Imagine walking into a bustling metropolis where billions of dollars flow every second, an invisible undercurrent of illicit money changing hands. This unseen world of money laundering impacts economies globally, enabling criminals to convert ill-gotten gains into legitimate assets. Today, the fight against money laundering has become more crucial than ever.

From global crackdowns to the rise of cryptocurrency, financial systems are constantly evolving to combat these activities. In this article, we’ll explore the staggering scale of the problem and highlight critical trends shaping the future of anti-money laundering efforts worldwide.

Editor’s Choice

- An estimated $800 billion to $2 trillion is laundered each year, representing approximately 2% to 5% of global GDP.

- A UNODC report indicates that only 1% of illicit financial flows are detected and seized by authorities.

- As of 2026, the FATF identified 23 countries as high-risk or under increased monitoring for money laundering.

- Approximately $750 billion in illicit funds is laundered through European countries every year.

- 74% of major money laundering schemes involve real estate transactions, with billions funneled through properties.

Recent Developments

- FATF’s latest 2026 report lists Algeria, Angola, and Bolivia among 20 jurisdictions under increased monitoring for AML/CFT deficiencies.

- Over 30 jurisdictions advanced crypto policy developments in 2025, including new VASP licensing and stablecoin rules to combat money laundering.

- The EU’s AMLA fully operationalized on January 1, 2026, after transferring AML/CFT mandates from EBA to coordinate supervisors.

- Mexico’s 2025 AML reform mandates real estate developers and notaries as obligated entities to report suspicious transactions above 8,000 UMAs.

- U.S. banks and fintechs ramped up investments in real-time AI-driven AML monitoring and compliance programs in 2026.

- FATF expanded its focus on global crypto AML through Recommendation 15 updates and monitoring 30+ jurisdictions in 2025.

- Nigeria exited the FATF grey list in October 2025 after addressing 19 action items on sanctions and beneficial ownership.

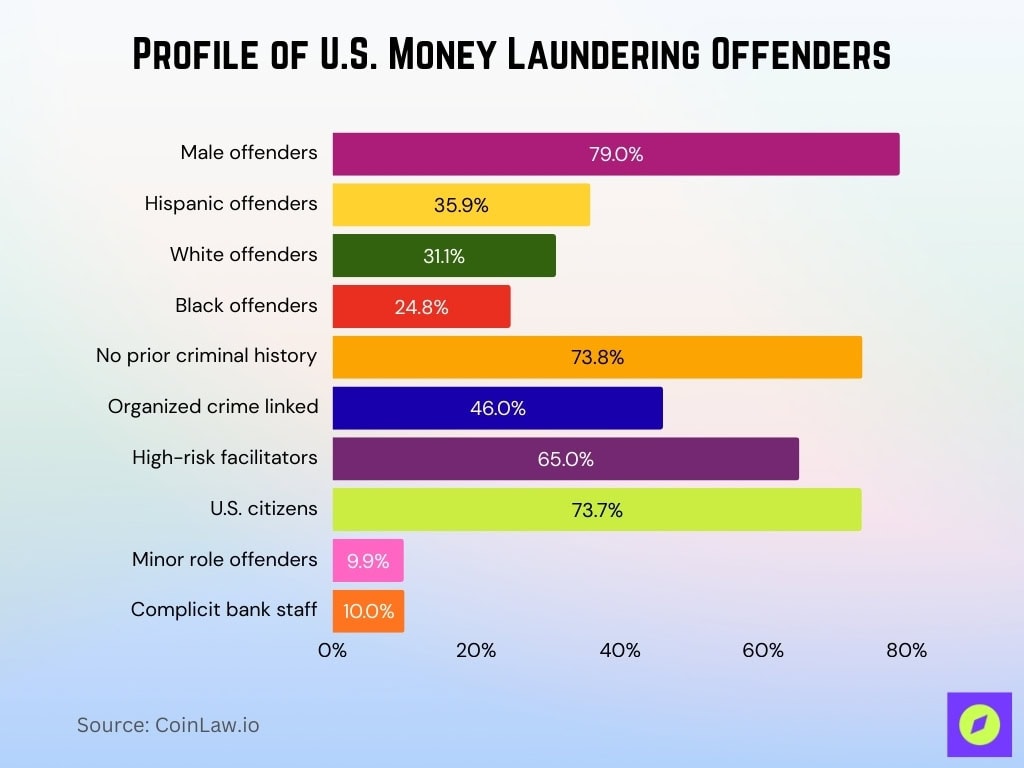

Individual and Offense Characteristics

- 79.0% of U.S.-sentenced money launderers are men.

- The average age of US money launderers stands at 43 years.

