Medical debt continues to affect millions of Americans, shaping their financial decisions and limiting access to critical health care. Whether caused by insurance gaps, high deductibles, or surprise billing, the financial toll reaches across all demographics. Employers, policymakers, and health systems increasingly face pressure to respond to this growing crisis. From emergency care to chronic illness management, the consequences are widespread and costly. This article breaks down the latest statistics and trends behind America’s medical debt burden, exploring the full scope of the issue below.

Editor’s Choice

- 36% of U.S. adults reported skipping or delaying care in the past year due to cost.

- The average medical debt in collections ranges from $2,456 to $7,931 per person.

- 1 in 5 Americans (about 41%) report some form of medical debt.

- 33.8% of those with medical debt forgo mental health care due to cost.

- Medical debt is the largest share of all consumer debt in collections.

- Surprise billing protections have helped, but high-deductible plans still leave gaps.

- Racial and income disparities persist, with Black and Hispanic households carrying more debt.

Recent Developments

- In the past year, about 31 million Americans borrowed an estimated $74 billion to pay medical bills.

- The three major credit bureaus have stopped reporting medical debts under $500, reducing credit damage for many.

- 15% of U.S. adults say they’ve been contacted by a medical debt collector within the past year.

- New rules removed paid medical collections and debts less than a year old from credit reports.

- Policy advocates continue pushing for total medical debt cancellation or limits on out-of-pocket costs.

- Emergency care, mental health services, and post-hospitalization costs are driving the highest unpaid bills.

- Insured individuals still face debt, especially under high-deductible health plans.

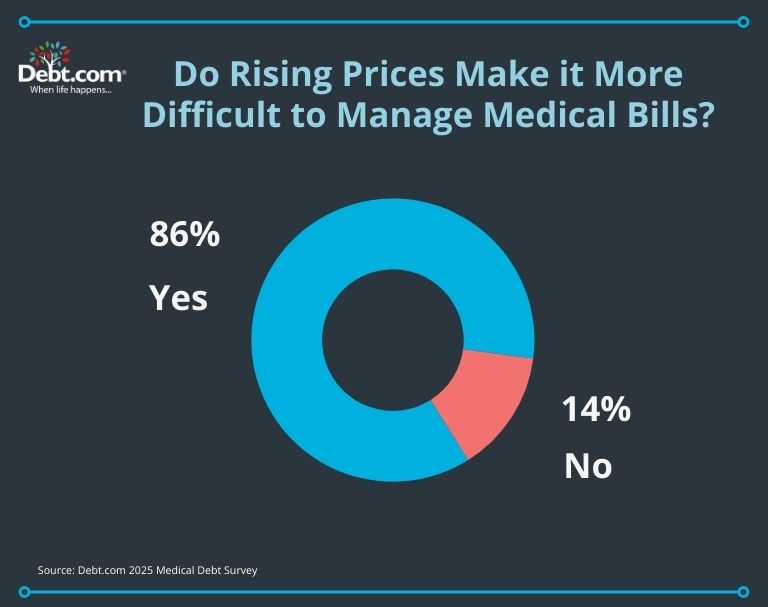

Rising Prices Are Worsening the Medical Debt Burden

- 86% of Americans say that rising prices make it more difficult to manage medical bills, highlighting the growing strain of inflation on healthcare affordability.

- Only 14% believe that higher prices do not impact their ability to handle medical expenses.

Key Medical Debt Statistics Overview

- Around 100–110 million U.S. adults, about 4 in 10, have some form of healthcare‑related debt.

- 14 million adults owe more than $1,000 in medical debt.

- Approximately 3 million Americans carry more than $10,000 in unpaid medical bills.

- Nearly 41% of adults report having health-related debt, whether to providers, credit cards, or family.

- One-third of indebted adults say the debt limits their ability to afford food, rent, or utilities.

- Over half of adults with medical debt said they put off necessary care.

- Despite insurance, many Americans still end up in debt due to deductibles, copays, or uncovered services.

- The problem extends beyond hospitals; urgent care, dental, and lab tests also contribute to rising debt.

- Among those with employer coverage, one in three still reported medical debt or unpaid bills.

