Imagine opening your digital wallet to pay a friend, pay bills, or even invest, all with a few taps on your phone. For millions of people in India, this convenience is brought to life by MobiKwik, a pioneering digital wallet and financial services provider. Launched as an e-wallet in 2009, MobiKwik has evolved, continually expanding its capabilities to offer everything from mobile recharges to insurance, investments, and more. As the company prepares to step further into financial technology, its 2025 journey provides key insights into the dynamics of digital payments and financial inclusivity in India.

With an impressive growth trajectory and a steadfast commitment to innovation, MobiKwik has captured a significant user base while navigating the complexities of the fintech industry. Here, we delve into MobiKwik’s latest financial milestones, growth metrics, and funding rounds, bringing you up to date on its status as a key player in the fintech space.

Editor’s Choice

- MobiKwik added 7 million new users, bringing its total registered user base to 179 million, reflecting a 14.2% YoY growth in 2025.

- MobiKwik shares surged 92% on debut, valuing the company at approximately ₹46 billion ($552 million).

- The company’s $67 million IPO was heavily oversubscribed, with demand over 130 times the shares on offer.

- Payments GMV hit ₹312 billion in Q4 FY25, marking a 197% YoY increase.

- Nine-month Payments GMV reached ₹902 billion, showing a 234% YoY growth in 2025.

- The registered user base reached 179 million as of 2025, with 7 million users added this year.

- MobiKwik’s IPO joined a strong market, with over 340 Indian companies raising $19.2 billion in 2025.

History

- Founding in 2009: MobiKwik was established in 2009 by Bipin Preet Singh and Upasana Taku as a mobile recharge platform. Their vision was to simplify mobile recharges, which quickly grew into a larger fintech vision as India’s digital landscape expanded.

- Shift to Digital Wallets: MobiKwik launched its digital wallet feature, allowing users to store money and make quick payments. This marked its transition from a simple recharge service to a more comprehensive payment platform.

- Strategic Pivot Post-Demonetization: Following India’s demonetization policy, MobiKwik saw rapid adoption as cashless payments surged. It played a pivotal role in promoting digital payments nationwide, benefiting from the government’s Digital India initiative.

- Expanding Financial Services: MobiKwik diversified into other financial services, including personal loans, insurance, and investments. This shift was instrumental in broadening its user base and revenue streams.

- Strengthening Security Protocols: The company enhanced its security frameworks by adopting advanced measures like multi-factor authentication and fraud detection algorithms, aimed at strengthening user trust.

- IPO Preparations: MobiKwik set the stage for an IPO by streamlining its operations and achieving operational profitability. This marked an essential step in its strategy to attract new investors and bolster its market position.

Revenue and Profit Growth

- MobiKwik’s 2025 revenue reached $196 million, marking a 32% YoY growth, fueled by user expansion and investment in product uptake.

- Net profit reported for the full fiscal year 2025, showcasing a major milestone in MobiKwik’s path to profitability.

- Analysts project 28% revenue growth for 2025, driven by strong fintech adoption and increasing user activity.

- EBIT margin improved to 12% in 2025, reflecting enhanced cost discipline and efficient business scaling.

- Non-transaction revenue now makes up 30% of total income, with rising contributions from ads and premium services.

- Operational costs dropped another 10% in 2025, thanks to improved backend systems and smarter infrastructure investments.

- User retention rate remained high at 82%, reflecting continued focus on customer experience and loyalty-building.

Mobikwik Shareholding Breakdown (as per DRHP)

- Bipin Preet Singh, co-founder and CEO, owns 20.21% of the company’s founder control, highlighting strong founder control.

- Upasana Taku, co-founder and COO, controls 14.31%, reinforcing the leadership team’s substantial influence.

- Sequoia Capital India holds 17.25%, representing a major institutional investment in Mobikwik.

- Bajaj Finance owns 13.86%, reflecting significant strategic interest from a financial services giant.

- Net1 Applied Technologies has a 10.79% share, indicating early-stage or long-term backing.

- Bennett, Coleman & Co. Ltd. (BCCL), parent of Times Internet, owns a 1.08% stake, though grouped under “Others” in the chart.

