Iris Energy Ltd (formerly Iris Energy) operates at the intersection of large-scale bitcoin mining and high-performance AI/cloud computing. The company owns data centers powered by renewable energy and uses its infrastructure both to mine cryptocurrency and to host compute workloads. In real-world terms, its operations affect how digital-asset miners access low-cost power and how AI firms lease GPU clusters across North America. Whether viewed by an investor or an operations manager, Iris Energy’s shift from pure bitcoin mining to diversified compute services marks a meaningful industry pivot. Continue reading for detailed statistics by business line and trend.

Editor’s Choice

- In April 2025, Iris Energy achieved an average operating hashrate of 36.6 EH/s, up from 30.3 EH/s in March.

- The company reported 579 BTC mined in April 2025, rising from 533 BTC in March.

- For December 2024, Iris Energy mined 529 BTC and generated a hardware profit margin of 77%.

- The company paused bitcoin mining expansion at 52 EH/s to redirect focus toward AI cloud services.

- As of March 2025, Iris Energy’s operational data center capacity reached approximately 660 MW, including both energized and partially commissioned infrastructure.

- Iris Energy’s Q3 FY25 revenue reached $148.1 million, with bitcoin-mining revenue of approximately $141.2 million.

- The company shipped 1,896 NVIDIA H100/H200 GPUs for its AI/cloud business as of March 2025.

Recent Developments

- In March 2025, Iris Energy announced it would suspend further bitcoin mining expansion after hitting approximately 52 EH/s, redirecting resources to AI cloud.

- As of April 2025, the installed bitcoin-mining capacity reached 40 EH/s mid-month, and the company remained on track for 50 EH/s by June 30.

- In April 2025, the average hashrate stepped up to 36.6 EH/s from 30.3 EH/s in March, demonstrating operational growth.

- Iris Energy announced an expansion of its AI cloud compute capacity, including the deployment of several thousand GPUs and securing data-center power.

- In December 2024, the company reported revenue of approximately $52.1 million from bitcoin mining and an operating hashrate of 28.1 EH/s.

- Efficiency metrics improved, a drop in hash cost from 24 J/TH in Q3 to 15.3 J/TH in Q4 was reported, signalling better hardware utilisation.

- Data-center power-securing progress reached about 2.75 GW in West Texas for future operations.

Business Model

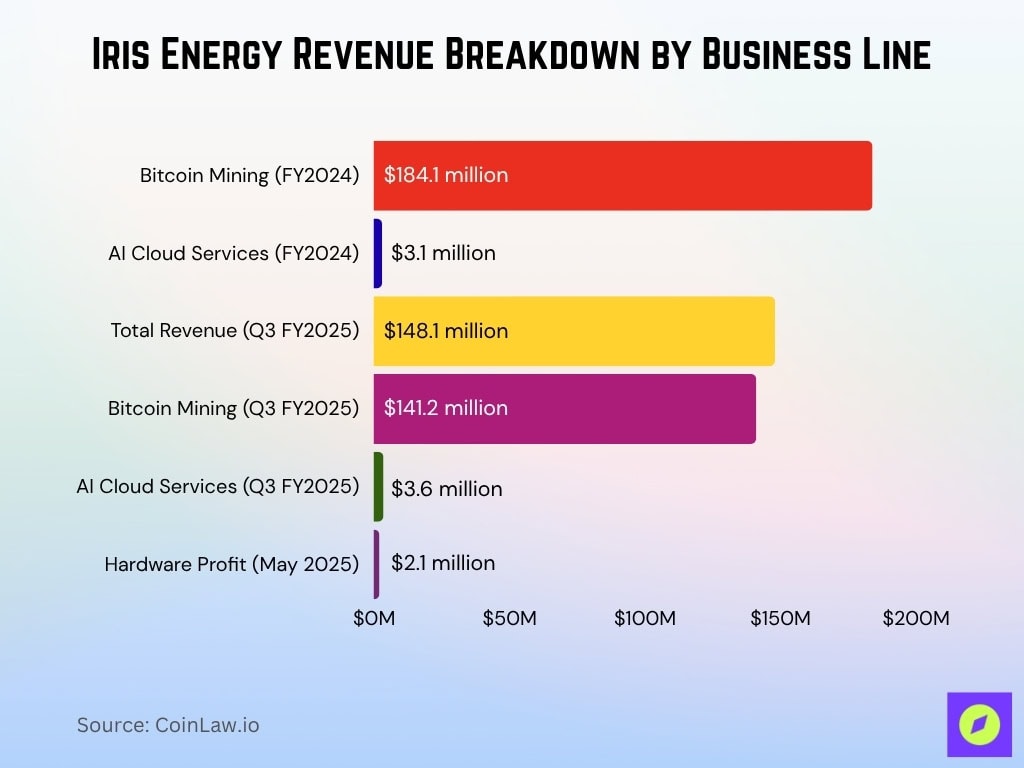

- Bitcoin mining generated over $184.1 million in revenue in FY2024, up 144% year-over-year.

