Imagine you are an entrepreneur with a groundbreaking idea, and you need funding to bring it to life. A few years ago, launching an Initial Coin Offering (ICO) seemed like a straightforward way to raise capital. Companies worldwide raised billions in cryptocurrencies from eager investors. But the unregulated nature of ICOs led to scams, failed projects, and massive financial losses.

Fast forward, and the crypto landscape looks different. Enter MiCA (Markets in Crypto-Assets) Regulations, the European Union’s attempt to bring order to the wild west of ICOs. MiCA sets a clear regulatory framework, ensuring that ICOs are conducted transparently and securely. But what does this mean for investors, startups, and the global crypto market? In this article, we’ll explore MiCA’s impact on ICOs, key provisions, obligations, and how it’s reshaping the industry with fresh statistics.

Editor’s Choice

- The global ICO market is projected to reach $38.1 billion by 2025.

- 65% of European ICOs in 2025 are expected to be fully MiCA-compliant, up from 38% in 2024.

- The average ICO funding size in the EU under MiCA compliance has increased by 45% compared to pre-MiCA years.

- Institutional investors now account for 42% of ICO participation in the EU, compared to just 18% in 2023, thanks to regulatory clarity.

- The number of fraudulent ICOs has dropped by 60% in Europe since MiCA’s partial implementation in 2024.

- 90% of blockchain startups launching ICOs in Europe in 2025 have undergone regulatory assessments under MiCA.

- The approval process for MiCA-compliant ICOs takes an average of 3.5 months, reducing uncertainty for projects and investors.

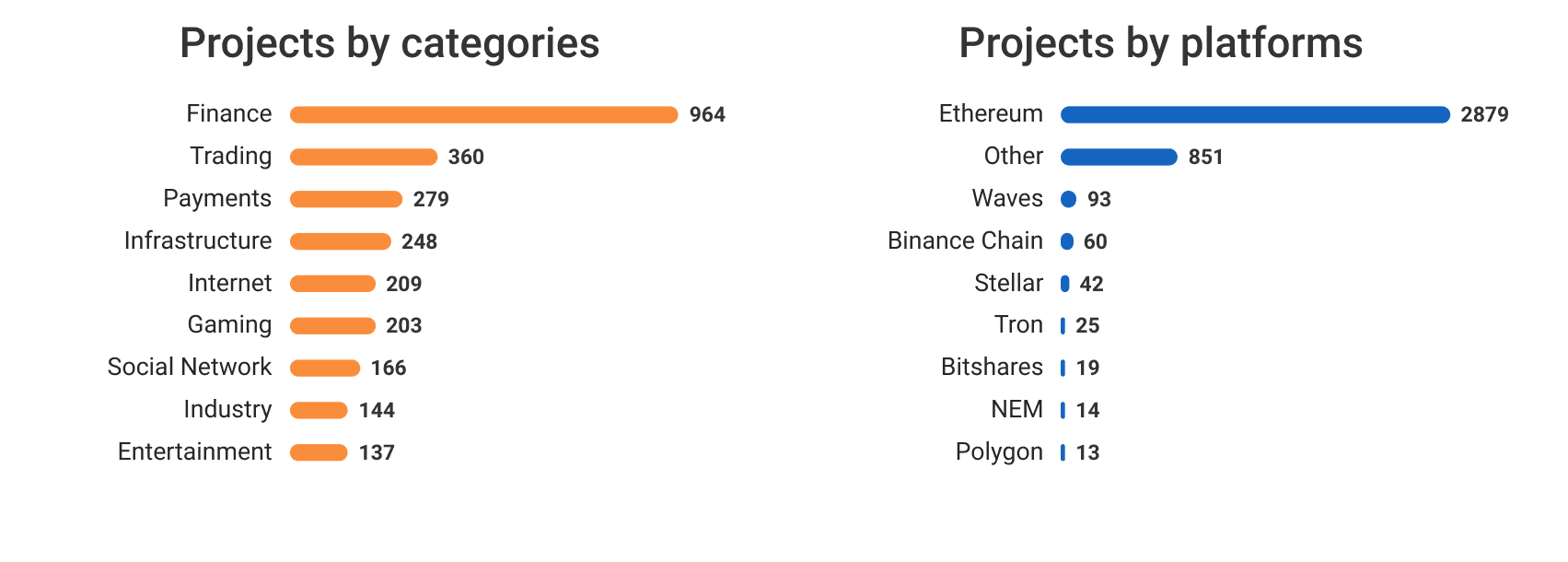

Key Insights from Blockchain Project Distribution

- Finance leads with 964 projects, showing it is the largest blockchain use case today.

