Hut 8 Mining Corp. (Hut 8) stands at the crossroads of Bitcoin mining and large-scale energy infrastructure. The company’s strategies span self-mining, hosting, and managed services, shaping not only its own growth but also the broader energy-intensive compute sector. For instance, Hut 8’s deployment of high-efficiency mining rigs affects global hash rate competition, while its energy capacity deals influence utility markets in North America. Read on to explore key statistics driving Hut 8’s performance and outlook.

Editor’s Choice

- 13,696 BTC held in Hut 8’s strategic reserve as of September 30, 2025, valued at about $1.6 billion.

- Total hash rate installed at approximately 26.8 EH/s as of Q3 2025.

- Operational hash rate at 23.7 EH/s as of Q3 2025.

- Energy capacity under management at 1,020 MW as of September 30, 2025.

- Q3 2025 revenue of $83.5 million, a 91% increase year over year.

- Fleet efficiency of approximately 16.3 J/TH as of September 30, 2025.

Recent Developments

- Launched its majority-owned subsidiary American Bitcoin on April 1, 2025, through which most of Hut 8’s mining operations are now conducted.

- Reported a Q1 2025 net loss of $134.3 million, reflecting heavy investment for future scale.

- Announced development of four new sites totaling 1,530 MW of new capacity in August 2025.

- Q3 2025 net income reached $50.6 million, up from $0.9 million in the prior year.

- Expanded total hash rate by about 14.8 EH/s in Q3 to reach 26.8 EH/s.

- Improved fleet efficiency to 16.3 J/TH, enhancing competitiveness.

- Continued strategic Bitcoin accumulation with holdings growing more than 50% year over year.

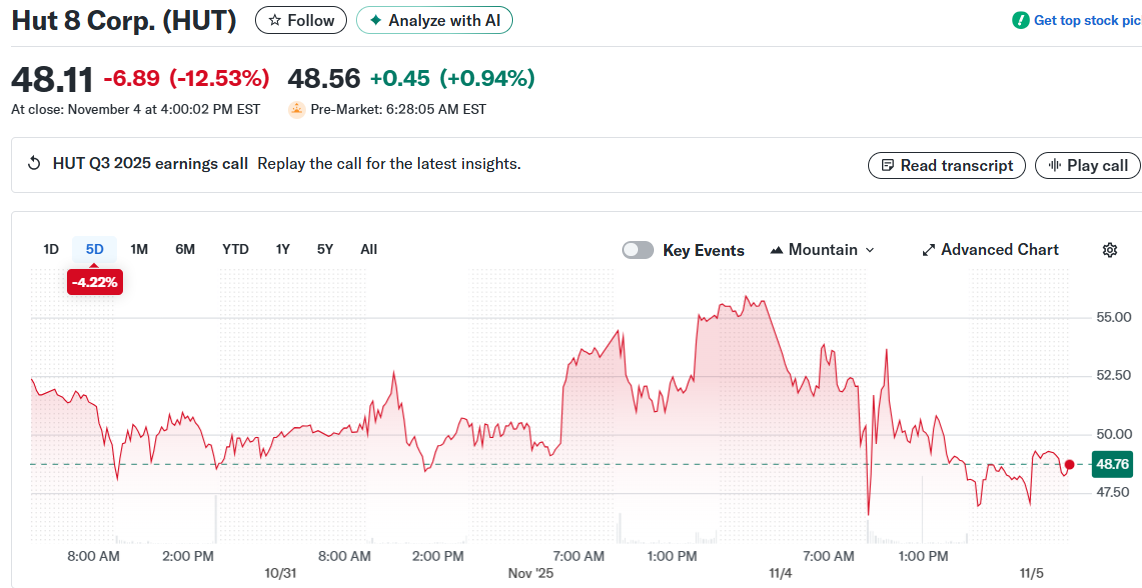

Hut 8 (HUT) 5-Day Stock Price Highlights

- $48.11 closing price on November 4, 2025, reflecting a -12.53% daily drop (–$6.89) after Q3 earnings.

- Pre-market price on November 5 rose to $48.56, a slight recovery of +0.94% (+$0.45).

