In a bustling Brooklyn café, twenty-six-year-old Ava uses her smartphone to invest in crypto while her thirty-five-year-old brother, Marcus, logs into his online banking portal to apply for a mortgage refinance. Though just a decade apart, their financial behavior illustrates a generational divide in how banking is experienced and trusted. As 2025 unfolds, the banking industry is witnessing an accelerated transformation driven by evolving expectations from Millennials and Gen Z, the two most influential demographics in today’s financial ecosystem.

Understanding their preferences isn’t just about technology; it’s about values, trust, and the way they want their money to work for them. Let’s break down the trends and stats shaping their choices.

Editor’s Choice

- 92% of Gen Z say they prefer using mobile banking apps over visiting a physical bank branch.

- Millennials are 2.3 times more likely than Gen Z to use traditional banks as their primary financial institution.

- 68% of Gen Z have used a buy-now-pay-later (BNPL) service at least once in the past 12 months.

- Millennials lead in financial product diversity, with 62% owning three or more banking products (e.g., checking, savings, loans).

- Digital-only banks saw a 37% year-over-year growth in Gen Z users in 2025.

- 81% of Millennials cite customer service quality as a top factor in choosing a bank, higher than Gen Z’s 65%.

- Only 14% of Gen Z trust traditional banks “a lot,” compared to 29% of Millennials.

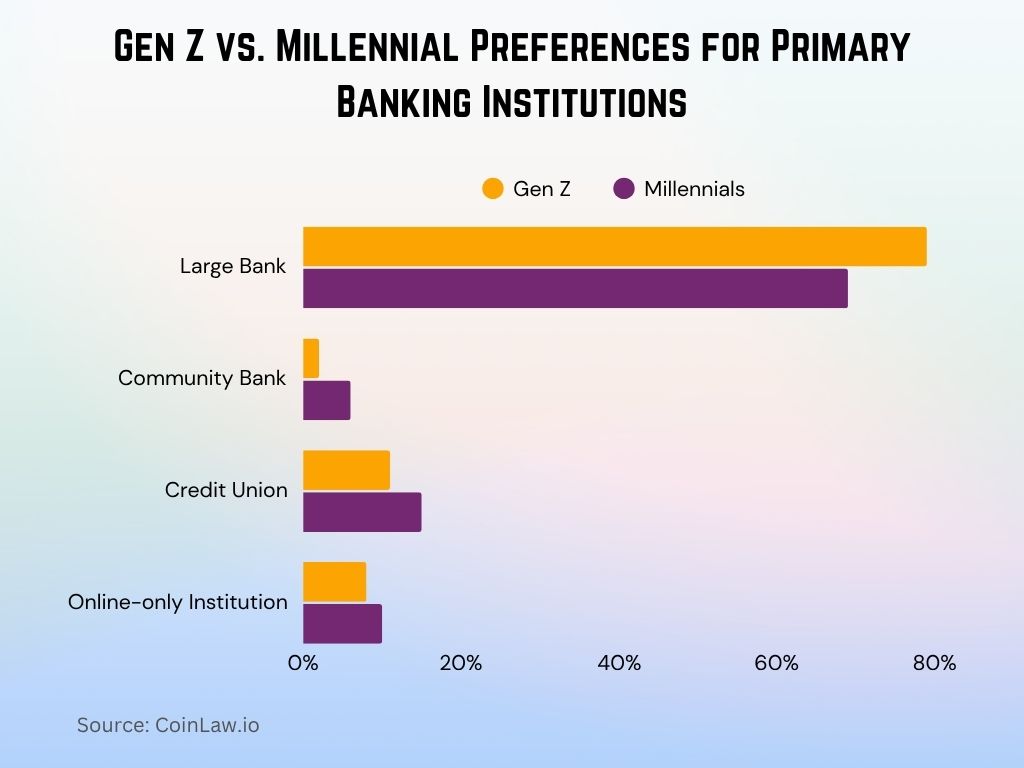

Gen Z vs. Millennial Preferences for Primary Banking Institutions

- Gen Z overwhelmingly prefers large banks, with 79% considering them their primary banking institution. This shows a strong inclination toward well-established financial brands among younger users.

- Millennials are slightly less reliant on large banks, with 69% identifying them as their main institution, 10 percentage points lower than Gen Z.

- Community banks attract only 2% of Gen Z, compared to 6% of Millennials. This suggests that younger generations are less engaged with local banking options.

