Imagine a world where convenience meets technology, and transactions become seamless across borders. This is the world that JCB Cards, a trailblazer in the payment industry, has been building since its inception. Founded in Japan in 1961, JCB has grown from a domestic card issuer to a global powerhouse, offering innovative solutions for individuals and businesses alike. Its network spans millions of merchants and cardholders across the globe, cementing its position as one of the most recognized and trusted names in the payment card industry. Let’s delve into the fascinating statistics behind JCB’s growth and influence in 2025.

Editor’s Choice

- Over 160 million JCB cardholders globally in 2025, reinforcing its role as a top global payment network.

- JCB’s 2025 transaction volume rose by 18%, surpassing $410 billion in global payments.

- JCB is now accepted in 195 countries and territories, expanding its global presence further in 2025.

- Contactless payment usage jumped 28% in 2025, driven by demand for fast and secure checkouts.

- In 2025, JCB cards made up 20% of all card transactions in Asia, solidifying regional leadership.

- Co-branded card issuance grew by 42% in 2025, thanks to expanded fintech partnerships worldwide.

- JCB recorded a customer satisfaction rate of 94% in 2025, reflecting strong user trust and service quality.

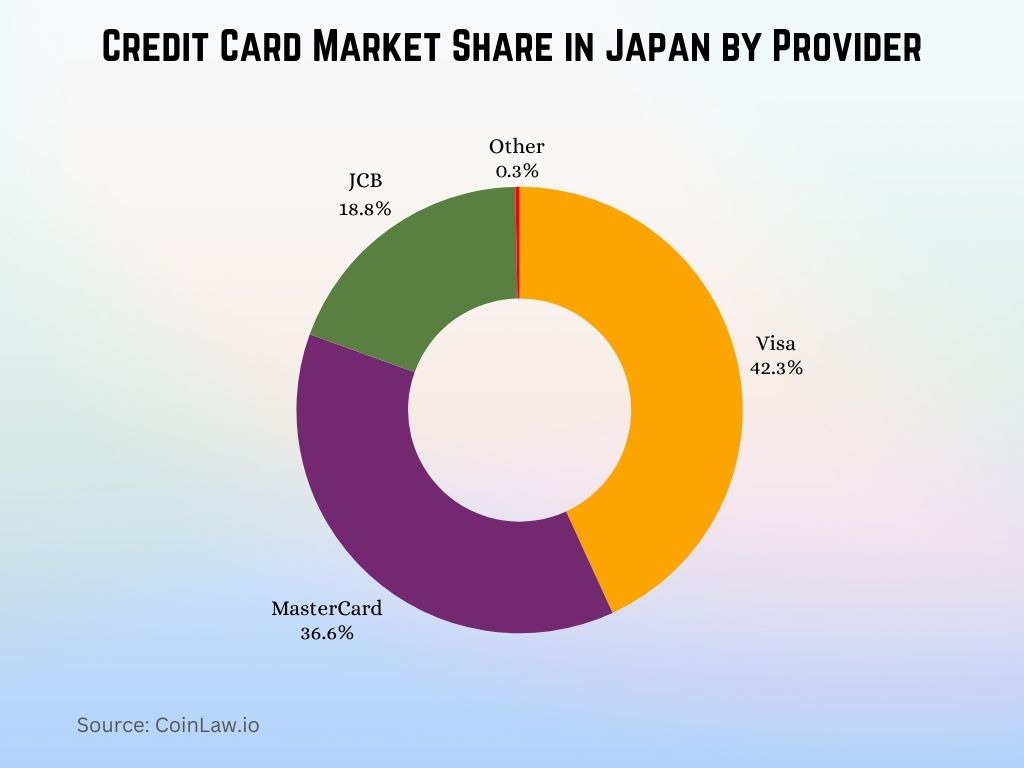

Credit Card Market Share in Japan by Provider

- Visa holds the largest market share among credit card providers in Japan, accounting for 42.3% of the market.

- MasterCard follows closely with a significant share of 36.6%, reinforcing its strong presence in the region.

- JCB, a Japan-based provider, captures 18.8% of the market, reflecting solid domestic adoption.

- Other providers make up a minimal 0.3%, indicating limited competition outside the top three brands.

About JCB

JCB (Japan Credit Bureau) has come a long way from being a domestic payment card issuer to a globally recognized financial services provider. Here’s an overview of its remarkable journey:

- Established in 1961, JCB launched its first credit card in Japan, aiming to offer a convenient payment solution to Japanese consumers.

