The insurance brokerage industry is a dynamic field, bridging the gap between clients and insurers. Imagine Sarah, a small business owner in California, worried about safeguarding her bakery from unforeseen challenges. She consults a local insurance broker who simplifies complex policy terms, ensuring she selects the best coverage for her needs. Stories like Sarah’s are happening daily across the U.S., showcasing how brokers provide essential guidance in navigating the complex insurance landscape.

Editor’s Choice

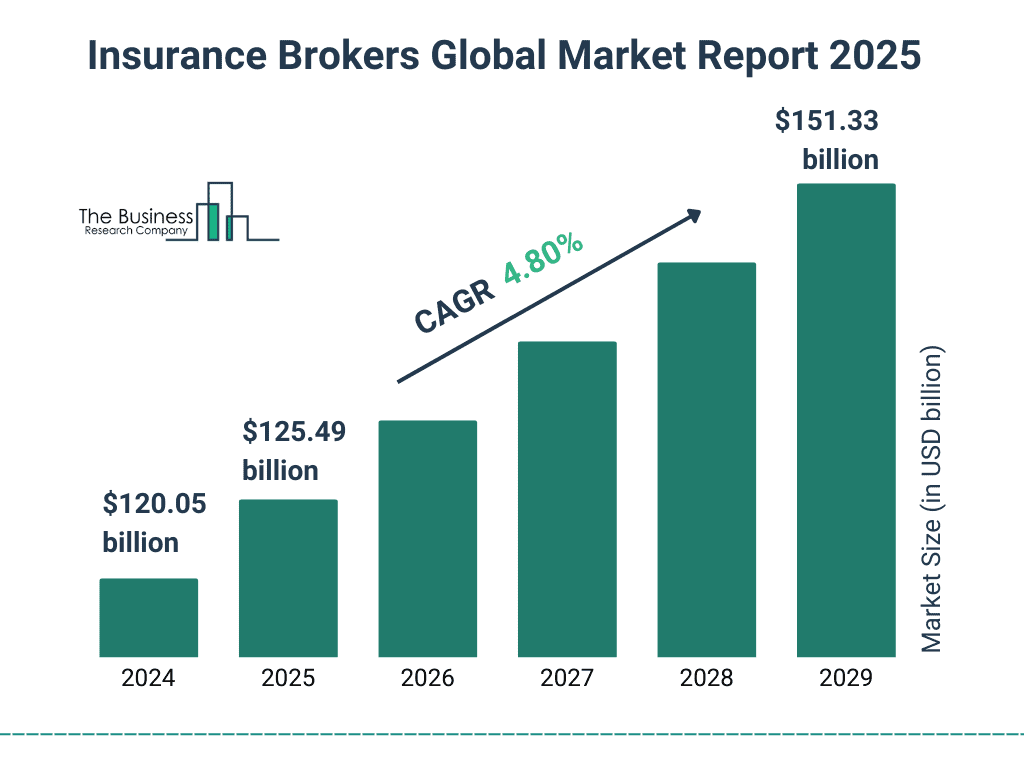

- The global insurance brokerage market size reached $125.49 billion in 2025, with projections climbing to $151.33 billion by 2029.

- Around 82% of insurance brokers use advanced analytics to personalize policies, reflecting growing reliance on data.

- Independent agencies in the U.S. continue to account for over 50% market share, dominating the customized insurance segment.

- Digital platforms contribute to roughly 30% of total brokerage revenues in 2025, up from 27% in 2023.

- Client satisfaction among brokerage customers remains high, estimated at around 89% in 2025.

- Cyber insurance demand remains strong, with growth continuing above 30% annually due to digital threats.

- The top 10 global brokerage firms generated over $100 billion in combined revenues, maintaining their leadership in 2025.

Global Insurance Brokerage Market Growth

- The insurance brokerage market is projected to grow from $120.05 billion in 2024 to $151.33 billion by 2029.

- In 2025, the global market is expected to reach $125.49 billion, reflecting steady year-over-year expansion.

- The industry is growing at a Compound Annual Growth Rate (CAGR) of 4.80%, driven by demand for specialized risk management services.