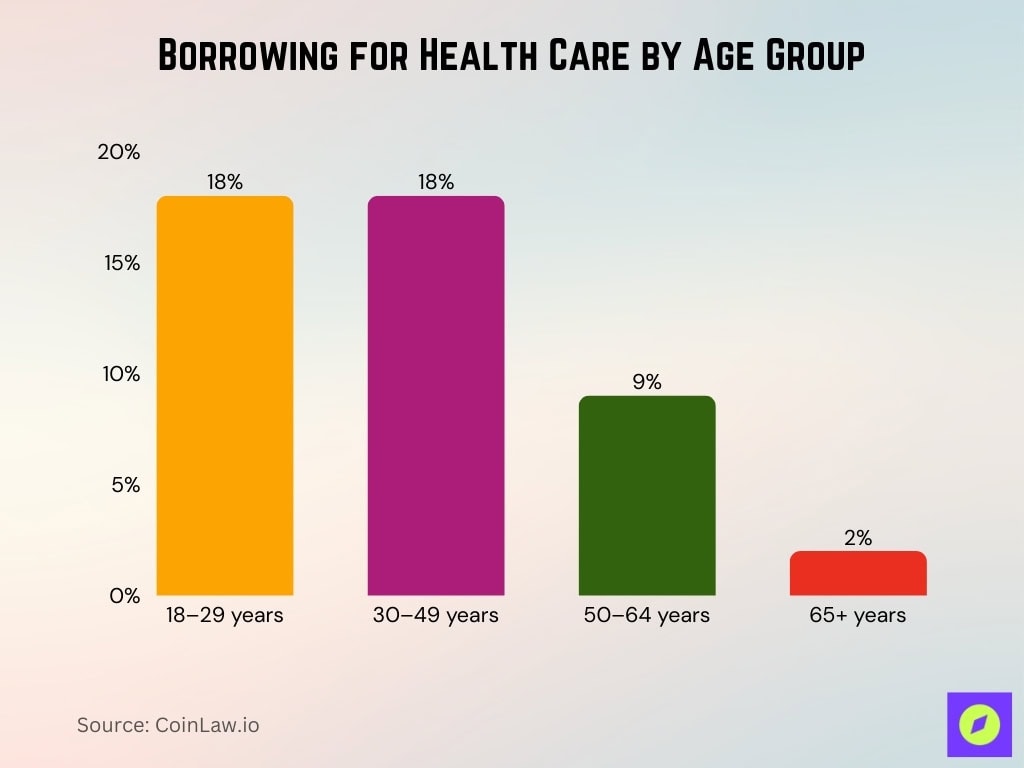

How Common Is Medical Debt?

- Among adults who reported borrowing money for health care in the past 12 months, 18% of those aged 18–29 said they needed to borrow

- Adults aged 30–49 showed similar borrowing rates of 18%.

- Borrowing declines in older age groups: only 9% of adults 50–64 and 2% of those 65 and older reported borrowing for care.

- Middle-aged adults (50–64) report more medical debt than those over 65, likely due to pre-Medicare out-of-pocket costs.

- Younger households (under 50) are more likely to carry medical debt or need to borrow.

- Even among insured people, 22% report current medical debt.

Total Medical Debt Owed

- The total amount of medical debt in the U.S. is estimated at about $194–195 billion in active medical collections, with some broader estimates slightly lower depending on what debts are counted.

- Medical debt accounts for 58% of all debt in collections, the highest among any debt type.

- Roughly 1 in 5 credit reports shows medical debt, more than student loans or credit cards.

- Collection amounts vary widely, but many are for amounts under $500.

- Medical debt makes up over 70% of total collections among lower-income households.

- 38% of households report actively paying off medical bills over time.

- Many debts are not reported or collected formally, meaning totals may be underestimated.

- Rural areas report higher per capita medical debt than urban regions.

- Over half of all medical debts are related to hospital stays or emergency room visits.

Average Medical Debt Per Person

- The mean total active medical collections per person ranges between $2,456 and $7,931.

- About 6% of adults owe more than $1,000 in medical debt.

- Around 1% of U.S. adults owe more than $10,000.

- Nearly half of all individuals with debt owe $2,000 or more.

