In recent years, the merchant services industry has seen a tremendous evolution, shifting from traditional cash-based transactions to a digital-first ecosystem. Today, businesses and consumers alike are part of a payment landscape that prioritizes speed, security, and convenience. The pace of growth shows no sign of slowing, with innovative technologies like contactless payments, digital wallets, and cryptocurrencies becoming everyday staples. This article delves into key statistics and trends shaping merchant services, offering a comprehensive view of an industry at the forefront of global commerce.

Editor’s Choice

- The POS terminals market is projected to reach $38.98 billion in 2026.

- The digital payments market size is expected to rise from $200.03 billion in 2026 to $790.59 billion by 2035.

- Digital wallets already account for about 50% of global e-commerce transaction value.

- Digital wallets represent around 32% of in‑store point‑of‑sale transactions worldwide.

- Mobile commerce is expected to generate nearly 60% of online retail sales by 2026.

- The global contactless payment market reached about $69.7 billion in 2025 and is on track for strong double‑digit growth through 2030.

Recent Developments

- Real-time payment adoption is accelerating, with RTP now reaching about 71% of U.S. demand deposit accounts and FedNow rapidly scaling volume.

- BNPL usage in the U.S. is projected to hit about 96.3 million users, representing roughly 42% of adults.

- AI-powered fraud detection tools are delivering up to 20–25% improvements in fraud detection accuracy for eCommerce merchants.

- FedNow continues expanding, with participating institutions handling millions of instant payments and quarterly volume growth exceeding 60% in some recent periods.

- Voice-based payments are scaling, with the market expected to reach about $12.69 billion in value.

- IoT-driven voice payments are forecast to surpass $28 billion in transaction value globally.

- The voice biometrics market is projected to reach about $3.06 billion, reflecting rapid adoption in financial services.

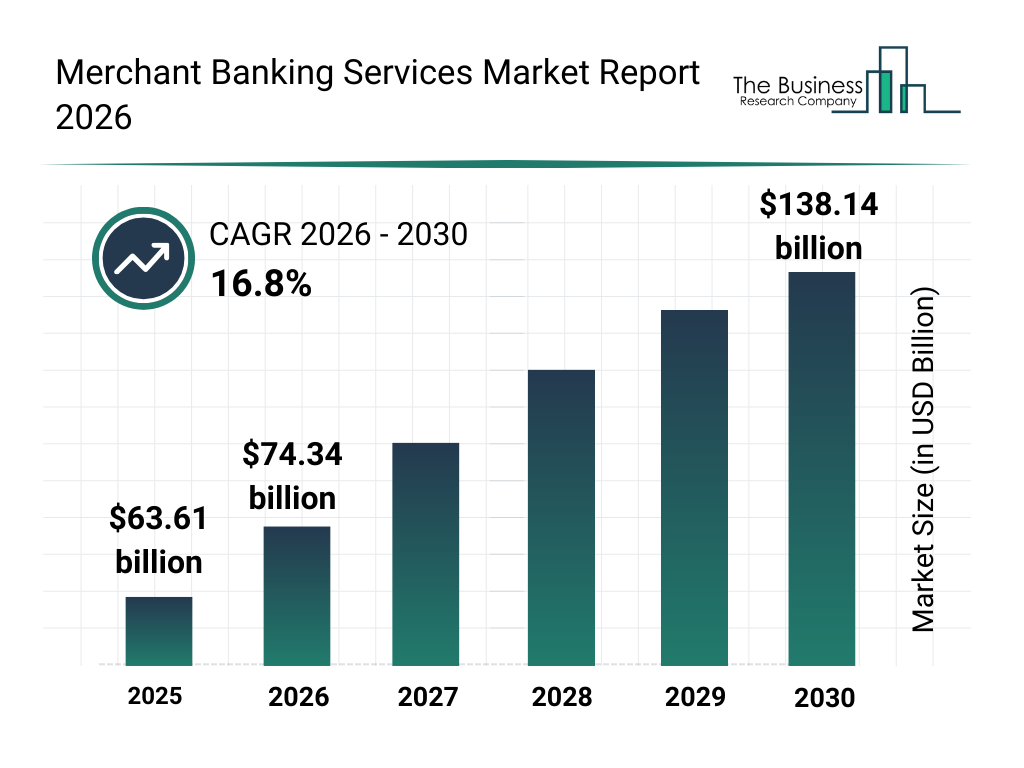

Merchant Banking Services Market Growth

- The global merchant banking services market reached $63.61 billion in 2025, showing strong demand for advisory and financial services.