- This upward trend reflects increased adoption of digital platforms, AI-driven underwriting, and M&A activity among global brokers.

Insurance Brokerage Market Analysis

- U.S. insurance sectors saw $30 billion in deal value across 209 disclosed deals in the six months ending mid‑May 2025.

- M&A activity in North America reached $9.85 billion in Q2 2025 from 125 insurance‑related deals compared to $6.65 billion in the prior quarter.

- Emerging markets like India and Brazil continue rising insurance penetration in 2025, estimated increase of 15‑18% aided by growing awareness.

- Over 70% of U.S. brokerage M&A deals in 2025 so far are from private capital‑backed buyers, representing strong adoption of new structures.

- Major brokerage firm valuations are growing, e.g., Trucordia reached $5.7 billion valuation in 2025 after investment.

Key Players in the Industry

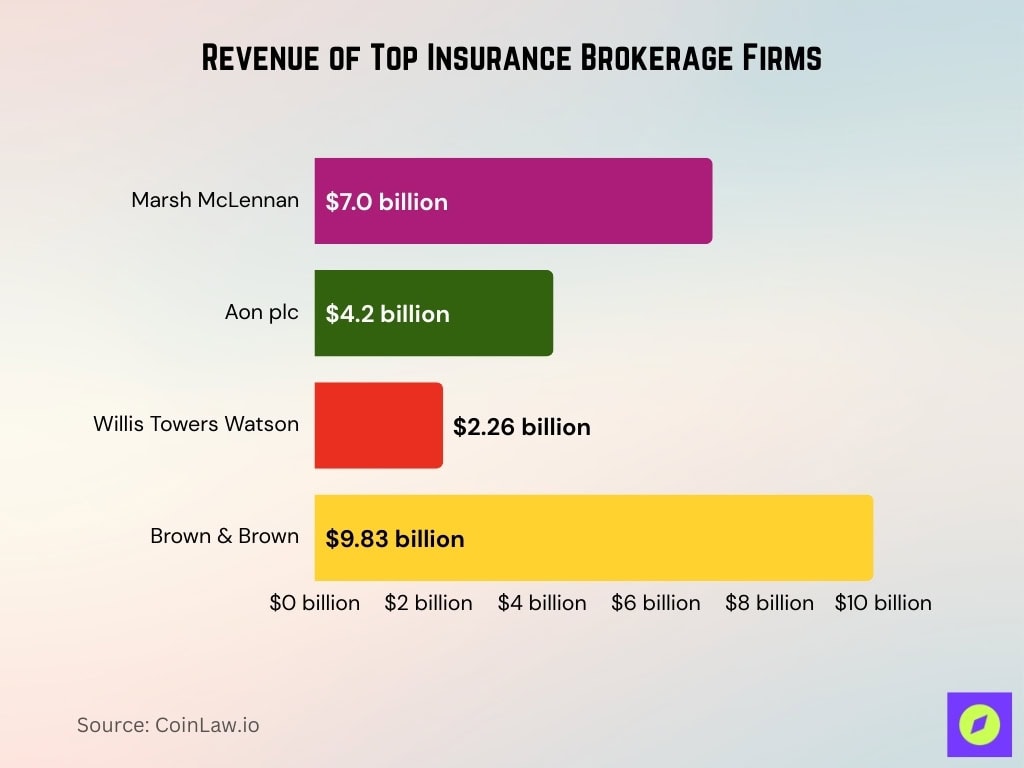

- Marsh McLennan posted $7.0 billion in total revenue in Q2 2025, up 12% year‑over‑year, led by its risk and insurance services business.

- Aon plc achieved organic revenue growth of 6% in Q2 2025, with revenues of around $4.2 billion in that quarter.

- Willis Towers Watson saw revenue of approximately $2.26 billion in Q2 2025 with 5% organic growth matching Q1 levels.

- Brown & Brown struck at $9.83 billion in mid‑2025, acquiring Accession Risk Management to significantly expand its U.S. footprint.

- Arthur J. Gallagher & Co. recorded 5.4% organic growth in Q2 2025 and completed an acquisition, generating about $290 million in annualized revenue.

