Insurance exists to reduce uncertainty, but sometimes, the events it covers are unprecedented in both scale and cost. From devastating hurricanes and terror attacks to global product recalls and cyber disasters, the largest insurance payouts in history reveal how fragile modern systems can be. These record-setting claims didn’t just impact balance sheets; they reshaped entire industries, forced regulatory changes, and altered the future of risk modeling and reinsurance worldwide.

Key Takeaways

- Hurricane Katrina remains the most expensive insured event in history, with over $82 billion in payouts.

- 9/11 triggered $40+ billion in claims across aviation, property, and life policies, becoming the largest man made insurance loss ever.

- Corporate liability and product recall claims, like Volkswagen’s Dieselgate, resulted in $16+ billion in payouts.

- Merck’s $1.4 billion cyber insurance win after NotPetya set a precedent for cyberattack coverage under traditional policies.

- A life insurance policy reportedly paid out $201 million, one of the highest known individual payouts ever recorded.

What Makes a Claim So Expensive?

Some insurance claims spiral into billions due to the scale of damage, multi-policy triggers, and long-term liabilities. From corporate scandals to natural disasters, these factors compound the final payout.

- Multi-Line Policies: One event can activate property, liability, business interruption, and environmental clauses.

- Geographic Spread: Disasters like hurricanes or wildfires affect tens of thousands of policyholders at once.

- Third-Party Liability: Claims involving legal settlements or lawsuits (e.g., Deepwater Horizon) increase costs dramatically.

- Unmodeled Risks: Events not previously accounted for, like global pandemics, often lack policy caps.

- Extended Timelines: Some payouts take years of litigation, with costs rising due to inflation, legal fees, and cleanup.

