Imagine running a small business, bustling with customers, when an unexpected event, like a slip and fall or product malfunction, throws a wrench into your operations. Liability insurance is the unsung hero for businesses and individuals alike, shielding them from unforeseen risks that could otherwise lead to financial ruin. With the liability insurance industry poised to hit new milestones, understanding its growth, trends, and challenges has never been more crucial. This article dives into key statistics and insights shaping the industry, helping you make informed decisions.

Editor’s Choice

- The global liability insurance market size reached $313.2 billion in 2025.

- The US liability insurance sector makes up approximately 36% of the global market.

- Cyber liability insurance premiums are expected to total $16.3 billion in 2025, reflecting sustained demand.

- Average general liability premiums for US small businesses increased by around 4‑5% in 2025.

- Product liability insurance claims continued to rise, driven by recalls in automotive and electronics.

- Legal defense costs for liability insurers remain elevated due to complex litigation, though no 2025 total has been confirmed.

- Emerging markets like Southeast Asia and Latin America show strong momentum in liability insurance adoption.

Liability Insurance Market Segmentation Overview

- General Liability, Product Liability, and Professional Liability are the three core coverage types offered by providers.

- Private insurers, government-backed schemes, and online platforms make up the key distribution channels in this sector.

- Manufacturing, retail, pharmaceuticals, food & beverages, and automotive are the top end-user industries driving demand.

- Small and Medium Enterprises (SMEs) and large enterprises are the primary policyholder segments, shaping product design and pricing.

Premiums and Revenue Statistics

- Global liability insurance premiums reached $313.2 billion in 2025.

- The US liability insurance sector generated over $145 billion in premiums in 2025, maintaining global dominance.

- Cyber liability premiums rose by 6.5% in 2025, reflecting ransomware risk saturation and tighter underwriting.

- Healthcare liability insurance premiums increased by 4.2%, tied to complex malpractice litigation and inflation.

- General liability insurance for US small businesses averaged $44 per month in 2025, showing a 4.8% annual increase.

- Umbrella liability insurance premiums grew by 8.9%, driven by high-value claim settlements and social inflation.

- EU liability insurance premium pricing rose by 3.7% in 2025, following updated risk-adjusted solvency rules.

- Product liability insurance premiums in the US reached $2.6 billion in 2025, marking an 8.3% annual growth.

Global Insurance Market Growth Outlook

- The life and non-life insurance market is projected to reach $11,892.01 billion by 2029.

- In 2025, the global insurance market size will be $9,834.56 billion.

- The industry is expected to grow at a CAGR of 4.9% from 2025 to 2029.

- This steady rise reflects expanding demand across both life and non-life segments, driven by increased risk awareness and regulatory shifts.

- The forecast suggests nearly a $2 trillion increase in market value over five years.

Claims and Loss Ratios

- US liability insurance loss ratios averaged 59.8% in 2025, showing continued improvement from 61% in 2024.

- Cyber liability claims surged by 25% in 2025, reflecting a wave of large-scale attacks and stricter reporting rules.

- Product liability claims represented 23.4% of total liability claims in 2025, highlighting increased scrutiny on safety and compliance.

- The average general liability claim size rose to $18,200 in 2025, driven by legal fees and social inflation.

- Automobile liability insurance payouts totaled $57.3 billion in 2025, making up around 44% of total liability claims.

- Healthcare liability claims averaged $438,000 per case in 2025, marking a 3% increase from 2024.

- Environmental liability claims jumped by 19% in 2025, spurred by ESG lawsuits and stricter enforcement.

- Small business liability claims in the US increased by 10% in 2025, largely due to slip-and-fall incidents and property claims.