- Marsh McLennan’s risk & insurance segment grew by 15% in Q2 2025 while its consulting arm grew by 7%, driving overall growth.

Impacts on the Brokerage Ecosystem

- Brokers using digital insurance and automation have reduced operational costs by approximately 15‑20% in 2025 from efficiencies like AI onboarding and self‑service platforms.

- Insurtech firms are gaining market share with millennials shifting ~30% of their purchases toward digital brokers in 2025 vs traditional brokers.

- Small business cyber insurance premiums have increased by around 20% year‑over‑year in 2025 due to a higher incidence of claims and more stringent underwriting.

- Demand for property insurance spiked in 2025 following severe climate‑driven events, creating double‑digit growth opportunities for brokers in fluvial flood and wildfire zones.

- Many brokerage firms (~65%) have adopted remote or hybrid work in 2025 to attract talent and reduce fixed overhead.

- Partnerships between brokers and tech providers surged in 2025, with over 50% of firms collaborating on client management or analytics solutions.

Global Product Line Trends

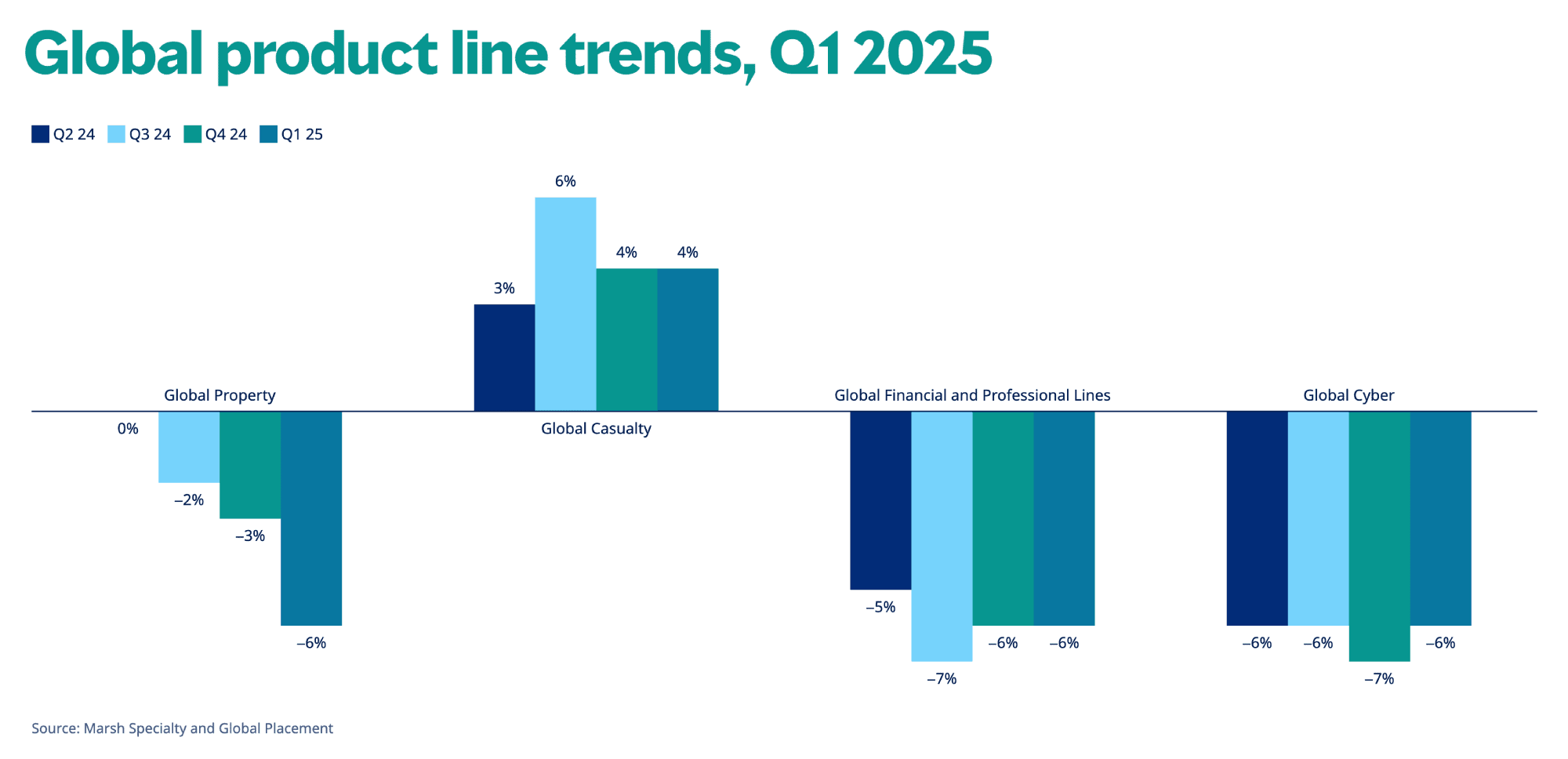

- Global Property saw a sharp decline of -6% in Q1 2025, deepening from 0% in Q2 2024.

- Global Casualty maintained growth at 4% in Q1 2025, following a peak of 6% in Q3 2024.

- Global Financial and Professional Lines dropped to -6% in Q1 2025, after falling as low as -7% in Q3 2024.

- Global Cyber remained consistently weak at -6% in Q1 2025, with the steepest dip at -7% in Q4 2024.

Technological Advancements

- AI automation in customer service and claims tasks reduced operational costs by about 30% for many firms in 2025.