- 35.9% of offenders are Hispanic, 31.1% White, 24.8% Black.

- 73.8% have little or no prior criminal history.

- 46% of schemes are tied to organized crime syndicates like the Mafia and cartels.

- Lawyers, accountants, and real estate agents comprise high-risk 65% facilitation roles.

- 73.7% are US citizens among convicted launderers.

- Median loss per US money laundering offense reaches $526,000.

- 9.9% classified as minor role participants in schemes.

- 10% of cases involve complicit bank employees.

Scale of Global Money Laundering Activities

- Asia-Pacific illicit flows reach $1.5 trillion annually, maintaining the highest regional risks.

- United States detects $730 billion laundered yearly through financial systems.

- Drug trafficking accounts for 30–40% of global money laundering cases.

- Global illicit economy valued at over $4 trillion, equivalent to 3-4% of GDP.

- Casinos launder approximately $140 billion in illicit funds each year.

- Tax havens like the British Virgin Islands are involved in 20% of US bank suspicions.

- Global laundered amounts are estimated at $800 billion to $2 trillion annually.

- US AML systems market is projected at $13.54 billion amid rising money laundering threats.

- Organized crime, including laundering, totals up to 3-4% of global GDP.

- China-linked laundering introduces at least $2 trillion of illicit proceeds yearly.

Cryptocurrency and Money Laundering Trends

- Crypto crime reached record highs with 162% YoY increase in illicit activity.

- Sanctions evasion crypto volumes surged over 400% year-over-year.

- Stablecoins comprised 84% of illicit cryptocurrency transaction volume.

- Chinese laundering networks processed $16.1 billion in illicit crypto funds.

- North Korean hackers stole a record $2 billion in cryptocurrency.

- Impersonation scams laundered via DeFi with $17 billion stolen.

- Monero was used to launder $282 million from a major theft in early 2026.

- Huione Group laundered $4 billion in illicit proceeds, including crypto.

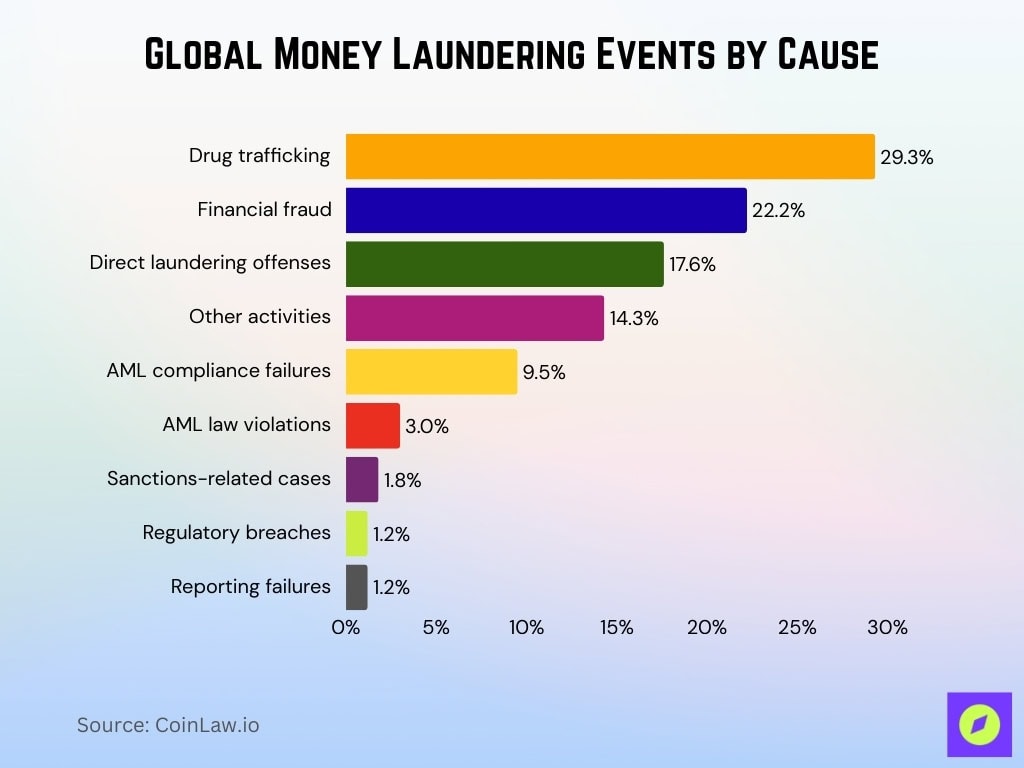

Global Breakdown of Money Laundering Events by Cause

- Drug trafficking accounts for 29.3% of global money laundering events.

- Financial fraud comprises 22.2% of money laundering-related activities.

