In recent years, the microfinance industry has been pivotal in providing financial services to underserved communities, transforming the lives of millions worldwide. With small loans, savings accounts, and other financial products, microfinance institutions (MFIs) aim to bring financial stability and growth opportunities to individuals who lack access to traditional banking. As we step into 2025, the microfinance sector is poised for continued growth and innovation. This article explores key milestones, market forecasts, and critical data that illustrate the evolving role of microfinance in promoting financial inclusion and economic development worldwide.

Editor’s Choice

- Market analysts project a continued robust growth pattern for the microfinance sector, anticipating a market size of $524.84 billion by 2031, progressing at a CAGR of 10.5%.

- Individual loans made in microfinancing may be small, but they play a significant role in the global economy. The total market size of microfinancing was valued at $215.51 billion in 2024.

- The SBA issued approximately $94 million in microloans, with an average loan size of about $16,200.

- More than 5,800 loans were issued, with approximately 34% going to Black-owned businesses and 14% to Latino-owned businesses.

- Remittance services are now offered by 40% of microfinance institutions, facilitating secure and affordable fund transfers, especially for rural populations.

- The rise of digital wallets for microfinance transactions is forecasted to grow by 30% annually, driven by smartphone penetration in developing markets.

- Peer-to-peer (P2P) lending in microfinance has seen a surge, with P2P platforms growing by 15% annually as alternative financing gains popularity.

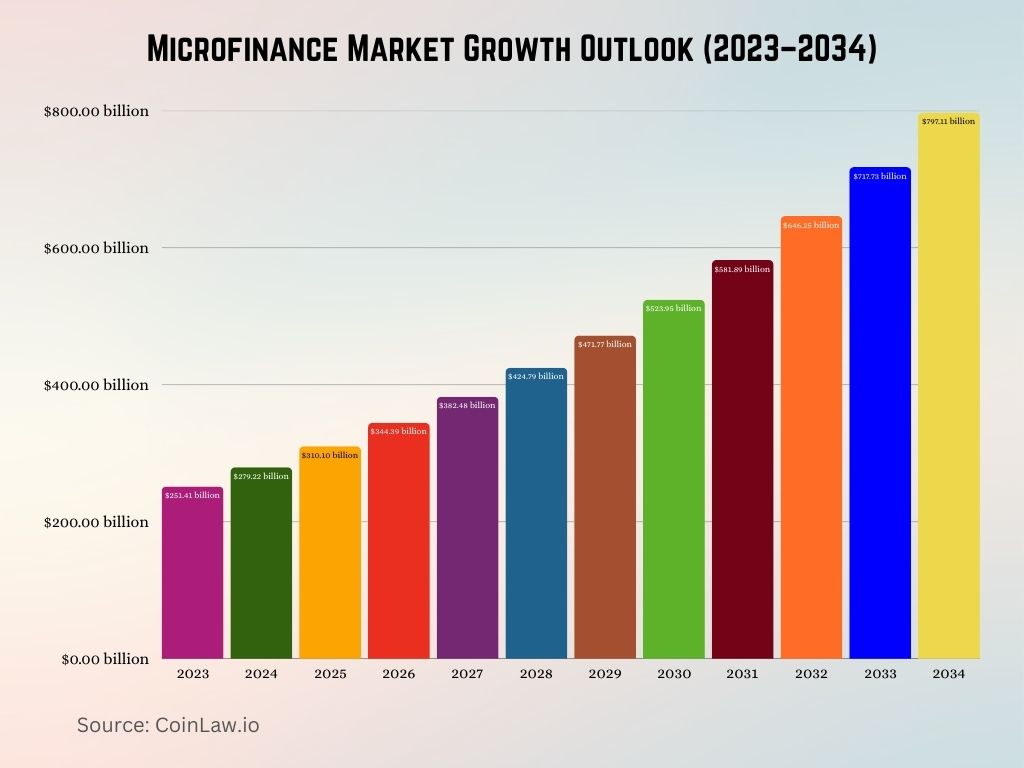

Microfinance Market Size Forecast (2023–2034)

- The global microfinance market is projected to grow consistently from 2023 to 2034, driven by rising financial inclusion and demand for small-scale lending solutions.