- Chatbots and virtual assistants now handle up to 80% of routine inquiries in financial services by mid‑2025, cutting response time drastically.

- Approximately 48% of insurance brokers are using predictive analytics in 2025 to tailor policy recommendations and improve risk modelling.

- Blockchain adoption remains modest, with around 20‑25% of firms experimenting with transparent policy record systems in 2025.

- IoT‑driven policy adjustments, especially in auto insurance, affect roughly 25‑30% of active policies as telematics and real‑time sensors become more common.

- Cloud‑based tools are used by a large majority of brokers, about 65‑70% in 2025, for scalability and secure data storage.

- Advanced CRM tools in 2025 improved engagement rates by around 25‑30% enabling more personalised outreach and services.

Direct Purchases of Insurance by Clients

- The embedded insurance market size reached about $116.49 billion in 2025, reflecting growth in direct‑to‑consumer and in‑product insurance offerings.

- Only 15% of consumers in 2025 prefer a fully digital insurance experience, while 48% favor a hybrid (digital‐first with human support) model.

- The digital insurance platform market is valued at $ 148.16 billion in 2025, with rising adoption in urban regions compared to rural ones.

- About 64% of consumers in 2025 would consider switching insurers for an improved digital experience, underscoring transparency and ease of comparison.

- Younger consumers (Millennials & Gen Z) are driving the shift toward self‑service and direct purchase channels, though the exact conversion rate advantages for hybrids over traditional ones are not fully quantified yet.

- Legacy brokers increasingly adopt omnichannel strategies in 2025, combining physical presence with digital tools to meet consumer expectations.