Funding

- MobiKwik has raised over $265 million to date across equity and debt rounds, reflecting strong investor confidence in its growth strategy.

- Major funding rounds include $25M Series B (2015) and $55M Series D (2021), with long-term participation from global investors.

- Key backers include Sequoia Capital, Bajaj Finance, and American Express, who continue to provide strategic and financial support.

- In 2025, MobiKwik raised $70 million in a new round combining equity and debt to boost its lending and wealth-tech services.

- Valuation surpassed $1.2 billion in 2025, maintaining its position as a leading fintech unicorn in the Indian market.

- 40% of funding went to tech upgrades, 35% to lending expansion, and 15% to customer acquisition and brand marketing.

- IPO launched in Q2 2025, opening new growth opportunities and marking a major liquidity event for early investors.

Market Position and User Base

- User Base Milestone: MobiKwik has reached 120 million registered users, a notable achievement reflecting its strong market presence in India’s digital payment ecosystem.

- Active Users: Approximately 30 million active users transact on MobiKwik monthly, with high engagement in services like bill payments, mobile recharges, and investment offerings.

- Geographical Reach: MobiKwik operates across 29 states in India, with a strong presence in both urban and rural regions, catering to diverse demographic needs.

- Market Share in Digital Payments: The company holds an estimated 16% market share in India’s digital payment sector, positioning it among the top players alongside Paytm and PhonePe.

- Mobile App Ratings: The MobiKwik app boasts a 4.3-star rating on Google Play, with over 20 million downloads, reflecting user satisfaction with the platform’s ease of use and reliability.

- Focus on Tier II and Tier III Cities: More than 35% of new users come from Tier II and Tier III cities, driven by MobiKwik’s targeted outreach and localized marketing efforts.

- Retention Rate: The company maintains an 80% retention rate among its active users, showcasing the platform’s appeal and the effectiveness of its user engagement strategies.

Cyber-safety and Security Measures

- MobiKwik employs 256-bit SSL encryption across all services, maintaining one of the highest data security standards in digital payments.

- Two-factor authentication is enabled for 100% of users, ensuring extra protection during logins and transactions.

- AI-based fraud detection reduced fraud by 38% in 2025, using real-time pattern recognition and transaction behavior analysis.

- MobiKwik remains fully compliant with India’s DPDP Act, IT Act, and updated data localization norms for enhanced user protection.

- Quarterly cybersecurity training covers all employees, focusing on emerging threats, phishing tactics, and regulatory updates.

- “Stay Safe Online” campaign reached 22 million users in 2025, promoting password hygiene and phishing awareness.

- ISO 27001 certification renewed in 2025, reaffirming MobiKwik’s global commitment to information security and compliance.

