A small crypto startup in Berlin was on the verge of a breakthrough. Their secure digital wallet had gained traction, attracting thousands of users. Then, MiCA (Markets in Crypto-Assets) Regulation came into effect. Overnight, the team found themselves navigating a new world of compliance, risk assessments, and reporting obligations. They weren’t alone. Across Europe, wallet providers faced the same challenge, adapting to a regulatory framework designed to standardize the crypto industry while ensuring consumer protection and financial stability.

MiCA is a game-changer for the industry, setting clear rules for crypto-assets and wallet providers across the European Union (EU). But what does this mean for businesses, investors, and users? This article unpacks key statistics, compliance trends, and the impact of MiCA on the crypto wallet sector.

Editor’s Choice

- MiCA’s regulatory scope covers 85% of crypto-assets currently traded in Europe, ensuring broad industry oversight.

- Retail crypto adoption increased by 27% in Q1 2025, driven by greater investor confidence in regulated wallet providers.

- MiCA mandates capital reserves of €350,000 for custodial wallet providers, making it difficult for smaller firms to maintain financial sustainability in 2025.

- Over 65% of EU-based crypto startups applied for regulatory licenses under MiCA by mid-2025, highlighting the regulation’s widespread impact.

- Reported fraud cases among MiCA-compliant wallet providers dropped by 15–22% in 2025.

Overview of MiCA (Markets in Crypto-Assets) Regulation

- MiCA officially came into effect in December 2024, with full compliance deadlines for CASPs ranging from December 2025 to June 2026, depending on the member state.

- The regulation applies to over 530 crypto-asset service providers (CASPs) in the EU, including wallet providers.

- MiCA’s regulatory provisions cover stablecoins, utility tokens, and asset-referenced tokens (ARTs), but exclude fully decentralized finance (DeFi) solutions.

- Crypto firms must register with local financial regulators across the EU, leading to a 45% increase in regulatory applications in 2025.

- MiCA introduces capital requirements of €350,000 for wallet providers offering custodial services to ensure consumer asset protection.

- Over 80% of European regulators reported increased staffing and resources to handle MiCA-related compliance and enforcement in 2025.

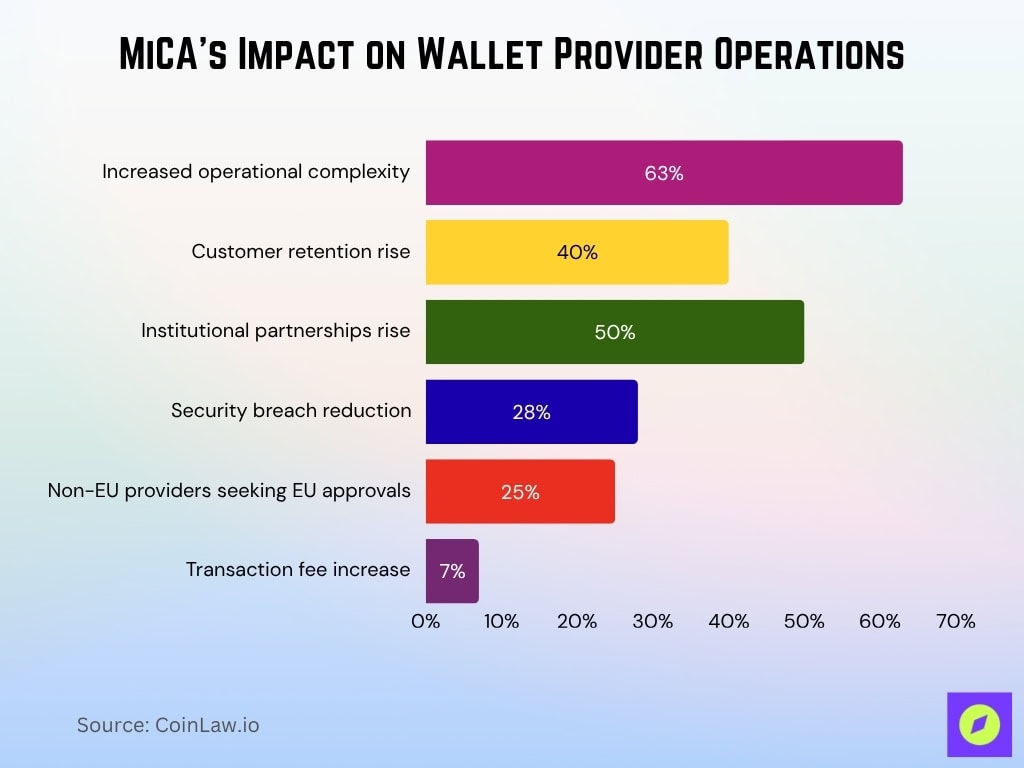

Impact of MiCA Compliance on Wallet Providers

- 63% of wallet providers reported increased operational complexity due to MiCA’s compliance obligations in 2025.