- 41% of adults (≈ 107 million people) carry some form of health-related debt.

- 58% of borrowers took out $500 or more.

- Adults 50+ reported a median borrowing of $3,000, while younger adults borrowed less.

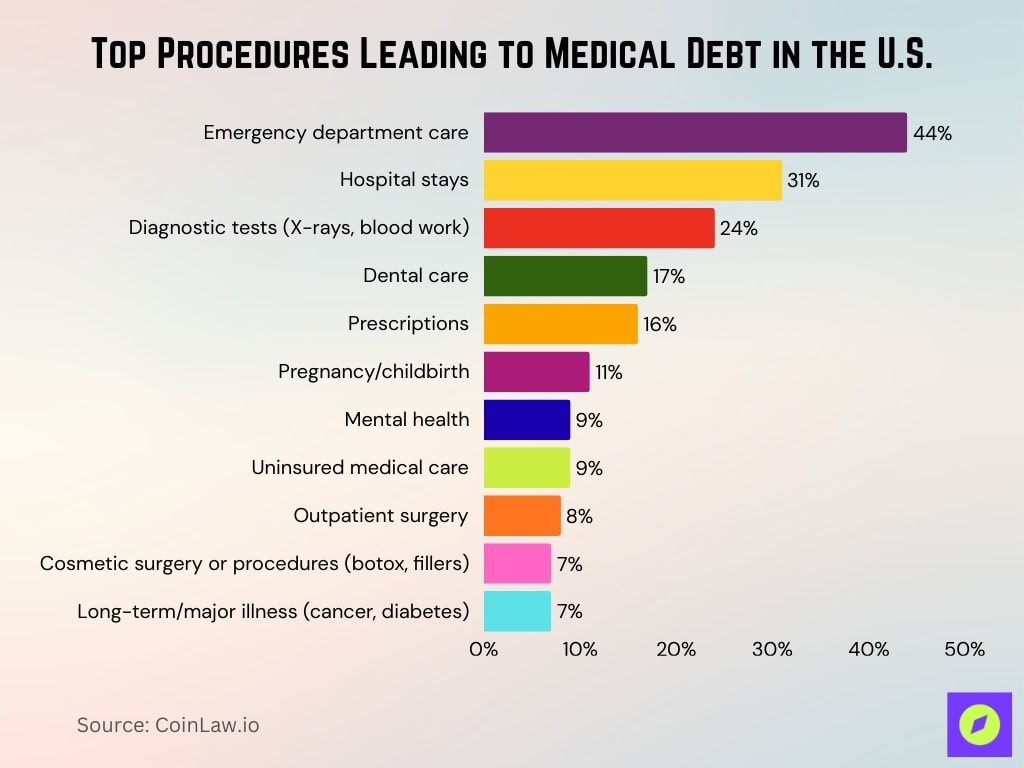

Top Procedures Leading to Medical Debt in the U.S.

- 44% of respondents cited emergency department care as the main source of their medical debt.

- 31% incurred debt due to hospital stays, making it the second most common cause.

- 24% pointed to diagnostic tests such as X-rays and blood work.

- 17% accumulated debt from dental care, highlighting a frequent gap in insurance coverage.

- 16% blamed the high cost of prescription medications.

- 11% reported pregnancy and childbirth expenses as a contributing factor.

- 9% each cited mental health treatment and uninsured medical care.

- 8% had debt from outpatient surgery.

- 7% mentioned cosmetic procedures such as botox and fillers.

- Another 7% attributed their debt to long-term or major illnesses, including cancer and diabetes.

- 6% selected “Other”, indicating a range of less common or miscellaneous medical costs.

Extreme Medical Debt (High-Dollar Balances)

- About 3 million adults owe between $5,001 and $10,000 in medical debt.

- Another 3 million owe more than $10,000.

- A small group of 0.3% of adults holds over half of the total medical debt.

- Unpaid balances classified as “bad debt” are increasing among hospitals.

- 30% of adults with medical debt owe it for hospital bills alone.

- Even insured individuals can incur high debt after serious medical events.

- High-deductible plans contribute to large unpaid balances.

- Long-term debt often results in taking loans, cutting necessities, or delaying other bills.