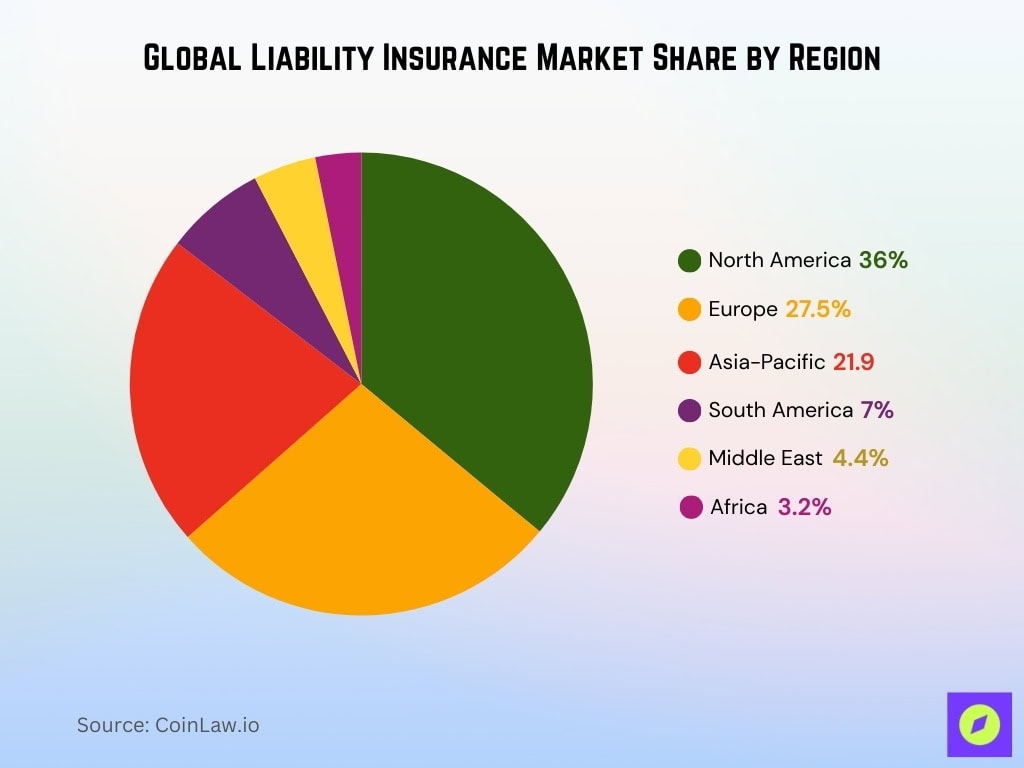

Market Share by Region and Provider

- North America holds a 36% share of the global liability insurance market in 2025, from a global market size of about $288.7 billion.

- Europe accounts for a 27.5% share of the global liability insurance market in 2025, with a market size of about $79.4 billion.

- Asia-Pacific captures a 21.9% share in 2025, market size of approximately $63.2 billion, ranked as a significant growth region.

- South America holds 7%, the Middle East 4.4%, and Africa 3.2% shares of the global liability insurance market in 2025.

- Global liability insurance market projected at $309.5 billion in 2025, rising from $291.9 billion in 2024, with a CAGR of 6.04% through to 2034.

Product Liability Insurance

- The average product liability claim payout is around $7 million at trial worldwide in 2025

- Small and medium manufacturers continue to account for ~60% of new product liability policies in 2025 (no major change).

- Automotive recalls represent about 20% of product liability claims globally in 2025 (consistent with prior years).

- Food and beverage industry product liability premiums are up by approximately 15% year-over-year into 2025 (driven by contamination and safety incidents).

- The US remains the largest market for product liability insurance in 2025, representing approximately 45% of global premiums.

- Technology sector product liability insurance grew by around 25% by 2025 due to risks from software, IoT, and supply chain issues.

Insurers’ Legal Defense Costs

- Global legal defense costs for liability insurers are estimated at $18.8 billion in 2025, driven by increasing case complexity.

- The average cost of defending a liability claim in the US is now around $75,000 in 2025, especially higher in product and professional liability matters.

- Cyber liability cases account for roughly 15% of total defense spending in 2025 because of more frequent cybersecurity lawsuits.

- Healthcare-related liability legal fees increased about 10% year-over-year into 2025, driven by malpractice and new regulatory challenges.

- Environmental liability defense costs rose by approximately 8% in 2025, with large-scale contamination cases pushing the increase.