- In 2023, the market size was valued at $251.41 billion.

- By 2024, it is expected to grow to $279.22 billion, and then to $310.10 billion in 2025.

- The market is set to surpass the $400 billion mark by 2028, with an estimated size of $424.79 billion.

- A notable jump is forecasted in 2029, with the market reaching $471.77 billion, followed by $523.95 billion in 2030.

- Continued growth is expected into the 2030s:

- $581.89 billion in 2031

- $646.25 billion in 2032

- $717.73 billion in 2033

- By 2034, the global microfinance market is projected to reach a substantial $797.11 billion, more than tripling its 2023 value.

- This upward trend underscores the critical role of microfinance in empowering small businesses, individual entrepreneurs, and underserved populations around the world.

Regional Insights and Analysis

- South Asia remains the largest microfinance market, with India alone accounting for nearly 35% of global microfinance clients in 2023.

- Sub-Saharan Africa saw a significant 15% growth in microfinance outreach in 2023, with Kenya and Uganda as leading contributors.

- Latin America has a diverse microfinance landscape, with Brazil and Mexico holding over 50% of the region’s total microfinance portfolio.

- The Middle East and North Africa (MENA) region lags in microfinance penetration, but significant growth is expected due to new government initiatives and policies aimed at financial inclusion.

- Eastern Europe and Central Asia have a well-established microfinance market, with a 9% growth rate in 2023, led by countries like Georgia and Armenia.

- Southeast Asia, particularly the Philippines and Indonesia, saw a 20% increase in microfinance digital adoption in 2023, enhancing accessibility for remote populations.

- North America has a relatively small microfinance market, but U.S.-based microfinance programs have expanded, with $4 billion in loans provided to small businesses and underserved communities in 2023.