Medical Debt by Age Group

- 36% of households in the U.S. carry some form of medical debt.

- 18–29 year-olds: 18% needed to borrow for care in the last year.

- 30–49 year-olds: borrowing rates are similar to younger adults.

- 50–64 year-olds: 9% reported needing to borrow.

- 65+: only 2% reported borrowing, likely due to Medicare.

- Adults 65+ report the lowest levels of new medical debt.

- Middle-aged adults often face the highest absolute medical bills.

- Insurance gaps before Medicare eligibility contribute to middle-aged debt loads.

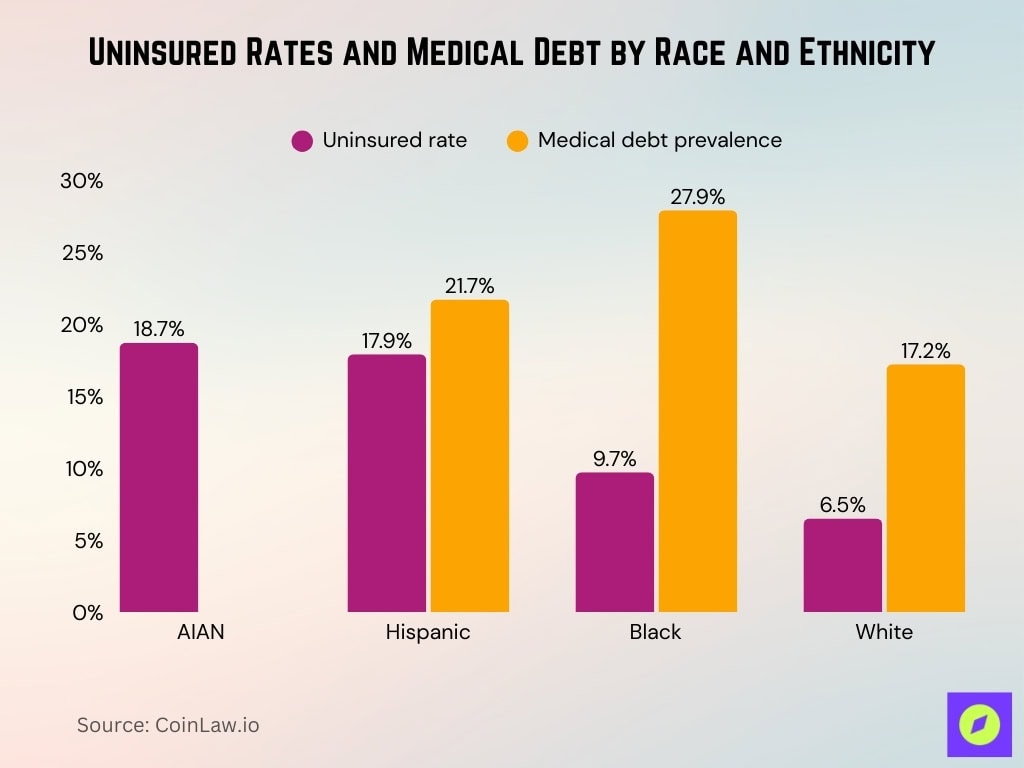

Race and Ethnicity

- Uninsured rates by group (under 65): AIAN 18.7%, Hispanic 17.9%, Black 9.7%, White (non-Hispanic) 6.5%.

- Black, Hispanic, and AIAN individuals face higher debt risks due to lower coverage.

- People in poor health or with disabilities carry disproportionate debt burdens.

- Black households historically had 27.9% medical debt rates vs. 17.2% for White households.

- Hispanic households report ~21.7% medical debt rates.

- Contributing factors include lower employer coverage and structural inequalities.

- Many minority families face limited insurance networks or high out-of-pocket costs.

- Medicaid expansion status also affects regional racial disparities.

Medical Debt in Collections

- 36% of households had any medical debt; 21% had a past-due bill.

- 23% were paying off bills over time to providers.

- 17% used credit or loans to pay medical bills.

- 15% of adults were contacted by a debt collector.

- 12% had medical debt on their credit report.

- 5% had new debt added in the past year.

- Medical and dental providers are acting as informal lenders.