- Credit unions are more popular among Millennials, with 15% choosing them, while only 11% of Gen Z rely on them as their primary financial institution.

- Online-only banks are favored by 8% of Gen Z and 10% of Millennials, indicating a growing but still moderate shift toward digital-native banking platforms.

Overview of Banking Preferences by Generation

- Millennials (ages 28–43 in 2025) prefer comprehensive banking platforms with robust web and mobile integration.

- Gen Z (ages 13–27 in 2025) lean toward mobile-first, minimalist banking interfaces with instant access to features like spending insights and budgeting.

- 72% of Gen Z would rather open a bank account via app than visit a branch.

- Millennials still value personal finance advice, with 47% stating they prefer speaking to a human for complex issues.

- Gen Z is 1.5 times more likely to use social media to discover new banking products or fintech apps.

- Digital banking satisfaction is slightly higher among Millennials (82%) than Gen Z (76%) due to expectations around app performance.

- 69% of Gen Z users said they’d consider switching banks if eco-friendly practices were not adopted by their current provider.

Digital Banking Adoption Rates

- 95% of Millennials use digital banking at least once a week.

- 89% of Gen Z interact with their bank via smartphone apps, often bypassing desktop platforms altogether.

- The average Gen Z user logs into their mobile banking app 21 times per month, compared to 14 times for Millennials.

- Digital bank account openings by Gen Z increased by 42% from 2024 to 2025.

- Millennials are more likely to use desktop banking for bill payments, while Gen Z prefers app-based automation.

- Gen Z adoption of neobanks (like Chime and N26) reached 61% in 2025.

- Voice banking usage is more prominent among Millennials, with 22% adoption compared to 11% in Gen Z.