Insurance Brokerage Market Share by Insurance Type

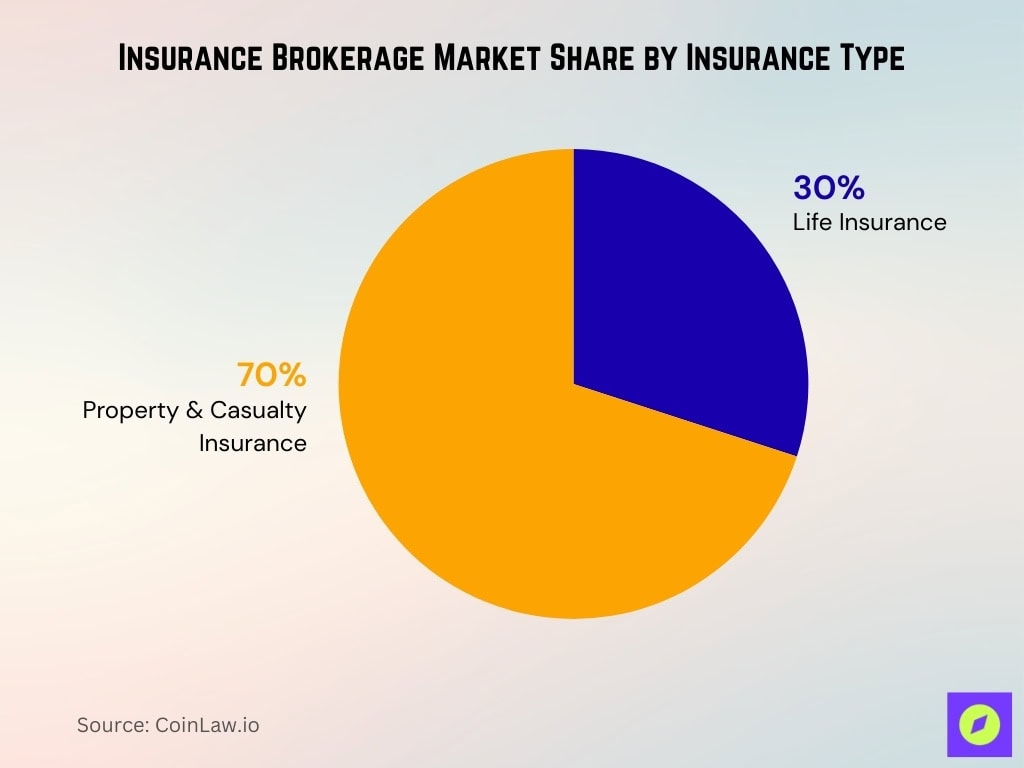

- Property & Casualty Insurance dominates the market with a 70% share, reflecting its critical role in risk management.

- Life Insurance accounts for 30% of the market, showing steady but smaller demand compared to property and casualty lines.

- The combined market highlights that non-life insurance products drive over two-thirds of brokerage revenues globally.

- The 70-30 split underscores how corporate and commercial risk coverage significantly outweighs personal life coverage in brokerage activity.

Growing Awareness of the Need for Insurance Policies

- 51% of American adults say they have some sort of life insurance coverage in 2025, and 42% believe they need more insurance.

- Gen Z (ages 12‑27) ownership of life insurance stands at 36% in 2025, Millennials (28‑43) at 50%, both rising slowly.

- Individual new annualized life insurance premiums in the U.S. grew by 8% year‑over‑year in Q1 2025 to $3.94 billion.

- Cost misconceptions persist, with about 72% of younger generations overestimating the cost of basic term life policies in 2025.

- Roughly half of Americans (51%) researched life insurance online in 2025 compared with much lower under‑27 years ago.

Recent Developments

- The blockchain in the insurance market reached $3.08 billion in 2025, supporting secure policy management and automated claims processing.

- AI-powered risk assessment tools reduced underwriting times by up to 30% in commercial lines during 2025.

- Insurtech startups raised around $1.09 billion in Q2 2025, reflecting continued innovation despite a dip in quarterly funding.

- Total cumulative investment in insurtech exceeded $60 billion by mid‑2025, showing sustained long-term investor interest.

- Microinsurance products expanded in emerging markets, with broker engagement rising by an estimated 20–25% in 2025.

- ESG considerations influenced over 30% of new insurance products in 2025, responding to demand for sustainable offerings.

- Crypto-related insurance products generated under $1 billion in revenues in 2025, with adoption still under 15% among crypto holders.

Frequently Asked Questions (FAQs)

The market is projected to grow from $125.49 billion in 2025 to $236.14 billion by 2032, implying a 9.5% CAGR.

It was about $328.47 billion in 2025 and is projected to reach $480.66 billion by 2030.

The market is expected to grow at a 9.21% CAGR from 2025 to 2034.

It is expected to grow from about $80.07 billion in 2024 to $197.39 billion in 2034, roughly a 9.42% CAGR.

Conclusion

As the insurance brokerage industry evolves, the key to staying competitive lies in adaptability and innovation. From navigating a digital-first world to embracing cutting-edge technologies like AI and blockchain, brokers continue to transform their approaches to meet client expectations. The pandemic reshaped client needs, while new trends like direct purchases and ESG-focused policies are redefining the industry’s future. With projected global growth and a clear focus on emerging markets, this year holds immense promise for the sector.