- Small businesses face an average of $20,000 in legal fees per liability claim in 2025, prompting more interest in legal coverage add-ons.

- Insurers noted litigation costs up by about 5% in 2025 due to longer case durations and more complex legal environments.

Most Common Liability Insurance Types Among Small Business Owners

- 52% of small business owners purchase general liability insurance, making it the most widely held coverage.

- 41% opt for a business owner’s policy (BOP), which bundles liability and property coverage.

- 29% hold workers’ compensation insurance to cover employee injuries and claims.

- 24% purchase commercial property insurance to protect their physical assets.

- 20% have professional liability insurance, also known as errors and omissions coverage.

- 18% invest in product liability insurance to cover damages from defective products.

- Only 10% carry cyber liability insurance, despite rising digital threats.

Liability Insurance Market Growth Factors

- Global cyber liability premiums are expected to reach $15.6 billion in 2025, reflecting continued demand due to rising cyberattacks.

- SME liability insurance adoption is growing at a CAGR of 5% annually in Europe from 2024 to 2031, driven by economic recovery and business expansion.

- Regulatory changes in 2025 across Europe and North America are increasing compliance requirements and policy uptake in manufacturing and high-risk industries.

- Premium sensitivity is rising as underwriters estimate increases for cyber liability of around 20% in 2025 due to losses and regulatory pressures.

- Climate and environmental liability risk are prompting insurers to develop specialized liability products in 2025 with expanded coverage for pollution and disaster scenarios.

- E-commerce businesses are seeing higher liability exposure, with online business liability policies increasing in uptake in 2025.

- Technology in risk modelling and underwriting is improving accuracy and reducing costs for insurers in 2025 with wider use of analytics, IoT, and AI-based assessments.

Trends Shaping the General Liability Insurance Market

- Digital insurance platforms selling liability insurance online are estimated to contribute ~30% of sales in 2025 as more consumers demand seamless policy purchase and management.

- IoT-enabled risk monitoring tools help businesses reduce premiums by ~15-20% in 2025 through proactive risk mitigation and improved loss prevention.

- Parametric insurance models are expected to process ~25% of new liability claims by predefined triggers in 2025, enabling faster payouts compared to traditional claims processes.

- Focus on ESG compliance is driving the development of liability products, especially in Europe and North America, with ESG-linked claims rising by about 12% in 2025.

- AI in claims processing is reducing settlement times by ~40% in 2025, improving customer satisfaction and operational efficiency.

- Tailored liability coverage for niche industries like drone operators and gig economy workers is increasing, with policy count growth estimated at ~30% in 2025 in these segments.

- Blockchain technology trials are expected to reduce fraud-related losses by ~25% in liability insurance claims in 2025 by improving transparency and tracking.

Strategic Tips for General Liability Insurance Buyers

- Assess industry-specific risks to secure the most relevant coverage in 2025, helping reduce unnecessary expenses.

- Bundle liability insurance policies with other business coverage to save up to 20% on premiums in 2025.

- Shop around and compare quotes from multiple insurers in 2025 to find the best value without losing coverage quality.

- Consider higher deductibles to lower premium costs in 2025, especially if your business has a low risk of frequent claims.

- Review your policy annually in 2025 as coverage needs and market conditions continue to shift significantly year over year.

- Implement safety measures like employee training and inspections to cut premiums by 10-15% in 2025.

- Understand exclusions in policies in 2025, such as limits for cyberattacks or environmental damage, to avoid claim surprises.

- Use risk management services from insurers in 2025, such as compliance audits and legal consultations, to strengthen coverage benefits.

Impact of Economic Factors

- Inflation has increased liability claim payouts by an average of ~5% in 2025, driving up premiums across most sectors.

- Recession concerns have led businesses to reassess coverage levels, with optional liability policies declining by ~8% in 2025.

- Economic recovery in emerging markets like Southeast Asia has driven liability insurance growth by ~10% in 2025, matching earlier strong projections.

- Rising interest rates have impacted the liability insurance sector, with investment incomes partially offsetting underwriting losses in 2025.