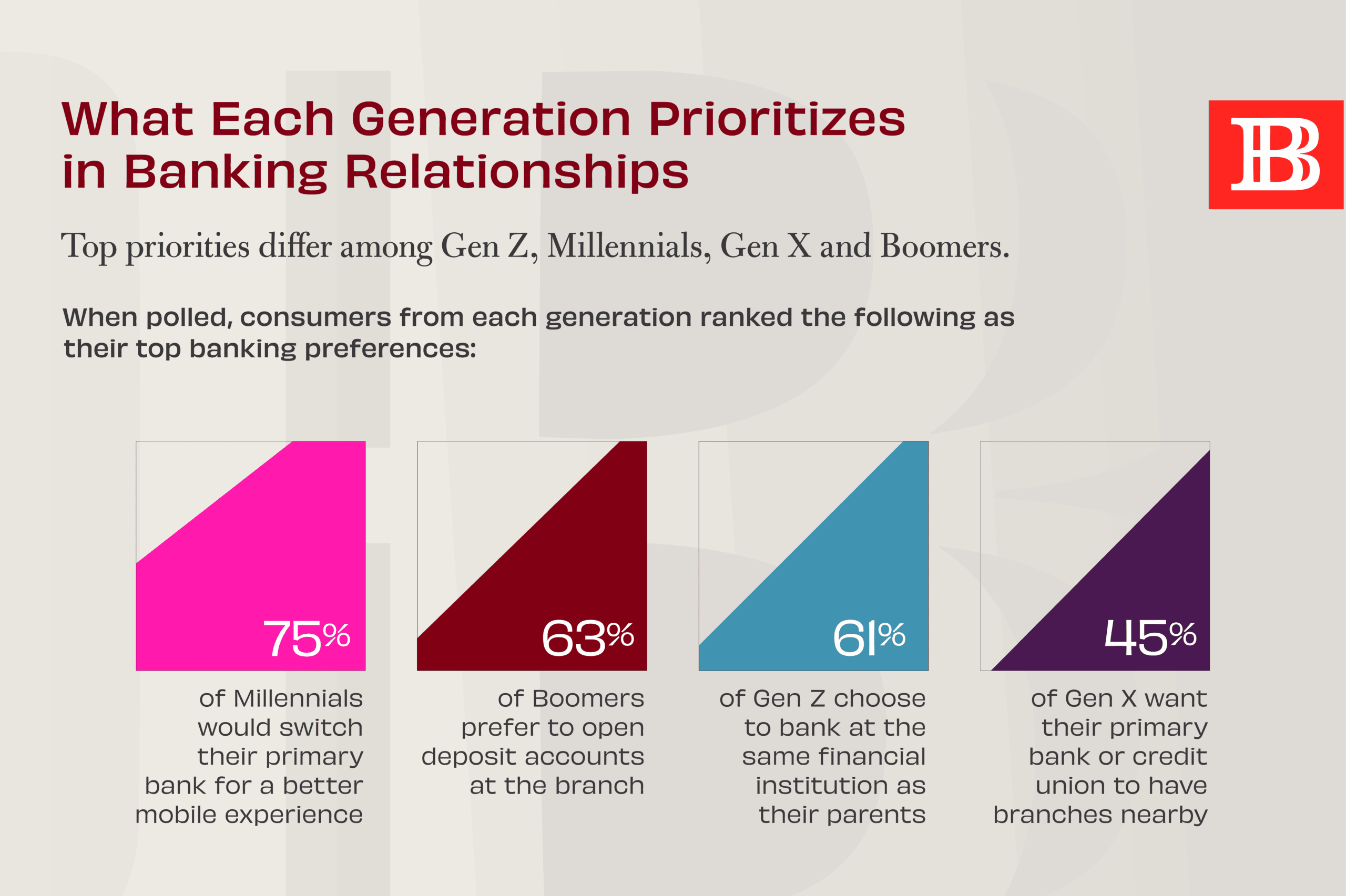

Top Banking Priorities by Generation

- 75% of Millennials would switch banks if offered a better mobile experience, showing their strong preference for digital convenience.

- 63% of Boomers prefer to open deposit accounts in person at a physical branch, highlighting their trust in traditional banking methods.

- 61% of Gen Z tend to bank at the same institution as their parents, indicating a reliance on family influence when choosing a financial provider.

- 45% of Gen X prioritize having nearby branches for their primary bank or credit union, reflecting the importance of accessibility and convenience for this age group.

MobileApp Usage for Financial Services

- Gen Z ranks app user experience as the number one reason for staying with a bank.

- Millennials prefer functional over flashy apps, with 80% prioritizing account management features.

- 74% of Gen Z have enabled app notifications for real-time spending updates.

- Millennials are more likely to use mobile apps for investment tracking, especially for retirement accounts.

- 71% of Gen Z use mobile apps for peer-to-peer (P2P) payments weekly, compared to 53% of Millennials.

- In-app financial education features are used by 33% of Gen Z, compared to only 19% of Millennials.

- Banking app uninstalls among Gen Z are often due to a lack of updates or slow performance, reported by 45% of users.

- Millennials lead in using mobile apps to apply for loans, showing greater comfort with financial planning tools.

Trust in Traditional vs Digital-Only Banks

- Only 16% of Gen Z say they have “a lot of trust” in traditional banks, compared to 30% of Millennials.

- Digital-only banks are trusted more by Gen Z, with 41% rating them as more transparent than legacy institutions.

- Millennials still lean on familiarity, 57% prefer banking with established brands with physical branches.

- Gen Z is 2.7 times more likely to trust a tech company with their money than Millennials.

- 76% of Millennials believe regulations protect their banking interests; Gen Z’s belief sits at 58%.

- When asked who they’d trust more for financial advice, Gen Z was more likely to name influencers, while Millennials preferred bank staff.

- 28% of Gen Z consider their banking relationship “transactional only,” while Millennials value long-term service.

- Security breaches in legacy banks caused 19% of Gen Z to explore switching to a digital bank in 2025.