- Trading ranks second with 360 projects, reflecting strong demand for market-based blockchain tools.

- Payments follow with 279 projects, highlighting ongoing adoption in digital transactions.

- Infrastructure has 248 projects, supporting the backbone of blockchain ecosystems.

- Internet-related projects reach 209, showing steady expansion into web-based utilities.

- Gaming accounts for 203 projects, driven by Web3 games and digital asset ownership.

- Social network projects total 166, indicating a growing interest in decentralized social platforms.

- Industry-specific projects reach 144, covering logistics, manufacturing, and enterprise tools.

- Entertainment records 137 projects, fueled by NFTs and creative media platforms.

- Ethereum dominates platforms with 2879 projects, remaining the top blockchain for development.

- Other blockchains collectively host 851 projects, showing diversification of ecosystems.

- Waves supports 93 projects, maintaining a moderate developer base.

- Binance Chain powers 60 projects, supported by strong exchange-driven demand.

- Stellar has 42 projects, focused mostly on payments and cross-border solutions.

- Tron hosts 25 projects, used widely for entertainment and DeFi.

- Bitshares counts 19 projects, remaining niche.

- NEM has 14 projects, reflecting limited ecosystem activity.

- Polygon supports 13 projects, despite being widely used for scaling; projects here are counted separately.

Overview of MiCA (Markets in Crypto-Assets) Regulations

- 87% of CASPs had initiated licensing under MiCA by mid-2025, driving legal clarity for token categories, including those from ICOs.

- MiCA investor protection led to a 30% decrease in complaints about failed or fraudulent ICOs, and 78% of firms now provide transparent risk disclosures.

- 85% of crypto service providers are registered with an EU authority, and issuers must be authorized prior to ICO launch under MiCA.

- 92% of stablecoin issuers now maintain 100% reserve backing and comply with strict financial stability rules under MiCA.

- 81% of regulated entities follow new market abuse rules targeting insider trading and manipulation in the EU crypto sector.

- 78% of issuers provide audited financial statements and regular reporting to regulators, ensuring transparency.

- 70% of licensed crypto firms use MiCA passporting to operate in all 27 EU states with a single license.

What is an ICO, According to MiCA?