- Over the past 5 days, the stock declined by -4.22%, signaling bearish short-term momentum.

- The highest price point during the 5-day window touched above $55, suggesting a brief rally before earnings.

- The lowest price dipped near $47.50 in early trading on November 5.

- The chart reflects volatile intraday swings, likely driven by earnings sentiment and market reactions.

- A significant drop occurred after earnings call announcements on November 4, sharply pulling down the stock from recent highs.

Company Overview

- Hut 8 is publicly listed on NASDAQ and TSX under the ticker symbol HUT.

- Headquarters are located in Toronto, Canada, with operations across Canada and the U.S.

- Business segments include Power Generation, Digital Infrastructure, Compute, and Other.

- Power-first strategy focuses on controlling energy assets to support compute workloads.

- The 12-month stock return as of November 2025 was approximately +96.4%.

- This return significantly outperformed the S&P 500’s +14.9% over the same period.

- Total employee count reported at 222 as of November 2025.

- Hut 8 manages over 2.5 GW of mining and infrastructure capacity.

- The company holds liquidity and capital resources exceeding $2 billion for expansion.

- Market capitalization as of late 2025 is near $1.8 billion.

Energy Capacity and Infrastructure

- As of June 30, 2025, Hut 8 managed about 1,020 MW of energy capacity.

- The development pipeline stood at 10,800 MW as of June 30, 2025, with 3,100 MW under exclusivity.

- Announced four new U.S. sites expected to advance 1,530 MW into development.

- Platform expected to exceed 2.5 GW across 19 sites upon full commercialization.

- Approximately 90% of the 1,020 MW platform was contracted as of June 30, 2025.

- New site buildouts include a 205 MW Texas facility designed for next-generation compute.

- Expansion covers regions such as Louisiana, Texas, and Illinois.

- Strategy aims to support high-power demand from AI, HPC, and other workloads.

- Infrastructure scale supports rapid deployment and long-term growth.

Bitcoin Mining Operations

- As of September 30, 2025, self-mining operations achieved an installed hash rate of 26.8 EH/s.

- Operational hash rate reached 23.7 EH/s on the same date.

- Approximately 25 EH/s is attributed to American Bitcoin.