- Workplace dynamics, including remote work, have altered risk profiles leading to new liability products tailored for hybrid setups in 2025.

- Consumer litigation activity has surged with a ~15% increase in lawsuits in 2025, prompting higher demand for comprehensive coverage.

- Government subsidies for small businesses have enabled ~20% more SMEs to purchase liability insurance by mid-2025, mitigating economic pressures.

Regulatory and Compliance Statistics

- The EU’s Corporate Sustainability Reporting Directive (CSRD) mandates stricter liability disclosures, influencing ~50% of European liability policies in 2025.

- US workplace safety regulations triggered a ~12% rise in liability insurance claims in 2025 under OSHA and related reforms.

- Global data privacy laws like GDPR and CCPA drove a ~30% uptick in cyber liability policies in 2025 as compliance pressures mount.

- Environmental liability regulations prompted a ~25% increase in demand for pollution liability coverage in 2025 across affected industries.

- Compliance audits offered by insurers rose by ~20% in 2025, reflecting stronger demand for proactive risk management.

- Fines for non-compliance with insurance mandates in emerging markets increased by ~18% in 2025, leading to higher adoption rates.

- ESG reporting requirements became a key driver for tailored liability insurance policies in Europe and North America, with uptake rising by ~22% in 2025.

Technological Innovations and Digital Adoption

- AI-driven underwriting models are reducing quote turnaround times by ~50% in 2025, improving efficiency.

- Blockchain is now being tested for securing claims processing and reducing fraud risks by ~30% in liability insurance in 2025.

- Telematics and IoT devices enable insurers to offer customized liability policies using real-time data, with policy premiums adjusted by ~20% in 2025.

- Cyber liability insurance platforms integrating AI are driving a ~25% increase in customer adoption through 2025.

- Digital-first insurers have captured ~25% of the liability insurance market by 2025 by simplifying purchase processes.

- Mobile apps for policyholders are used by ~50% of users in 2025 to manage claims and renewals via digital tools.

- Cloud-based compliance tracking systems are assisting businesses with regulatory requirements, boosting demand for liability coverage by ~18% in 2025.

Recent Developments

- Merger activity in the liability insurance sector rose by ~23% in 2025, reshaping market competition and driving consolidation among brokers.

- Cyber liability insurers introduced bundled packages with ransomware recovery services, increasing customer uptake by ~25% in 2025.

- Expansion into emerging markets by major providers led to double-digit growth in Asia-Pacific, with market growth of around 12-15% in 2025.

- Product launches targeting SMEs, such as customizable general liability insurance, grew by ~20% in the US and Europe in 2025.

- Environmental liability policies were redesigned in 2025 to cover new risks, including extreme weather events tied to climate change, increasing demand by ~18%.

- Legal tech startups partnering with insurers to offer automated claims processing and dispute resolution tools saw adoption increase by ~30% in 2025.

- Growth in litigation funding contributed to a ~15% rise in claim frequency in 2025, prompting insurers to revise pricing models.

Frequently Asked Questions (FAQs)

The market is about $309.49 billion in 2025 and is projected to reach $524.66 billion by 2034 at a 6.04% CAGR.

North America holds 36% of the market on the latest split available, with Asia Pacific expected to be the fastest-growing region.

Global cyber premiums are projected at $15.6 billion in 2025, with growth expectations revised to about 5% CAGR.

Average global insurance rates declined 4% in Q2 2025, with the US flat versus the prior quarter.

H1 2025 insured catastrophe losses hit about $80 billion, heightening risk pressures that influence casualty and liability pricing.

Conclusion

To begin with, the liability insurance industry today is at the forefront of innovation and expansion, catering to a diverse range of risks faced by businesses and individuals. In addition, from rising premiums to technological transformations, the industry continues to evolve rapidly. As a result, businesses navigating these changes must stay informed about key trends and statistics to make well-rounded decisions. For example, adopting cyber liability insurance to combat digital threats or leveraging new technologies like IoT and blockchain highlights the industry’s adaptability. Ultimately, the future of liability insurance looks both promising and dynamic.