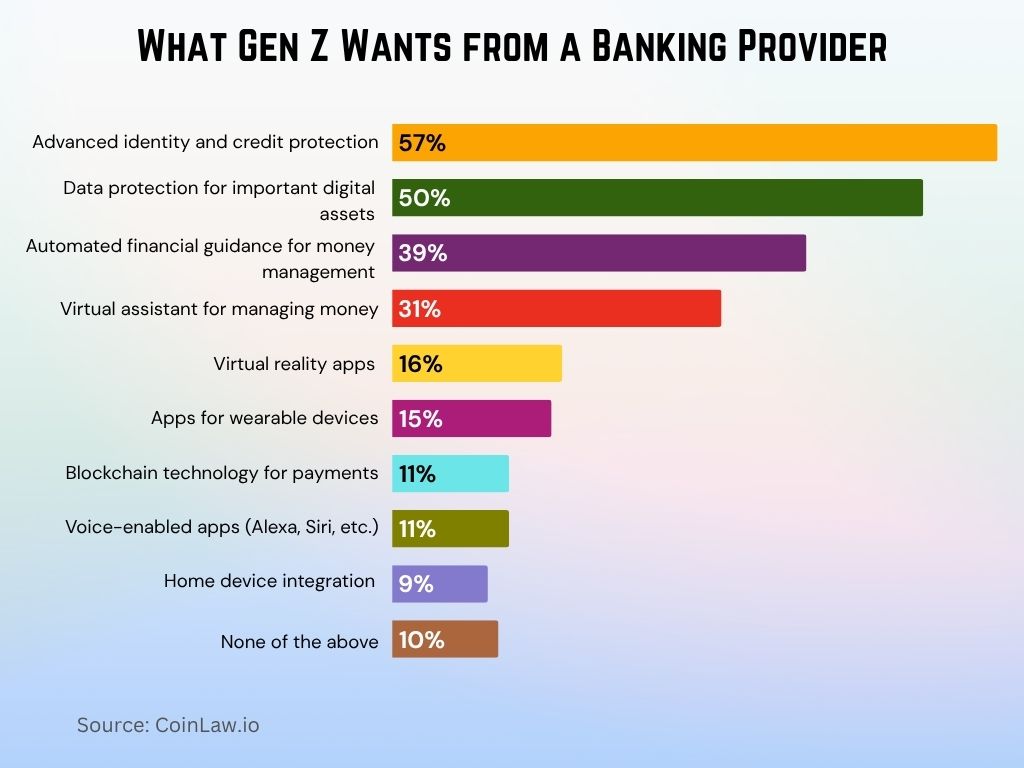

What Gen Z Wants from a Banking Provider

- 57% of Gen Z prioritize advanced identity and credit protection, making security their top concern when choosing a bank.

- 50% are looking for data protection for their most important digital assets, reflecting growing concerns around privacy in the digital age.

- 39% value automated financial guidance, indicating interest in smart tools to help with money management.

- 31% want a virtual assistant to help them manage finances, highlighting a demand for AI-powered banking support.

- 16% are interested in virtual reality apps, showing curiosity about immersive banking experiences.

- 15% want apps compatible with wearable devices, emphasizing their expectation for on-the-go accessibility.

- 11% favor blockchain technology for payments, suggesting early adoption of decentralized finance among younger users.

- Another 11% are drawn to voice-enabled apps like Alexa or Siri for seamless, hands-free banking interactions.

- 9% see value in home device integration, connecting their banking with smart home systems.

- Only 10% said “none of the above”, indicating that most Gen Z users have specific expectations from modern banking services.

Preferred Banking Features and Tools

- Millennials favor comprehensive dashboards, with 65% preferring consolidated views of savings, credit, and investments.

- Gen Z prefers modular tools, especially those offering goal-based savings widgets.

- Round-up savings features are used by 48% of Gen Z, compared to 32% of Millennials.

- 38% of Millennials rely on AI-based financial planning tools, whereas Gen Z uses them mainly for budgeting.

- Custom card designs and instant virtual card issuance are top priorities for Gen Z.

- Millennials value credit monitoring tools and integrated rewards tracking.

- Both groups prefer apps with biometric logins, but Gen Z places greater importance on facial recognition.

- 68% of Gen Z want personalized spending insights directly on the home screen of their banking apps.

Attitudes Toward Financial Literacy and Education

- Millennials are more likely to say they are financially literate, 61% vs. Gen Z’s 44%.

- Gen Z relies heavily on TikTok and YouTube for financial advice, often bypassing formal sources.

- 43% of Millennials have taken at least one financial literacy course or webinar in the past 12 months.

- Only 22% of Gen Z feel confident in managing credit scores or understanding interest rates.

- Banks offering free financial coaching tools saw a 31% increase in Gen Z engagement in 2025.

- Millennials are more likely to use comparison tools for loans and credit cards (56%), while Gen Z prioritizes instant approval rates.

- Gen Z ranks “understanding how to invest” as their top financial education goal for 2025.

- Millennials cite “long-term wealth planning” as their most important area for ongoing learning.