Mobikwik’s Financial Performance Before IPO

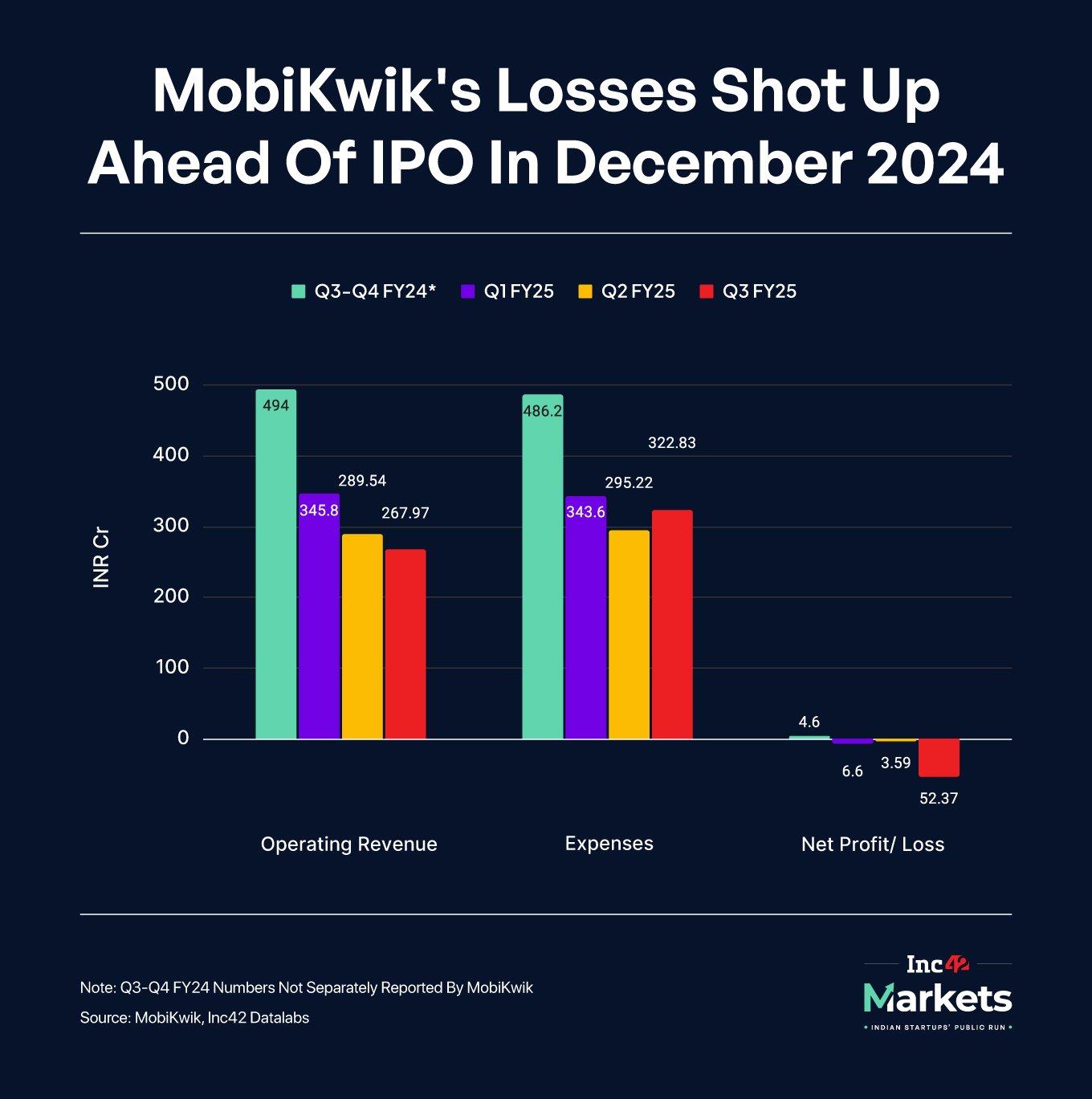

- Operating revenue dropped from ₹494 Cr in Q3–Q4 FY24 to just ₹267.97 Cr in Q3 FY25, showing a steady decline over three quarters.

- Q1 FY25 revenue was ₹345.8 Cr, followed by ₹289.54 Cr in Q2 FY25, continuing the downward trend.

- Expenses also declined but at a slower rate, from ₹486.2 Cr in Q3–Q4 FY24 to ₹322.83 Cr in Q3 FY25.

- Q1 FY25 expenses stood at ₹343.6 Cr, dipping slightly to ₹295.22 Cr in Q2 FY25.

- Net profit/loss flipped significantly, with a ₹4.6 Cr profit in Q1 FY25, followed by losses of ₹6.6 Cr in Q2 and a sharp ₹52.37 Cr loss in Q3 FY25.

- The trend signals rising losses and shrinking margins ahead of Mobikwik’s IPO, especially notable in Q3 FY25’s ₹52.37 Cr loss.

Payment Gateway and Digital Wallet Usage

- Daily Transaction Volume: MobiKwik’s digital wallet processes around 2.5 million transactions daily, making it one of the most frequently used payment solutions in India.

- UPI Transactions: MobiKwik processed 500 million UPI transactions, reflecting the growing preference for the Unified Payments Interface (UPI) among its users.

- QR code-based payments rose by 52% in 2025, with strong uptake among small merchants, kirana stores, and gig workers.

- MobiKwik is now integrated with over 28,000 e-commerce platforms, supporting seamless wallet checkout across major online retailers.