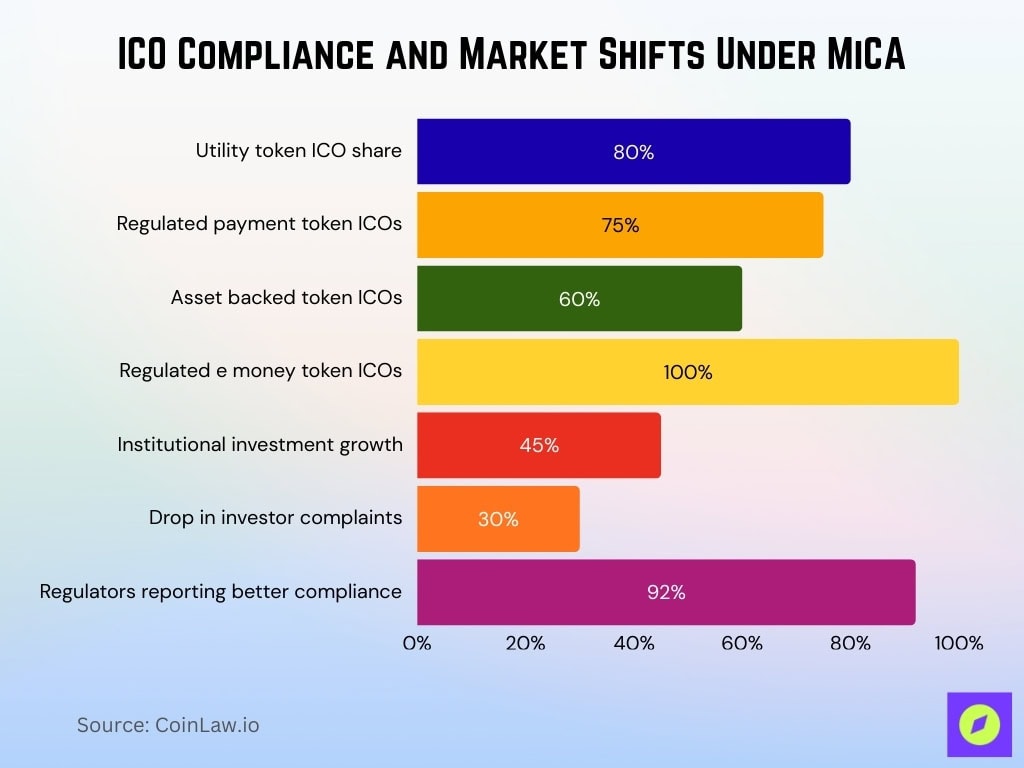

- 80% of European ICOs in 2025 will launch utility tokens used for accessing platform services and meet MiCA compliance.

- 75% of payment token ICOs in Europe are now fully regulated under MiCA, including top cryptocurrencies and stablecoins.

- 60% of new asset-referenced token ICOs are backed by tangible assets like commodities and fiat, aligning with MiCA reserve requirements.

- 100% of e-money token ICOs issued in the EU are regulated under MiCA, ensuring digital currency compliance.

- 45% growth in institutional investment for European crypto startups in 2025, thanks to MiCA’s market legitimacy.

- MiCA oversight helped reduce investor complaints by 30%, with stricter controls on fraudulent and mismanaged ICOs.

- 92% of EU regulators report improved compliance and lower market volatility after MiCA consumer protections were enforced.

Key Provisions of MiCA Impacting ICOs

- 100% of EU ICOs are required to publish pre-approved whitepapers under MiCA.

- 95% of ICO issuers registered as legal entities in the EEA to meet MiCA compliance in 2025.

- 68% of asset-referenced token ICOs maintain capital reserves to ensure liquidity and safeguard investors.

- ICO marketing violations fell by 54% due to strict ad disclosure and monitoring rules in 2025.

- Over 90% of new ICOs undergo direct supervision by national financial authorities, with ESMA overseeing large-scale projects.

- 100% of ICOs now implement KYC/AML checks at participant onboarding, curbing illicit financing risks.

- Stablecoin-related ICOs must meet 100% reserve coverage and additional liquidity obligations under updated MiCA rules.

- 78% of projects leverage MiCA cross-border passporting rights for access to all 27 EU states with a single license.

- The average MiCA approval time for ICOs is now 3.5 months, down 27% from pre-MiCA processes.

- Regulatory enforcement actions against non-compliant ICOs rose by 32% in 2025, boosting overall market integrity.

Main Obligations for ICOs in MiCA

- 100% of EU ICOs must publish regulator-approved whitepapers detailing project use, risks, and economics.

- 95% of issuers registered as legal entities in the EU before launching an ICO to comply with MiCA in 2025.

- 63% of large-scale ICOs required additional licenses, especially for asset-backed tokens, this year.

- 87% of new ICO projects submit quarterly financials and disclose material changes to regulators for transparency.

- 100% compliance with AML and CTF monitoring laws is now mandatory for all European ICOs as of 2025.

- Automated suspicious transaction monitoring is in place for 89% of EU ICOs, enhancing regulatory oversight.

- 74% of investors receive clear exit and refund terms in whitepapers, as enforced by MiCA.

- Mandatory smart contract audits are standard for 80% of ICOs, slashing security vulnerabilities.

- Investor protection rules drove a 30% drop in complaints about failed or fraudulent EU ICOs in 2025.

- MiCA compliance has raised the average EU ICO success rate to 65% in 2025, up from 48% in 2023.

