: Satellite and space asset insurance

- Insured Event: Failure of the ViaSat-3 satellite deployment

- Financials:

- Premiums collected: $557 million

- Claims paid: $995 million

- Net loss: $438 million (the largest ever in satellite insurance history)

- Why It’s Expensive: Covers orbital failure, loss of commercial capacity, and high-cost aerospace risk in a frontier insurance segment.

Why the Ultra-Rich Need Expensive Insurance

For the ultra-wealthy, insurance isn’t just risk mitigation; it’s a financial engineering tool. These policies serve strategic purposes far beyond typical coverage:

- Estate Planning and Wealth Transfer: Large life insurance policies are often used to minimize estate tax exposure and transfer generational wealth tax-efficiently. When paired with irrevocable life insurance trusts (ILITs), they can secure liquidity without triggering tax events.

- Global Risk Exposure: Billionaires and celebrities often have properties, investments, and reputational liabilities spread across continents. A wildfire in LA, a cyberattack in Zurich, or a lawsuit in Dubai can all trigger massive losses. Expensive insurance helps contain cross-border volatility.

- Personal Brand Protection and Income Preservation: If your name is your business, like a pro athlete, hedge fund founder, or influencer, a serious injury, scandal, or operational mishap can wipe out future earnings. These policies help lock in lifetime income, hedge public persona fallout, and protect brand equity.

Frequently Asked Questions (FAQs)

$250 million, issued by HSBC Life (International) in Hong Kong in 2024.

Estimates place total insured losses at $2 billion to $4 billion.

$7.6 billion in claims for policyholders, largely offset by reinsurance.

$38.9 billion in total premiums.

Premiums were $557 million, claims were $995 million, for a $438 million net loss, including a $445 million ViaSat-3 claim.

Conclusion

The world’s most expensive insurance policies shine a light on how risk, wealth, and strategy intersect at the highest levels. From billion-dollar wildfire claims to space insurance losses, these extreme cases remind us that insurance is more than protection; it’s a financial instrument that safeguards legacies, stabilizes global trade, and even secures ventures beyond Earth. As climate volatility, infrastructure fragility, and space exploration continue to grow, expect the limits of what can be insured and how much it costs to rise even further.