Keplr Wallet has become a critical access point for users engaging with the Cosmos ecosystem and beyond. Since its launch, it has expanded in features, users, and integrations. In the realm of staking, governance, and cross‑chain transfers, real‑time data show meaningful shifts. In practice, institutions managing validator nodes use Keplr for delegations, while individual users depend on it for seamless staking and token management. Let’s dive into the statistics that define Keplr Wallet.

Editor’s Choice

- Keplr claims a user base of over 2 million wallets.

- The platform’s valuation in its latest seed round reached $50 million.

- That funding round raised $5 million.

- Keplr is ranked #75692 globally in web traffic ranking (April 2025) for keplr.app.

- On Google Play Store, it shows activity from “over 100k global users” in some metrics.

- In April 2025, keplr.app is ranked #253 in the Investing category.

- The platform has facilitated self‑custody of at least $5 billion+ in assets (estimated).

Recent Developments

- In early 2025, Keplr raised $5 million in seed funding led by 1confirmation.

- That investment round gave Keplr a $50 million valuation.

- The wallet expanded integration beyond Cosmos to support EVM chains, enhancing its utility across non‑Cosmos ecosystems.

- It also integrated with Starknet, marking its first non‑EVM, non‑Cosmos ecosystem addition.

- The XPLA network became fully integrated, enabling staking and governance directly via Keplr.

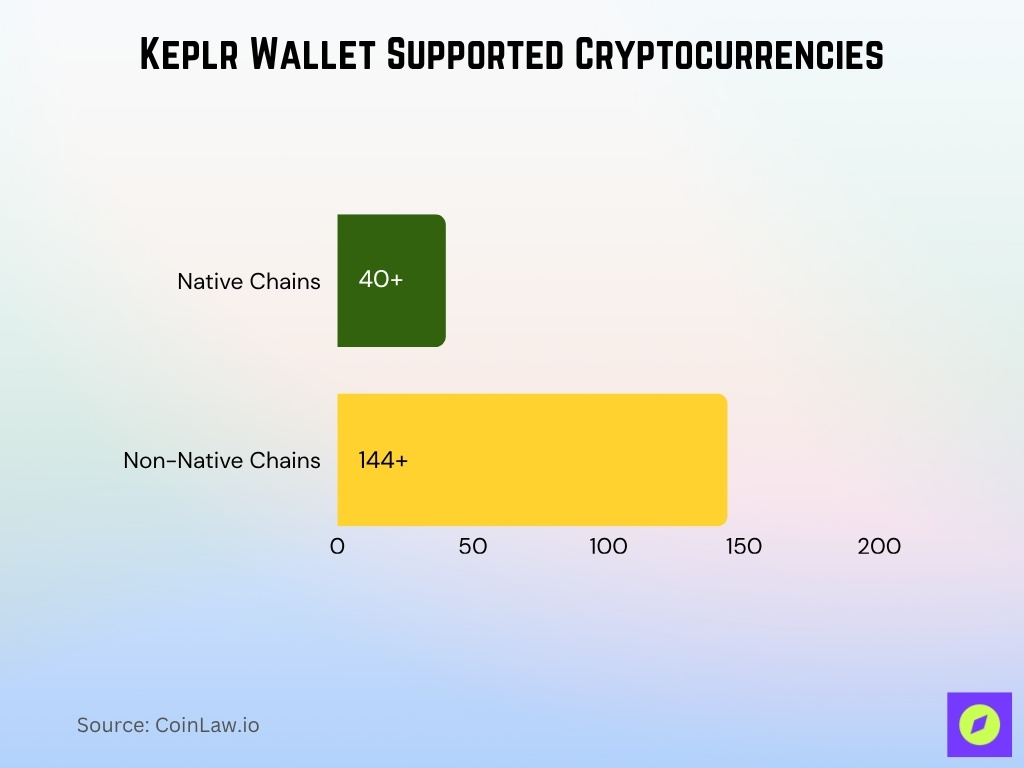

- Keplr supports 144 non‑native blockchain networks and 40+ native ones (as of 2024).

- The wallet’s web domain (keplr.app) maintains a moderate global presence; in April 2025, it ranked #75692 and #253 in the Investing category.

