The crypto industry has long been compared to the Wild West, unregulated, unpredictable, and filled with both opportunity and risk. But as the digital asset market matures, so does the need for clear and consistent regulation. Enter MiCA (Markets in Crypto-Assets Regulation), the European Union’s landmark framework designed to bring order to the digital asset space.

As the deadline for MiCA compliance looms, businesses, exchanges, and asset managers are racing to align with its strict requirements. While some see it as a necessary step toward stability, others worry about the cost of compliance and its impact on innovation.

Editor’s Choice

- Over 65% of EU crypto firms were MiCA-compliant by early 2025.

- 42% of crypto firms expect compliance costs to exceed €500,000 annually.

- 70% of EU exchanges believe MiCA will strengthen investor confidence.

- 42% of blockchain startups in the EU fear MiCA will slow innovation.

- 78% of institutional investors view MiCA as a positive development.

- 30% of non-EU crypto firms plan to exit European markets due to stricter rules.

- Fines for noncompliance can reach €5.6 million or 10% of annual turnover.

- MiCA became fully applicable in December 2024, with active enforcement in 2025.

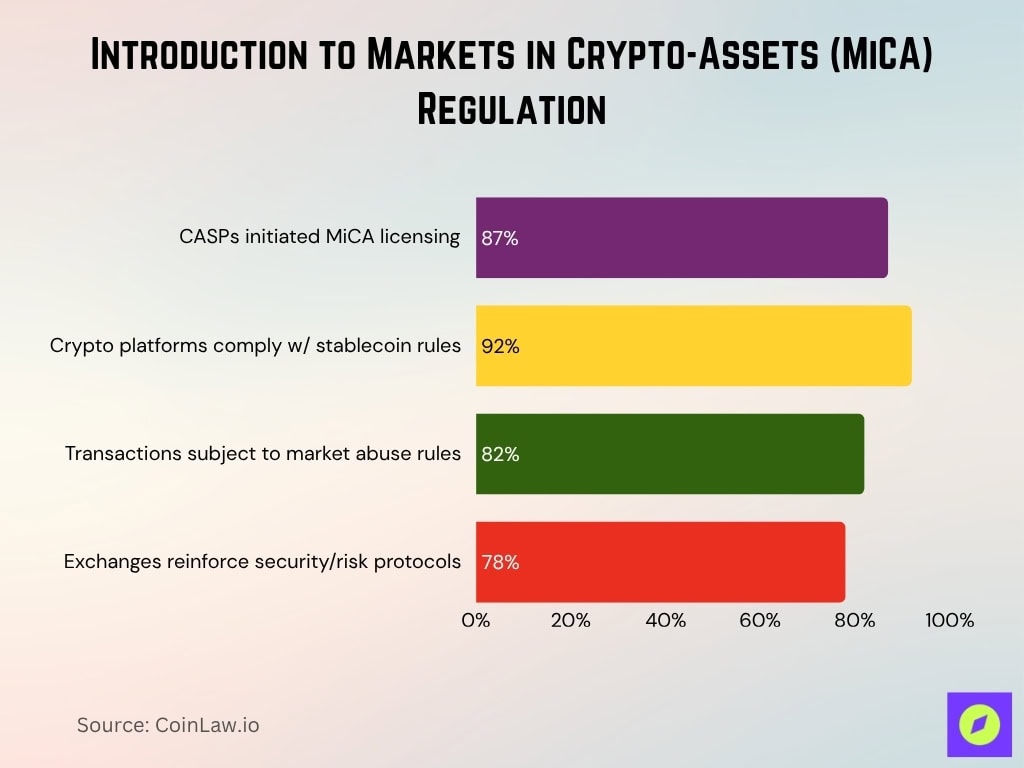

Introduction to Markets in Crypto-Assets (MiCA) Regulation

- 87% of CASPs had initiated licensing under MiCA by mid-2025.

- 92% of platforms now comply with stablecoin rules, maintaining full reserves and redemption rights.

- 82% of crypto transactions are now subject to market abuse rules preventing insider trading and manipulation.

- 78% of exchanges have reinforced security/risk management protocols to meet MiCA standards.

Key Points of MiCA Regulation

- 85% of crypto service providers (CSPs) had registered with an EU financial authority by mid-2025.

- 78% of firms now provide transparent disclosures and risk warnings under consumer protection rules.

- 92% of stablecoin issuers maintain 100% reserves and adhere to strict transaction limits.

- 81% of regulated entities comply with market abuse rules to prevent manipulation and insider trading.

- 65% of crypto firms meet minimum capital and financial stability thresholds by 2025.

- 100% of national regulators in the EU now act as supervisory authorities enforcing MiCA mandates.