| Region | Notable Data Points | 2023 Growth (%) |

| Sub-Saharan Africa | Kenya, Uganda drive 15% growth | 15% |

| Eastern Europe & Central Asia | Led by Georgia, Armenia, 9% growth | 9% |

| Southeast Asia | Philippines, Indonesia digital adoption grew 20% | 20% |

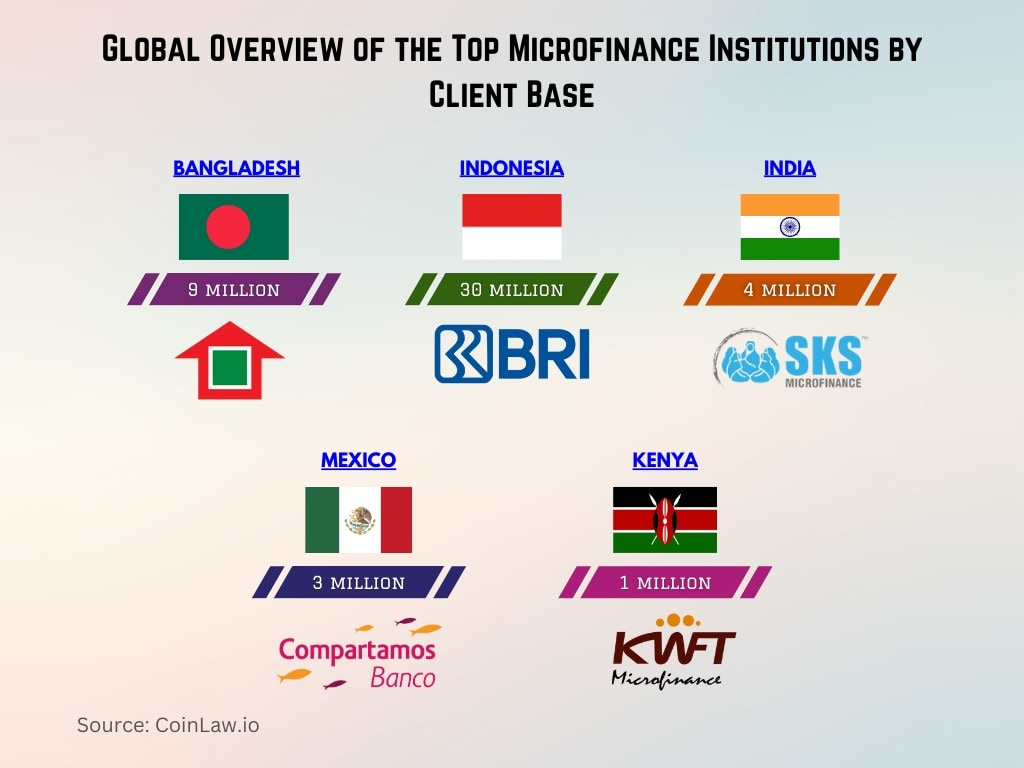

Key Companies & Market Share Insights

- Grameen Bank remains one of the largest MFIs globally, servicing 9 million clients and holding a market share of 4% in 2023, particularly in Bangladesh and Asia.

- BancoSol, Bolivia’s premier microfinance institution, reached $1.5 billion in loan portfolios, representing 3% of the Latin American microfinance market.

- Bank Rakyat Indonesia (BRI), known for its microfinance operations, controls 40% of Indonesia’s microfinance sector, serving 30 million clients nationwide.

- SKS Microfinance in India grew its loan book by 12% in 2023, serving approximately 4 million clients across rural India.

- Equitas Small Finance Bank, also based in India, expanded its client base by 10% and now holds a 2% market share in the broader South Asian microfinance market.

- Compartamos Banco in Mexico, one of Latin America’s leading MFIs, reached $1 billion in loan disbursements in 2023, serving over 3 million borrowers.

- In Africa, KWFT Microfinance Bank in Kenya expanded its loan portfolio by 15% and now serves over 1 million clients, making it one of the continent’s leading institutions.

Microfinance’s Role in Bridging Financial Inclusion

- 2 billion people worldwide remain unbanked, and microfinance institutions are addressing this gap, particularly in rural and remote areas.

- Microfinance products such as micro-savings and micro-insurance have enabled over 50 million low-income individuals to safeguard and grow their assets as of 2023.

- The introduction of digital financial services has accelerated financial inclusion, with digital loans accounting for 25% of total microfinance disbursements in 2023.

- Gender-focused microfinance programs have helped empower women by making up 70% of the total microfinance client base, enhancing their economic stability.

- Microfinance loans have helped create over 20 million jobs globally, particularly for small business owners and entrepreneurs in low-income communities.

- Through financial literacy programs, MFIs have educated over 10 million people about money management, enabling them to make informed financial decisions.

- In post-conflict and disaster areas, microfinance has played a critical role in economic recovery, providing over $5 billion in loans for rebuilding efforts over the past decade.

