As the insurance industry transforms, the rise of insurtech has redefined the traditional model of how insurance is accessed and managed. From smart contracts and AI-driven underwriting to customized policy delivery via digital platforms, insurtech has unlocked a new frontier, reshaping insurance as we know it.

More than ever, both investors and consumers recognize the potential of insurtech to deliver efficiency, accessibility, and personalization, all while trimming costs and improving service quality. The statistics below will paint a detailed picture of insurtech’s rapid expansion and key trends driving the industry this year.

Editor’s Choice

- InsurTech funding reached $420 million in January, led by US firms like Corgi and Nirvana.

- Early-stage investments show recovery, with Q4 2025 at $403 million, an 11-quarter high.

- M&A activity robust, including WTW’s $1.3 billion acquisition of Newfront.

- AI-focused InsurTechs dominate January funding, with Corgi raising $108 million.

- The number of InsurTech unicorns stands at 38.

- U.S. deal share leads with 8 of 13 deals in January.

- Asia-Pacific funding is modest, e.g., Igloo’s $5 million from Tokio Marine.

Recent Developments

- Pay-as-you-go insurance grew by 45% in early 2026, driven by demand for flexible usage-based policies.

- AI-driven fraud detection integrates into over 65% of systems, preventing 25% of fraudulent claims.

- Cyber insurance market reaches $18.5 billion in 2026, up 12% from 2025.

- Embedded insurance in e-commerce expands to $135 billion, enabling seamless point-of-sale coverage.

- Telematics-based auto insurance claims 28% market share as usage models dominate.

- 40% of U.S. adults use wearable health devices, fueling insurer health tech partnerships.

- U.S. insurtech IPOs surge with debuts like Slide at $2.5 billion valuation.

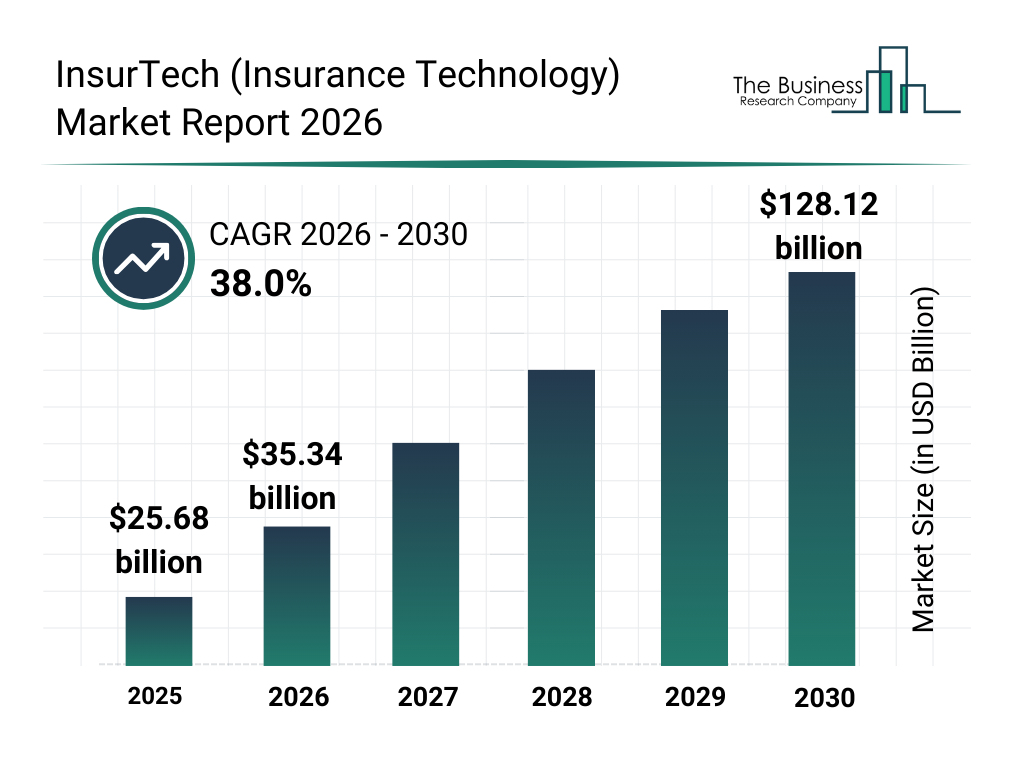

InsurTech Market Size Forecast

- The global InsurTech market reached $25.68 billion in 2025, showing strong growth as insurers adopt digital technology.

- The market is expected to grow to $35.34 billion in 2026, reflecting rapid expansion in insurance technology solutions.

- By 2027, the market size may reach about $48.59 billion, driven by increased use of AI, automation, and digital platforms in insurance.