- 70% of licensed firms operate cross-border across all EU countries on a single license.

- 60% of crypto advertising and marketing now abide by fair and non-misleading standards under MiCA.

MiCA and the Role of Compliance

- 87% of exchanges in the EU had begun their MiCA compliance process by mid-2025.

- 48% of crypto firms have hired legal consultants to navigate MiCA requirements.

- 18% of blockchain startups are considering shifting operations outside the EU to avoid MiCA burdens.

- 83% of institutional investors say they are more likely to invest in crypto given MiCA’s regulatory clarity.

MiCA Compliance Requirements

- 85% of crypto asset service providers (CASPs) had applied for or secured MiCA licenses by mid-2025.

- 92% of stablecoin issuers now maintain 100% reserve backing and comply with transaction caps.

- 68% of crypto firms meet the required minimum capital and financial stability levels by 2025.

- 81% of regulated entities adhere to anti-market-manipulation rules, preventing insider trading and price abuse.

- 78% of firms enforce consumer protection policies, including disclosures, risk warnings, and secure transaction practices.

- 85% of firms have upgraded to strong AML/KYC standards under MiCA’s mandates.

- 70% of licensed entities comply with data security and privacy requirements for user and transaction data.

- 60% of crypto businesses say they are partially compliant and still making adjustments.

- 40% of DeFi platforms report uncertainty over whether they fall under MiCA’s regulatory scope.

- 30% of smaller firms lack the resources to achieve full compliance by 2025.

- 75% of major exchanges have now submitted initial licensing applications under MiCA.

Where Companies Are Securing Their MiCA CASP Licences

- Germany leads Europe with 18 CASP licences, positioning itself as the top hub for MiCA compliance and regulated crypto operations.

- The Netherlands follows with 14 licences, highlighting its growing appeal to exchanges and custodians such as Bitvavo and Bitstamp.

- France and Malta are tied, each hosting 6 licensed crypto service providers, solidifying their role as long-standing European crypto centers.

- Spain and Luxembourg have 3 licences each, showing steady participation from traditional finance firms entering the regulated crypto space.

- Austria holds 2 licences, while Ireland, Cyprus, Lithuania, and Finland each have 1, often serving as regional bases for global crypto brands like Kraken and eToro.

- The data from ESMA (as of September 2025) underscores a clear concentration of MiCA registrations in Western Europe, especially among countries with robust fintech ecosystems and investor protections.

Statistics on MiCA Compliance Adoption

- Over 65% of EU crypto firms are actively working toward full MiCA compliance in 2025.

- 80% of institutional investors support MiCA’s regulatory clarity in 2025.

- 35% of blockchain startups estimate compliance costs will exceed $500,000 annually under MiCA.

- 60% of stablecoin issuers are adjusting business models to meet MiCA reserve and transaction rules.

- 25% of global crypto firms plan to withdraw from the EU due to elevated MiCA compliance costs.

- 53 major crypto firms have been approved under MiCA in 2025, including 14 stablecoin issuers and 39 CASPs.

- 30% of crypto hedge funds intend to increase EU exposure now that MiCA’s framework is clearer.

- > 50% of DeFi protocols still lack clarity on their MiCA classification as of 2025.

- Institutional adoption is projected to grow with a 45% increase in regulated crypto investment products by 2026.

Strategic MiCA Regulation-Related Considerations for Asset Managers

- 55% of crypto hedge funds are reviewing MiCA’s impact on their investment strategies in 2025.

- 60% of digital asset firms believe MiCA will raise compliance costs but lower systemic risk.

- 30% of EU-based asset managers view MiCA as an opportunity to attract institutional capital.

- 40% of firms say MiCA compliance might delay launching new crypto products.