- Bill payments through MobiKwik exceeded $2.7 billion in 2025, led by utility, mobile, and insurance categories.

- Wallet-to-bank transfers account for 18% of daily transactions, showing rising demand for instant fund mobility.

- MobiKwik SuperCash boosted repeat transactions by 26%, proving the effectiveness of reward-led user retention strategies.

Expansion into Financial Services

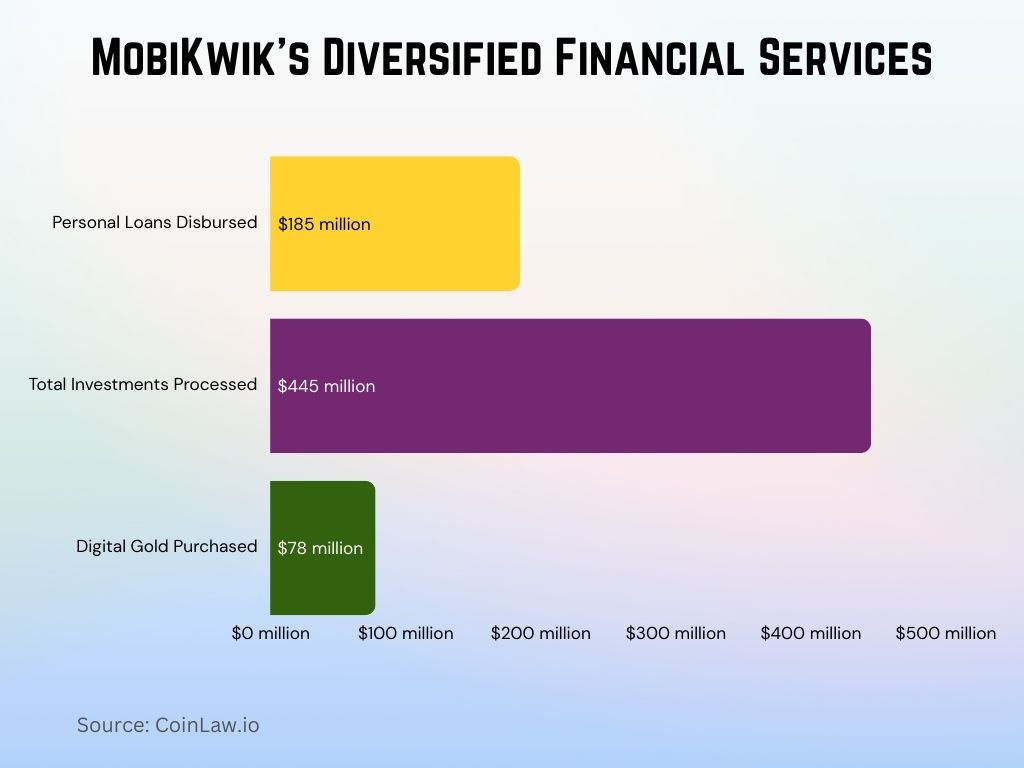

- MobiKwik disbursed over $185 million in personal loans in 2025, with ticket sizes ranging between $50 to $700 across India.

- Micro-insurance policies exceeded 90,000 sales, driven by strong partnerships with top insurers like ICICI Prudential and HDFC Ergo.

- Total investments processed hit $445 million in 2025 across mutual funds, digital gold, and wealth-building products.

- MobiKwik ZIP crossed 1.7 million users in 2025, making it a leading buy-now-pay-later solution in Tier 2 and Tier 3 cities.

- Mutual fund investments from first-time users grew 40%, with most starting at just $1, reinforcing MobiKwik’s financial inclusion push.

- Digital gold purchases reached $78 million, reflecting growing user trust in fractional digital assets for long-term savings.

- Over 27 million users accessed free credit score insights, helping boost financial literacy and encourage healthier borrowing habits.

Speed Bumps for MobiKwik

- The 2021 data breach affecting 100 million users still influences public trust, despite major security enhancements implemented since then.

- MobiKwik continues to face intense competition from PhonePe, Paytm, and GPay, all of which maintain larger user ecosystems.

- RBI’s evolving digital lending rules in 2025 caused a 12% dip in new loan approvals, prompting a strategic shift in credit risk assessment.