- Regulated wallet providers saw a 40% rise in customer retention as users sought out compliant and legally protected services in 2025.

- European crypto firms saw a 50% rise in institutional partnerships as MiCA’s clarity attracted financial institutions into the sector in 2025.

- Regulated wallets experienced a 28% reduction in security breaches thanks to stricter operational and cybersecurity requirements in 2025.

- 25% of non-EU wallet providers sought European regulatory approvals, aiming to tap into the region’s newly structured crypto market in 2025.

- Transaction fees on compliant wallet platforms increased by an average of 7% covering the added costs of MiCA compliance in 2025.

Market Trends and Adoption Rates

- The global crypto wallet market grew by 15% in 2025, fueled by investor confidence in MiCA-compliant services.

- Over 60% of new crypto wallets launched in 2025 focused on compliance-first features, integrating AML, KYC, and fraud detection tools.

- Regulated exchanges offering compliant wallet services saw a 35% rise in trading volumes in 2025, with users favoring platforms that adhered to MiCA standards.

- Crypto wallet user retention rates increased by 40% on MiCA-certified platforms in 2025, as customers sought secure and legally compliant storage options.

Challenges in Meeting MiCA Compliance Standards

- Regulatory compliance costs surged by 30% with medium-sized wallet providers spending an average of €500,000 annually to meet MiCA standards in 2025.

- 42% of crypto wallet firms cited legal uncertainty as their biggest challenge, particularly concerning decentralized and non-custodial wallet models in 2025.

- 64% of self-custodial wallet providers expressed concerns over MiCA’s potential impact as regulators debated the extent of oversight on decentralized solutions in 2025.

- 30% of crypto startups in the EU delayed product launches due to ongoing regulatory approvals and compliance challenges in 2025.

- A 55% increase in cybersecurity investment was reported among wallet providers as MiCA requires stronger fraud detection and encryption mechanisms in 2025.

- Customer onboarding times increased by an average of 25% as MiCA’s strict KYC requirements led to lengthier identity verification processes in 2025.

CASP Licence Distribution Across Europe

- Germany leads with 18 CASP licences, showing the strongest early uptake of MiCA compliance among EU member states.

- The Netherlands follows with 14 licences, highlighting its growing role as a fintech and crypto hub.

- France and Malta each recorded 6 licences, indicating competitive regulatory environments attracting mid-sized players.

- Spain and Luxembourg both issued 3 licences, reflecting moderate but steady adoption of MiCA frameworks.

- Austria granted 2 licences, signalling gradual industry expansion.

- Four countries issued just 1 licence each: Ireland, Cyprus, Lithuania, and Finland, representing early-stage adoption or smaller ecosystem sizes.

Penalties and Enforcement Mechanisms

- Over €250 million in fines were issued to non-compliant crypto firms in the first half of 2025.

- 40% of regulatory fines targeted wallet providers that failed to implement robust AML and KYC procedures in 2025.

- 11% of non-compliant wallet providers faced temporary suspensions, preventing them from operating until full regulatory adherence was achieved in 2025.

- Regulators flagged 18% of self-custodial wallets for potential compliance risks, with ongoing debates about how decentralized services fit within MiCA’s framework in 2025.

- Fines for MiCA violations averaged €1.2 million per company, with some firms facing penalties exceeding €5 million for major security breaches or fraud concerns in 2025.

- Consumer fraud claims against wallet providers dropped by 15% as MiCA’s enforcement mechanisms improved transparency and security protections in 2025.

Regional Differences in MiCA Implementation

- Germany led MiCA compliance efforts with over 85% of wallet providers already licensed under BaFin in 2025.

- France adopted a fast-track compliance program allowing wallet providers to transition to MiCA regulations within six months in 2025.

- Italy and Spain saw slower adoption rates, with only 55% of wallet providers actively working toward compliance by mid-2025.

- Scandinavian countries (Sweden, Denmark, Finland) maintained a high compliance rate of 80% due to existing strict financial regulations in 2025.

- Malta and Cyprus emerged as MiCA-friendly hubs attracting 30% of EU-based crypto startups seeking regulatory clarity and business-friendly environments in 2025.

- Eastern European countries, including Poland and Hungary, had the lowest MiCA compliance rates, with less than 50% of wallet providers meeting regulatory deadlines in 2025.