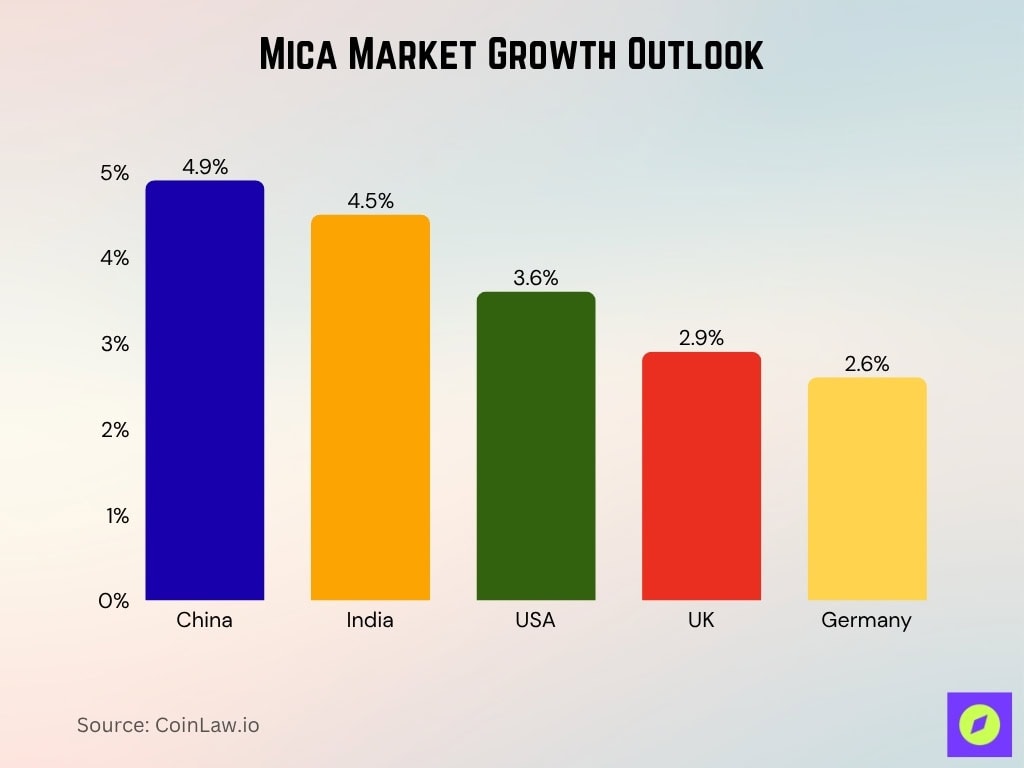

MiCA Market Growth Outlook

- The global mica market is projected to expand at a compound annual growth rate (CAGR) of 3.8% between 2025 and 2035, reflecting steady industrial demand.

- China leads with the highest CAGR of 4.9%, driven by its large-scale electronics manufacturing and construction materials sector.

- India follows closely with a 4.5% CAGR, supported by the cosmetics, paints, and automotive industries, where mica is a key filler and pigment material.

- The United States shows a moderate 3.6% CAGR, underpinned by demand for insulation materials and electronics applications.

- Growth in Europe remains stable, with the UK at 2.9% and Germany at 2.6%, as industries focus on synthetic mica and sustainable sourcing.

Challenges in the MiCA Regulatory Landscape

- > 50% of DeFi platforms remain uncertain whether MiCA applies to them in 2025.

- 28% of crypto firms report annual compliance expenses exceeding $620,000 in 2025.

- 45% of exchanges cite technical integration challenges, upgrading systems to meet reporting/security standards.

- 22% of firms applying for MiCA licenses in 2025 report significant delays in approval processes.

- 33% of blockchain startups fear MiCA will slow down new project launches.

- 40% of firms observe diverging national interpretations, causing operational and legal confusion.

- 78% of stablecoin issuers adhere strictly to MiCA rules, limiting usage in unregulated transactions.

Penalties for Noncompliance

- Fines reaching €5 million or 10% of annual turnover can be imposed on noncompliant firms.

- License revocation may bar firms from operating within the EU.

- Executives may face criminal liability in cases involving fraud or market manipulation.

- Trading restrictions, such as delisting from European exchanges, can be enforced.

- Permanent bans may be imposed on repeat offenders.

- In 2024, regulators issued €412 million in cumulative fines across the EU for MiCA violations.

- Over 58 CASPs had their licenses revoked by early 2025 for ongoing noncompliance.

Future Trends in MiCA Compliance

- 59% of institutional investors plan to allocate over 5% of AUM to crypto in 2025, fueling increased institutional participation.

- 7 countries outside the EU are actively drafting MiCA-style regulations to mirror EU frameworks.

- 90% of stablecoin issuers are moving to stronger reserve compliance, leading to greater adoption of regulated stablecoins.

- 73% of crypto firms are investing in AI and blockchain analytics tools to streamline reporting and compliance.

- 68% of firms support cross-border regulatory alignment initiatives between the EU, US, and Asia to harmonize standards.

Frequently Asked Questions (FAQs)

More than 50 firms, with reports of 53 licensed across the EEA.

At least €5,000,000 for legal entities, or 3–12.5% of total annual turnover.

Across 30 EEA countries.

Many RTS/ITS applied from 1 January 2025 per ESMA’s Level-2/3 table.

Conclusion

MiCA is a game-changer for the crypto industry, bringing long-awaited regulatory clarity while introducing significant compliance challenges. With billions of dollars in investments and the future of digital finance at stake, crypto firms must act now to align with MiCA regulations.