- AI cloud services delivered $3.1 million in revenue in FY2024, marking a new business segment.

- In Q3 FY2025, total revenue hit $148.1 million, with $141.2 million from Bitcoin mining and $3.6 million from AI Cloud.

- Hardware profit (revenue minus electricity) reached nearly $2.1 million in May 2025.

- Childress site power cost was 3.2 cents/kWh in December 2024, ensuring industry-low energy rates.

- Company-wide net margin reached 16.7% in 2025, exceeding sector benchmarks.

- As of August 2025, Iris Energy operated over 50 EH/s of Bitcoin hashrate and 10,900 NVIDIA GPUs for AI/HPC.

- Revenue grew by 168% year-over-year as of March 2025, among the fastest in the peer group.

- Vertical integration cut reliance on third parties and led to a debt-to-equity ratio of just 0.23.

- The business expects Bitcoin mining to stabilize as AI/HPC services spearhead future margin growth.

Bitcoin Mining Statistics

- December 2024 operating hashrate averaged 28.1 EH/s.

- April 2025 operating hashrate averaged 36.6 EH/s, up from 30.3 in March.

- Bitcoin mined in April 2025 totaled 579 BTC, and March totaled 533 BTC.

- Revenue per Bitcoin mined in April 2025 was about $86,522, and in March, about $85,012.

- The electricity cost per Bitcoin in April 2025 was around $24,381, and in February about $28,341.

- Hardware profit margin in April 2025 stood at 72%, compared to 76% in March.

- December 2024 results showed 529 BTC mined, hardware profit of approximately $40 million, and unit economics margin near 77%.

- Hashcost improvement reduced to about 15.3 J/TH from 24 J/TH in Q3, indicating efficiency gains.

- Installed mining capacity target reached 50 EH/s by H1 2025.

AI Cloud Services Statistics

- As of March 2025, the company reported approximately 1,896 NVIDIA H100/H200 GPUs installed.

- In April 2025, the AI cloud business generated $2.0 million in revenue.

- In March, the AI cloud business revenue was approximately $1.6 million, February about $1.2 million.

- The company projects AI cloud services could reach $200 million + in annualised revenue by December 2025.

- Iris Energy achieved NVIDIA Preferred Partner status in 2025, supporting its AI cloud expansion.

- AI business hardware profit margin was around 98%.

- The company is scaling GPU inventory from approximately 1.9 k to 10.9 k units in 2025, including Blackwell-generation GPUs.

- The transition toward AI cloud is supported by non-dilutive GPU financing worth about $200 million.

Iris Energy Key Operational and Financial Highlights

- 510 MW total data center capacity, showcasing large-scale infrastructure expansion.

- 31 EH/s of installed hashrate, underscoring the company’s strong Bitcoin mining capability.

- 1,896 NVIDIA H100 and H200 GPUs deployed, supporting Iris Energy’s growing AI cloud segment.

- $45 million in revenue, reflecting solid performance across both mining and AI services.

- $13 million in electricity costs, highlighting energy efficiency amid high-power operations.

- $32 million in hardware profit, signaling improved margins and effective cost management.

Year-Over-Year Growth

- From December 2023 to December 2024, bitcoins mined increased to 3,984 BTC in 2024.

- Operating hashrate at year-end 2024 rose to 28.1 EH/s from approximately 19.7 EH/s a year earlier.

- Mining revenue in December 2024 was about $52.1 million, a roughly 60% increase versus December 2023.

- Q3 FY25 revenue of $148.1 million represented a 28% growth in profit after tax compared to the prior period.

- AI cloud services revenue year-over-year rose from about $2.66 million in Q4 2024 to $3.6 million in Q3 FY25.

- Data centre power secured increased from 2.31 GW to approximately 2.75 GW.

- Efficiency improvement in hash cost fell from 24 J/TH to 15.3 J/TH, a reduction of about 36% in energy per hash.

Profitability Metrics

- For FY 2025, the company reported net income of $86.9 million, a turnaround from a net loss of $28.9 million in FY 2024.

- In Q4 FY25, it posted $187.3 million in revenue and $176.9 million in net income.

- Adjusted EBITDA for Q4 FY25 was $121.9 million, with a margin of about 65%.

- Gross profit margin for 2025 reached approximately 68%.

- Hardware profit margin for AI Cloud services was ~98% in August 2025.

- Return on invested capital improved, though still modest.

- Operating margin turned positive in FY 2025, reflecting operational leverage.

Global Renewable Energy Capacity by Source (GW)

- Hydropower – RoW leads with a total of 0.984 GW, representing the largest renewable share outside China.