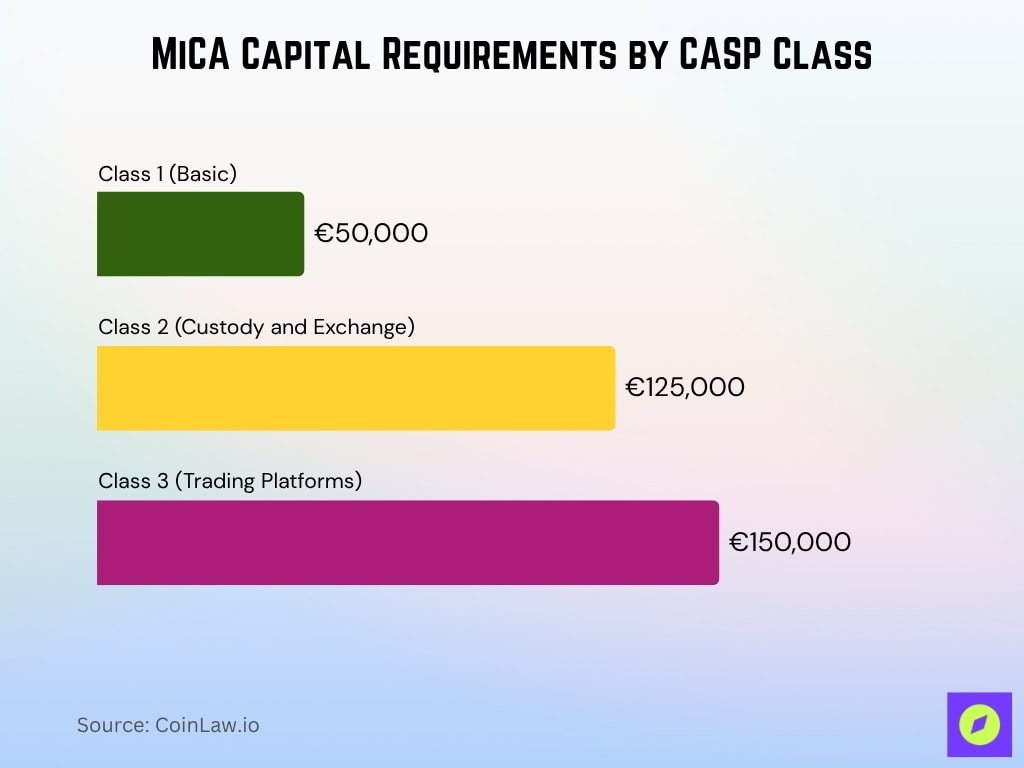

MiCA Capital Requirements by CASP Class

- Class 1 (Basic) requires a minimum capital of €50,000, covering services like advisory, order execution, portfolio management, and investment advice.

- Class 2 (Custody and Exchange) mandates €125,000 in capital, reflecting the higher risk profile of crypto custody and both crypto to fiat and crypto to crypto exchange services.

- Class 3 (Trading Platforms) carries the highest threshold at €150,000, aligned with the operational and market integrity risks of running a full crypto trading platform.

Opportunities for Wallet Providers Under MiCA

- Over 40% of MiCA-compliant wallet providers launched premium services, including insurance-backed custody and advanced fraud protection in 2025.

- 45% of European fintech startups integrated MiCA-compliant wallet solutions to offer secure crypto storage within traditional banking apps in 2025.

- EU-based wallet providers reported a 28% increase in cross-border transactions, benefiting from standardized compliance frameworks in 2025.

- Regulated wallet providers saw a 22% surge in customer trust ratings, as users preferred platforms with legal protections in 2025.

- 70% of institutional investors favored MiCA-certified wallets, citing improved security and legal clarity as key factors in 2025.