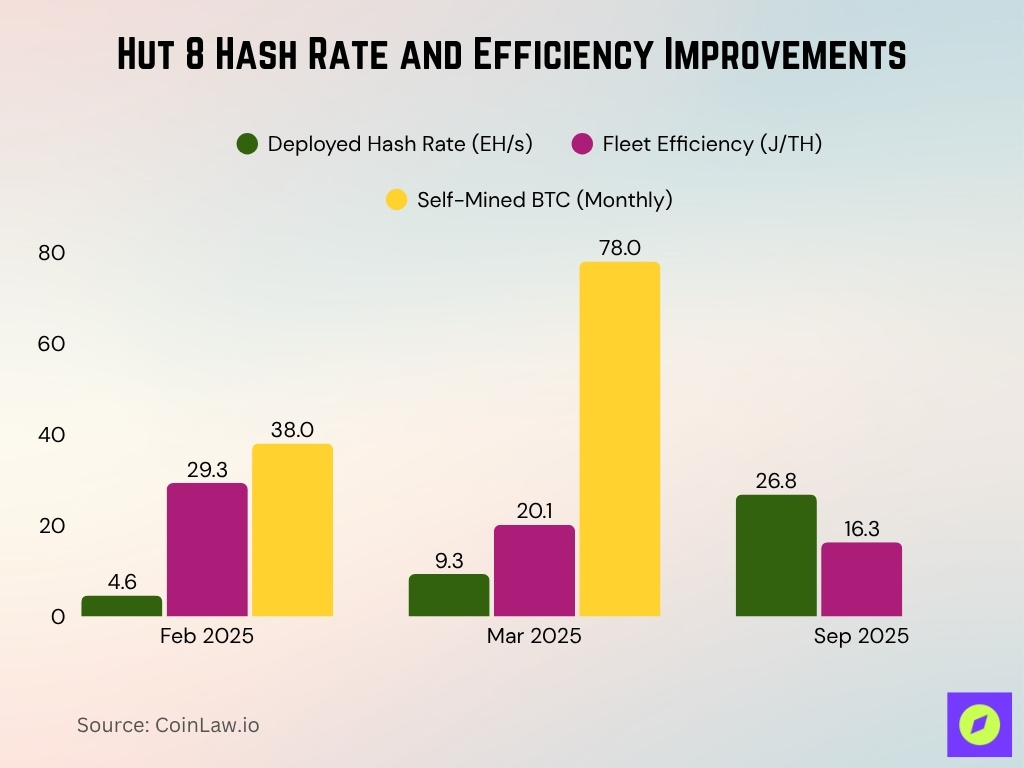

- Q1 2025 deployed hash rate increased 102% from February to March, from 4.6 EH/s to 9.3 EH/s.

- Fleet efficiency improved in Q1 2025 from about 29.3 J/TH to around 20.1 J/TH.

- Self-mined BTC production, net of JV share, reached 78 BTC in March 2025, up from 38 BTC in February.

- From November 2024 to November 2025, Hut 8 targeted a 66% hash rate increase and a roughly 37% efficiency improvement.

Managed Services and HPC Data Centers

- Hut 8 reports Managed Services and HPC Data Centers as major segments.

- Managed Services energy capacity reached 280 MW as of March 2025.

- Operated 120.8K deployed miners under management in March 2025.

- Deployed mining hash rate reached 9.3 EH/s in March 2025, up from 4.6 EH/s in February.

- Launched a 205 MW Texas facility supporting advanced computing in June 2025.

Fleet Expansion and Equipment Metrics

- Q1 2025 deployed hash rate increased 102% from February to March.

- Fleet efficiency improved by about 31% during the same period, reaching 20.1 J/TH.

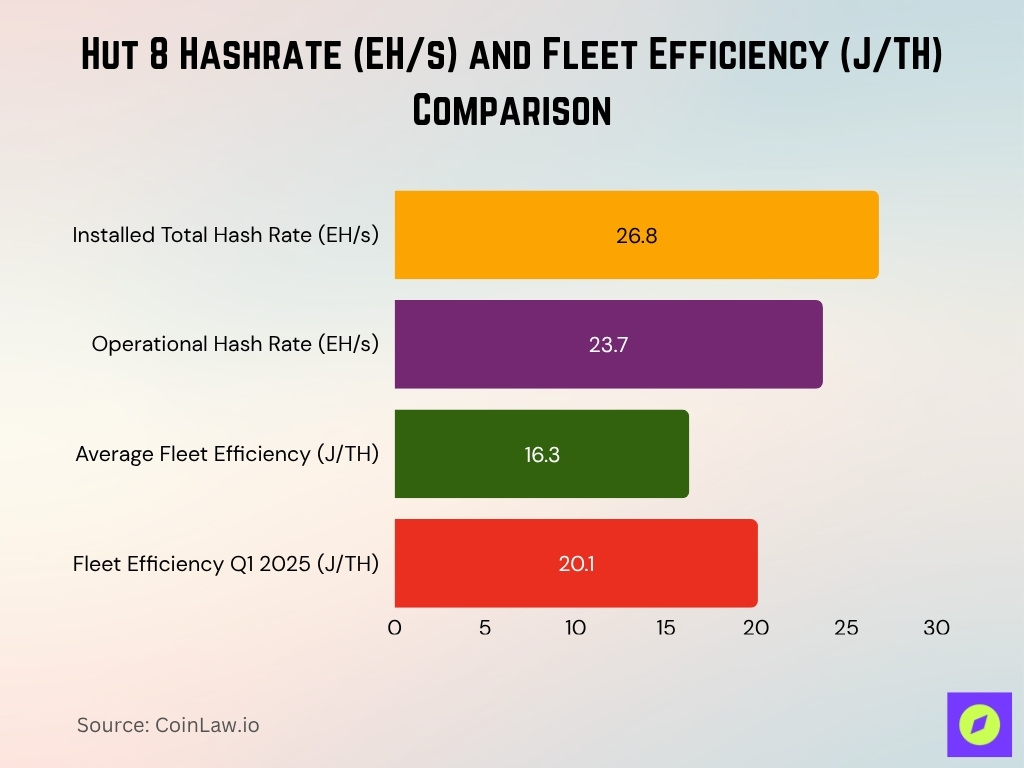

- Installed hash rate totaled 26.8 EH/s as of September 30, 2025.

