Trading infrastructure outages have become an increasingly disruptive force in modern investing. Outages affected not just individual brokerages but major exchanges, highlighting how fragile global markets can be when platforms go dark. These incidents don’t just impact institutions; they leave retail traders locked out, portfolios exposed, and risk models scrambling to keep up.

From data center failures to API downtime, the consequences of these outages ripple across financial systems. Institutional hedging gets delayed, individual P&Ls take hits, and confidence in platforms erodes. Real-world examples like the CME Group’s data center cooling failure and Robinhood’s trading outage show how outages disrupt even the most resilient systems.

Editor’s Choice

- Around 10–11 hours of trading were halted globally during the late‑November 2025 CME Group outage, disrupting futures, FX, and commodities contracts.

- Downtime cost estimates for large exchanges range from $5 million to $20 million per hour during high-volatility sessions.

- API-related outages surged by over 60% in Q1 2025 compared to the same quarter in 2024.

- Robinhood’s October 2025 outage affected more than 11,000 users at market open.

- Charles Schwab recorded 14,500+ outage complaints during the August 2024 platform failure.

- Data center cooling system failures are now linked to multiple critical trading halts.

- The average platform uptime in 2025 dropped from 99.66% to 99.46% year-over-year.

Recent Developments

- CME Group suffered an hours‑long outage of roughly 10–11 hours on November 27–28, 2025, halting key futures, FX, and commodities trading after a data‑center cooling failure.

- Robinhood and Coinbase faced hours-long downtime in October 2025 from an AWS outage, with over 2,000 complaints reported.

- Global trading API uptime dropped to 99.46% in Q1 2025, up 60% downtime from 99.66% in Q1 2024, per the Uptrends report.

- AWS outage on October 20, 2025, disrupted Robinhood, Coinbase, and others, causing global service interruptions for several hours.

- Average weekly API downtime climbed from 34 minutes in Q1 2024 to 55 minutes in Q1 2025, a roughly 60% increase that can cost trading platforms millions in missed orders and delays.

- Financial sector outages declined vs. the 2020-2024 average in 2024, but cyber incidents rose with severe impacts per the Uptime report.

- Robinhood stock dipped 1.25% to $146.05 during the October 2025 outage amid high-volume trading disruptions.

- 31% of firms report 8-hour cloud outage as catastrophic during business hours in 2025 surveys.

Executive Misalignment on Resilience Priorities

- 86% of executives now admit they’ve been prioritizing cybersecurity over resilience planning.

- This reflects a growing awareness that readiness for service disruptions has been underinvested across major firms.

- The finding underscores the shift in focus from just defense (security) to continuity (resilience) in IT and trading infrastructures.

Overview of Investment Platform Outages

- CME Group, Robinhood, Schwab, and Fidelity were the most affected platforms in 2025.

- An estimated 14% of active U.S. traders experienced at least one outage in 2025.

- Platform outages most commonly occur during peak hours, market open (9:30 a.m. ET) and close (4 p.m. ET).

- API errors and data latency accounted for increasing partial outages rather than full platform failures.

- 45% of outages reported on Downdetector in 2025 were login-related.

- Nearly 70% of outages occurred during volatile market periods, intensifying their impact.

- Over 33% of retail investors said they missed trades or incurred losses due to platform instability in 2025.

- Most trading platforms attributed downtime to “unspecified technical errors,” signaling systemic or cloud-related issues.

- Average weekly API downtime rose to 55 minutes in Q1 2025, up from 34 minutes in Q1 2024, costing millions.

- 31% of firms consider an 8-hour cloud outage catastrophic during business hours.

Historical Outage Trends

- Reported outages among top U.S. trading platforms increased from 218 in 2023 to 272 in 2024 and 301 by October 2025.

- Robinhood experienced over 40 publicized outages between 2020–2025, many during key trading windows.

- The longest outage in the past five years was a 13-hour halt at TD Ameritrade in March 2022.

- Outage frequency shifted from rare annual events to regular disruptions over the last decade.