- The industry could expand further to around $67.05 billion in 2028, as more insurers invest in digital transformation.

- In 2029, the InsurTech market is projected to reach roughly $92.53 billion, supported by growing demand for personalized insurance services.

- The market is forecast to hit $128.12 billion by 2030, highlighting strong long-term industry growth.

- Overall, the InsurTech market is expected to grow at a 38.0% compound annual growth rate (CAGR) from 2026 to 2030, making it one of the fastest-growing segments in the insurance industry.

Key Insurtech Investment Statistics

- Global insurtech funding reached $420 million in January with 13 major deals led by US firms.

- Corgi raised $108 million for an AI-native startup insurance after regulatory approval.

- Nirvana Insurance secured a $100 million Series D extension at a $1.5 billion valuation.

- WithCoverage obtained, $42 million Series B to challenge traditional brokerage models.

- Recare raised €37 million (~$40 million) for an AI-driven hospital workflow in Germany.

- Stoïk garnered €20 million (~$21 million) for European cyber insurance expansion.

- AI insurtechs captured 77.9% of Q4 2025 funding at $1.31 billion across 66 deals.

AI and Technology Adoption in Insurtech

- 45% of insurers fully adopted AI operations-wide by Q1, up from 34% last year.

- AI chatbots boosted customer satisfaction to 87% across major insurtech platforms.

- ML fraud detection achieved 94% accuracy, flagging claims in under 10 days.

- The telematics auto insurance market hit $6.2 billion with 22% YoY growth.

- 62% of firms advanced RPA deployment, 25% completed full integration.

- Predictive analytics cut underwriting time by 65%, enhancing 92% risk accuracy.

- Wearables shaped 38% of new health policies for personalized premium models.

- Generative AI adoption reached 51% in claims processing, saving $1.2 billion.

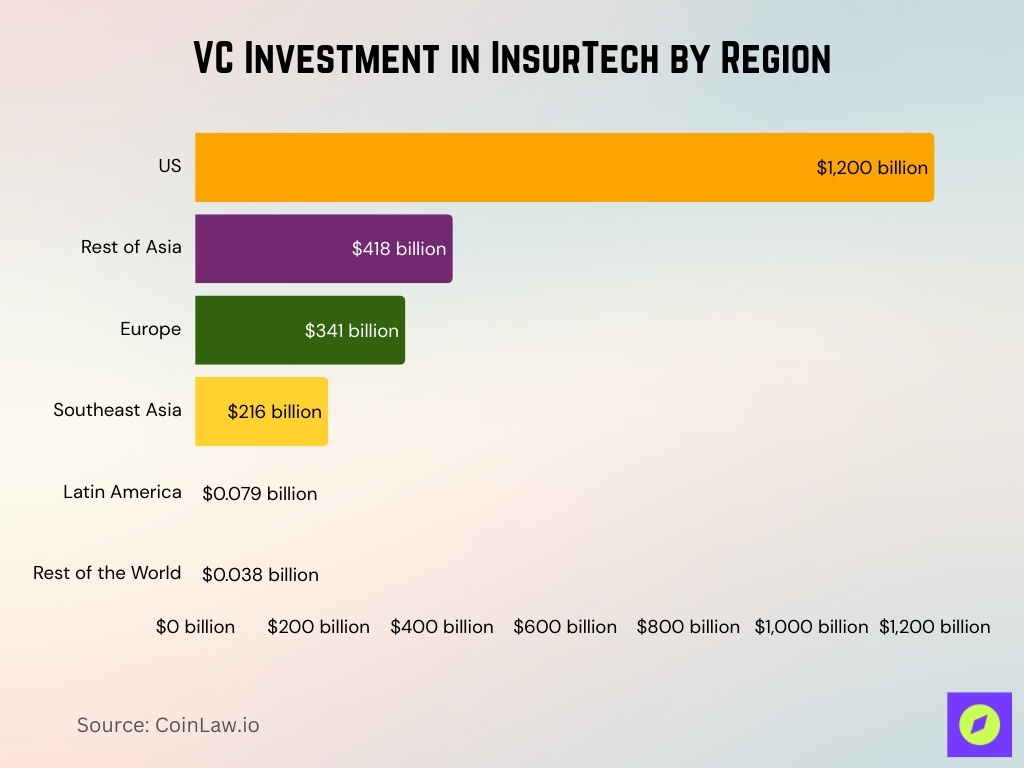

VC Investment in InsurTech by Region

- The United States leads global funding with about $1,200 billion in venture capital investment, showing its strong position in the InsurTech industry.

- The rest of Asia ranks second, attracting around $418 billion in InsurTech investments from venture capital firms.

- Europe follows with approximately $341 billion, reflecting steady growth in insurance technology startups across the region.