- Operational hash rate recorded at 23.7 EH/s.

- Efficiency reached 16.3 J/TH by September 2025.

- Upgrade cycles driven by next-generation ASICs such as S21 models.

- Energy capacity expansion supports large-scale fleet growth.

- Lower cost per TH strengthens margin resilience.

- Scale places the company among the top global miners.

Hashrate Capacity and Efficiency

- Installed total hash rate reached 26.8 EH/s as of September 30, 2025.

- Operational hash rate recorded at 23.7 EH/s.

- Average fleet efficiency reported at 16.3 J/TH as of September 30, 2025.

- Q1 2025 fleet efficiency was approximately 20.1 J/TH, showing strong improvement within the year.

- Deployed hash rate increased by around 79% in Q1 2025 quarter over quarter.

- Efficiency gains are achieved through next-generation ASIC upgrades such as Antminer S21 series units.

- Large-scale improvements strengthened Hut 8’s competitive edge.

Treasury and Bitcoin Holdings

- Hut 8 held 13,696 BTC as of September 30, 2025, valued at roughly $1.6 billion.

- Represents an increase of about 50% from 2024 levels.

- Hut 8 holds 10,278 BTC directly, and subsidiary American Bitcoin Corp holds 3,418 BTC, totalling the group’s reserve of 13,696 BTC.

- Ranked among the top 10 public companies in Bitcoin treasury size.

- Average cost per BTC is estimated at around $113,902.

- Treasury position provides long-term strategic flexibility.

- The accumulation approach prioritizes reserve building over immediate liquidation.

- Treasury valuation significantly impacts equity value.

- Bitcoin holdings help hedge mining cycle volatility.

Market Share and Rankings

- Hut 8 is considered one of the largest North American miners by installed hash rate.

- Q3 2025 installed hash rate of 26.8 EH/s supports its ranking.

- Its treasury holdings place it in the top public Bitcoin holding companies globally.

- Analysts assigned a target price of $78, driven by scale and strategy.

- Infrastructure pipeline growth signals competitive expansion.

- Diversification into HPC and managed services broadens market position.

- North American presence enhances access to favorable energy markets.

Hut 8 Mining (HUT) Intraday Price Spike

- Hut 8 shares opened around $52.00 in the early morning session, with initial price stability.

- Between 6:05 AM and 9:15 AM, the stock moved modestly between $52.0 and $54.0, showing low volatility.

- Around 9:30 AM, the price spiked sharply, jumping from roughly $53.0 to above $55.5 within minutes.

- This reflects a sudden +4.7% intraday gain, likely driven by market reaction to earnings, investor sentiment, or news flow.

- The breakout included consecutive green candlesticks, signaling strong bullish momentum during the final 15 minutes.

- Prior to the breakout, the chart showed sideways trading, with a mix of red and green candles and no clear direction.

- This kind of movement suggests reactive trading behavior, possibly tied to external events or corporate disclosures.

Regional Operations (Canada & USA)

- Hut 8 operates 15 sites across Canada and the U.S. with a combined capacity of 1.02 GW.

- The company has over 1.5 GW of new capacity under development across four U.S. sites in Louisiana, Texas, and Illinois.

- Hut 8’s operations include five Bitcoin mining and hosting sites in Alberta, New York, and Texas.

- The Texas Vega site features 205 MW capacity powered by wind and ERCOT grid connections.

- Canadian facilities benefit from clean hydroelectric power, supporting sustainable mining.

- Hut 8 holds 80% ownership in power generation assets totaling 310 MW in Ontario.

- The King Mountain Joint Venture in Texas contributes around 1.8 EH/s in mining capacity with 50% ownership.

- U.S. sites include a 300 MW facility in Louisiana and two Texas sites totaling 1,180 MW.

- Hut 8’s U.S. expansion aligns with power markets diversification, including ERCOT, MISO, and PJM regions.

- Total managed energy capacity is expected to exceed 2.5 GW across 19 sites by the end of 2025.