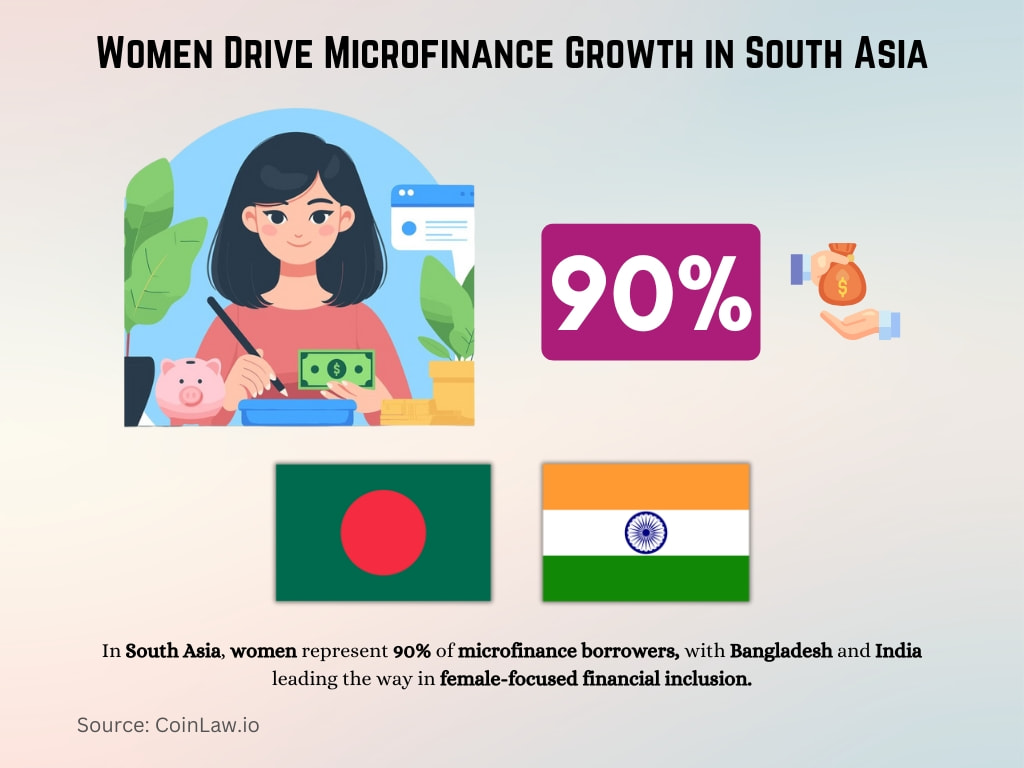

Gender and Microfinance: New Insights

- Women constitute 80% of microfinance clients as MFIs prioritize lending to female entrepreneurs, a segment that has shown high repayment reliability.

- In South Asia, women represent 90% of microfinance borrowers, with Bangladesh and India leading the way in female-focused financial inclusion.

- A study from 2023 revealed that women-led businesses financed by MFIs reported 12% higher growth rates compared to their male counterparts.

- Microloans have directly supported over 100 million women globally, empowering them to start or expand their businesses.

- Interest rates for women-led enterprises in microfinance are often 5-10% lower than for other borrowers, incentivizing female entrepreneurship.

- Financial literacy training provided by MFIs has helped improve money management skills for over 15 million women worldwide.

- In Latin America, 40% of women who received microloans successfully transitioned from informal to formal employment, boosting economic empowerment.

Client Demographics and Outreach

- Microfinance client demographics show that 65% of clients are under the age of 35, indicating a youthful user base eager for economic opportunities.

- Nearly 50% of microfinance clients come from rural areas, where traditional banking infrastructure is limited or nonexistent.

- Youth-focused microfinance programs have grown by 15% in 2023, helping young entrepreneurs launch startups in developing economies.

- Low-income individuals make up 80% of microfinance borrowers, illustrating the sector’s focus on serving financially vulnerable communities.

- In urban areas, microfinance serves small-scale entrepreneurs, with 35% of borrowers using funds for retail or trade businesses.

- Agricultural loans represent 30% of all microfinance products, supporting farmers and agribusinesses in regions where agriculture is a primary livelihood.

- In Sub-Saharan Africa, 85% of microfinance clients rely on their loans for agriculture-related activities, fostering local food security and business growth.

Global Performance of Microfinance Institutions

- The loan repayment rate across global microfinance institutions (MFIs) remains high, averaging 96%, which underscores borrowers’ commitment and reliability.

- In 2023, microfinance institutions provided $130 billion in loans globally, helping millions in low-income brackets to gain economic independence.

- Asian MFIs continue to dominate the sector, with over 60% of global microfinance assets, largely driven by India and Bangladesh.

- Latin America and the Caribbean hold a substantial 16% share of the microfinance market, with Mexico and Bolivia leading in loan disbursement volumes.

- In Sub-Saharan Africa, microfinance institutions served 18 million clients in 2023, a 12% increase from the previous year.

- Europe and Central Asia represent around 6% of the global microfinance portfolio, with Eastern Europe showing a steady 8% growth in micro-lending services.

- By 2024, digital micro-lending is expected to grow by 30% globally, with countries like Kenya and India leading in mobile-based financial services.

Financial Products and Services Offered

- Micro-loans are the most widely offered product, with average loan amounts varying between $100 and $2,000 depending on the region and client profile.

- Micro-savings accounts have gained popularity, with over 50 million accounts opened in 2023, enabling clients to secure small amounts for future use.

- Micro-insurance products, primarily covering health and agriculture, reached 25 million policyholders worldwide in 2023.

- The introduction of micro-pensions has provided a long-term savings solution for over 2 million clients, primarily in South Asia.