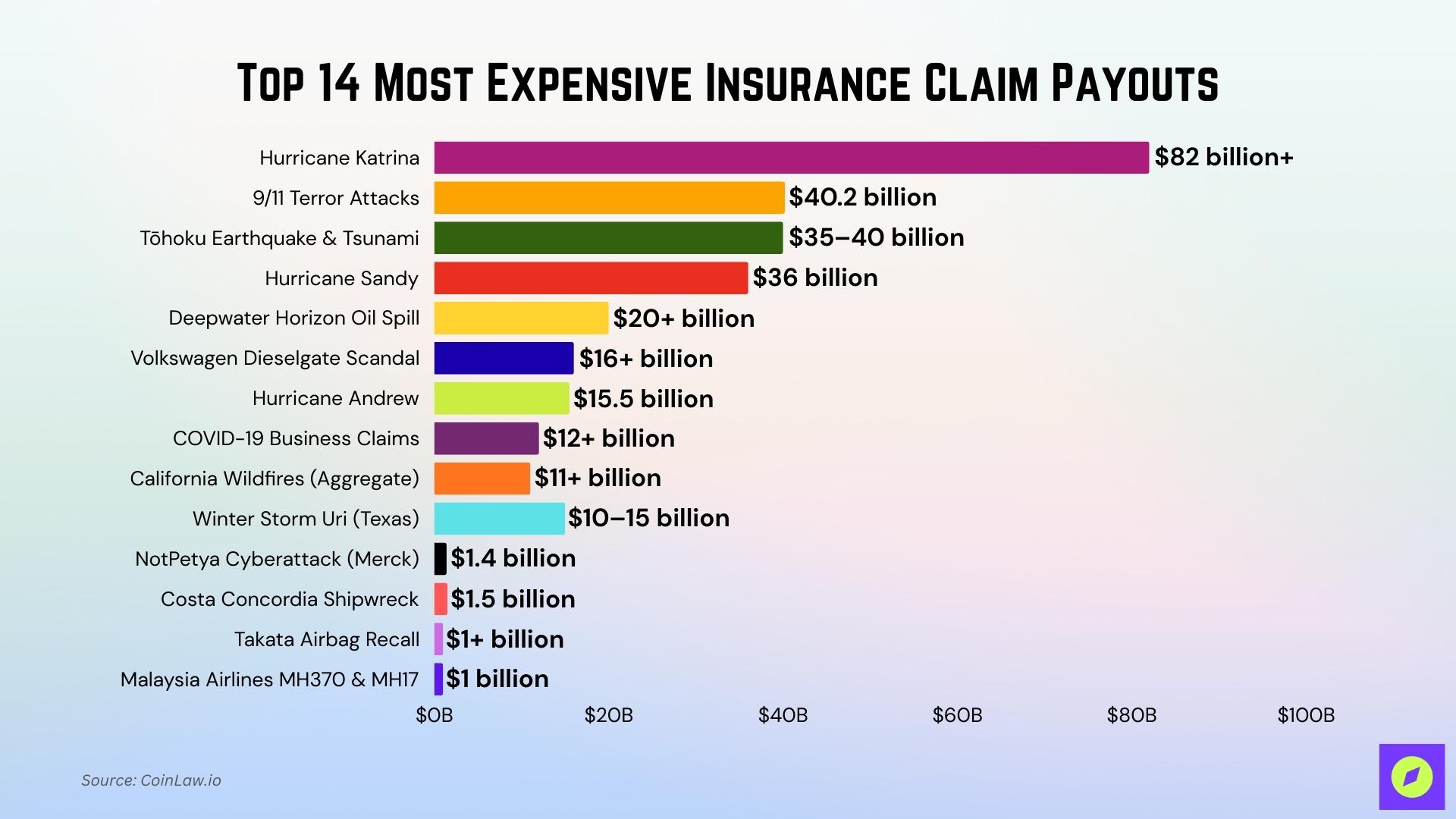

Top 14 Most Expensive Insurance Claim Payouts

These record-setting claims highlight the staggering scale of financial risk in today’s world. Each payout on this list reshaped insurance underwriting, triggered global reinsurance responses, and exposed how vulnerable even the most prepared systems can be.

| Event | Year | Insured Payout | Claim Type |

| Hurricane Katrina | 2005 | $82 billion+ | Natural disaster – hurricane, flood |

| 9/11 Terror Attacks | 2001 | $40.2 billion | Terrorism – property, liability, aviation, life |

| Tōhoku Earthquake & Tsunami | 2011 | $35–40 billion | Natural disaster – earthquake, tsunami |

| Hurricane Sandy | 2012 | $36 billion | Natural disaster – superstorm, flood |

| Deepwater Horizon Oil Spill | 2010 | $20+ billion | Environmental disaster – liability, business interruption |

| Volkswagen Dieselgate Scandal | 2015+ | $16+ billion | Corporate liability – D&O, product recall |

| Hurricane Andrew | 1992 | $15.5 billion | Natural disaster – hurricane |

| COVID-19 Business Claims | 2020–2022 | $12+ billion | Global event – BI, event cancellation |

| California Wildfires (Aggregate) | 2017–2020 | $11+ billion | Natural disaster – wildfire, property |

| Winter Storm Uri (Texas) | 2021 | $10–15 billion | Natural disaster – freeze, infrastructure |

| NotPetya Cyberattack (Merck) | 2017–2022 | $1.4 billion | Cyberattack – business interruption |

| Costa Concordia Shipwreck | 2012 | $1.5 billion | Maritime – hull, liability, salvage |

| Takata Airbag Recall | 2013–2021 | $1+ billion | Product recall – liability |

| Malaysia Airlines MH370 & MH17 | 2014 | $1 billion | Aviation – hull, war risk, liability |

1. Hurricane Katrina (2005)

The most devastating natural disaster in U.S. history caused $82 billion in insured losses and over $160 billion in total economic damage. Flooding devastated New Orleans, and more than 1.7 million insurance claims were filed. Reinsurance companies like Munich Re and Lloyd’s took major losses, reshaping catastrophe underwriting for the next two decades.

- Insured Loss: $82 billion

- Total Economic Cost: $160 billion+

- Key Insurers: Allstate, State Farm, Zurich, Lloyd’s, Swiss Re

2. 9/11 Terror Attacks (2001)

The September 11 attacks led to $40.2 billion in insurance claims, the largest insured loss from a single event. Payouts spanned life insurance, business interruption, workers’ comp, and property. It also led to the creation of the Terrorism Risk Insurance Act (TRIA) in the U.S.

- Total Insured Loss: $40.2 billion

- Key Insurers: Swiss Re, Berkshire Hathaway, Allianz

- Largest Claim: $4.55B for WTC property

3. Tōhoku Earthquake & Tsunami (2011)

This magnitude 9.0 quake, tsunami, and nuclear incident devastated northeastern Japan. Although total damages neared $300 billion, insured losses were limited to about $35–40 billion due to widespread exclusions, especially nuclear-related risks.

- Insured Loss: $35–40 billion

- Uninsured Nuclear Losses: Excluded

- Reinsurers Affected: Munich Re, Swiss Re

4. Hurricane Sandy (2012)

Sandy merged with a cold front to become a “superstorm” that ravaged the U.S. Northeast. It caused $36 billion in insured losses, much of it from flood and storm surge damage, prompting reforms in FEMA’s flood insurance structure and private flood coverage expansion.

Insured Loss: $36 billion

Contested Claims: Storm surge vs. flood exclusions

5. Deepwater Horizon Oil Spill (2010)

BP’s offshore drilling rig explosion resulted in the worst marine oil spill in U.S. history. While BP’s total exposure exceeded $60 billion, insurance (liability, environmental, business interruption) covered over $20 billion.

- Insured Loss: $20 billion+

- Corporate Loss: $60 billion+

- Trust Fund: $20 billion payout pool for damages

6. Volkswagen Dieselgate Scandal (2015)

VW’s emissions fraud scandal sparked fines, lawsuits, and recall costs surpassing $30 billion, with at least $16 billion absorbed by insurers under directors & officers (D&O), recall, and liability policies. It remains the most expensive corporate misrepresentation case ever insured.