- Platforms fully reliant on third-party cloud services had 35% more issues than hybrid cloud users.

- In 2024, 50% of reported trading platform outages lasted longer than 30 minutes.

- The COVID-era surge in digital investing caused long-term infrastructure strain still unresolved by many firms.

- Outage-related class action lawsuits increased by 22% between 2022 and 2025.

- Hybrid cloud adoption helped reduce platform outage vulnerability by about 25% compared to full cloud reliance.

- Annual outage reports rose by an average of 15% year-over-year between 2023-2025.

Most Companies Experience Weekly Outages: Key Causes Explained

- 38% of outages are due to network issues, the top contributor to weekly service disruptions.

- 36% of downtime stems from software issues, including bugs, misconfigurations, and faulty updates.

- 36% are caused by cyberattacks, showing that security threats still severely impact availability.

- 35% relate to cloud provider reliability problems, underscoring dependency on third-party infrastructure.

- 43% come from third-party service failures, such as vendor outages or API breakdowns.

- 31% are triggered by environmental factors, including power outages, natural disasters, and cooling failures.

- 31% of incidents involve human error, highlighting the ongoing risk of manual missteps.

- 30% of outages are linked to capacity issues, where systems can’t handle traffic spikes or load surges.

- 30% are caused by hardware failures, like server breakdowns or physical component malfunctions.

Frequency of Trading Platform Downtime

- Average downtime frequency for trading platforms reached 1.6 incidents per month per provider in 2025, up from 1.2 in 2024.

- Robinhood logged at least 11 distinct outages by October 2025.

- Schwab and Fidelity users reported platform issues at least 9 times each on Downdetector in 2025.

- HFT platforms averaged $7 million/hour in lost P&L during outages.

- Brokerages with legacy systems experienced 3.5x more outages than cloud-augmented peers.

- Peak outages correlated strongly with Fed announcement days and earnings weeks.

- Platforms serving retail and institutional clients faced more frequent multi-hour outages.

- Financial sector outage frequency declined vs. the 2020-2024 average, but cyber incidents rose.

Robinhood Outage Statistics

- Downdetector registered 11,700 user reports at peak during the October 6, 2025, incident.

- Platform restored by 9:55 a.m. ET, about 45 minutes after disruptions began.

- Robinhood stock dropped 1.25% following the October 6 outage amid user frustration.

- October 20, 2025, AWS outage affected Robinhood alongside Coinbase, with thousands reporting issues.

- Over 11,000 users reported outages right at market open on October 6, 2025, per Downdetector.

- AWS disruption caused hours-long slowdowns for Robinhood services on October 20.

- Robinhood experienced at least 11 outages by October 2025, many during peak volatility.