- Southeast Asia records about $216 billion in VC funding, showing rising investor interest in digital insurance platforms.

- Latin America receives about $0.079 billion, highlighting a much smaller share of global InsurTech investment.

- The rest of the world, including Oceania and Africa, attracts roughly $0.038 billion in venture capital funding for InsurTech companies.

- Overall, North America and Asia dominate InsurTech venture capital investment, while other regions still show early-stage market growth.

Insurtech versus Traditional Insurance: Business Model Benefits

- Digital platforms cut operational costs by 65% versus traditional insurers.

- Customer retention rose 35% on insurtech apps with instant claims.

- Claims processing dropped to 72 hours average, 68% faster than legacy.

- User satisfaction hit 89% for insurtech, 28% above traditional models.

- Paperless ops saved 62% in admin costs for digital-first carriers.

- Insurtech personalization is 3.2x higher via AI-driven policy tailoring.

- Automated underwriting slashed costs 55%, boosting affordability.

- Insurtech NPS scored 47 points, traditional averaged 22 points.

Innovations Driving Insurtech Change

- Blockchain insurance solutions are valued at $3.8 billion, up 95% from last year.

- Smart contracts automated 28% of policies, cutting fraud by 42%.

- IoT devices shaped 25% of property/auto policies with live risk data.

- UBI models surged 68%, powering 15 million personalized premiums.

- Peer-to-peer insurance grew 41%, covering 2.3 million users globally.

- Wearables drove 45% of health plans with behavior-based discounts.

- Data personalization boosted engagement 52% via AI insights.

- Generative AI accelerated 33% of claims with instant approvals.

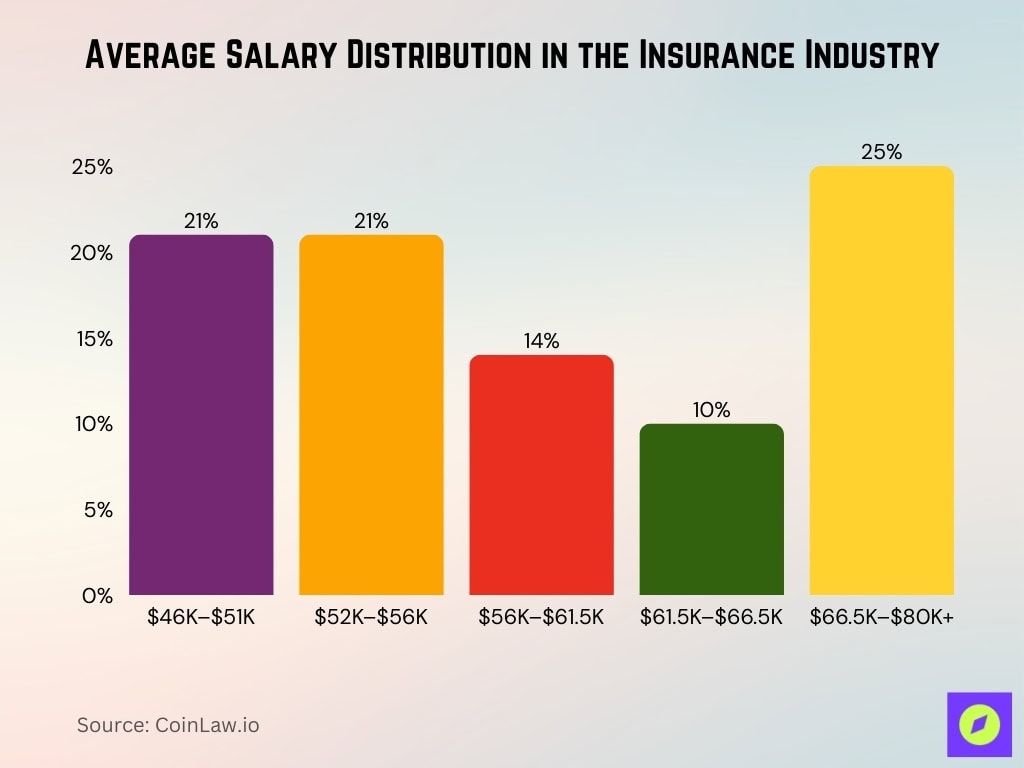

Average Insurance Industry Salaries

- 21% of workers earn $46K-$51K annually.

- 21% earn $52K-$56K per year.

- 14% make $56K-$61.5K.

- 10% earn $61.5K-$66.5K.

- 25% exceed $66.5K, up to $80K+ for top earners.

- Average salary stands at $58K-$90K across roles.

- 25th percentile at $48K, 75th at $66.5K-$101K.