- The market is expected to grow to $74.34 billion in 2026, marking a significant year-over-year increase.

- Analysts project the industry will expand at a 16.8% CAGR from 2026 to 2030, highlighting rapid sector growth.

- If this pace continues, the market could reach $86.83 billion in 2027, as more businesses seek merchant banking support.

- The market size may rise further to $101.42 billion in 2028, driven by increasing corporate financing needs.

- By 2029, the industry could grow to about $118.46 billion, reflecting rising global investment activity.

- The merchant banking services market is forecast to reach $138.14 billion by 2030, more than doubling its 2025 market value.

Number of Merchants and Business Landscape

- There are roughly 33.3 million small businesses, most of which are owner-managed without additional employees.

- The U.S. has an estimated 2.7 to 3.5 million active online stores, out of about 32 million total businesses.

- There are about 2.8 million eCommerce firms in the United States, growing at roughly 12% compounded over three years.

- The number of retail trade businesses in the U.S. reached 2,885,697, up 0.7% year over year.

- The United States hosts nearly 50% of all e-commerce sites worldwide, underscoring its leading digital retail market.

- Over 6.9 million live Shopify stores exist globally, with more than 3.7 million based in the U.S. alone.

- Realistically, between 2.5 and 3.5 million Shopify stores are actively trading worldwide.

- Shopify powers roughly 30% of U.S. eCommerce, attracting about 351.5 million monthly visits.

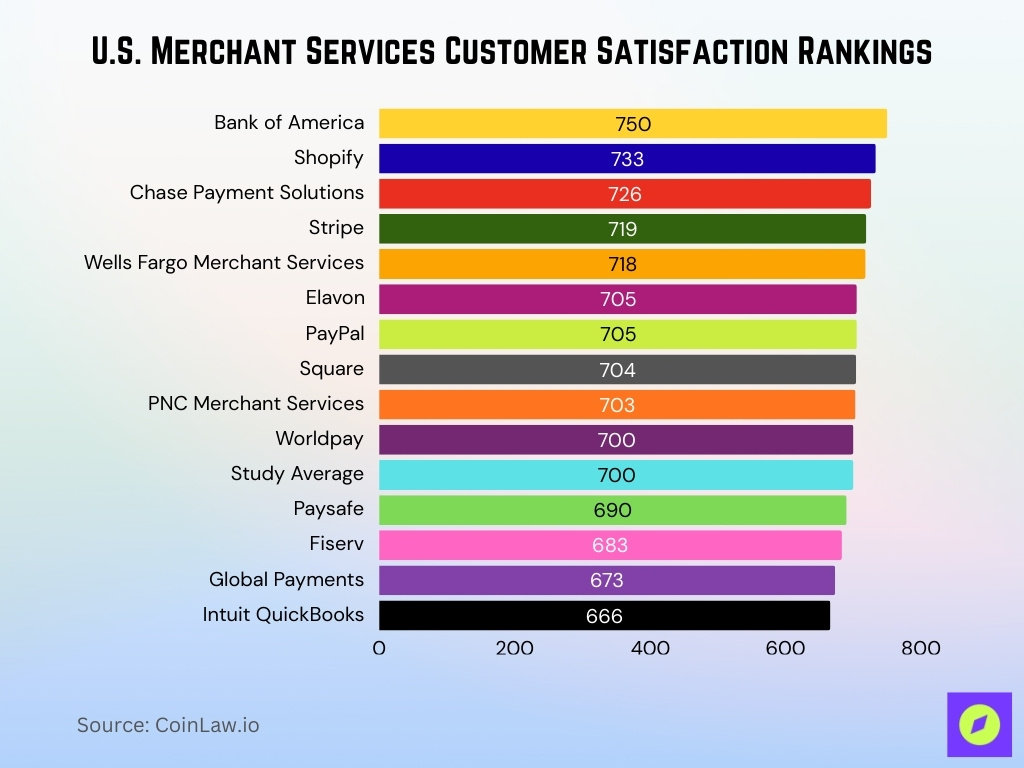

U.S. Merchant Services Customer Satisfaction Rankings

- Bank of America leads the ranking with a customer satisfaction score of 750 points, making it the top merchant services provider in the study.