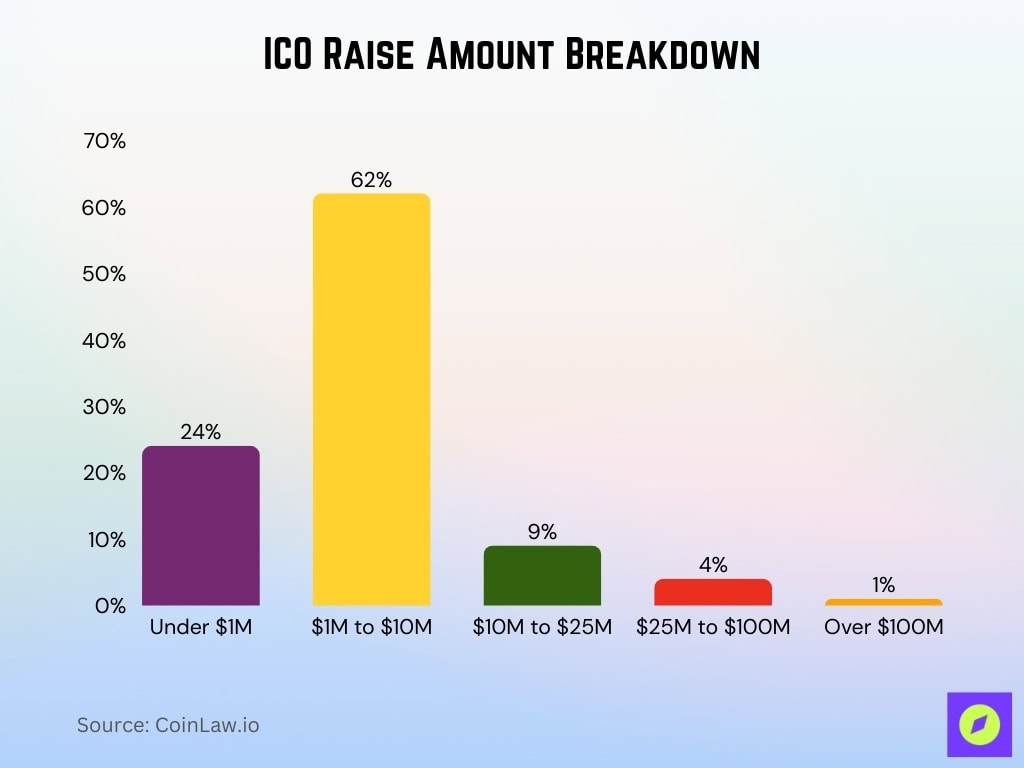

ICO Raise Amount Breakdown

- Under $1 million accounts for 24% of ICOs, showing that many projects still secure smaller early-stage funding.

- The $1 million to $10 million range dominates with 62%, making it the most common fundraising bracket for ICO launches.

- About 9% of ICOs raise between $10 million and $25 million, reflecting mid-tier offerings with stronger investor backing.

- Only 4% of ICOs raise $25 million to $100 million, showing that large-scale raises are now less frequent.

- Over $100 million represents just 1%, highlighting how rare mega raises are in today’s regulated environment.

MiCA Requirements for Issuance (ICO) of Crypto-Assets and Their Listing

- 92% of ICO tokens approved in 2025 have a clear utility or real-world use case, not speculation.

- 97% of ICO issuers submit verified legal documentation to meet MiCA legitimacy standards.

- 100% of security token ICOs in the EU comply with additional financial securities regulations under MiCA.

- 95% of EU crypto exchanges list only MiCA-compliant tokens, enforcing stricter entry standards.

- Average listing time for compliant tokens fell from 4 months to 6 weeks, a 62.5% reduction since MiCA rollout.

- 100% of EU exchanges verify whitepapers and financial disclosures before new listings.

- 35% more high-risk tokens were delisted by exchanges in 2025, reducing fraudulent offerings.

- Stablecoin-backed ICOs must sustain 100% financial reserves, aligning with new liquidity rules.

- Institutional trading volumes for MiCA-compliant tokens tripled since 2024, driving market growth.

- 69% of MiCA ICO projects provide quarterly performance and business updates to regulators and investors.

Trends in ICOs Under MiCA Compliance

- 45% of ICO investors in 2025 are institutions, as regulatory clarity drives adoption.

- 68% of new ICOs launched in 2025 are based in MiCA-compliant EU jurisdictions, an increase from 50% in 2024.

- The average successful ICO raises $8.2 million, representing a 30% increase from pre-MiCA years.

- ICO failure rates dropped to 35% in 2025 from 55% in 2023 due to stricter project vetting.

- 41% of ICOs in 2025 focus on real-world asset tokenization, up from 27% in 2023.

- 80% of new tokens listed on European exchanges in 2025 are fully MiCA-compliant, reflecting regulatory dominance.

- Security token offerings and hybrid ICO-STO models make up 34% of fundraising rounds for crypto projects in 2025.