Capital Actions and Fundraising

- Secured a commercial license in the Dubai International Financial Centre in July 2025 to support global treasury operations.

- Launched a $1 billion ATM equity program and a $200 million revolving credit facility in Q3 2025.

- Reported total liquidity of about $2.4 billion as of June 30, 2025.

- Expanded energy capacity through structured development financing.

- Extended and expanded its Bitcoin-backed credit facility with a major lender.

- Net income for Q2 2025 was $137.5million (driven by non-cash gains on digital assets), while Q3 2025 net income was $50.6 million.

- Terminated the prior ATM program with about 40% unused capacity.

Strategic Partnerships and Mergers

- Hut 8 holds an 80% ownership stake in American Bitcoin Corp, formed in March 2025.

- The partnership with American Data Centers involved a strategic transfer of ASIC equipment.

- Hut 8 announced four U.S. site developments totaling 1,530 MW capacity.

- The company rebranded in July 2025 to emphasize its platform-driven business model.

- Strategic collaborations span utilities and landowners across key U.S. and Canadian regions.

- Partnerships support Hut 8’s expansion into high-performance computing (HPC) and digital infrastructure.

- Mergers and alliances reduced Hut 8’s cost of capital for infrastructure scaling.

- The combined entity American Bitcoin is expected to trade on Nasdaq under the ticker symbol “ABTC”.

- Hut 8’s liquidity position supports up to $2.4 billion for expansion and operational growth.

- The four new U.S. sites in the pipeline range from 50 MW to 1,000 MW each.

ESG and Sustainability Metrics

- HPC data centers in Ontario and British Columbia reported grid mixes of 94% and 97% carbon-free electricity.

- Diverted more than 94% of waste from landfills in 2022.

- Offset 369 metric tonnes of e-waste in 2023, generating 7,500 metric tonnes CO2 equivalent in carbon credits.

- Targeting carbon neutrality by 2025.

- Holds a medium ESG risk rating according to several sustainability indexes.

- Uses SASB and GRI frameworks to improve reporting transparency.

- Clean energy sourcing supports operational cost competitiveness.

Risks and Challenges

- Hut 8’s development pipeline exceeds 10,800 MW, posing significant execution risk.

- Bitcoin price volatility shows a ±35% quarterly earnings fluctuation impact on revenue.

- Capital intensity for site development and infrastructure exceeds $2.4 billion in planned investment.

- ASIC supply chain delays have affected mining capacity expansions by up to 6 months.

- Regulatory and environmental scrutiny increased by 20% year-over-year, impacting operations.

- Multi-jurisdiction operations span 6 provinces and states, adding permitting complexity.

- Short-term financial results remain volatile, with Q1 2025 net loss reported at $134 million.

- Diversification into infrastructure introduces integration risk across more than 19 sites.

- Rising electricity prices and tight labor markets threaten to delay commissioning by 3-6 months.

Outlook and Guidance

- Hut 8’s platform capacity is expected to exceed 2.5 GW across 19 sites upon commercialization.

- Nearly 90% of the current 1,020 MW platform capacity is secured under long-term contracts.

- Revenue is shifting towards more low-volatility infrastructure contracts over purely mining-derived income.

- The 205 MW Vega facility is on track for full ramp-up by Q2 2025.

- Energy costs averaged $39.82 per MWh recently, reflecting tight control on expenses.

- Multi-year growth is projected with a revenue forecast of $767 million by 2028.

- Q3 2025 revenue rose 91% year-over-year to $83.5 million.

Frequently Asked Questions (FAQs)

$50.6 million

10,800 MW

About 96.4%.

Conclusion

Hut 8 Mining Corp’s narrative is defined by the transition from a pure play Bitcoin miner to a broader, power-first infrastructure and compute platform. The company’s multi-gigawatt energy pipeline, strategic Bitcoin reserve, and ESG commitments underscore this shift. At the same time, the challenges of capital intensity, execution complexity, and crypto price dependence remain central. As Hut 8 scales its infrastructure and diversifies revenue, stakeholders should watch progress on key milestones, including commercialization timelines, energy cost management, and compute service adoption.