- Shopify ranks second with 733 points, showing strong satisfaction among merchants using its payment platform.

- Chase Payment Solutions takes third place with 726 points, reflecting consistent performance in merchant services.

- Stripe records 719 points, placing it among the top digital payment providers in customer satisfaction.

- Wells Fargo Merchant Services earns 718 points, staying close behind Stripe in the rankings.

- Elavon and PayPal both receive 705 points, indicating similar satisfaction levels among their merchant customers.

- Square scores 704 points, slightly above many traditional payment processors.

- PNC Merchant Services reports 703 points, maintaining a competitive position in the market.

- Worldpay records 700 points, which matches the industry study average of 700 points.

- Paysafe receives 690 points, placing it slightly below the industry average.

- Fiserv earns 683 points, reflecting moderate satisfaction among merchants.

- Global Payments scores 673 points, positioning it toward the lower end of the ranking.

- Intuit QuickBooks records 666 points, the lowest score in the study among the listed providers.

Payment Processing Trends: Identity Theft Cases

- Credit card fraud remains the top identity theft category, with about 503,450 reported cases through the first three quarters.

- Other identity theft types follow with roughly 379,898 reports, reflecting diversified fraud tactics.

- Loan or lease fraud accounts for approximately 178,210 identity theft reports, driven by illicit financing activity.

- Overall identity theft reports reached about 1,157,317 cases in the first three quarters, already surpassing the prior full year.

- Credit card fraud cases grew by around 54% year over year, underscoring escalating payment card risks.

- Identity theft and credit card fraud together generated fraud losses exceeding $12 billion in the latest full year of data.

- Total fraud reports submitted to the FTC’s Sentinel Network climbed to about 6.5 million, up roughly 20% from the previous year.

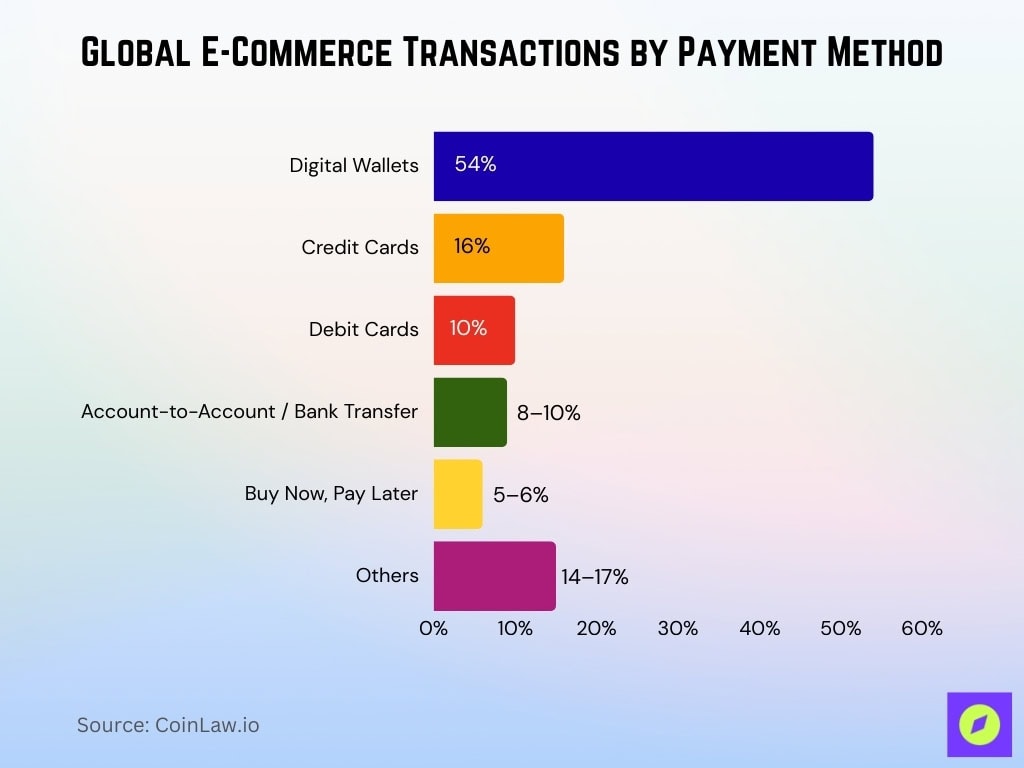

Total E-Commerce Transactions by Payment Method

- Digital wallets dominate global e-commerce, accounting for about 54% of online transactions.