- Remittance services are now offered by 40% of MFIs, facilitating the secure and affordable transfer of funds, especially for rural populations.

- In Africa, solar energy micro-leasing is on the rise, allowing clients to pay for renewable energy solutions in small installments.

- Education loans tailored to low-income families grew by 10% in 2023, helping students access quality education and future job opportunities.

Microfinance Market Dynamics and Trends

- Digital transformation in microfinance has led to a 25% increase in online loan applications in 2023, especially among younger clients.

- Blockchain technology is being tested by select MFIs to enhance transparency and security, aiming to improve trust among clients and investors.

- The rise of digital wallets for microfinance transactions is forecasted to grow by 30% annually, driven by smartphone penetration in developing markets.

- Environmental, Social, and Governance (ESG) practices are gaining prominence in microfinance, with 50% of institutions integrating ESG metrics into their operations.

- Peer-to-peer (P2P) lending in microfinance has seen a surge, with P2P platforms growing by 15% annually as alternative financing gains popularity.

- Youth-targeted micro-loans are expanding, with 60% of MFIs offering customized loan packages for young entrepreneurs by the end of 2023.

- The impact investing trend in microfinance is rising, with investors increasingly looking to fund socially responsible MFIs that contribute to poverty reduction.

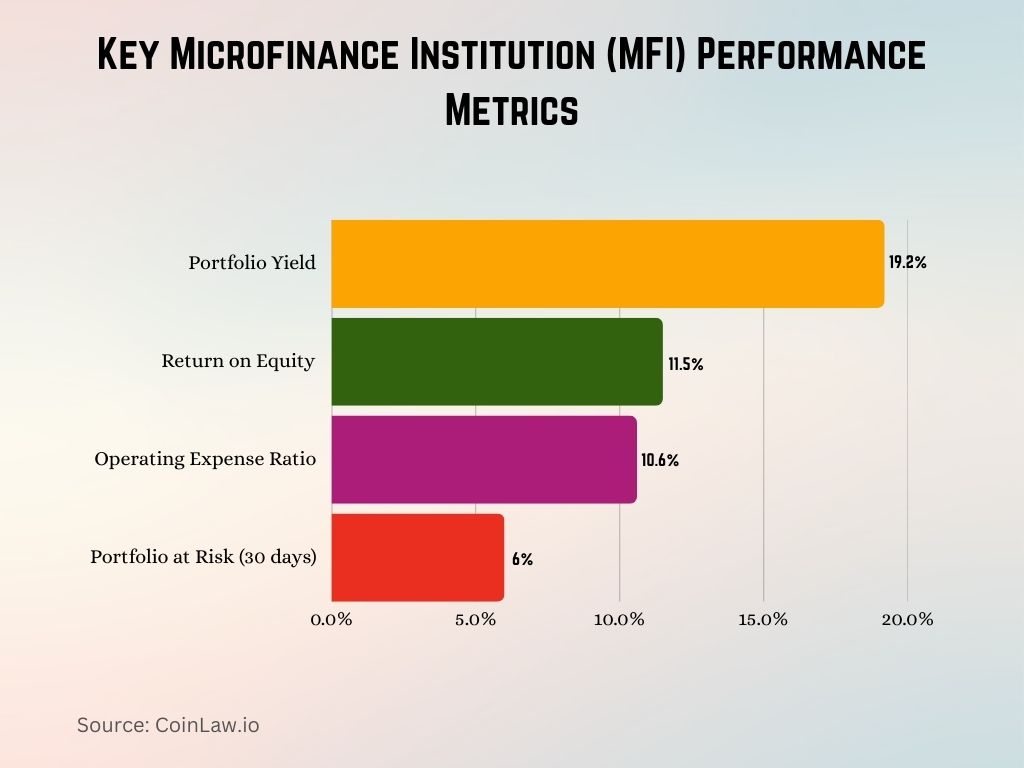

Key Microfinance Institution (MFI) Performance Metrics

- In 2017, the average performance ratio for MFIs revealed valuable insights into operational and financial efficiency.

- Portfolio Yield was the highest among the key metrics, standing at 19.2%, reflecting the income generated from lending activities.