- Total Corporate Loss: $30 billion+

- Insurance Payouts: $16 billion+

- Policies Triggered: D&O, product recall, legal liability

7. Hurricane Andrew (1992)

Before Katrina, Andrew was the costliest U.S. hurricane with $15.5 billion in insured losses. It wiped out entire Florida neighborhoods and caused 11 insurer bankruptcies, leading to Florida’s state-backed insurance pool.

- Insured Loss: $15.5 billion

- Legacy: Birth of catastrophe bonds and Florida Citizens Insurance

8. COVID-19 Business Interruption Claims (2020–2022)

Although many pandemic-related claims were denied due to virus exclusions, insurers still paid over $12 billion globally, particularly in event cancellation, travel insurance, and contingency business lines.

- Insured Loss: $12 billion+

- Main Coverage Areas: Event cancellation, travel, and some business interruption

9. California Wildfires (2017–2020)

Back-to-back wildfires scorched Northern California and triggered massive payouts under property, auto, and business interruption lines. PG&E’s liability alone pushed multiple insurers to the brink.

- Insured Loss: $11 billion+ (multiple years)

- Main Fires: Camp Fire, Tubbs Fire, Mendocino Complex

10. Winter Storm Uri (Texas, 2021)

A sudden Arctic blast damaged Texas’ infrastructure, resulting in burst pipes, power failures, and widespread home and commercial damage. Insurance payouts approached $15 billion, making it the most expensive winter storm in U.S. history.

- Insured Loss: $10–15 billion

- Notable Payouts: Homeowners, freeze-related commercial property

11. NotPetya Cyberattack (Merck, 2017)

After a five-year legal battle, Merck won a $1.4 billion claim under its all-risk property policy for damages from the NotPetya cyberattack, despite the insurer citing “act of war” exclusions. The court ruled in favor of Merck, setting a key precedent for cyber insurance.

- Payout: $1.4 billion

- Policy Type: All-risk property (non-cyber-specific)

- Legal Outcome: Insurer liable despite war clause

12. Costa Concordia Shipwreck (2012)

The cruise liner’s capsizing off Italy’s coast killed 32 people and resulted in a $1.5 billion marine insurance payout, covering the ship, passenger liability, environmental damage, and recovery costs.

- Insured Loss: $1.5 billion

- Insurers Involved: The Standard Club, Lloyd’s, Munich Re

13. Takata Airbag Recall

This global product recall affected over 100 million vehicles and triggered over $1 billion in insurance recoveries under product liability and recall cover. Automakers also filed subrogation claims against the manufacturer’s insurers.

- Total Recall Cost: $24 billion+

- Insured Portion: $1 billion+

- Policies Involved: Product liability, OEM recall clauses

14. Malaysia Airlines MH370 & MH17 (2014)

In a devastating year, Malaysia Airlines lost two aircraft, MH370 mysteriously vanished, and MH17 was shot down over Ukraine. Together, these events led to nearly $1 billion in insurance claims.

- Combined Insured Loss: ~$1 billion

- Coverage Types: Aviation hull, war risk, liability

Why These Claims Reshaped the Insurance Industry

Each record-breaking claim has lasting effects on how policies are written, priced, and interpreted. Insurers use these costly lessons to tighten exclusions and innovate new types of coverage.

- Post-9/11 Terror Coverage: Led to the Terrorism Risk Insurance Act (TRIA) and revamped war exclusions.

- Cyber Insurance Evolution: Merck’s NotPetya case forced a redefinition of “act of war” clauses in cyber and property policies.

- Environmental Risk Pricing: Deepwater Horizon redefined how insurers calculate liability for oil spills and pollution.

- Pandemic Exclusions: COVID-19 losses prompted many providers to exclude viruses from business interruption policies.

- Rise of Parametric Insurance: Triggered by events like wildfires and floods, these products pay based on data (e.g., wind speed), not damage reports.

Frequently Asked Questions (FAQs)

The protection gap in 2024 was roughly 40‑60%, with about 62‑63% of global economic losses from disasters remaining uninsured.

Swiss Re estimated that insured losses from natural catastrophes in 2025 could reach about $145 billion, nearly 6% higher than the loss figure recorded in 2024.

In 2023, U.S. life insurers paid $89.1 billion in death benefits, and policy surrenders amounted to $41.6 billion

Insured losses in 2024 from natural disasters were about $140 billion, out of $320 billion in total (insured + uninsured) losses globally.

Conclusion

These massive payouts reveal just how wide the financial safety net of the global insurance industry stretches, and how critical it is when catastrophe strikes. From hurricanes and oil spills to cyberattacks and recalls, insurance isn’t just about protecting individuals; it’s a risk redistribution engine for entire economies. As climate change, cyber risk, and global connectivity increase exposure, the next record-setting claim might be closer than we think.