Metaplanet Inc. has purchased an additional 518 Bitcoin for approximately $61.4 million, boosting its total BTC holdings to 18,113 coins.

Key Takeaways

- 1Metaplanet spent 9.1 billion yen ($61.4 million) to acquire 518 BTC.

- 2The company’s total Bitcoin stash is now valued at around $1.85 billion.

- 3Metaplanet is targeting long-term growth and aims to own 5 percent of all Bitcoin.

- 4Institutional backing and market liquidity are helping drive its accumulation strategy.

What Happened?

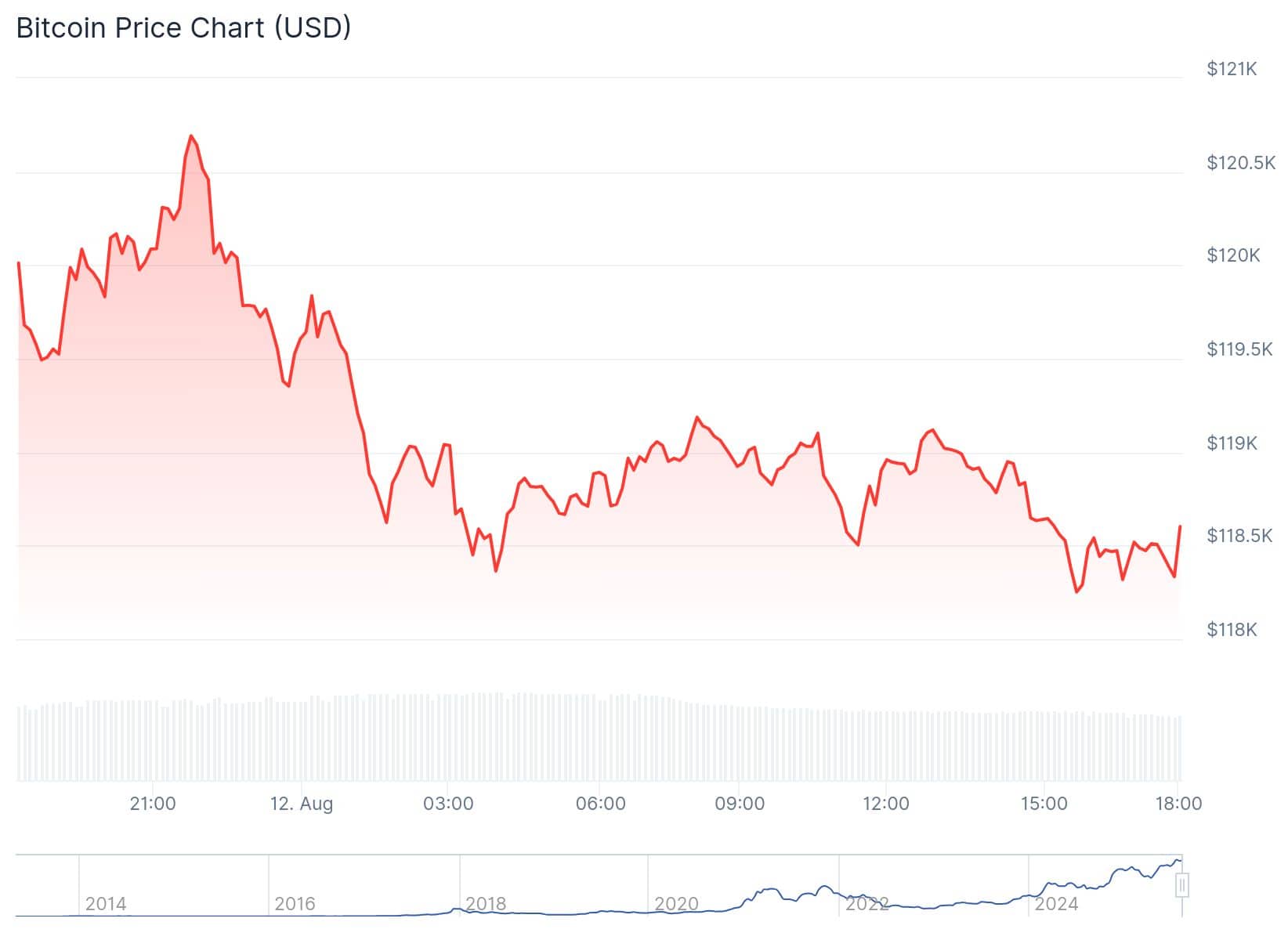

Metaplanet Inc., a Tokyo-listed firm often compared to MicroStrategy for its crypto-heavy strategy, has deepened its Bitcoin commitment. The company bought 518 BTC at an average price of $118,519, bringing its total holdings to 18,113 Bitcoin, worth approximately $1.85 billion. The announcement was made on August 12, 2025.

*Metaplanet Acquires Additional 518 $BTC, Total Holdings Reach 18,113 BTC* pic.twitter.com/rKT2l2oTRj

,Metaplanet Inc. (@Metaplanet_JP) August 12, 2025

The move reflects Metaplanet’s aggressive drive to become one of the world’s top corporate Bitcoin holders and aligns with its previously stated goal of acquiring 5 percent of all Bitcoin in circulation.

Metaplanet Becomes Japan’s Largest Corporate Bitcoin Holder

With this acquisition, Metaplanet secures its spot as Japan’s largest corporate BTC holder and rises to the sixth position globally, behind names like Riot Platforms. Since launching its crypto treasury strategy in 2024, the company has grown its holdings rapidly, increasing from 17,595 BTC to 18,113 BTC in just a few days.

- Total BTC acquisition cost: 274.93 billion yen (~$1.86 billion)

- Average purchase price per BTC: 14,926,496 yen

- Global rank among corporate BTC holders: #6

Big Investors and Bigger Ambitions

Backing Metaplanet’s BTC strategy are major institutional investors, including ARK Invest’s Cathie Wood, Pantera Capital, Founders Fund, Kraken, and Galaxy Digital. The company also ranks 25th in daily U.S. stock trading volume, surpassing traditional financial giants like JPMorgan and Micron Technology.

Earlier this month, Metaplanet revealed plans to raise $3.7 billion through a stock offering to fuel further Bitcoin acquisitions, echoing a playbook used successfully by MicroStrategy (now named Strategy).

BTC Yield and Financial Outlook

Metaplanet closely monitors its BTC Yield, a metric that measures the return on Bitcoin purchases relative to share dilution. Recent figures show positive yield growth, signaling that these acquisitions are enhancing financial performance.

- BTC yield indicates financial health improvements

- Growing Bitcoin reserves attract new investor interest

- Strategy aims to improve shareholder value over time

Bitcoin Market Update

The timing of the latest acquisition coincides with notable market action. Bitcoin is currently trading at $118,387, down 1.5 percent in the last 24 hours. While BTC recently approached record highs of over $123,000, short-term volatility remains.

Despite a 2.4 percent dip in Metaplanet’s share price on Tuesday, the long-term outlook remains bullish given Bitcoin’s strong performance as a macro asset over the past five years.

CoinLaw’s Takeaway

Honestly, this is a bold move by Metaplanet and I respect the conviction. They’re not just dipping a toe into Bitcoin, they’re diving in headfirst with serious money. Trying to grab 5 percent of all BTC in circulation is an audacious goal, but they are taking real steps to get there. With heavyweight investors backing them and a war chest ready for more buys, Metaplanet is proving it’s playing the long game in crypto. If Bitcoin continues to climb, they’re setting themselves up as a global powerhouse.