- Return on Equity (ROE) was 11.5%, indicating a strong ability of MFIs to generate profit from shareholders’ equity.

- The Operating Expense Ratio was 10.6%, showing the proportion of income spent on operating costs, a key indicator of cost-efficiency.

- Portfolio at Risk (30 days) stood at 6.0%, measuring the percentage of the loan portfolio that was overdue by 30 days or more, a critical risk indicator.

- These figures underline the financial health and risk management efficiency of MFIs in 2017, offering benchmarks for future performance assessments.

Challenges and Risks in the Microfinance Sector

- High operational costs remain a significant challenge as MFIs struggle with expenses related to lending in remote areas without digital infrastructure.

- The over-indebtedness of clients is an increasing concern, with 10% of microfinance borrowers in some regions taking multiple loans to cover existing debts.

- The risk of loan defaults is higher in volatile economies, particularly in regions facing political or economic instability, impacting MFIs’ financial stability.

- Interest rate caps in some countries have squeezed MFI margins, making it difficult for institutions to cover their operational costs sustainably.

- Regulatory pressures are mounting as governments worldwide are implementing stricter compliance requirements for microfinance operations.

- Climate change poses a unique risk, especially for agricultural clients who face crop loss or damage due to extreme weather, affecting their ability to repay loans.

- Data privacy and security have become urgent issues as digital microfinance grows, with MFIs needing to invest in robust cybersecurity measures.

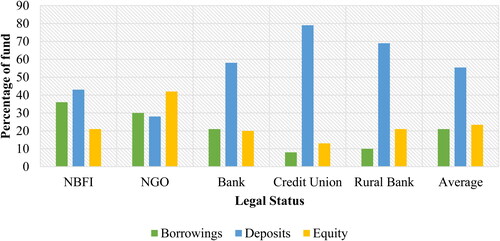

Sources of Funds by Legal Status of Microfinance Institutions

- Credit Unions rely most heavily on deposits, with 80% of their funding coming from this source.

- Rural Banks also depend largely on deposits, making up 70% of their total funds.

- Banks fund themselves through a mix, with 60% from deposits and 25% from borrowings.

- NGOs depend the most on equity, which accounts for 50% of their funding.

- NBFIs (Non-Banking Financial Institutions) have a more balanced mix, with 40% from borrowings and 50% from deposits.

- On average, microfinance institutions source 55% of funds from deposits, 30% from equity, and 25% from borrowings.

Recent Developments

- Regulatory Adjustments in India: The Reserve Bank of India (RBI) has reduced risk weight requirements for consumer microfinance loans by 25 percentage points, reverting to pre-2023 levels. This move aims to ease lending and stimulate growth in the microfinance sector.

- Market Growth Projections: The global microfinance market is projected to grow from $215.51 billion in 2024 to $240.49 billion in 2025, reflecting a compound annual growth rate (CAGR) of 11.6%. This growth underscores the increasing demand for microfinance services worldwide.

- Technological Innovations: Microfinance institutions are increasingly adopting digital platforms, mobile banking, and AI-driven credit assessments to enhance service delivery and operational efficiency. These technologies enable better client outreach and streamlined processes.

- Asset Quality Concerns: Indian banks have reported rising non-performing assets (NPAs) in the microfinance sector, leading to increased provisions for potential losses. This trend highlights the need for robust risk management practices within microfinance lending.

- Financial Inclusion Initiatives: Efforts to expand financial services to underserved populations continue to gain momentum, with microfinance playing a pivotal role in promoting economic development and reducing poverty.

Conclusion

As microfinance continues to grow, it plays a crucial role in empowering individuals, supporting small businesses, and driving economic development in regions lacking traditional financial services. With a strong trend toward digital transformation, the sector is expanding its reach and accessibility, especially among rural and unbanked populations. However, MFIs face challenges like operational costs, regulatory pressures, and the risk of client over-indebtedness. Moving forward, innovations such as blockchain, AI-based credit scoring, and mobile-based financial services promise to reshape the microfinance landscape. As these institutions adapt to evolving demands and technologies, the microfinance industry is set to make a lasting impact on global financial inclusion efforts.