- Many debts remain off the record, never making it to collections.

Medical Debt on Credit Reports

- Medical collections made up 58% of all consumer collections.

- Most medical collections are for under $500.

- These changes reduce long-term credit harm from small, resolved debts.

- Yet, many debts remain unreported or misclassified.

- People with reported debt average $2,456 to $7,931.

- Even small debts can impact credit scores and access to housing or loans.

Skipping or Delaying Care Because of Cost

- 36% of adults skipped or delayed care in 2024–25 due to cost.

- 38% of women vs. 32% of men reported delays.

- 34–39% of adults with employer coverage and debt avoided care.

- Even insured people delay treatment due to out-of-pocket costs.

- Preventive care and mental health services are most often skipped.

- Lower-income groups cut back on food, rent, and utilities.

- Households with medical debt delay care more than debt-free households.

- Delaying care leads to chronic conditions and worse outcomes.

Medical Debt and Mental Health

- 33.8% with medical debt forgo mental health care vs. 6.3% without debt.

- A 17.3-point increase in unmet mental health needs is linked to medical debt.

- Among those with depression and debt, 36.9% delayed, 38.0% went without care.

- For anxiety and debt: 38.4% delayed, 40.8% didn’t seek care.

- Those without debt: only ~17% delayed or avoided care.

- Debt triples the risk of mental health issues like anxiety or depression.

- Chronic stress and financial instability contribute to worsening mental health.

- Cancer survivors and patients with serious illness face compounding psychological burdens.

Surprise Billing and Medical Debt

- No Surprises Act cut out-of-pocket costs by $567-$600 annually per privately insured patient.

- 26% of Connecticut adults received an unexpected medical bill in the past year.

- 37% faced financial burdens from medical bills, including depleted savings or collection actions.

- 23% reported outstanding medical debt, mostly $1,000-$2,499.

- 59% incurred debt because insurance covered only part of the services, leaving bills too high.

- 1.4 million IDR disputes initiated in 2024, up 115% year-over-year under NSA.

- Providers won 85% of 1.5 million NSA arbitration cases, raising payments over 4x in-network rates.

- 68% of medical debt stemmed from hospital services like labs and imaging.

- Households with disabilities had a 29% medical debt rate vs. 21% without.

- 25-34 year-olds faced the highest medical debt at 34% prevalence.

Impact of Credit Reporting Policy Changes on Medical Debt

- CFPB rule removes $49 billion in medical debt from the credit reports of 15 million Americans.

- Affected consumers see an average 20-point credit score increase from medical debt removal.

- The rule bans lenders from using medical information in credit decisions.

- 19.5% of credit reports currently contain one or more medical bills.

- $500 threshold excludes small medical collections from credit reports.

- Policy enables 22,000 additional mortgage approvals annually.

- 14 million people benefit from the halted medical debt credit impact.

Emerging Medical Debt Trends

- 36% of US households had medical debt in 2024-2025.

- 21% had past-due medical bills, and 23% paying providers over time.

- 14.6% contacted by collectors for medical debt in the past year.

- Medical debt is linked to more unhealthy days, higher mortality at the county level.

- $194 billion in active medical collections nationwide.

- HDHP minimum deductibles rose to $1,650 individual/$3,300 family in 2025.

- 39% with debt skipped doctor visits, 26% reduced prescriptions.

Frequently Asked Questions (FAQs)

Approximately 14 million adults, about 6% of U.S. adults, owe more than $1,000 in medical debt.

About 3 million adults, roughly 1% of U.S. adults, carry medical debts exceeding $10,000.

Among people with debts in active medical collection, the average (mean) collection balances range from $2,456 to $7,931 per person.

Conclusion

Medical debt remains a pervasive and multifaceted issue in the United States. A substantial portion of adults continue to skip or delay care due to cost, including mental-health services. The burden of unpaid bills, unexpected expenses, and surprise medical bills undermines not just financial stability but also physical and mental health. Policy changes, like credit-reporting reforms and surprise-billing protections, offer relief, but they don’t eliminate the root causes: high cost, inadequate insurance, and unpredictable billing. Addressing medical debt, therefore, requires systemic solutions that combine coverage, transparency, and cost control.