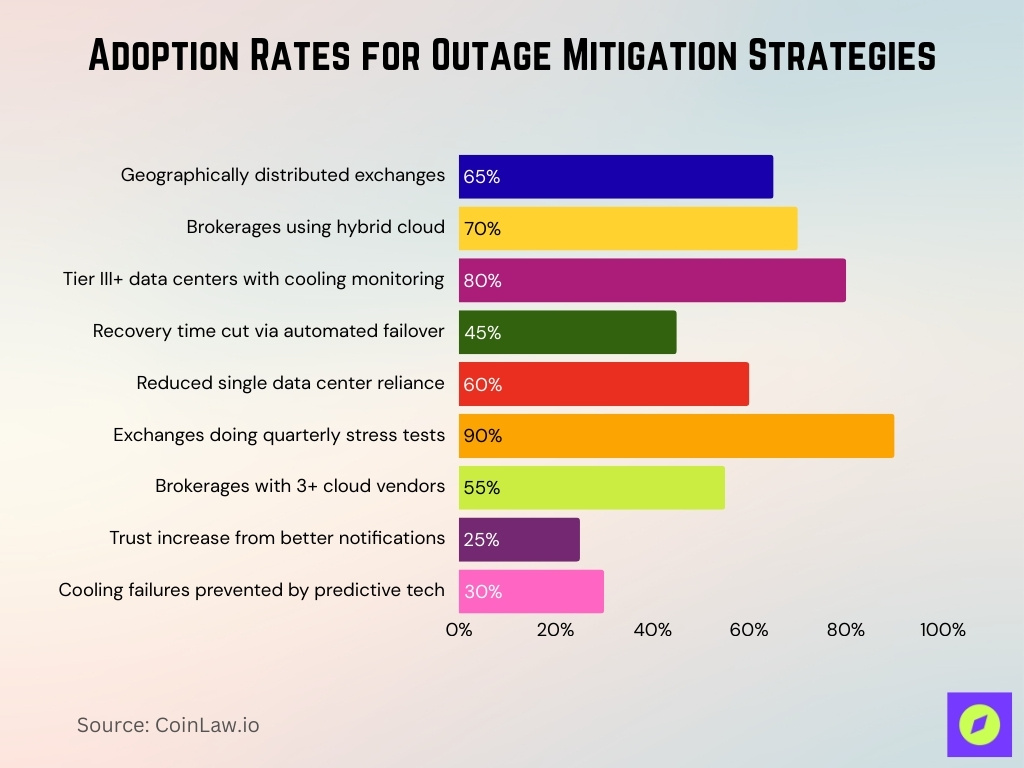

Mitigation and Preparedness Strategies

- 65% of exchanges adopted geographically distributed infrastructure post-2025 CME outage.

- Hybrid cloud architectures are implemented by 70% of brokerages, balancing control and scalability.

- Real-time monitoring for cooling systems deployed across 80% of Tier III+ data centers.

- Automated failover mechanisms reduced recovery time by 45% in stress-tested platforms.

- Hybrid-cloud plus edge-computing cuts single data center dependency by 60% for major firms.

- Quarterly stress tests mandated for 90% of regulated exchanges by mid-2025.

- Vendor diversification across 3+ cloud providers has been adopted by 55% of brokerages.

- Client notification protocols improved transparency, boosting trust by 25% post-outage.

- Predictive maintenance prevented 30% of potential cooling failures in 2025.

Charles Schwab and Fidelity Issues

- August 5, 2024, sell-off saw ~14,500 Downdetector reports for Charles Schwab at peak.

- Fidelity Investments recorded over 3,600 outage reports on August 5, 2024.

- Vanguard logged nearly 2,800 complaints alongside Schwab and Fidelity outages.

- Schwab had 36.5 million active brokerage accounts by the end of 2024.

- Outages peaked at 9:50 a.m. ET with 15,000+ Schwab reports during market turmoil.

- Schwab issues resolved by early afternoon after intermittent login failures.

- 3,400+ Schwab users reported downtime alongside 3,500+ Fidelity peaks.

- E-Trade and others saw thousands of complaints during the 2024 outage wave.

- Brokerages acknowledged technical glitches amid global stock sell-off stress.

Financial Impact and Losses

- CME 2025 outage cost traders an estimated $500 million+ in lost opportunities across halted futures markets.

- HFT firms lose $7 million per hour during trading platform downtime from missed P&L opportunities.

- Robinhood’s October outage led to a 1.25% stock drop valued at $200 million+ market cap loss.

- AWS outages cost financial services $1.6 billion annually in disrupted trading and payments.

- Retail investors missed critical trades during the 45-minute Robinhood outage, amplifying losses by 2-5% on volatile days.

- Cloudflare outage potentially cost brokers $1.6 billion in single-day financial service disruptions.

- Institutional hedging delayed by CME downtime increased exposure by 10-15% for unhedged positions.

- Average financial sector outage costs $9 million/hour in direct revenue and opportunity losses.

- Repeated outages erode 20-30% user trust, driving 15% account migrations to competitors.

Regulatory Impact on Outages

- 2025 CME outage triggered regulatory scrutiny on data-center redundancy and cloud dependency risks.

- 43% of impactful outages in 2025 involved third-party vendor failures, prompting transparency demands.

- Regulators demand mandatory business-continuity plans, including alternate data-center fallbacks.

- 80% of operators are now required to report outage duration and remediation steps publicly.