- Hydropower – China contributes 0.436 GW, reflecting continued reliance on hydro infrastructure.

- Wind – RoW accounts for 0.608 GW, showing strong growth in non-Chinese markets.

- Wind – China follows closely with 0.522 GW, underscoring the country’s expanding turbine network.

- Solar – RoW delivers 0.977 GW, marking a significant portion of global renewable additions.

- Solar – China produces 0.888 GW, confirming its leadership in photovoltaic deployment.

- Bioenergy – RoW adds 0.118 GW, highlighting moderate adoption across diverse regions.

- Bioenergy – China contributes a smaller 0.033 GW, showing limited biomass capacity development.

Funding and Capital Structure

- The company secured about $200 million in non-dilutive GPU financing for its AI Cloud business.

- Debt-to-equity ratio for FY 2025 was roughly 0.53, indicating moderate leverage.

- Cash and equivalents totaled $565 million in Q4 FY25, up around 37% from the previous year.

- An ATM facility was implemented to raise capital for growth initiatives.

- Total debt on the balance sheet as of June 2025 stood at $0.88 billion.

- Capital allocation is shifting from ASIC-heavy to GPU-heavy assets.

- Vertical integration reduces dependency on external financing.

Debt and Equity Analysis

- Debt-to-equity ratio of around 0.53 places the company at moderate leverage.

- Total liabilities are balanced by revenue growth of approximately 168% YoY.

- FY 2025’s profitability strengthened equity value.

- The company prioritises asset-financed expansion rather than share dilution.

- Transition to U.S. domestic issuer status in July 2025 expanded capital access.

- Debt maturities remain manageable under current cash flow conditions.

- Improved profitability reduces share-issuance risk.

Data Center Capacity

- Operational capacity totals around 660 MW as of mid-2025.

- Expansion target includes 750 MW at the Childress site by year-end 2025.

- The Prince George site is projected to deploy over 20,000 GPUs with a 50 MW IT load.

- British Columbia campuses can support more than 160 MW, targeting over 60,000 Blackwell GPUs.

- Renewable-powered data centres offer a significant cost advantage.

- Expansion allows switching between mining and AI workloads seamlessly.

- Vertical integration supports rapid scale-up potential.

Liquidity and Cash Flow

- Operating cash flow (TTM) reached about $81.33 million, showing positive generation.

- Investing cash flow was -$991.64 million, reflecting infrastructure build-out.

- Free cash flow was -$713.93 million due to heavy capital expenditure.

- Current ratio stood at 1.63, indicating healthy short-term liquidity.

- The quick ratio was 0.86, suggesting moderate liquidity without inventories.

- Cash reserves of $565 million support operations.

- Cap-ex is offset by financing structures to protect near-term liquidity.

- Large infrastructure investments signal long-term cash-flow optimism.

Operational Efficiency

- Hardware profit margin for the AI Cloud segment was ~98%, demonstrating electricity efficiency.

- Bitcoin mining hardware profit margin in August 2025 reached 66%.

- Net electricity cost per Bitcoin mined varied between $32,000–$38,000, reflecting volatility.

- The average operating hashrate in August 2025 was 44 EH/s, slightly down from July.

- Iris Energy targets 750 MW in operational capacity by year-end 2025, with construction underway across several U.S. and Canadian sites.

- Transitioning from ASIC to GPU infrastructure reuses facilities efficiently.

- Liquid-cooled data-centre design enhances energy performance.

GPU Inventory and Expansion

- As of August 2025, approximately 10,900 NVIDIA GPUs were deployed.

- An additional 12,400 GPUs were ordered for about $674 million, including NVIDIA B300s, B200s, and AMD MI350Xs.

- The company targets more than 60,000 Blackwell GPUs in British Columbia data-centres.

- AI-Cloud annualised revenue goal is $200–250 million by December 2025, aiming for $500 million+ by Q1 2026.

- NVIDIA Preferred Partner status improves procurement.

- GPU fleet expansion shifts capital away from ASIC mining rigs.

Power Supply and Energy Sources

- All data centres are powered by 100% renewable energy or equivalent credits.

- The company secured approximately 2.91 GW of grid-connected power rights.

- Operational capacity is 810 MW, with 2,100 MW under construction and 1,000 MW in development.

- The average electricity cost is around $0.033 per kWh.

- Canadian sites use hydro power; Texas sites integrate wind and solar.

- Modular facilities allow flexible workload allocation.

- Power can shift between mining and AI operations based on profitability.

- Low renewable power cost provides a strong competitive edge.

ESG and Sustainability Initiatives

- 100% renewable energy policy achieved at all IREN facilities by 2025, with zero fossil fuel use for operations.

- Canadian sites operate on 99%+ hydroelectric power, supporting low-carbon intensity computing.