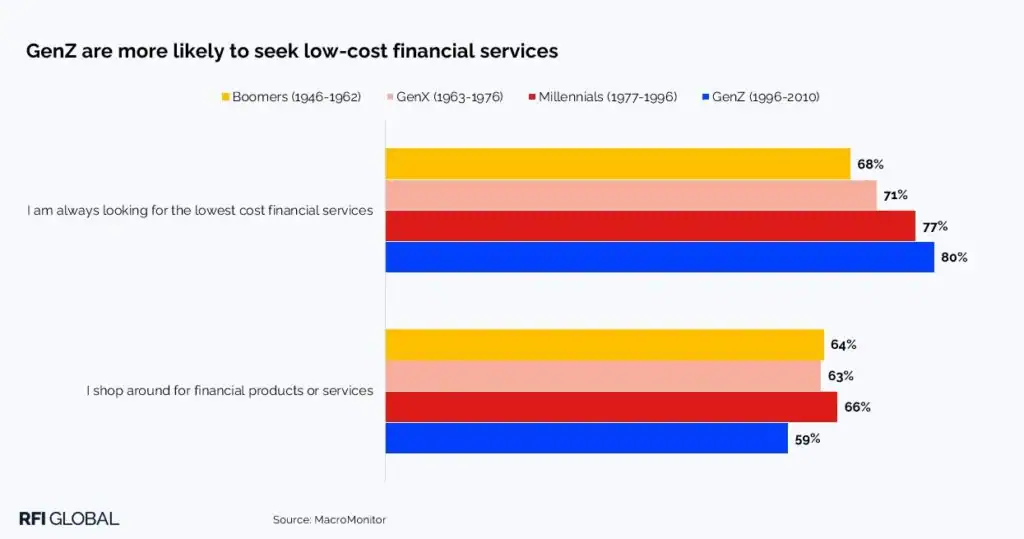

Gen Z Leads the Charge in Seeking Low-Cost Financial Services

- 80% of Gen Z actively look for the lowest cost financial services, making them the most cost-conscious generation surveyed.

- 77% of Millennials also prioritize affordability, showing strong alignment with Gen Z in valuing low-cost banking options.

- 71% of Gen X are on the lookout for low-cost financial services, slightly trailing Millennials.

- 68% of Boomers say they seek out the most affordable services, making them the least driven by cost compared to younger generations.

- When it comes to shopping around for financial products, 66% of Millennials lead the way, highlighting their comparison-focused behavior.

- 64% of Boomers and 63% of Gen X also shop around, showing relatively balanced behavior among older age groups.

- Interestingly, only 59% of Gen Z shop around for financial products despite being the most focused on cost, indicating they may be more brand-loyal once they find a cost-effective option.

Use of Fintech Services and Apps

- 92% of Gen Z have used a fintech app in the past year.

- Millennials average 3.2 fintech apps, while Gen Z averages 4.7 per user.

- Payment apps like Venmo and Cash App remain dominant among Gen Z, with 78% using them weekly.

- Millennials lean toward investment apps like Robinhood and Acorns, with 61% active usage.

- Crypto wallets are owned by 34% of Gen Z, indicating growing comfort with digital assets.

- Millennials are more skeptical of newer fintech brands, citing concerns over security and compliance.

- Gen Z prefers fintechs that integrate with social platforms, enhancing discoverability and peer engagement.

- Open banking APIs are used more by Millennials (24%) than Gen Z (12%) for consolidating financial data.

Customer Service Expectations and Satisfaction

- Millennials prioritize efficiency, with 72% saying fast response times define good banking service.

- Gen Z demands conversational support, expecting chatbots and live agents to be equally intuitive.

- Only 17% of Gen Z are satisfied with call-based support; most prefer messaging platforms or in-app chat.

- Millennials rate in-person service highly, with 39% still visiting branches when solving complex issues.

- Banks with 24/7 digital support report 41% higher satisfaction scores among Gen Z.

- Automated help centers must be intuitive; 48% of Gen Z will switch apps if FAQ or chatbot answers are unclear.

- Millennials are more forgiving of wait times if resolution is thorough; Gen Z demands instant updates.

- Customer service ratings dropped 9% year-over-year among Gen Z in 2025 due to slow app responses.