Changes to the Legal & Regulatory Framework

- 47 U.S. states enacted data privacy laws by Q1, covering 82% population.

- Indiana, Kentucky, and Rhode Island added comprehensive privacy laws on January 1.

- Connecticut lowered the threshold to 35K consumers mid-year for sensitive data.

- NAIC advanced AI model law via RFI, with 33 comments received.

- California bill mandates faster claims, higher penalties for disasters.

- SEC prioritized AI threats in FY2026 cyber exams and disclosures.

- Cyber insurers require MFA, CMP, and patching for 100% ransomware coverage.

- DORA influences global resilience rules, tightening anti-fraud mandates.

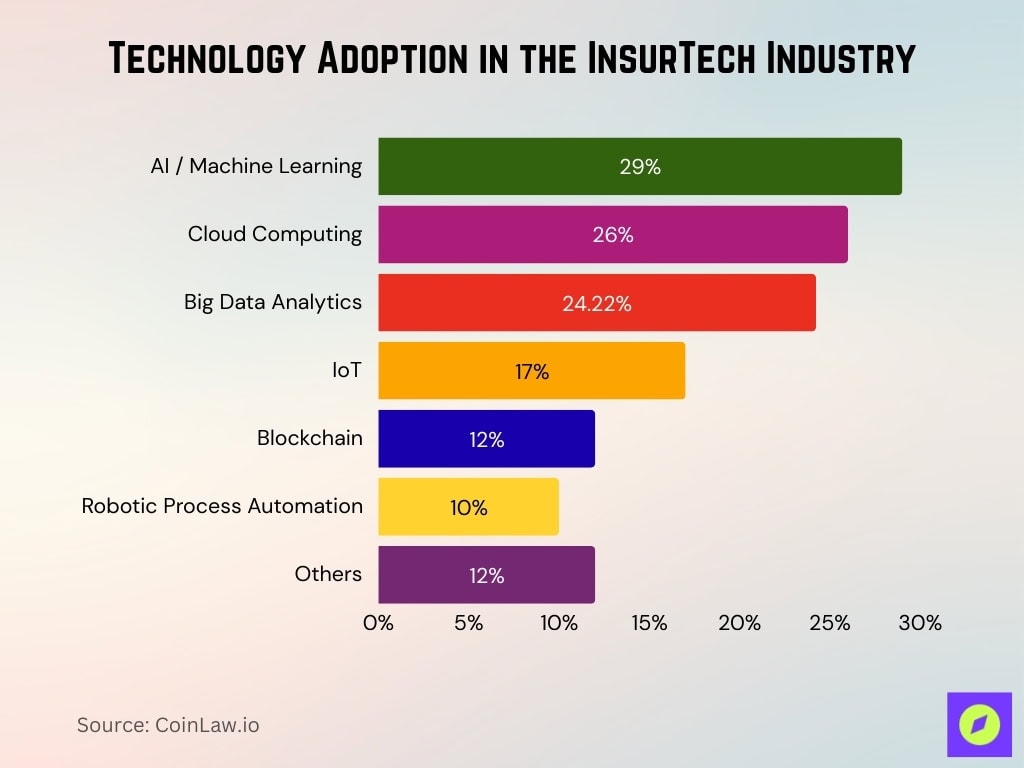

Technology Adoption in the InsurTech Industry

- Cloud computing commands 26% share for real-time operations.

- AI/ML leads with 29% dominance in risk prediction.

- Big data analytics holds 24.22% for efficiency gains.

- IoT captures 17% via telematics and sensors.

- Blockchain accounts for 12% in fraud prevention.

- RPA contributes 10% to automation workflows.

- Others comprise 12%, including robo-advisory.

Frequently Asked Questions (FAQs)

US insurance tech spending is projected to grow by $173 billion in 2026, up 7.8% year over year and representing about 6% of total US tech spending.

AI-centered insurtechs captured about 66% of total insurtech funding and 62% of all deals, raising roughly $3.35 billion across 227 transactions.

In January alone, insurtech firms attracted more than $420 million in funding, with two US players each raising over $100 million.

Insurance companies represent about 47.16% of the insurtech market share and are projected to grow at a 27.9% CAGR over the forecast period.

Conclusion

The insurtech industry’s journey from a disruptor to a mainstay in the insurance ecosystem has been nothing short of transformative. By capitalizing on AI, blockchain, and mobile-based innovations, insurtech companies are reshaping how policies are developed, sold, and managed. As regulatory landscapes adapt to accommodate new models and as emerging economies continue to embrace digital insurance solutions, the potential for growth remains immense.

With its relentless focus on personalization, accessibility, and efficiency, insurtech will continue to redefine the global insurance market, offering more flexible and user-friendly solutions that meet the demands of a diverse and evolving customer base.