- Direct money laundering offenses represent 17.6% of cases worldwide.

- Other unspecified activities contribute 14.3% to laundering events.

- AML compliance failures make up 9.5% of incidents.

- Violations of AML laws account for 3.0% of cases.

- International sanctions are involved in 1.8% of money laundering cases.

- Regulatory breaches and reporting failures each at 1.2%.

Punishment and Sentencing for Money Laundering Crimes

- US average sentence for money laundering is 62 months imprisonment.

- 89.8% of US money launderers were sentenced to prison terms.

- EU mandates a minimum 4-year prison term for money laundering convictions.

- UK money launderer sentenced to 6 years 8 months with £5.6 million confiscation.

- China imposes up to life imprisonment for severe money laundering cases.

- Australia sees ASIC 132 new investigations and 23 court actions in early 2025.

- South Africa sets a maximum 5-year imprisonment or R1 million fine.

- US maximum penalty reaches 20 years in prison and a $500,000 fine.

- UK default additional 8 years’ imprisonment for non-payment of confiscation orders.

- US guideline minimum averages 108 months for money laundering offenses.

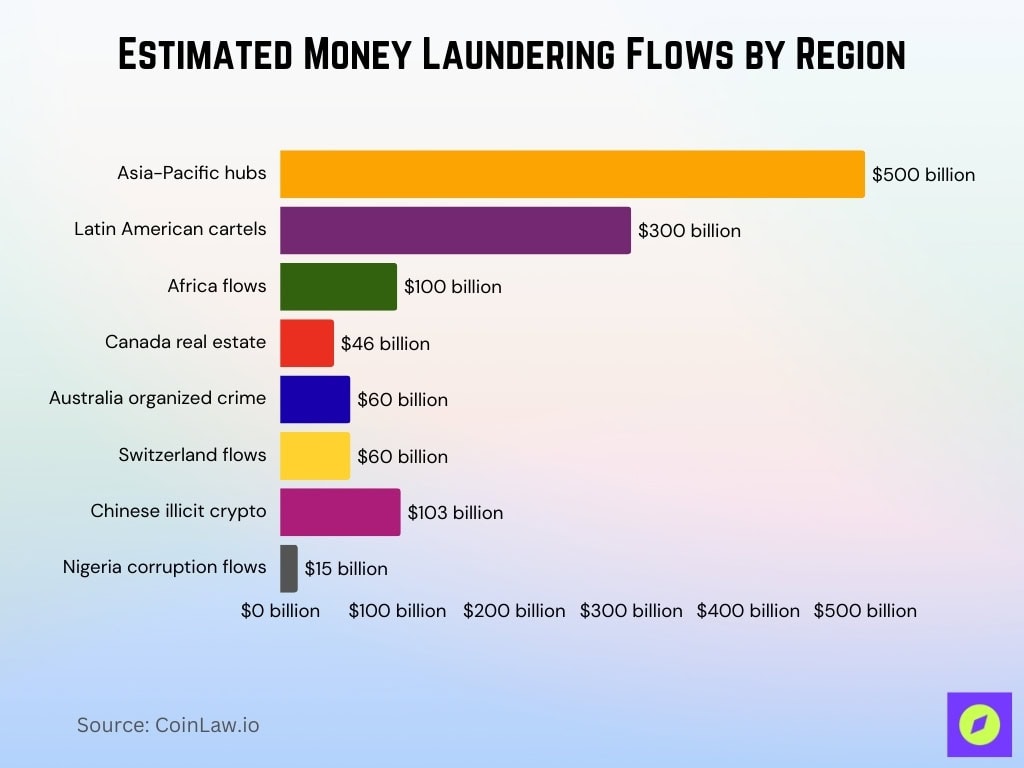

Regional Breakdown of Money Laundering Activities

- Asia-Pacific funnels $500 billion through Hong Kong, Singapore, and Malaysia.

- Latin America drug cartels account for over $300 billion in Colombia and Mexico.

- Africa moves over $100 billion in illicit funds via Nigeria and South Africa.

- Canada reports $46 billion laundered in Vancouver real estate yearly.

- Australia launders approximately $60 billion tied to organized crime.

- Switzerland sees around $60 billion in laundered funds.

- Chinese networks processed $103 billion of illicit crypto in 2025.

- Nigeria channels over $15 billion of corruption-linked laundering yearly.

Money Laundering Issues and Causes

- 65% of countries fail full FATF standards compliance.

- Trade-based money laundering flows $1 trillion yearly.

- Corruption facilitates 40% of laundering in developing countries.

- Lawyers or accountants are involved in 30% of global cases.

- $10 trillion is hidden in offshore tax havens globally.