- User churn rose by 4% in early 2025, driven by loyalty shifts toward competitors and increased feature overlap.

- Acquisition costs rose 18% YoY in 2025, as intense VC competition made scaling more capital-intensive than projected.

- Tier III merchant adoption remained sluggish, with concerns around transaction fees and onboarding complexity.

- Two major service outages occurred in 2025, attributed to backend scaling challenges during peak UPI traffic, affecting user satisfaction temporarily.

Mobikwik Turns Profitable in FY24: Key Financial Highlights

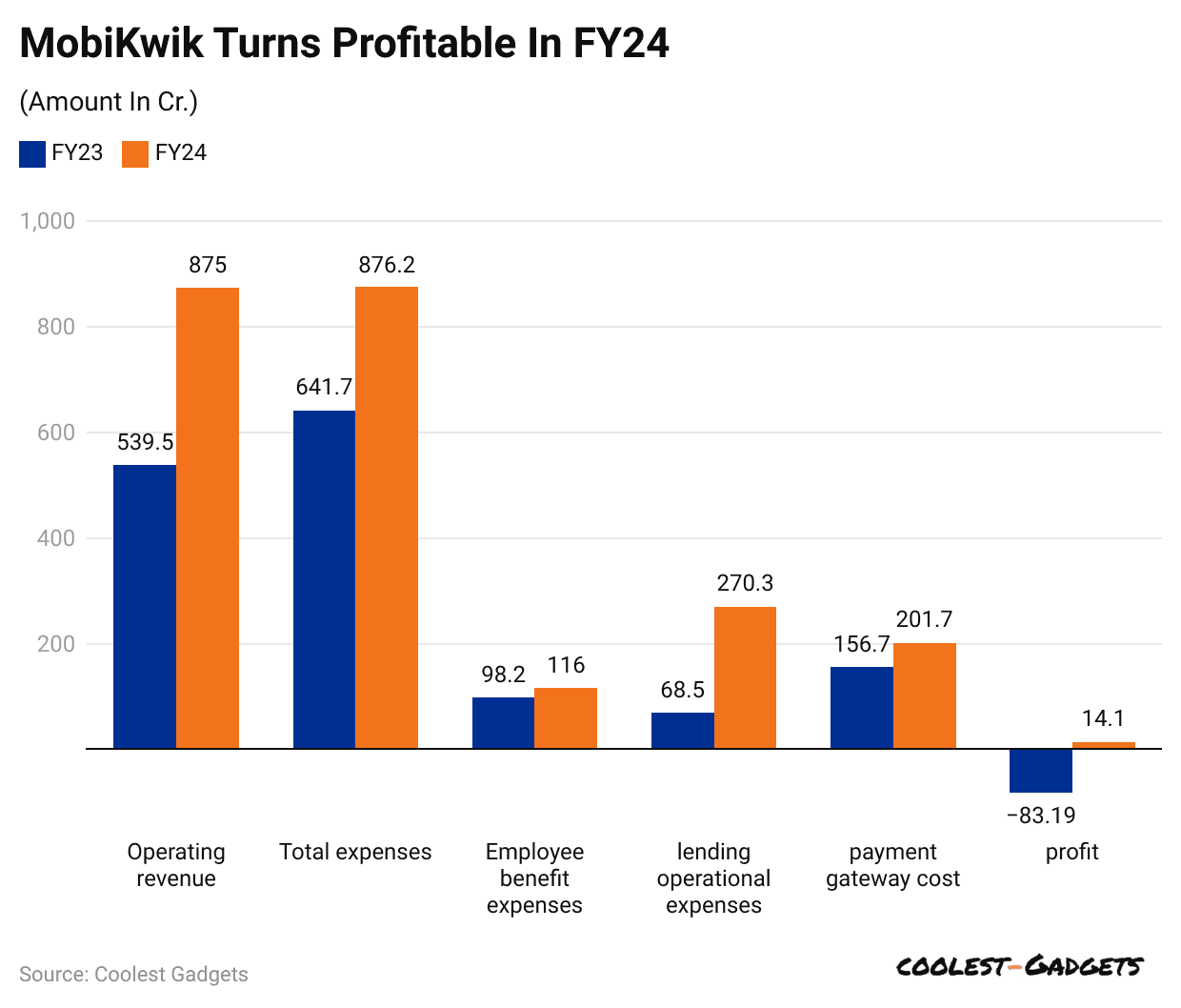

- Operating revenue grew significantly from ₹539.5 Cr in FY23 to ₹875 Cr in FY24, a 62% year-over-year increase.