- Today, JCB operates in 24 countries as an acquirer, issuer, and payment network operator.

- The company’s philosophy revolves around providing “Omotenashi”, a Japanese concept of hospitality, ensuring customer-centric services.

- JCB was among the first card networks to integrate NFC technology, enhancing contactless payment options.

- The brand maintains strong partnerships with over 30 international financial institutions, enabling cross-border payment solutions.

- JCB has invested heavily in digital transformation, with over 70% of its services now accessible through mobile platforms.

- Its Reward Program, which offers points on every transaction, contributed to a 15% increase in customer retention.

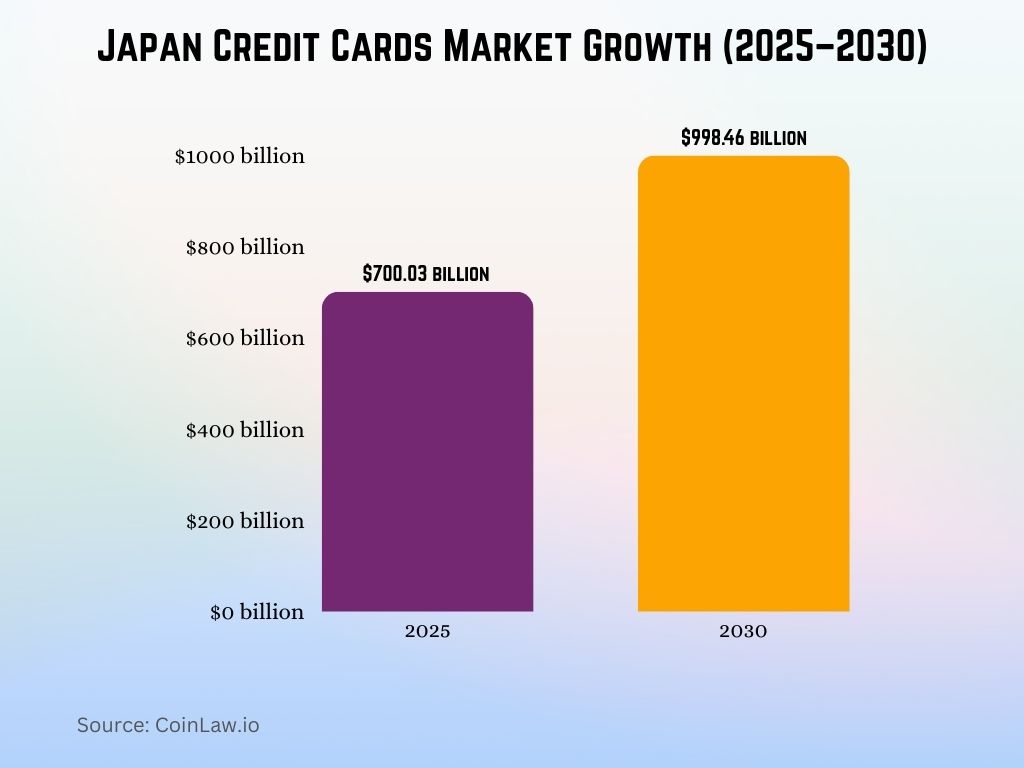

Japan Credit Cards Market Growth (2025–2030)

- The transaction value of the Japan credit cards market is projected to rise from USD 700.03 billion in 2025 to USD 998.46 billion by 2030.

- This growth reflects a compound annual growth rate (CAGR) of 7.36%, signaling a strong upward trend in credit card usage and spending in Japan.

The data highlights Japan’s expanding digital payment infrastructure and increased consumer reliance on cashless transactions.

Transaction Volume

- JCB processed $410 billion in global transactions in 2025, reflecting an 18% increase from the previous year.

- Travel and hospitality sectors made up 38% of JCB’s 2025 transaction volume, fueled by post-pandemic travel growth.

- Contactless payments rose 28% year-over-year in 2025, highlighting a strong shift to fast and secure tap-to-pay options.

- E-commerce transactions grew by 45% in 2025, as online spending using JCB cards continued its upward trend.

- Domestic transactions in Japan reached $165 billion, reinforcing JCB’s market dominance at home.

- JCB cards handled an average of 11.2 million transactions daily in 2025, confirming global scalability and trust.

- Retail transactions jumped 22% in 2025, boosted by strategic alliances with Walmart, Alibaba, and other major retailers.

Market Presence and Acceptance

JCB’s wide acceptance and strategic expansion have made it one of the most inclusive card networks globally. Here are some notable achievements:

- JCB is accepted at over 38 million merchant locations in 195 countries globally as of 2025.