- Repeated outages are treated as compliance failures, risking fines up to $10 million annually.

- Real-time monitoring was adopted by 65% of exchanges post-2025 regulatory pressure.

- Geographic redundancy is mandated for Tier IV data centers serving financial platforms.

- Hybrid infrastructure exploration rose 35% among exchanges by mid-2025.

Annual Revenue Losses from Outages

- Repeated outages cause 5-15% customer churn annually, reducing trading volumes and revenues.

- Retail brokers losing just 2% of users after outages see revenue dips of $20-$50 million yearly.

- Institutional client migration can reduce platform trading volumes by up to 10% over 3 years.

- Volatile years see clustering of outages, increasing revenue risk by 15-25% for affected firms.

- Regulatory fines and compliance costs from outages add up to $10 million annually for large brokerages.

- CME’s fee-based revenue risks decline by 5-7% after major outage events due to lost investor confidence.

- Infrastructure upgrades triggered by outages increase operating costs by 8-12% per year.

- Industry-wide, annual financial losses from outages may exceed $200 million, broadly impacting net income.

- Outages lead to delayed new account sign-ups, slowing growth rates by 3-5% annually.

Trader Panic and P&L Effects

- CME 2025 outage left traders exposed for over 10 hours, increasing risk exposure across futures positions.

- Post-outage order rush caused price gaps and slippage, eroding HFT profits by 2-5% on resumption.

- Global API downtime rose 60% in Q1 2025 vs Q1 2024, raising missed trade odds for retail.

- Margin traders faced cascading losses from unexecuted stop losses during 45-minute outages.

- Delayed data reduced transparency, leading to suboptimal decisions and heightened volatility post-resume.

- Institutional hedging failure exposed portfolios to 10-15% unhedged risk during CME downtime.

- Panic selling post-outage deepened drawdowns by 3-7% in affected asset classes.

- Newer investors suffered large relative losses, with a 20-30% confidence drop after single outages.

- HFT firms lost $7 million/hour from failed executions during platform downtime.

Data Center Cooling Failures

- CME 2025 outage stemmed from chiller plant failure affecting multiple cooling units at CyrusOne CHI1.

- 90% of global derivatives trading halted due to a cooling failure on November 28, 2025.

- Power issues caused 45% of data center outages, with cooling strain rising from AI demand.

- CyrusOne deployed temporary cooling equipment after multiple chiller failures at the Chicago facility.

- Data centers face a 30% annual heat increase from AI workloads, stressing cooling systems.

- 50% of data centers experienced impactful outages over the past 3 years.

- 80% of operators believe better processes could prevent cooling-related downtime.

- The cooling market reached $16.56 billion in 2024, driven by high-density server demands.

API and Network Downtime

- Global API downtime rose from 34 minutes/week in Q1 2024 to 55 minutes/week in Q1 2025, a 60% increase.

- Uptime dropped from 99.66% to 99.46%, adding 90 extra minutes of downtime per month.

- Increased volatility in uptime raises outage risks during peak trading hours for brokers relying on cloud providers.

- Major cloud vendors suffered widespread disruptions in 2025, impacting downstream financial platforms.

Frequently Asked Questions (FAQs)

The outage lasted about 10–11 hours.

The outage disrupted trading across some 26.3 million daily contracts.

Only 53% of operators reported experiencing an outage in the past three years (down from 60% in 2022)

The outage affected the CME’s main electronic platform, which handles roughly 90% of its overall volume.

Conclusion

Outages today showed that behind every trade is a fragile technological infrastructure, and even the most advanced exchanges remain vulnerable to environmental, network, or vendor-related failures. The multi-hour halt at CME, combined with rising API and network downtime globally, illustrates that platform risk is becoming a systemic risk. For traders, brokers, and regulators, resilience is now as essential as liquidity and capital.

Firms are responding by investing in redundancy, distributed systems, improved monitoring, and diversified infrastructure. Yet, the effectiveness of these strategies will hinge on execution and consistency as platform dependency intensifies worldwide.