User Adoption & Growth

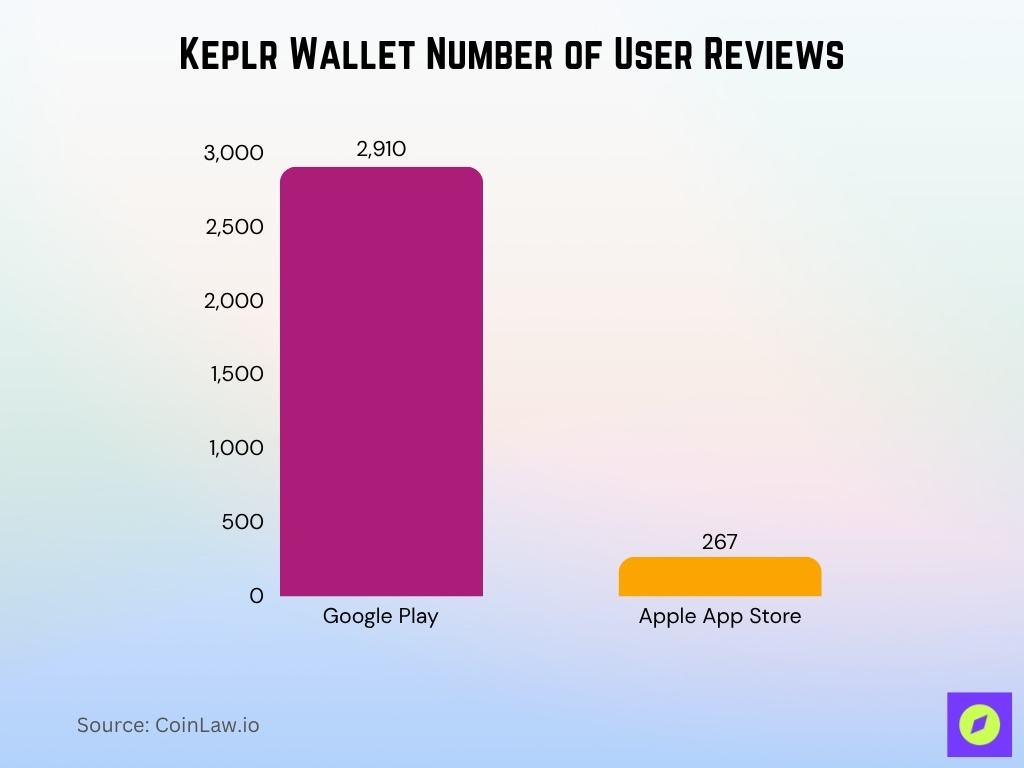

- The app maintains a 4.0 rating with about 2,910 reviews on Google Play (as of late 2025) per store listing.

- On Apple’s App Store, the iOS version has a 3.6 / 5.0 rating (267 ratings).

- The user base surpassed 2 million wallets in 2025.

- In earlier reports (2023–2024), some sources cited user counts of 1 million+, indicating doubling over time.

- Daily active user metrics show consistent rank presence within finance categories via SimilarWeb.

- On Google Play, the app’s listing signals support for “over 100k global users” in some contexts.

- In the finance app ranking (US), Keplr ranks around #857 in its category (28‑day usage metric).

Mobile App User Statistics

- The Google Play listing claims support for “over 100k global users” in some descriptive text.

- The app listing is regularly updated (e.g., last update: Sep 30, 2025), hinting at active maintenance.

- On iOS, version 2.1.100 was available as of Oct 1, 2025, aiming at stability improvements.

- The iOS app holds a 3.6 rating from 267 evaluators.

- The Android version has accumulated ~2,910 user reviews (Google Play) with a 4.0 average.

- Some user reviews note occasional bugs post‑login or UI instability on mobile.

- Mobile usage contributes to SimilarWeb’s 28‑day usage rank metrics (finance category) in the US and globally.

Supported Cryptocurrencies

- Keplr supports 40+ native chains and 144+ non‑native chains as of mid‑2024.

- It handles assets from EVM chains, extending its reach beyond pure Cosmos.

- With the XPLA integration, users can stake and manage XPLA tokens directly.

- Native chain support includes Cosmos Hub (ATOM), Kava, Osmosis, Juno, and others.

- Non‑native chains include ones that require bridging or indirect handling via IBC or wrapper assets.

- The addition of EVM compatibility allows assets like ETH, stablecoins, and ERC‑20 tokens to be held and managed.