- JCB’s market share in Asia rose to 20% in 2025, securing its position as a leading regional payment network.

- Expansion into the Middle East led to 8 major bank partnerships in 2025, boosting regional acceptance and reach.

- JCB’s collaboration with UnionPay in China enabled 5 million new cardholders to access the network.

- In the US market, acceptance of JCB cards grew by 15%, with an emphasis on luxury retail and travel-related merchants.

- JCB became the first Japanese card network to gain a significant foothold in Africa, focusing on South Africa and Kenya.

- Contactless payment adoption grew to 40% of JCB’s total transactions, further increasing its global presence.

Technological Innovations

- Biometric authentication reduced fraud by 42% in 2025, strengthening payment security both online and in-store.

- AI-powered fraud detection processed 6.2 billion transactions in real time, blocking over $1.3 billion in fraudulent activity.

- JCB expanded its cryptocurrency payment program in 2025, enabling digital asset payments with select global merchants.

- Contactless and mobile payments accounted for 46% of global JCB transactions in 2025, reflecting rising demand for convenience.

- “Tap & Connect” tech cuts processing time by 30%, resulting in faster checkouts and higher customer satisfaction.

- Co-branded digital card issuance rose 47% in 2025, fueled by new partnerships with fintech innovators.

- Machine learning tools improved trend prediction accuracy by 33%, helping merchants deliver targeted offers and boost engagement.

Japan Credit Cards Market Overview

- Card Segments: The market is divided into General Purpose Credit Cards and Specialty and Other Credit Cards, indicating a diverse range of offerings.

- Growth Trend: The chart illustrates a steady upward growth across the years, suggesting a positive compound annual growth rate (CAGR) for the Japan credit card market.

- Market Expansion: The market is expected to grow at a CAGR of XX% during the forecast period (20XX–20XX), as per IMARC analysis.

- Top Growth Segment: One segment recorded the highest CAGR, highlighted in a yellow section of the circular chart, emphasizing fast-paced adoption or innovation.

- Leading Market Share: A different segment holds the largest market share, indicated with a blue section in the donut chart, signaling its dominance in usage or reach.

AWS Services Used

Leveraging the robust infrastructure of Amazon Web Services (AWS), JCB has streamlined its operations and expanded its capabilities. Here’s how JCB utilizes AWS:

- JCB relies on AWS Lambda for serverless computing, enabling the company to handle spikes of up to 100,000 transactions per second during peak times.

- By utilizing Amazon Redshift, JCB has reduced its data query processing time by 60%, improving analytics and decision-making.

- The integration of AWS CloudTrail ensures compliance with global regulations, enhancing data security and transparency.

- JCB employs Amazon SageMaker for predictive analytics, allowing the company to anticipate customer needs and optimize services.

- With AWS Elastic Load Balancing, JCB maintains uninterrupted payment processing, even during unplanned system outages.

- The adoption of AWS IoT Core has enabled the company to integrate payment systems with smart devices, enhancing convenience.

- Using Amazon Rekognition, JCB implemented advanced facial recognition for identity verification, reducing onboarding time by 20%.

Recent Developments

- JCB and Visa expanded their dual-network card program in 2025, now active in 12 markets for greater global cardholder convenience.

- JCB Green Pay grew 60% year-over-year, offering 12% cashback on eco-friendly purchases and driving sustainable payment adoption.

- The JCB-Amazon Japan co-branded card reached 1.4 million new accounts in just six months, breaking internal issuance records.

- JCB partnered with SpaceX in 2025, pioneering payment tech for commercial space travel and zero-gravity transactions.

- API-based payment integration expanded to over 180,000 SMEs, boosting digital adoption in the merchant ecosystem.

- JCB achieved a 94% customer retention rate in 2025, driven by innovation, loyalty rewards, and trusted service.

- Employee Volunteer Program contributed 13,500 hours in 2025 to financial literacy across underserved and rural communities.

Conclusion

As JCB Cards continues to innovate and expand, it’s evident that the brand is shaping the future of the global payments landscape. With a steadfast commitment to technology, sustainability, and customer satisfaction, JCB is not only catering to the needs of today’s consumers but also preparing for the financial demands of tomorrow. From its growing global presence to groundbreaking technological advancements, JCB’s trajectory looks exceptionally promising.

By maintaining its core values of reliability, innovation, and customer focus, JCB solidifies its legacy as a payment network that seamlessly bridges tradition with the future of commerce.