- TBML comprises 80-85% of global money laundering volume.

- 21 countries are on the FATF grey list for deficiencies.

- China is fully compliant with only 7 of 40 FATF recommendations.

- Institutions face 3,000-5,000 daily false positive alerts.

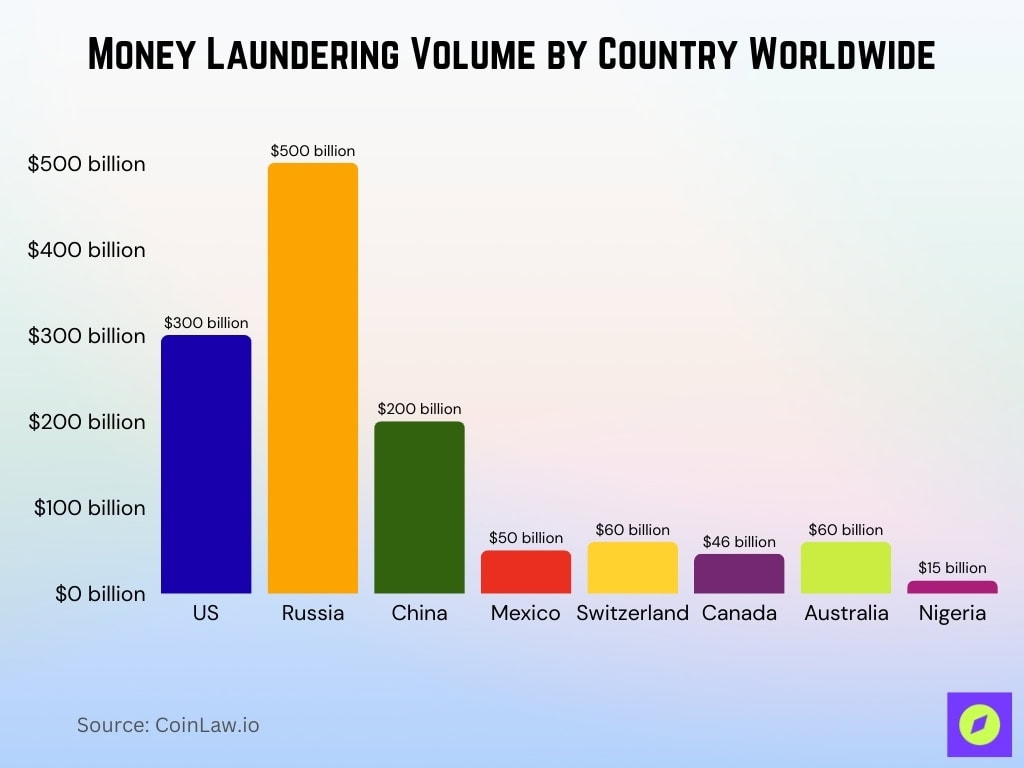

Money Laundering Statistics by Country

- United States launders $300 billion through financial systems annually.

- Russia processes $500 billion in illicit funds yearly via syndicates.

- China launders $200 billion through underground banks and casinos.

- Mexico drug cartels launder $50 billion into real estate yearly.

- Switzerland handles $60 billion in laundered funds despite regulations.

- Canada Vancouver real estate sees $46 billion laundered each year.

- Australia launders $60 billion tied to organized crime annually.

- Nigeria moves over $15 billion of corruption-linked funds yearly.

Government and Financial Sector Responses

- US DOJ imposes $42 million penalties on Brink’s for AML violations.

- UK Operation Machinize 2 freezes over £10 million criminal assets.

- Australia mandates licensing for Digital Asset Platforms from 2025.

- Canada PCMLTFA amendments effective April 1, 2025, adding sectors.

- EU 6AMLD sets a €10,000 uniform cash payment limit.

- China expands AML scope to real estate, lawyers, and accountants.

- FATF grey list drops to 21 countries, including South Africa and Nigeria.

Frequently Asked Questions (FAQs)

Money laundering costs about $5.5 trillion per year worldwide, equal to roughly 5% of global GDP.

Between 2% and 5% of world GDP is estimated to be laundered annually.

That 2–5% equates to roughly $800 billion to $2 trillion+ per year.

An estimated 90% of money laundering goes undetected worldwide.

AML compliance costs banks over $60 billion annually.

Conclusion

Money laundering remains a complex, ever-evolving challenge for governments and financial institutions worldwide. As criminals exploit new technologies and financial systems, the global response must be equally adaptive. With coordinated international efforts, stricter regulations, and advances in technology, there is hope that the gap between laundered funds and recovered assets can be closed. As the data shows, countries, industries, and policymakers must work together to stay ahead of this pervasive issue.