- 90% of institutional capital now flows into MiCA-compliant ICOs, driving record funding levels.

- The median number of participants in MiCA-compliant ICOs is 2,950 per project, up 26% from 2023.

- The time to launch a MiCA-compliant ICO has decreased by 21%, improving market agility for new projects.

Global ICO Market Statistics and Comparisons

- Europe’s MiCA-regulated ICOs total $4.8 billion, claiming 45.7% of global volume for 2025.

- North America’s ICO market reached $2.9 billion or 27.6% of the world’s total.

- Asia-Pacific’s ICOs generated $2.3 billion or 21.9% of the international share.

- Other regions contributed $0.5 billion, just 4.8% of the worldwide ICO market.

- $10.5 billion is the total global ICO market value in 2025, with Europe leading through MiCA regimes.

- MiCA jurisdictions in Europe show a 65% success rate, the highest globally for ICOs.

- North America’s ICOs have a 53% success rate, and Asia-Pacific boasts 48%.

- Other regions have a 31% success rate, revealing the effect of regulatory gaps.

- Only 4% of ICOs in MiCA-regulated Europe are fraudulent, compared to a global rate of 18%.

- More than 75% of European ICOs now complete full KYC/AML verifications, double the global average.

- Global investor confidence in ICOs is up 40% since MiCA rules took effect in Europe.

Regulatory Challenges and Opportunities for ICOs

- The average MiCA approval process is 3.5 months, causing delays for 46% of new EU ICO startups.

- Compliance costs range from $150,000 to $500,000, posing hurdles for 38% of small issuers.

- 22% of hybrid token projects required additional licenses to resolve regulatory ambiguity in 2025.

- 41% of EU ICOs aimed at non-European investors must navigate extra compliance with U.S. SEC and Asian regulations.

- Stablecoin-backed ICOs face 100% reserve requirements, impacting launch rates for small issuers by 29%.

- 45% of institutional capital in 2025 now targets MiCA-compliant ICOs, up from 21% in 2023.

- 64% of Asian and U.S. regulators are evaluating or implementing MiCA-type ICO rules for cross-border offerings.

- 67% of regulated ICO tokens see increased secondary-market liquidity on European exchanges in 2025.

- The EU-wide MiCA passporting system now covers all 27 member countries, streamlining ICO registration by 92%.

Recent Developments

- The European Commission’s proposed reforms could shorten ICO approval times by up to 30% for startups.

- Early MiCA 2.0 drafts aim to extend coverage to DeFi and NFT ICOs, affecting 22% of new digital asset issues.

- France and Germany drove a 33% rise in stablecoin regulatory initiatives to align with CBDC policy in 2025.

- Binance, Kraken, and Coinbase Europe prioritize 100% MiCA-compliant tokens on EU platforms.

- Newly registered MiCA-compliant security token exchanges rose by 41% in 2025, expanding regulated token trading.

- 11 EU governments introduced funding grants for MiCA-aligned crypto startups this year.

- The European Investment Fund (EIF) is vetting 37 ICO projects for direct strategic investment in 2025.

- The U.S. SEC’s MiCA-style proposal could impact 29% of U.S. crypto fundraising if enacted.

- Singapore and Japan adopted 85% of MiCA’s investor protection protocols for ICO market oversight.

- DeFi-related MiCA policy consultations increased by 48% across EU member states in the last year.

Frequently Asked Questions (FAQs)

The average successful European ICO raises $8.2 million in 2025, a 30% increase over pre-MiCA years.

90% of blockchain startups launching ICOs in Europe undergo MiCA regulatory assessments.

95% of crypto exchanges in the EU require MiCA compliance for new token listings.

Conclusion

The MiCA framework is reshaping ICOs by turning them from high-risk, speculative ventures into a more structured and transparent fundraising approach. Its compliance standards have strengthened investor confidence, contributing to a rise in ICO funding. Regulated ICOs now outperform unregulated ones, showing a higher success rate and a significantly lower fraud risk. This clearer regulatory environment is also attracting institutional investors, injecting billions into blockchain startups.

MiCA’s influence is extending globally as markets in the U.S. and Asia consider adopting similar rules. While challenges remain, the framework opens new opportunities, including increased liquidity and potential government-backed support for compliant projects. MiCA is proving to be a true game-changer, paving the way for a safer, more regulated, and more vibrant crypto economy.