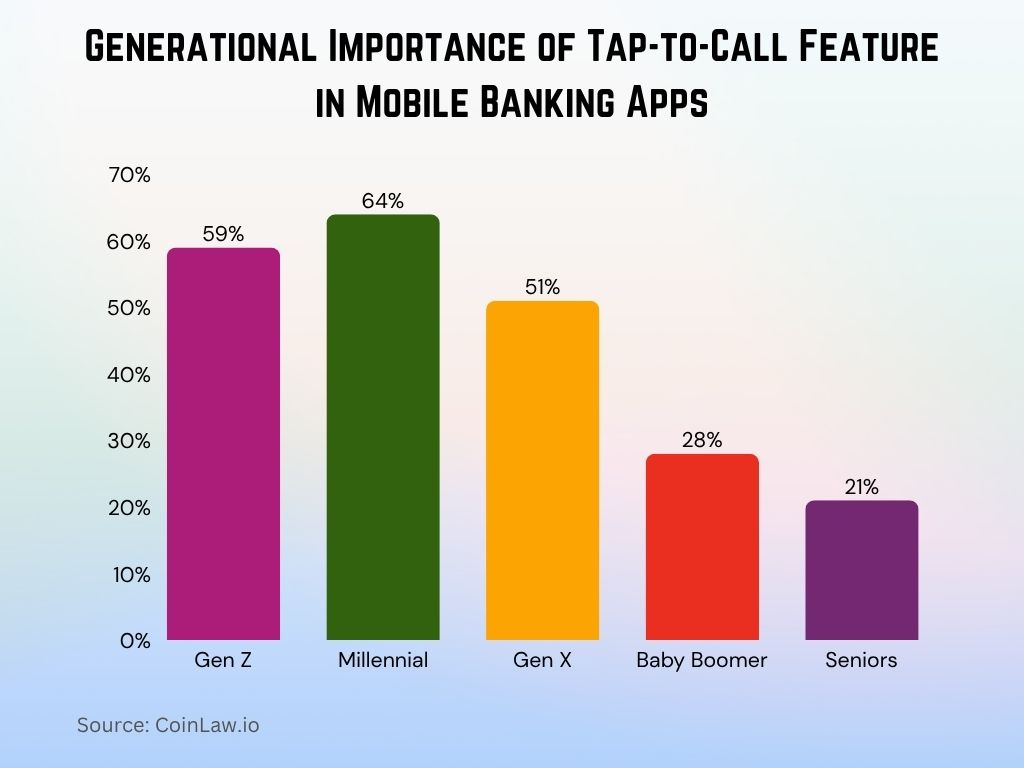

Generational Importance of Tap-to-Call Feature in Mobile Banking Apps

- 64% of Millennials (ages 26–40) consider the ability to tap to call customer service through a mobile banking app as critical or important, making them the most demanding of this feature.

- 59% of Gen Z (ages 21–25) also value this feature highly, reflecting their preference for quick and direct support via mobile.

- 51% of Gen X (ages 41–55) say the tap-to-call option is important, showing moderate reliance on in-app customer support options.

- Only 28% of Baby Boomers (ages 56–75) view this feature as critical, suggesting they may rely more on traditional customer service methods.

- Just 21% of Seniors (ages 76+) find the tap-to-call feature important, indicating a low mobile engagement level in this age group.

Security and Privacy Concerns

- 88% of Millennials cite data security as their top concern when choosing a banking provider.

- Biometric authentication is favored by 73% of Gen Z for everyday transactions.

- Millennials prefer two-factor authentication, especially for high-value actions like wire transfers or loan approvals.

- Only 18% of Gen Z are aware of how their financial data is stored or shared by digital banks.

- Data breaches in fintech apps have led 26% of Gen Z users to revert to traditional banking tools temporarily.

- Millennials trust encryption standards more than Gen Z, who tend to associate trust with app reviews and ratings.

- 39% of Gen Z are likely to delete a banking app after a single security incident, compared to 21% of Millennials.

Social and Ethical Banking Preferences

- 52% of Gen Z are more likely to choose a bank that promotes social justice or environmental causes.

- Millennials value ESG investing tools, with 29% using banks that align with their ethical values.

- Green banking features such as carbon tracking or eco-loans appeal to 47% of Gen Z in 2025.

- Banks with transparent donation matching programs saw a 12% increase in Gen Z accounts.

- Millennials contribute more often to community savings or charity rounds built into banking platforms.

- Banking apps that show carbon footprint data for purchases are used by 32% of Gen Z.

- Both generations agree that financial institutions must go beyond profit and demonstrate impact in 2025.