- Iris Energy’s carbon intensity is <30 g CO₂/kWh, markedly lower than the data center industry average.

- ESG benchmarks led to a reported 0 environmental fines or regulatory violations in 2025.

- IREN is positioned as a top sustainable Bitcoin miner, generating 50+ EH/s compute using green power.

- New site selection requires at least 90% renewable grid mix in host regions by internal sustainability policy.

- “Clean compute” solutions are being marketed to AI and cloud clients as part of IREN’s infrastructure pitch in 2025.

- Grid coordination partners secured to support the planned 2 GW+ expansion at low-carbon sites by 2027.

- Iris Energy’s sustainable energy use enables <5% grid-related emissions compared to fossil-only peers.

Strategic Partnerships

- NVIDIA Preferred Partner status secured in August 2025, after acquiring 1,200 B300 and 1,200 GB300 GPUs worth $168 million.

- Iris Energy’s total NVIDIA GPU fleet reached 10,900 GPUs in 2025 for AI and HPC workloads.

- Over $96 million in financing was raised in 2025 through a 24-month lease for NVIDIA GB300s installations.

- Reported 167.6% revenue growth in 2025, with annual revenue rising to $501 million.

- $484.6 million from Bitcoin mining revenue in 2025, up 163% year-over-year.

- All Iris Energy data centers are powered by 100% renewable energy via long-term PPAs with utilities.

Geographic Footprint

- IREN operates in British Columbia with sites at Prince George (50+ MW), Mackenzie (80 MW), and Canal Flats (30 MW), all hydro-powered.

- Texas operations include Childress (100 MW, expandable) and Sweetwater, targeting 2 GW capacity by 2027.

- Combined operational capacity exceeded 810 MW by late 2025, a tripling in data center scale.

- IREN controls 2.9 GW of renewable power rights, with less than 20% utilized in 2025.

- Multi-site footprint supports over 50 EH/s Bitcoin mining hashrate by 2025, up from 20 EH/s in 2024.

- Canadian sites operate on 98–100% renewable energy, mainly from hydro sources.

- All Texas projects feature modular, liquid-cooled designs for ASIC and GPU dual-use workloads.

- Expansion strategy enables capacity growth across both Canada and the US, diversifying regulatory and grid risks.

- British Columbia sites have future potential to host 20,000+ GPUs as part of IRENcloud expansion.

- Sweetwater, Texas, is projected as the world’s largest single-site by 2027, with a 2 GW development plan.

Market Share Analysis

- Installed hash rate reached 50 EH/s by June 2025, representing around 6% global share.

- By September 2025, Iris Energy operated 23,000 GPUs with an AI Cloud revenue run-rate targeting $500 million by Q1 2026.

- Customer contracts covered 11,000 GPUs for an annualized $225 million ARR by end-2025.

- Bitcoin mining revenue accounted for 95%+ of total revenue to mid-2025, but AI/cloud share is quickly rising.

- Power prices at key sites remain under 3.5 c/kWh, among the lowest globally for industrial-scale mining.

- AI/cloud revenue grew more than 200% YoY in 2025, making IREN a dual-market leader.

- Modular build-out and GPU pivot enabled fleet growth from 10.9k GPUs in Q1 to over 23k by Q3 2025.

- Renewables provided 100% of power for all sites, attracting sustainability-focused cloud clients.

- Iris Energy’s total market value surged to $13 billion in Q3 2025 amid growth in both mining and AI.

- Management expects continued hashrate leadership and GPU share expansion through 2026 and beyond.

Valuation Metrics

- Intrinsic value estimated at $25.71 per share, possibly overvalued by 59%.

- Market cap in October 2025 is near $14–15 billion.

- One-year return approximately +460%, far above the S&P 500.

- Valuation multiples are elevated due to a high growth outlook.

- Dual-engine model complicates comparables with peers.

- Execution and bitcoin volatility remain valuation risks.

- Renewable contract reliability affects investor confidence.

Frequently Asked Questions (FAQs)

Iris Energy reported a hardware profit margin of 98% for its AI Cloud Services segment in April 2025.

Iris Energy has secured approximately 2.75 GW of power-rights pipeline for future expansion.

In the early October 2025 report, Iris Energy’s debt-to-equity ratio was 0.53.

Iris Energy reported a revenue per Bitcoin mined of $86,522 in April 2025.

Conclusion

In summary, Iris Energy (IREN) stands at a critical inflection point, combining large-scale bitcoin-mining operations with a fast-growing pivot into AI and cloud infrastructure, all powered by low-cost renewable energy. Its results in hash-rate scale, GPU deployment, and power-rights advantage provide a strong base. However, the company faces execution risks around build-out, power expansion, and market competition. For investors and industry observers alike, IREN demonstrates how renewable-powered infrastructure aligns with the computing demands of the crypto and AI era.