- The expansion into multiple blockchains supports broader DeFi and cross‑chain asset movement.

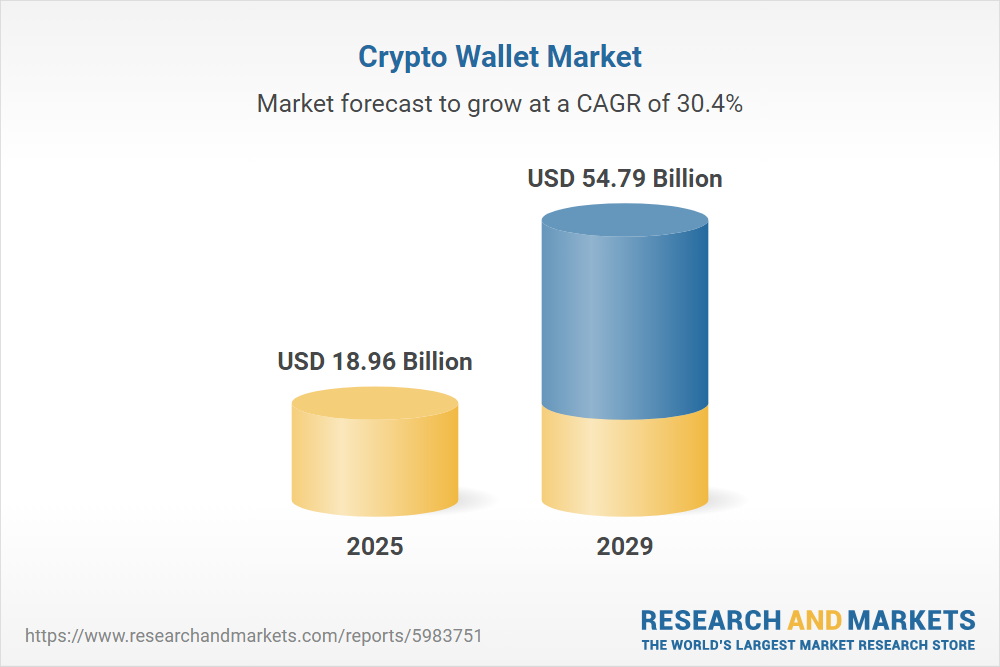

Crypto Wallet Market Growth

- The global crypto wallet market is forecast to grow significantly from $18.96 billion in 2025 to $54.79 billion by 2029.

- This represents an impressive compound annual growth rate (CAGR) of 30.4%, highlighting strong momentum in digital asset storage solutions.

- The surge reflects expanding crypto adoption, rising institutional interest, and broader Web3 ecosystem integration.

- By 2029, the market size will have nearly tripled, underscoring the increasing role of secure and user-friendly wallet technologies in global finance.

Wallet Features & Functionalities

- The Keplr dashboard offers a multichain portfolio overview & breakdown, letting users view all assets in one interface.

- Users can stake or liquid stake, browse validators, manage staking, and claim rewards via one click.

- A “Claim All” feature is available to claim staking rewards across multiple chains with a single action.

- Chain visibility is customizable; users can show or hide chains as needed within the UI.

- Keplr supports hardware wallet integration (e.g., Ledger) for improved security.

- Transaction history is tracked across chains, enabling review of past asset movements.

- The wallet interface supports translation of governance proposals, allows likes/comments, and shows validator updates.

- The mobile and browser versions sync for account continuity across devices.

- Integration with dApps is via WalletConnect style or native connections in the UI.

Staking Statistics

- Keplr supports staking across numerous Cosmos‑ecosystem chains (e.g., ATOM, OSMO, Juno) via its interface.

- On Cosmos Hub, delegators choosing validators do so via the Keplr tool, and unbonding takes 21 days.

- Validator self‑bonded rates and commission influence delegator choice.

- Some chains enforce slashing (e.g., double-sign penalty ~5%), which affects delegator risk.

- The “Claim All” feature reduces friction in harvesting staking rewards across multiple chains.

- Keplr’s UI shows validator status, commission, uptime, and reward metrics for informed staking.

- Staking operations (delegation, redelegation, claiming) form a significant portion of user interactions within Keplr.

- Some staking APRs in Cosmos chains have ranged from ~5% to 15% depending on network and supply dynamics.