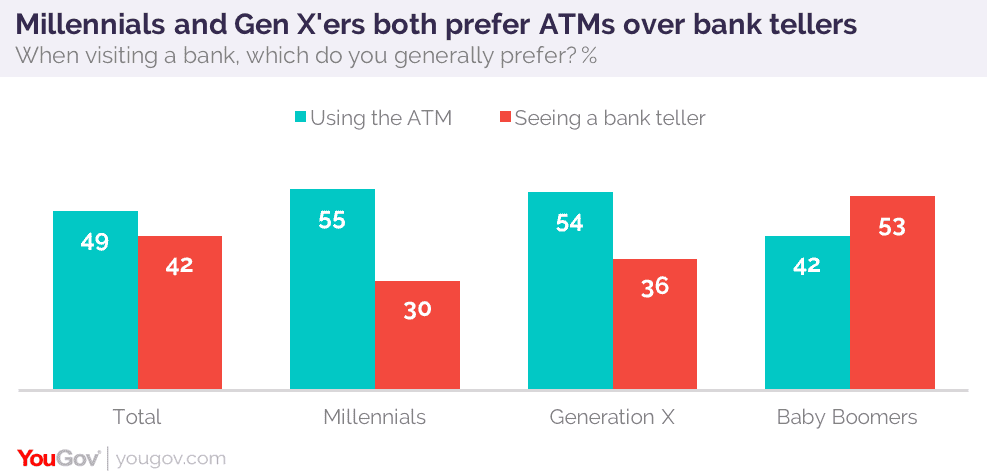

ATM vs. Bank Teller Preferences by Generation

- Millennials prefer ATMs, with 55% choosing them over 30% who prefer seeing a bank teller, highlighting their strong preference for self-service banking.

- 54% of Gen X also favor using ATMs, compared to 36% who prefer interacting with a teller, reflecting a similar trend toward convenience and efficiency.

- Baby Boomers buck the trend, with 53% preferring to see a bank teller and only 42% opting for ATMs, indicating a stronger reliance on in-person service.

- On average, 49% of all respondents favor ATMs, while 42% still prefer bank tellers, suggesting a gradual generational shift toward digital and automated banking options.

Impact of Economic Conditions on Banking Choices

- Gen Z focuses on flexible access to funds, often using payday advance tools and microloans.

- Interest rate volatility influenced 42% of Millennials to lock into fixed-rate products in 2025.

- Only 27% of Gen Z report understanding how rate hikes affect their loan repayments.

- Millennials increased investment in high-yield savings accounts, while Gen Z showed rising interest in crypto alternatives.

- Job insecurity drives 48% of Gen Z to prioritize banks with low or no account maintenance fees.

- Millennials are refinancing more, especially mortgages and personal loans, in response to shifting economic landscapes.

- Bank-switching due to fee structures grew 17% in Gen Z between 2024 and 2025.

Brand Loyalty and Bank Switching Behavior

- Gen Z exhibits low brand loyalty, with 61% switching banks in the past two years.

- Millennials stay longer, and only 28% changed their primary bank over the same period.

- Referral incentives and social proof are top motivators for Gen Z to switch.

- Millennials prioritize better financial products and improved service levels when considering switching.

- 67% of Gen Z would switch to a bank offering early paycheck access, compared to 39% of Millennials.

- Bank apps with gamification features increase retention among Gen Z by 24%.

- Millennials trust financial institutions with legacy and brand history, even if digital offerings lag slightly.

- Gen Z expects banks to evolve constantly, with 47% rating updates and new features as a trust factor.

Recent Developments in Gen Z and Millennial Banking Trends

- Embedded finance is rising, with Gen Z preferring to access banking features via non-bank platforms like ride-share or gaming apps.

- Millennials are adopting hybrid banking, combining traditional and digital tools to balance service and convenience.

- AI-based financial advice tools saw 54% adoption among Millennials, especially for portfolio diversification.

- Gen Z uses finance as a lifestyle choice, often aligning with brands that reflect their values and tech preferences.

- Banks are launching creator-specific financial products to tap into Gen Z’s gig and influencer economy.

- Millennials are driving the surge in demand for robo-advisors, particularly for retirement planning.

- 2025 saw a 33% rise in co-branded financial services, targeting Gen Z through partnerships with music, sports, and fashion brands.

- Real-time notifications and smart budgeting tools are becoming must-haves for both generations.

Conclusion

Millennials and Gen Z are redefining what banking looks like in 2025, not just in terms of technology, but in values, service expectations, and financial behaviors. Where Millennials prize stability, comprehensive features, and customer service, Gen Z craves agility, social alignment, and ultra-personalized digital experiences. For financial institutions, thriving in this landscape means not only embracing innovation but also building meaningful, trust-based relationships that evolve with these next-generation consumers.