- Total expenses also surged from ₹641.7 Cr to ₹876.2 Cr, keeping pace with revenue growth.

- Employee benefit expenses rose from ₹98.2 Cr to ₹116 Cr, indicating increased hiring or salary hikes.

- Lending operational expenses saw a sharp spike from ₹68.5 Cr to ₹270.3 Cr, marking a 294% jump.

- Payment gateway costs increased from ₹156.7 Cr to ₹201.7 Cr, reflecting higher transaction volumes.

- Mobikwik swung from a loss of ₹83.19 Cr in FY23 to a profit of ₹14.1 Cr in FY24, showcasing a major financial turnaround.

IPO and Funding Developments

- MobiKwik successfully launched its IPO in Q2 2025, achieving a valuation of $1.65 billion and expanding its public investor base.

- A $70 million pre-IPO funding round was completed in early 2025, attracting participation from both existing and new global investors.

- Sequoia Capital, American Express, and Bajaj Finance remain strong backers, reinforcing long-term investor confidence despite intense market competition.

- In 2025, MobiKwik raised $60 million in debt, further diversifying its funding mix and reducing reliance on equity dilution.

- IPO proceeds are allocated 38% to tech upgrades, 32% to geographic expansion, and 22% to working capital and compliance.

- Valuation surpassed $1.65 billion post-IPO, cementing MobiKwik’s role as a top fintech unicorn in India’s digital finance space.

- Global expansion targets Southeast Asia and MENA, leveraging its wallet, lending, and BNPL infrastructure to enter emerging digital payment markets.

General MobiKwik Statistics and Trends

- Digital lending now contributes 26% of total revenue, reflecting MobiKwik’s strategic expansion in personal finance offerings.

- Monthly active users (MAUs reached 36 million) in early 2025, showing a 20% YoY growth driven by increased user stickiness.

- Transaction fees make up 47% of total revenue, underlining the importance of recurring wallet-based transactions.

- Average transaction value stands at $33, with usage focused on daily utilities, mobile recharges, and merchant QR payments.

- 68% of MobiKwik users are aged 18–35, primarily urban, digital-first millennials seeking fast and flexible payment options.

- 78% of users actively use MobiKwik’s payment services, showcasing strong engagement with the wallet, UPI, and bill pay tools.

- User satisfaction hit 85% in 2025, with speed, simplicity, and rewards ranked as top drivers of loyalty.

Recent Developments

- MobiKwik’s user base reached 179 million in Q2 FY26, with 7 million new users added during the latest quarter.

- The merchant network grew to 4.7 million, with 130,000 new merchants onboarded through aggressive Tier 2–3 outreach.

- Total income hit INR 10,980 million for the nine months ending March 31, 2025, exceeding full FY24 revenue.

- MobiKwik fully rolled out India’s CBDC (e₹) in Jan 2025, becoming the first fintech to support it across all Android users.

- Insurance arm expanded with new licensed subsidiaries, entering insurance aggregation and distribution to strengthen recurring revenue streams.

Conclusion

MobiKwik’s journey from a mobile recharge platform to a fintech leader exemplifies the rapid evolution of digital finance in India. With its upcoming IPO and a user-centric approach to technology and innovation, MobiKwik is setting the stage for further growth. By addressing cybersecurity challenges, expanding into financial services, and forging strategic partnerships, MobiKwik has proven itself resilient in the face of competition and regulatory hurdles. As it moves into 2025 and beyond, the company’s commitment to inclusive financial solutions, combined with a strong focus on user experience, positions MobiKwik as a pioneering force in India’s digital economy. The future holds promising potential for MobiKwik to expand its footprint not only in India but also in emerging markets across the globe.