- Credit cards represent around 16% of global e-commerce payments.

- Debit cards account for roughly 10% of online transaction volume.

- Account-to-account and bank transfers together capture an estimated 8–10% share of e-commerce payments.

- Buy Now, Pay Later is projected to reach about 5–6% of global e-commerce transaction value.

- Other payment methods, including cash-on-delivery and cryptocurrency, make up the remaining 14–17% of online transactions.

Payment Method Insights

- Around 50% of global consumer payments are now made with card credentials, with total U.S. credit card spending surpassing $6.1 trillion annually.

- Over 3.3 billion credit cards are in circulation worldwide, including about 203 million U.S. cardholders.

- Contactless card transactions account for roughly 70–75% of in-person card payments worldwide, as tap-to-pay becomes standard.

- BNPL users worldwide reached about 380 million, with the market valued at roughly $509.2 billion and projected to approach $1 trillion by 2031.

- BNPL users in the U.S. are estimated at 96.3 million, on track to exceed 100 million by 2027.

- The BNPL payment market in the United States is expected to reach about $127.94 billion in transaction value.

- UPI in India processed over 21.63 billion transactions in a single month, with a monthly value exceeding ₹27.97 trillion.

- UPI accounted for about 84.8% of India’s total retail digital payment volumes in the first half of the fiscal year, highlighting bank transfers’ strength.

- Global payment revenues are projected to grow from about $3.12 trillion to $5.86 trillion between 2025 and 2031, driven by cards, wallets, and instant payments.

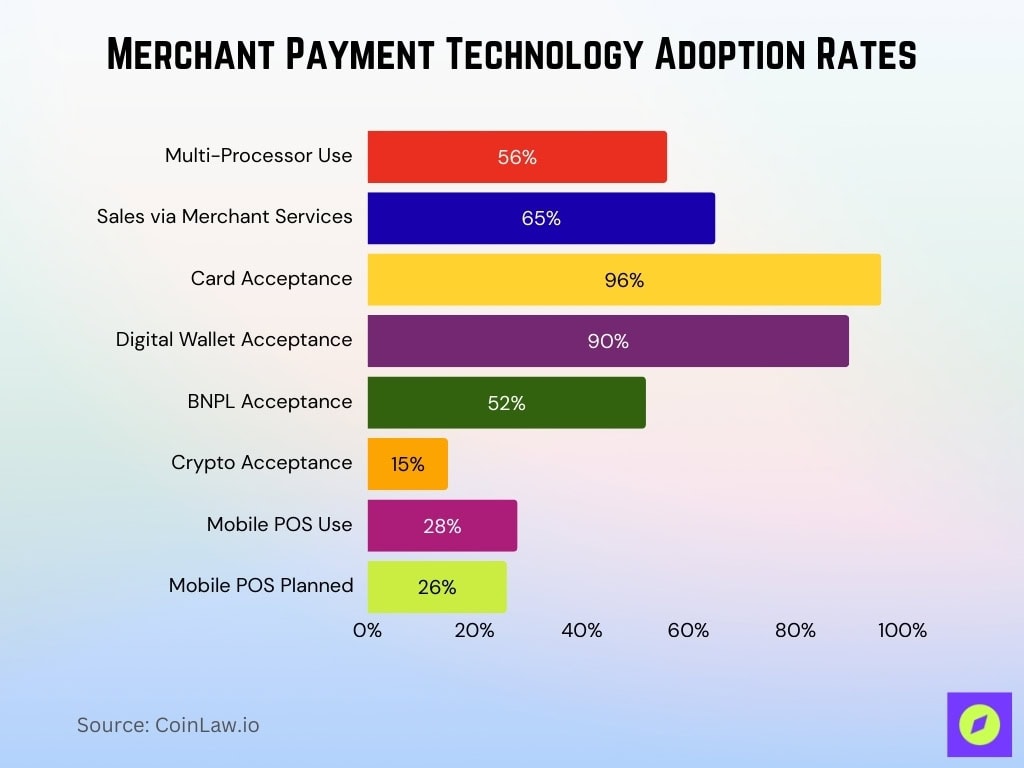

Payment Processor Usage Duration

- About 56% of merchants prefer working with multiple payment processors instead of committing to a single long-term provider.