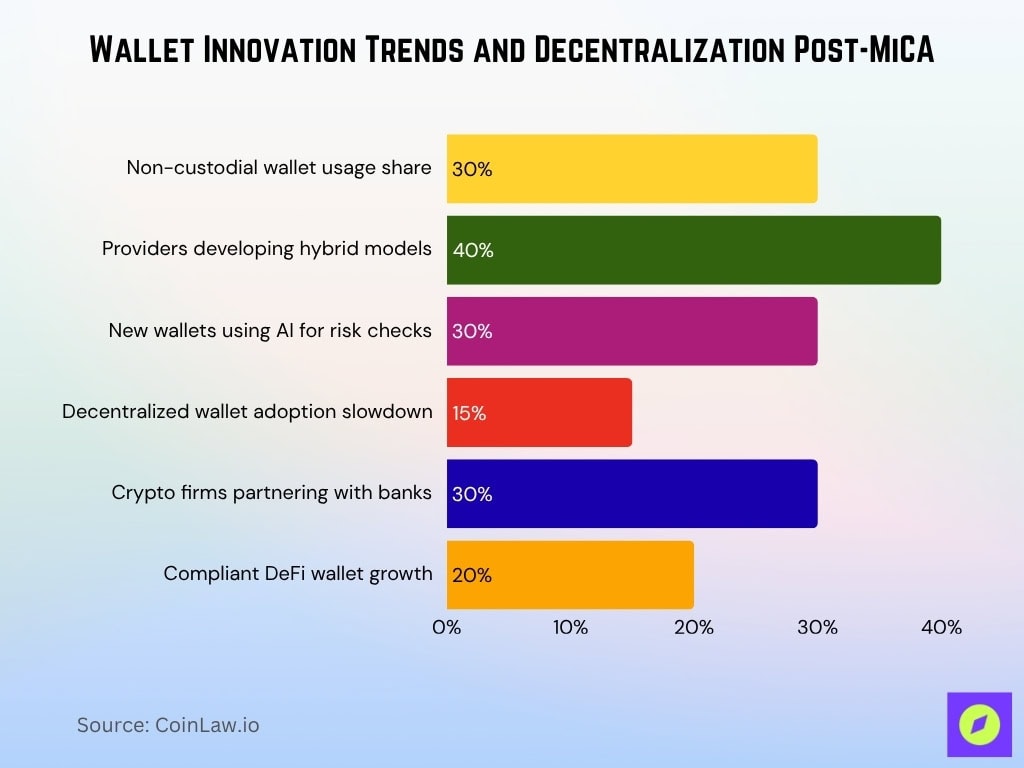

Impact on Wallet Innovation and Decentralization

- MiCA’s strict oversight is reshaping how wallet providers innovate, especially for decentralization and privacy-focused solutions in 2025.

- Non-custodial wallets accounted for 30% of total wallet usage in 2025 as users sought control over assets amid MiCA compliance concerns.

- 40% of wallet providers developed hybrid models offering both custodial and self-custodial options to balance security and user control in 2025.

- 30% of new crypto wallets integrated artificial intelligence (AI) for automated fraud detection and risk analysis in 2025.

- Decentralized wallets saw a 15% slowdown in adoption in 2025 as regulatory uncertainty made users cautious about compliance risks.

- 30% of crypto firms partnered with regulated banks, integrating wallet services with traditional financial institutions to ensure compliance in 2025.

- The development of compliant DeFi wallets grew by 20% in 2025, with a focus on smart contract audits and regulatory-approved stablecoins.

MiCA Impact on Cold Wallets

- Cold wallets accounted for 22–35% of total self-custody solutions in the EU in 2025, as MiCA heightened security concerns over online wallets.

- Institutional demand for insured cold storage solutions grew by 50% in 2025, as MiCA required stricter asset protection mechanisms.

- 30% of high-net-worth crypto investors moved assets to regulated cold storage services in 2025, avoiding compliance risks with online wallets.

- A 15% increase in multi-signature cold wallets was reported in 2025, as users sought added security layers for asset protection.

- Crypto exchanges integrated MiCA-compliant cold storage at a rate of 40% in 2025, ensuring customer funds met regulatory safekeeping standards.

- Demand for offline transaction signing increased by 25% in 2025, as users preferred cold wallets that allowed secure, air-gapped transactions.

- Major institutional custodians expanded cold storage services by 38% in 2025, responding to MiCA’s security and regulatory mandates.

Future Outlook for MiCA and Wallet Providers

- By 2026, MiCA’s scope may expand to include decentralized wallets, potentially impacting 25% of non-custodial services.

- 70% of wallet providers anticipate further regulatory updates, requiring additional compliance adjustments in the next 12–18 months.

- 40% of European regulators support stricter stablecoin rules, which could lead to new MiCA amendments in 2026.

- Cross-border crypto transactions within the EU are expected to increase by 50% as MiCA fosters a harmonized digital asset market.

- Consumer adoption of MiCA-regulated wallets is projected to reach 85% by 2027, as regulatory clarity boosts confidence in digital assets.

- DeFi wallet integration into compliant financial services will rise by 30% as regulatory frameworks evolve to support hybrid models.

- MiCA’s long-term impact could drive global adoption, with 20% of non-EU countries considering similar regulations for crypto-assets.

Frequently Asked Questions (FAQs)

42% of wallet providers were fully MiCA compliant in 2025.

Over €250 million in fines were issued to non-compliant crypto firms since early 2025.

Cold wallets account for 22–35% of self-custody assets in the EU in 2025

Conclusion

MiCA compliance has transformed the crypto wallet industry, creating both regulatory hurdles and opportunities for innovation and institutional growth. While wallet providers have faced higher costs, stricter oversight, and legal challenges, those embracing compliance have benefited from rising investor trust, regulatory clarity, and expanded market potential.

Looking ahead, MiCA is likely to evolve, influencing not just the EU market but also global crypto regulatory frameworks. Wallet providers that adapt early and build future-proof, compliant solutions will position themselves as leaders in the next era of digital asset custody.