Metaplanet has drawn an additional $130 million from its credit facility to ramp up its Bitcoin strategy, signaling further confidence in crypto-backed finance.

Key Takeaways

- Metaplanet borrowed $130 million on November 21, bringing its total credit facility usage to $230 million out of a $500 million limit.

- The loan is backed by Bitcoin reserves, which stood at 30,823 BTC, valued between $2.7 billion and $3.5 billion depending on the source.

- The funds will support further Bitcoin acquisitions, options-based income strategies, and potential share repurchases.

- Despite a strong BTC position, Metaplanet’s share price has fallen over 80% since June, highlighting investor concerns.

What Happened?

Metaplanet, the Tokyo-listed digital asset firm, executed a new $130 million draw on November 21 from its Bitcoin-backed credit facility. This brings total utilization of the $500 million facility to $230 million. The company plans to use the fresh capital to purchase more Bitcoin, expand its BTC income-generation operations, and potentially repurchase shares.

METAPLANET IS RAISING EVEN MORE MONEY TO BUY BITCOIN

— Arkham (@arkham) November 25, 2025

Metaplanet is raising another $150M to buy $BTC through convertible stock.

Metaplanet currently holds $2.67B of Bitcoin, with their last major inflow on 29th September. pic.twitter.com/J3JEXSdHCI

Metaplanet’s Growing Appetite for Bitcoin

Metaplanet has become one of the most aggressive corporate Bitcoin buyers in Asia. Its latest $130 million loan reflects a growing strategy to leverage its BTC holdings through structured financing. The loan terms include:

- Floating interest rate based on U.S. dollar rates, with a variable spread.

- Daily auto-renewal, offering flexibility with no fixed maturity.

- Repayable at any time at the company’s discretion.

- Secured by Bitcoin, which serves as collateral.

As of late October, Metaplanet held 30,823 BTC, with reported valuations ranging from $2.7 billion to $3.5 billion depending on market conditions. This reserve, one of the largest among public companies, allows Metaplanet significant headroom to absorb volatility. Management noted they operate within conservative collateral buffers to minimize risk.

Funding Mix Expands

This loan follows a prior $100 million draw earlier in November. Combined, Metaplanet has now tapped $230 million of its total $500 million credit line.

The company also recently raised $151 million through a perpetual preferred share offering, allocating $119 million toward its Bitcoin strategy:

- $107 million will fund BTC purchases between December 2025 and March 2026.

- $12 million is earmarked for options trading, using BTC as collateral.

This blend of debt and equity financing underpins Metaplanet’s broader plan to generate yield from its Bitcoin, including strategies like selling BTC options to earn premium income.

Pressure on Shares Despite Bold Strategy

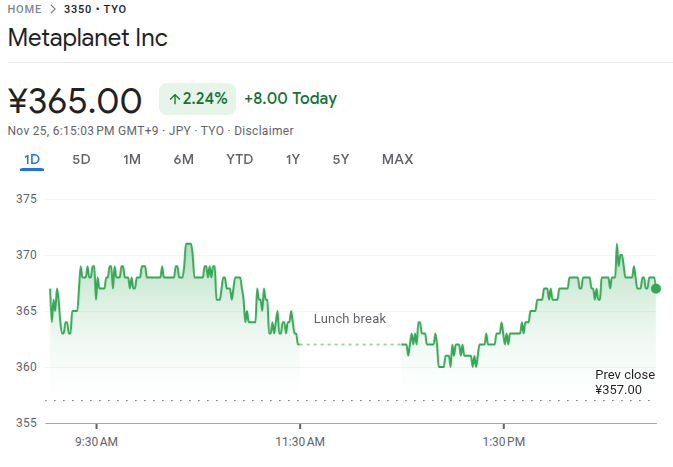

Despite its aggressive accumulation and innovative financing methods, Metaplanet’s stock performance has been underwhelming. Shares have fallen over 80% since June’s highs, currently trading at around 365 yen. The market cap-to-net asset value (NAV) ratio has slipped to 0.81, reflecting a lack of investor confidence.

The firm is also sitting on an unrealized loss of about $600 million, based on an estimated BTC acquisition cost of $3.3 billion. Still, it remains the fourth-largest public holder of Bitcoin, behind major players like MicroStrategy.

CoinLaw’s Takeaway

I think this move shows just how far Metaplanet is willing to go to double down on Bitcoin. In my experience, companies that commit this deeply to a crypto-backed financing model either come out with a strong edge or face major challenges if the market turns. What stands out here is how carefully Metaplanet is balancing risk with growth. They are not just buying more Bitcoin blindly. They are leveraging it for income, preparing for volatility, and still eyeing share buybacks. That tells me they see long-term value even amid short-term pressure. But with their share price down over 80%, the market clearly wants to see results before rewarding the strategy.