- Merchant services providers now process 65% of small businesses’ annual sales revenue.

- 96% of small businesses accept debit and credit cards, showing strong reliance on card processors.

- 90% of small businesses accept digital wallets, reflecting rapid integration by payment processors.

- 52% of merchants now accept BNPL, as more processors support installment payment options.

- Only 15% of merchants accept cryptocurrency, down from 20%, signaling a reassessment of crypto processors.

- 28% of merchants use mobile point-of-sale systems, while another 26% plan to deploy them through their processors.

Technological Innovations and Payment Technology Trends

- Around 90% of financial institutions now use AI in some form for fraud detection, risk scoring, or transaction monitoring.

- Risk management and fraud detection rank as leading AI use cases, with about 71% of financial institutions running programs or pilots.

- The global biometric payment market is projected to grow from about $13.48 billion to $44.69 billion by 2034, reflecting rapid adoption at POS.

- North America’s biometric payment market is valued at roughly $4.88 billion, with the U.S. alone nearing $3.48 billion.

- Cloud-based merchant payment platforms leveraging tokenization and AI optimization have delivered 4–15% improvements in authorization and conversion rates.

- Unified tokenization across card networks is boosting approval rates by about 4% and supporting one-click and one-tap payment experiences.

- AI-driven payment optimization engines are increasing successful transaction conversions by 9–15% for merchants.

- Biometric payment hardware accounts for about 57.84% of the biometric payment market, supporting fast, reliable authentication across conditions.

Security Advancements and Fraud Prevention

- Nearly 90% of financial institutions now use AI in fraud prevention, with 99% reporting some AI deployment for anomaly detection and case triage.

- Organizations using AI for fraud save about $2.2 million annually on average, rising to $4.3 million for those investing for over five years.

- Visa has issued more than 12.6 billion payment tokens globally as tokenization moves toward widespread adoption.

- Around 33% of global payment transactions already use network tokenization, with rapid growth across card-on-file use cases.

- The 3D Secure 2.0 authentication market is expected to reach roughly $2.94 billion by 2029, growing at about 15.5% CAGR.

- Consumer fraud losses reported to regulators totaled about $12.5 billion in 2024, increasing pressure for stronger PCI DSS and MFA adoption.

Digital Currency and Payments

- The global digital payments market is projected to reach around $790.59 billion by 2035, up from roughly $200.03 billion in the mid‑2020s.

- About 137 countries and currency unions, representing 98% of global GDP, are exploring a CBDC, with 3 having fully launched.

- CBDC projects include 49 active pilot programs worldwide and over 70 initiatives in advanced stages, such as development, pilot, or launch.

- The number of digital wallet users is expected to exceed 5.2 billion globally, reaching over 60% of the world’s population.

- In several Asia‑Pacific markets, digital wallet adoption is nearing 75% of the population as superapps and QR payments scale.

- QR code–based digital wallet payments are forecast to hit about 380 billion transactions, representing over 40% of wallet transaction volume.

- U.S. small business crypto acceptance has climbed back to roughly 19%, recovering from a prior-year decline.

Frequently Asked Questions (FAQs)

Around 72% of global transactions now occur digitally, reflecting the shift that underpins merchant acquiring and merchant services growth.

The global merchant acquiring ecosystem includes thousands of payment processors, acquirers, payment facilitators, and independent sales organizations, though precise counts vary depending on how providers are categorized.

Over 1 million businesses in the United States offer merchant services, highlighting a large and competitive provider landscape.

Conclusion

The merchant services industry is undergoing a transformative shift as digital payments, emerging technologies, and customer demands reshape the landscape. The continued growth in contactless payments, digital currencies, and AI-driven security measures signals an industry that is both dynamic and resilient. Businesses that embrace these innovations are positioned to thrive in a fast-evolving market, while customers benefit from faster, safer, and more convenient ways to transact. Looking ahead, the industry’s focus on enhancing payment technology and expanding digital access suggests an exciting future for merchants and consumers alike.