- Across chains, staked assets locked via the Keplr platform may represent a material share of the chain’s total staking.

Transaction Volume & Activity

- As Keplr supports 40+ native chains and 144+ non‑native chains, its interface must handle a high volume of cross‑chain token transfers.

- Public, precise transaction volume numbers specifically for Keplr are limited in public domain reports.

- However, the wallet’s extension and dashboard regularly show activity across IBC transfers, staking operations, and governance transactions.

- Given that Keplr claims self‑custody of at least $5 billion+ in assets, internal transfers, staking, and liquidity movements drive activity.

- The extension is a gateway for many DeFi dApps, so on‑wallet swaps, claims, and interactions feed into volume.

- Validator activity (delegations, re‑delegations, unbonding) contributes a steady stream of transactions.

- Day trading or frequent moves are less common in staking contexts, so daily transaction spikes often align with governance windows or network events.

- Some user reports indicate occasional bugs or delays during mobile-to-web transitions, possibly affecting the volume seen.

Validator and Staking Pool Metrics

- Cosmos Hub maintains ~100–150 active validators in its active set, many of which accept delegations via Keplr.

- Validators differ in commission rates, which users view and compare in Keplr’s UI.

- Some validators show a high self‑bonded share (i.e., “skin in the game”) to build trust.

- Uptime and reliability metrics are critical; missing blocks risk slashing penalties.

- Delegation caps or saturation thresholds push new delegators to smaller validators via tools like Keplr UI.

- Pool sizes in larger networks may reach billions in tokens; Keplr’s users contribute part of that total.

- Validator updates (commission changes, status) are pushed in Keplr’s interface.

- Rebalancing across staking pools (redelegation) is supported.

- Some delegation activity occurs automatically via scripts or third‑party tooling that interacts with Keplr.

Integration with Cosmos Ecosystem

- Keplr is specialized for the Cosmos / IBC (Inter‑Blockchain Communication) ecosystem, allowing seamless cross‑chain transfers between Cosmos SDK chains.

- It supports dozens of native Cosmos chains such as Cosmos Hub, Osmosis, Juno, Kava, Secret Network, etc.

- Keplr’s support extends to bridging or interacting with EVM networks, increasing its interoperability beyond pure Cosmos.

- Many Cosmos dApps have built direct support for the Keplr wallet for connection and operations.

- In Cosmos Hub, the Keplr dashboard shows on‑chain metrics such as fees, block data, and validator stats.

- Community tooling around Cosmos often assumes Keplr compatibility.

- Integration with network upgrades, proposals, and parameter changes is facilitated via Keplr in many Cosmos chains.

- The wallet’s native compatibility with IBC makes it easier for users to traverse chains within the Cosmos ecosystem.

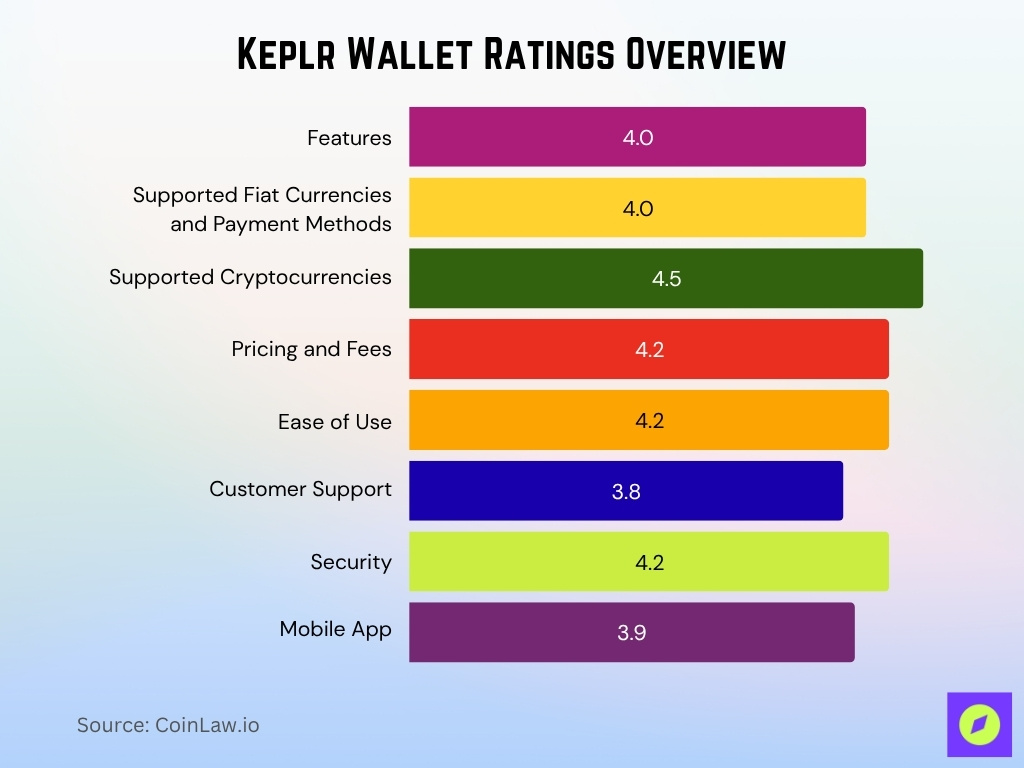

Keplr Wallet Ratings Overview

- Features rated 4 / 5, highlighting Keplr’s solid functionality for staking, governance, and cross-chain management.

- Supported fiat currencies and payment methods scored 4 / 5, showing adequate flexibility but room for broader integration.

- Supported cryptocurrencies earned the highest score at 4.5 / 5, reflecting strong multi-chain support within the Cosmos ecosystem.

- Pricing and fees received 4.2 / 5, indicating competitive transaction costs compared to other DeFi wallets.

- Ease of use achieved 4.2 / 5, confirming Keplr’s intuitive interface and beginner-friendly design.

- Customer support was rated 3.8 / 5, suggesting moderate responsiveness and potential improvement areas.

- Security stood at 4.2 / 5, underscoring robust protection through hardware wallet compatibility and encryption.

- Mobile app received 3.9 / 5, showing stable performance with minor limitations versus the browser extension version.

dApp Interaction Data

- Keplr serves as the primary wallet interface for Cosmos‑based DeFi apps, allowing users to swap, pool, provide liquidity, stake, and vote via dApp connections.

- The wallet supports wallet connection methods for dApp integration, with signing and permission flows mediated via the extension or mobile app.

- Many dApps show in their UI a “Connect Keplr” button, indicating the prevalence of Keplr as a default wallet.

- Users can sign transactions such as token swaps or staking operations directly from dApps with Keplr’s prompt confirmation model.

- Keplr’s architecture supports adding new chains from dApps, so dApps can propose chain inclusion.

- For non‑Cosmos ecosystems, dApps using Keplr must bridge or handle cross‑chain logic via wrappers, which is still early but growing.

- Reporting of dApp usage metrics specific to Keplr users is limited publicly, but ecosystem dashboards in Cosmos often segment by wallet use.

- In ecosystem reviews, Keplr is often noted as a first‑class wallet for dApp developers in Cosmos, aiding adoption.

Geographic User Distribution

- In the United States, Keplr ranks #857 in Finance (28‑day usage) among apps.

- In global web rankings for keplr.app, the site is #75,692 globally in April 2025.

- On the same date, keplr.app ranked #253 in the Investing category.

- In country‑level app rankings, Keplr ranks in the top finance apps in the Philippines (#37 in Finance).

- In the “All categories” app ranking, Keplr is #6,722 in the U.S. (overall).

- Keplr is available in over 170 countries.

- Asia and North America are frequently highlighted as key user regions for Cosmos apps.

Frequently Asked Questions (FAQs)

Over 2 million users.

$50 million valuation.

$5 million was raised.

Ranked #857.

Conclusion

Keplr Wallet is not only a wallet but a gateway to the Cosmos and multichain world. Its strength lies in deep integration with IBC, robust staking and governance tools, and a security model that keeps keys in user control. While we lack full public transparency on some metrics (e.g., transaction volumes and dApp usage breakdowns), what is visible paints a picture of growth, adoption across regions, and competitive positioning in a niche ecosystem.

As DeFi, governance, and cross‑chain applications expand, tools like Keplr become central infrastructure. The statistics we’ve covered show promise, highlight gaps, and guide where the next waves of user demand may emerge. Dive into the full article to explore each metric in depth and understand how Keplr’s growth may shape the broader crypto landscape.